See more : Jinke Smart Services Group Co., Ltd. (9666.HK) Income Statement Analysis – Financial Results

Complete financial analysis of Universal Stainless & Alloy Products, Inc. (USAP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Universal Stainless & Alloy Products, Inc., a leading company in the Steel industry within the Basic Materials sector.

- Jerónimo Martins, SGPS, S.A. (JMT.WA) Income Statement Analysis – Financial Results

- Cementos Pacasmayo S.A.A. (CPAC) Income Statement Analysis – Financial Results

- Méthanor SCA (ALMET.PA) Income Statement Analysis – Financial Results

- Wuxi Lead Intelligent Equipment CO.,LTD. (300450.SZ) Income Statement Analysis – Financial Results

- SUZHOU KEMATEK INC (301611.SZ) Income Statement Analysis – Financial Results

Universal Stainless & Alloy Products, Inc. (USAP)

About Universal Stainless & Alloy Products, Inc.

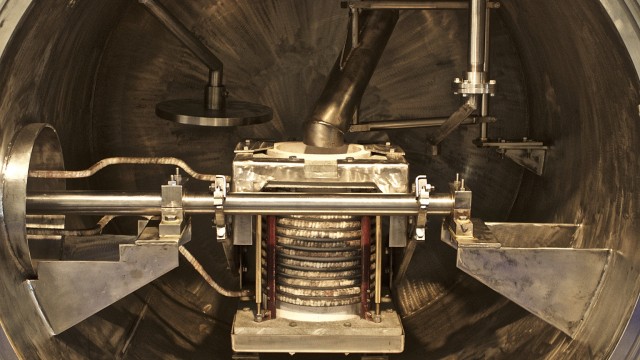

Universal Stainless & Alloy Products, Inc., together with its subsidiaries, manufactures and markets semi-finished and finished specialty steel products in the United States and internationally. Its products include stainless steel, nickel alloys, tool steel, and various other alloyed steels. The company offers semi-finished and finished long products in the form of ingots, billets, and bars; flat rolled products, such as slabs and plates; and customized shapes primarily for original equipment manufacturers (OEMs), which are cold rolled from purchased coiled strip, flat bar, or extruded bar. It also offers conversion services on materials supplied by its customers. The company's products are used in aerospace, power generation, oil and gas, heavy equipment, general, and industrial markets. It sells its products to service centers, forgers, rerollers, and OEMs. Universal Stainless & Alloy Products, Inc. was incorporated in 1994 and is headquartered in Bridgeville, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 285.94M | 202.11M | 155.93M | 179.73M | 243.01M | 255.93M | 202.64M | 154.43M | 180.66M | 205.56M | 180.77M | 250.99M | 252.60M | 189.42M | 124.91M | 235.11M | 229.94M | 203.87M | 170.02M | 120.64M | 68.99M | 70.88M | 90.66M | 88.35M | 66.70M | 72.60M | 81.30M | 60.30M | 47.00M | 5.70M |

| Cost of Revenue | 244.40M | 187.93M | 147.96M | 182.39M | 215.37M | 218.11M | 179.61M | 140.92M | 171.07M | 173.54M | 166.89M | 209.84M | 205.15M | 155.65M | 117.90M | 204.93M | 184.49M | 160.68M | 140.95M | 102.97M | 65.53M | 61.97M | 71.92M | 69.40M | 56.50M | 58.60M | 63.90M | 47.70M | 40.00M | 5.60M |

| Gross Profit | 41.54M | 14.19M | 7.97M | -2.66M | 27.64M | 37.82M | 23.03M | 13.51M | 9.60M | 32.02M | 13.88M | 41.15M | 47.45M | 33.77M | 7.01M | 30.18M | 45.45M | 43.19M | 29.07M | 17.67M | 3.46M | 8.91M | 18.74M | 18.95M | 10.20M | 14.00M | 17.40M | 12.60M | 7.00M | 100.00K |

| Gross Profit Ratio | 14.53% | 7.02% | 5.11% | -1.48% | 11.37% | 14.78% | 11.37% | 8.75% | 5.31% | 15.58% | 7.68% | 16.39% | 18.78% | 17.83% | 5.61% | 12.84% | 19.76% | 21.19% | 17.10% | 14.65% | 5.01% | 12.57% | 20.67% | 21.45% | 15.29% | 19.28% | 21.40% | 20.90% | 14.89% | 1.75% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 19.75M | 20.35M | 21.75M | 18.80M | 17.48M | 19.41M | 21.12M | 17.89M | 17.75M | 17.76M | 13.35M | 11.66M | 11.09M | 12.04M | 10.79M | 8.44M | 7.40M | 5.84M | 5.88M | 6.20M | 5.00M | 4.30M | 4.90M | 4.70M | 4.50M | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 27.78M | 21.18M | 20.24M | 19.75M | 20.35M | 21.75M | 18.80M | 17.48M | 19.41M | 21.12M | 17.89M | 17.75M | 17.76M | 13.35M | 11.66M | 11.09M | 12.04M | 10.79M | 8.44M | 7.40M | 5.84M | 5.88M | 6.20M | 5.00M | 4.30M | 4.90M | 4.70M | 4.50M | 3.50M | 1.20M |

| Other Expenses | 0.00 | 684.00K | 445.00K | 1.12M | 474.00K | 829.00K | 49.00K | -230.00K | 153.00K | -22.00K | 481.00K | 140.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.47M | 2.10M | 1.50M | 1.10M | 500.00K | 300.00K | 100.00K |

| Operating Expenses | 27.78M | 21.18M | 20.24M | 19.75M | 20.35M | 21.75M | 18.80M | 17.48M | 19.41M | 21.12M | 17.89M | 17.75M | 17.76M | 13.35M | 11.66M | 11.09M | 12.04M | 10.79M | 8.44M | 7.40M | 5.84M | 5.88M | 6.20M | 7.46M | 6.40M | 6.40M | 5.80M | 5.00M | 3.80M | 1.30M |

| Cost & Expenses | 272.19M | 209.11M | 168.21M | 202.14M | 235.72M | 239.86M | 198.41M | 158.40M | 190.47M | 194.66M | 184.77M | 227.59M | 222.91M | 169.00M | 129.56M | 216.01M | 196.53M | 171.47M | 149.39M | 110.37M | 71.37M | 67.85M | 78.11M | 76.86M | 62.90M | 65.00M | 69.70M | 52.70M | 43.80M | 6.90M |

| Interest Income | 0.00 | 4.39M | 2.21M | 3.01M | 3.99M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 8.41M | 4.16M | 1.99M | 2.78M | 3.77M | 4.05M | 4.02M | 3.66M | 2.32M | 3.04M | 2.60M | 2.59M | 1.42M | 452.00K | 89.00K | 105.00K | 722.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 19.43M | 17.40M | 17.40M | 17.55M | 16.83M | 16.32M | 16.42M | 16.73M | 18.61M | 17.48M | 16.49M | 12.63M | 7.27M | 5.49M | 4.86M | 4.17M | 3.73M | 3.34M | 3.09M | 3.06M | 3.09M | 3.27M | 2.78M | 2.47M | 2.10M | 1.50M | 1.10M | 500.00K | 300.00K | 100.00K |

| EBITDA | 33.16M | 13.07M | 15.57M | -3.74M | 24.60M | 33.22M | 23.11M | 14.33M | -13.72M | 26.14M | 12.76M | 35.91M | 36.72M | 26.00M | 897.00K | 24.17M | 36.36M | 35.74M | 23.28M | 12.21M | 711.00K | 6.29M | 15.33M | 13.95M | 5.90M | 9.10M | 12.70M | 8.10M | 3.50M | -1.10M |

| EBITDA Ratio | 11.59% | 6.35% | 4.65% | -1.15% | 10.98% | 13.90% | 11.28% | 8.62% | 4.64% | 13.48% | 6.93% | 14.41% | 14.63% | 13.68% | 0.72% | 9.89% | 15.81% | 17.27% | 13.69% | 10.12% | 0.85% | 8.24% | 16.84% | 15.80% | 8.85% | 10.47% | 15.74% | 13.10% | 7.02% | -12.28% |

| Operating Income | 13.76M | -6.53M | -12.05M | -22.41M | 7.29M | 16.07M | 4.24M | -3.97M | -30.08M | 10.90M | -4.01M | 23.40M | 29.69M | 20.42M | -4.66M | 19.09M | 33.41M | 32.40M | 20.63M | 10.27M | -2.38M | 3.02M | 12.54M | 11.49M | 3.80M | 8.40M | 11.60M | 7.60M | 3.20M | -1.20M |

| Operating Income Ratio | 4.81% | -3.23% | -7.73% | -12.47% | 3.00% | 6.28% | 2.09% | -2.57% | -16.65% | 5.30% | -2.22% | 9.32% | 11.75% | 10.78% | -3.73% | 8.12% | 14.53% | 15.89% | 12.13% | 8.51% | -3.45% | 4.27% | 13.84% | 13.00% | 5.70% | 11.57% | 14.27% | 12.60% | 6.81% | -21.05% |

| Total Other Income/Expenses | -8.45M | -3.70M | 8.23M | -1.89M | -3.52M | -3.47M | -4.23M | -4.90M | -2.74M | -3.70M | -2.56M | -2.45M | -1.21M | -360.00K | 606.00K | 806.00K | 45.00K | -584.00K | -414.00K | 697.00K | -255.00K | 2.00K | -519.00K | -908.00K | -800.00K | -500.00K | -200.00K | 0.00 | -300.00K | -400.00K |

| Income Before Tax | 5.31M | -10.70M | -4.04M | -24.29M | 3.77M | 12.60M | 9.00K | -8.87M | -32.82M | 7.20M | -6.57M | 20.95M | 28.48M | 20.06M | -4.05M | 19.90M | 33.45M | 31.82M | 20.22M | 10.97M | -2.64M | 3.03M | 12.03M | 10.58M | 3.00M | 7.90M | 11.40M | 7.60M | 2.90M | -1.60M |

| Income Before Tax Ratio | 1.86% | -5.29% | -2.59% | -13.52% | 1.55% | 4.92% | 0.00% | -5.75% | -18.16% | 3.50% | -3.63% | 8.35% | 11.27% | 10.59% | -3.24% | 8.46% | 14.55% | 15.61% | 11.89% | 9.09% | -3.82% | 4.27% | 13.26% | 11.98% | 4.50% | 10.88% | 14.02% | 12.60% | 6.17% | -28.07% |

| Income Tax Expense | 398.00K | -2.62M | -3.28M | -5.25M | -502.00K | 1.94M | -7.60M | -3.53M | -12.14M | 3.15M | -2.50M | 6.33M | 10.36M | 6.82M | -1.09M | 5.95M | 10.95M | 11.20M | 7.16M | 3.84M | -1.22M | 933.00K | 4.39M | 3.97M | 900.00K | 2.90M | 4.20M | 2.80M | 200.00K | 1.20M |

| Net Income | 4.91M | -8.07M | -758.00K | -19.05M | 4.28M | 10.66M | 7.61M | -5.35M | -20.67M | 4.05M | -4.06M | 14.62M | 18.12M | 13.24M | -2.96M | 13.95M | 22.50M | 20.61M | 13.06M | 7.13M | -1.42M | 2.09M | 7.64M | 5.06M | 2.10M | 5.00M | 7.20M | 4.80M | 2.70M | -2.40M |

| Net Income Ratio | 1.72% | -3.99% | -0.49% | -10.60% | 1.76% | 4.17% | 3.76% | -3.46% | -11.44% | 1.97% | -2.25% | 5.82% | 7.17% | 6.99% | -2.37% | 5.93% | 9.79% | 10.11% | 7.68% | 5.91% | -2.05% | 2.95% | 8.43% | 5.73% | 3.15% | 6.89% | 8.86% | 7.96% | 5.74% | -42.11% |

| EPS | 0.54 | -0.90 | -0.09 | -2.16 | 0.49 | 1.31 | 1.05 | -0.74 | -2.92 | 0.58 | -0.58 | 2.13 | 2.65 | 1.95 | -0.44 | 2.08 | 3.39 | 3.19 | 2.00 | 1.20 | -0.23 | 0.34 | 1.26 | 0.83 | 0.34 | 0.79 | 1.15 | 0.76 | 0.57 | -0.96 |

| EPS Diluted | 0.53 | -0.90 | -0.09 | -2.16 | 0.48 | 1.28 | 1.03 | -0.74 | -2.92 | 0.57 | -0.58 | 2.02 | 2.56 | 1.93 | -0.44 | 2.05 | 3.32 | 3.11 | 1.97 | 1.18 | -0.23 | 0.34 | 1.25 | 0.83 | 0.34 | 0.79 | 1.12 | 0.76 | 0.57 | -0.96 |

| Weighted Avg Shares Out | 9.09M | 8.97M | 8.91M | 8.82M | 8.78M | 8.13M | 7.23M | 7.19M | 7.07M | 7.03M | 6.95M | 6.87M | 6.83M | 6.78M | 6.76M | 6.71M | 6.64M | 6.45M | 6.38M | 5.94M | 6.16M | 6.20M | 6.08M | 6.07M | 6.11M | 6.33M | 6.29M | 6.27M | 4.74M | 2.50M |

| Weighted Avg Shares Out (Dil) | 9.28M | 8.97M | 8.91M | 8.82M | 8.87M | 8.35M | 7.37M | 7.19M | 7.07M | 7.12M | 6.95M | 7.45M | 7.14M | 6.87M | 6.76M | 6.80M | 6.77M | 6.61M | 6.48M | 6.04M | 6.16M | 6.20M | 6.11M | 6.07M | 6.11M | 6.33M | 6.43M | 6.27M | 4.74M | 2.50M |

Universal Stainless & Alloy Products, Inc. (USAP) Q4 2022 Earnings Call Transcript

Universal Stainless & Alloy Products, Inc. (USAP) Q3 2022 Earnings Call Transcript

Universal Stainless & Alloy Products (USAP) Reports Q3 Loss, Misses Revenue Estimates

Here Is Why Bargain Hunters Would Love Fast-paced Mover Universal Stainless (USAP)

Universal Stainless & Alloy Products Ignored On The Runway As Business Starts To Take Off

Universal Stainless & Alloy Products Inc. (USAP) CEO Denny Oates on Q2 2022 Results - Earnings Call Transcript

Universal Stainless & Alloy Products (USAP) Reports Break-Even Earnings for Q2

Universal Stainless to Webcast Second Quarter 2022 Conference Call on July 27th

Universal Stainless & Alloy Products, Inc. (USAP) CEO Dennis Oates on Q1 2022 Earnings Call Transcript

Universal Stainless to Webcast First Quarter 2022 Conference Call on April 20th

Source: https://incomestatements.info

Category: Stock Reports