See more : CD Projekt S.A. (CDR.WA) Income Statement Analysis – Financial Results

Complete financial analysis of Vivani Medical, Inc. (VANI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Vivani Medical, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- T2 Metals Corp. (AGLAF) Income Statement Analysis – Financial Results

- Cyfuse Biomedical K.K. (4892.T) Income Statement Analysis – Financial Results

- Oji Holdings Corporation (3861.T) Income Statement Analysis – Financial Results

- Marquee Raine Acquisition Corp. (MRAC) Income Statement Analysis – Financial Results

- Hess Corporation (HES) Income Statement Analysis – Financial Results

Vivani Medical, Inc. (VANI)

About Vivani Medical, Inc.

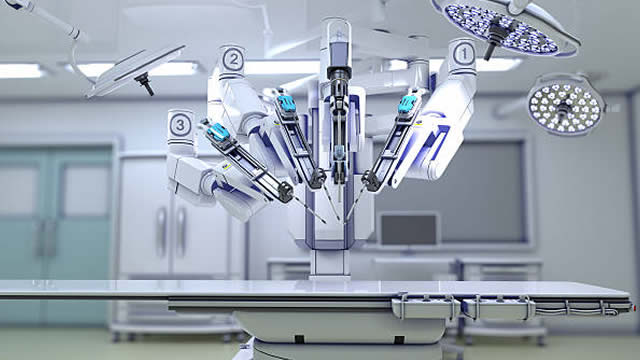

Vivani Medical, Inc., a clinical stage company, develops various implants that treat chronic diseases with high unmet medical need. It engages in developing a portfolio of miniature drug implants to deliver minimally fluctuating drug profiles; and implantable visual prostheses devices to deliver useful artificial vision to blind individuals. The company is headquartered in Emeryville, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 3.38M | 6.90M | 7.96M | 3.99M | 8.95M | 3.40M | 1.56M | 1.37M |

| Cost of Revenue | 357.00K | 381.00K | 345.00K | 167.00K | 2.15M | 4.89M | 7.75M | 9.35M | 4.30M | 3.56M | 5.63M | 4.40M |

| Gross Profit | -357.00K | -381.00K | -345.00K | -167.00K | 1.23M | 2.01M | 211.00K | -5.36M | 4.65M | -160.28K | -4.06M | -3.03M |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 36.31% | 29.12% | 2.65% | -134.60% | 51.93% | -4.72% | -259.72% | -221.58% |

| Research & Development | 16.97M | 14.17M | 11.00M | 6.87M | 16.50M | 10.21M | 7.99M | 5.35M | 3.04M | 5.04M | 3.25M | 3.05M |

| General & Administrative | 10.00M | 7.07M | 2.32M | 2.38M | 9.23M | 10.69M | 10.93M | 10.08M | 8.22M | 6.57M | 4.17M | 4.03M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 6.10M | 11.34M | 9.57M | 8.99M | 8.94M | 6.84M | 3.30M | 2.19M |

| SG&A | 10.00M | 7.07M | 2.32M | 2.38M | 15.33M | 26.63M | 23.56M | 21.77M | 20.67M | 13.41M | 7.47M | 6.22M |

| Other Expenses | 0.00 | 475.00K | -91.00K | -36.00K | 3.35M | 4.60M | 2.64M | -727.00K | -991.00K | 2.62M | 3.22M | 3.73M |

| Operating Expenses | 26.97M | 21.24M | 13.32M | 9.24M | 31.82M | 36.83M | 28.92M | 27.85M | 24.70M | 21.07M | 13.93M | 12.99M |

| Cost & Expenses | 26.97M | 21.24M | 13.32M | 9.24M | 33.98M | 41.72M | 36.67M | 37.20M | 29.00M | 24.63M | 19.56M | 17.39M |

| Interest Income | 0.00 | 0.00 | 0.00 | 16.00K | 362.00K | 86.00K | 93.00K | 31.00K | 2.00K | 9.11K | 7.45K | 7.51K |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 29.00K | 7.03M | 5.01M | 267.03K |

| Depreciation & Amortization | 357.00K | 381.00K | 345.00K | 167.00K | 414.00K | 435.00K | 457.00K | 432.00K | 335.00K | 279.18K | 315.77K | 324.71K |

| EBITDA | -26.61M | -19.16M | -12.98M | -8.89M | -33.18M | -34.66M | -28.06M | -32.75M | -19.68M | -27.89M | -17.64M | -15.69M |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -893.25% | -498.69% | -354.75% | -822.53% | -220.25% | -820.75% | -1,127.18% | -1,147.39% |

| Operating Income | -26.97M | -21.24M | -13.32M | -9.24M | -30.60M | -34.83M | -28.71M | -33.21M | -20.05M | -21.23M | -18.00M | -16.02M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -905.50% | -505.00% | -360.48% | -833.38% | -223.99% | -624.91% | -1,150.05% | -1,171.82% |

| Total Other Income/Expenses | 1.31M | 7.35M | 550.00K | -36.00K | -3.00M | -269.00K | 193.00K | 31.00K | 29.00K | -13.97M | -4.97M | -257.74K |

| Income Before Tax | -25.65M | -13.89M | -12.77M | -9.28M | -33.59M | -35.09M | -28.52M | -33.18M | -20.02M | -35.20M | -22.97M | -16.28M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -994.14% | -508.90% | -358.06% | -832.60% | -223.66% | -1,035.99% | -1,467.73% | -1,190.67% |

| Income Tax Expense | 0.00 | -7.35M | -641.00K | 147.70K | 362.00K | 86.00K | 93.00K | 31.00K | 58.00K | -6.93M | 42.22K | 9.29K |

| Net Income | -25.65M | -6.54M | -12.13M | -9.28M | -33.59M | -35.09M | -28.52M | -33.18M | -20.02M | -35.20M | -22.97M | -16.28M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -994.14% | -508.90% | -358.06% | -832.60% | -223.66% | -1,035.99% | -1,467.73% | -1,190.67% |

| EPS | -0.50 | -0.17 | -1.10 | -1.35 | -6.85 | -12.69 | -12.64 | -20.13 | -13.48 | -10.31 | -4.87 | -3.45 |

| EPS Diluted | -0.50 | -0.17 | -1.10 | -1.35 | -6.85 | -12.69 | -12.64 | -20.13 | -13.48 | -10.31 | -4.87 | -3.45 |

| Weighted Avg Shares Out | 50.85M | 38.24M | 11.03M | 6.86M | 4.90M | 2.77M | 2.26M | 1.65M | 1.48M | 3.41M | 4.72M | 4.72M |

| Weighted Avg Shares Out (Dil) | 50.85M | 38.24M | 11.03M | 6.86M | 4.90M | 2.77M | 2.26M | 1.65M | 1.48M | 3.41M | 4.72M | 4.72M |

Second Sight Medical stock skyrockets 8-fold in 2 days after FDA approves retinal prosthesis system

EYES Stock: 12 Things for Second Sight Medical Investors to Know as Shares Keep Rocketing

EYES Stock Price Increases Over 55% Pre-Market: Why It Happened

What Did the Stock Market Do Today? 3 Big Stories to Catch Up On.

EYES Stock: The Big FDA News That Has Second Sight Shares Soaring

EYES Stock Price Increases Over 40% Pre-Market: Why It Happened

Second Sight Medical Products, Inc. Receives FDA Approval for the Argus 2s Retinal Prosthesis System

Brewery Clearance Sale: Argus Brewing Slashes Price By $500,000

Married At First Sight: Fans Are Beginning To Doubt The Experts

China reportedly orders halt to imports of Australian coal

Source: https://incomestatements.info

Category: Stock Reports