See more : Elsight Limited (ELS.AX) Income Statement Analysis – Financial Results

Complete financial analysis of Vipshop Holdings Limited (VIPS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Vipshop Holdings Limited, a leading company in the Specialty Retail industry within the Consumer Cyclical sector.

- B2B Software Technologies Limited (B2BSOFT.BO) Income Statement Analysis – Financial Results

- The Farmers Bank of Appomattox (FBPA) Income Statement Analysis – Financial Results

- CompX International Inc. (CIX) Income Statement Analysis – Financial Results

- Hyundai Engineering & Construction Co., Ltd. (000725.KS) Income Statement Analysis – Financial Results

- Solytech Enterprise Corporation (1471.TW) Income Statement Analysis – Financial Results

Vipshop Holdings Limited (VIPS)

About Vipshop Holdings Limited

Vipshop Holdings Limited operates online platforms for various brands in the People's Republic of China. It operates in Vip.com, Shan Shan Outlets, and Others segments. The company offers women's apparel, such as casual wear, jeans, dresses, outerwear, lingerie, pajamas, and maternity clothes; men's apparel comprising casual and smart-casual T-shirts, polo shirts, jackets, pants, and underwear; and skin care and cosmetic products, including cleansers, lotions, face and body creams, face masks, sunscreen, foundations, lipsticks, eye shadows, and other cosmetics-related items. It also provides shoes and bags, which comprises casual and formal shoes, purses, satchels, luggage, duffel bags, and wallets; handbags; apparel, gears and accessories, furnishings and decor, toys, and games for boys, girls, infants, and toddlers; sportswear, sports gear, and footwear for various sporting activities; home furnishings, such as bed and bath products, home decor, kitchen and tabletop items, and home appliances; and consumer electronic products. In addition, the company offers food and snacks, beverages, fresh produce, and pet goods; beauty products; and internet finance services, including consumer and supplier financing, and microcredit. Vipshop Holdings Limited provides its branded products through its vip.com and vipshop.com online platforms, as well as through its internet website and cellular phone application. Further, it offers warehousing, logistics, product procurement, research and development, technology development, and consulting services; software development and information technology support solutions; and supply chain services. Vipshop Holdings Limited was founded in 2008 and is headquartered in Guangzhou, the People's Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 112.86B | 103.15B | 117.06B | 101.86B | 92.99B | 84.52B | 72.91B | 56.59B | 40.20B | 23.41B | 10.28B | 4.32B | 1.43B | 216.10M | 19.15M |

| Cost of Revenue | 87.14B | 81.54B | 93.95B | 80.57B | 72.31B | 67.45B | 56.62B | 42.99B | 30.31B | 17.59B | 7.81B | 3.36B | 1.16B | 194.83M | 17.59M |

| Gross Profit | 25.72B | 21.62B | 23.11B | 21.29B | 20.68B | 17.07B | 16.29B | 13.60B | 9.90B | 5.82B | 2.47B | 964.20M | 272.40M | 21.28M | 1.56M |

| Gross Profit Ratio | 22.79% | 20.96% | 19.74% | 20.90% | 22.24% | 20.19% | 22.35% | 24.03% | 24.62% | 24.87% | 24.03% | 22.32% | 19.08% | 9.85% | 8.15% |

| Research & Development | 1.77B | 2.00B | 1.52B | 1.22B | 1.57B | 2.00B | 1.81B | 1.56B | 1.08B | 679.09M | 244.83M | 91.41M | 34.67M | 3.73M | 704.89K |

| General & Administrative | 4.15B | 4.46B | 13.36B | 11.85B | 12.95B | 12.16B | 11.16B | 8.41B | 6.05B | 3.95B | 1.75B | 853.31M | 852.06M | 61.12M | 9.32M |

| Selling & Marketing | 3.24B | 2.83B | 5.09B | 4.28B | 3.32B | 3.24B | 2.98B | 2.84B | 2.09B | 1.18B | 451.48M | 201.44M | 95.87M | 16.17M | 2.07M |

| SG&A | 15.49B | 7.29B | 18.45B | 16.13B | 16.27B | 15.40B | 14.13B | 11.25B | 8.13B | 5.13B | 2.20B | 1.05B | 947.93M | 77.29M | 11.39M |

| Other Expenses | -645.32M | 6.13B | -924.58M | -707.86M | -2.21B | -2.66B | -2.27B | -1.90B | -1.37B | 20.54M | -297.60M | -107.41M | -38.22M | -4.25M | -1.11M |

| Operating Expenses | 16.62B | 15.42B | 17.52B | 15.43B | 15.63B | 14.65B | 13.60B | 10.89B | 7.83B | 4.98B | 2.14B | 1.04B | 944.38M | 76.77M | 10.99M |

| Cost & Expenses | 103.75B | 96.96B | 111.48B | 96.00B | 87.94B | 82.10B | 70.22B | 53.88B | 38.13B | 22.56B | 9.96B | 4.39B | 2.10B | 271.60M | 28.58M |

| Interest Income | 780.29M | 764.02M | 671.46M | 449.02M | 217.03M | 242.87M | 101.13M | 107.04M | 267.21M | 292.10M | 94.94M | 22.21M | 769.52K | 3.74K | 320.92 |

| Interest Expense | 22.93M | 24.26M | 14.46M | 67.36M | 86.00M | 159.74M | 82.44M | 85.20M | 85.76M | 76.16M | 94.94M | 1.39M | 3.11M | 3.74K | 320.92 |

| Depreciation & Amortization | 1.52B | 1.41B | 1.26B | 1.14B | 950.51M | 889.73M | 1.12B | 1.01B | 583.83M | 361.48M | 53.57M | 28.26M | 8.60M | 684.44K | 282.13K |

| EBITDA | 11.53B | 6.96B | 6.25B | 6.31B | 5.98B | 2.66B | 3.74B | 3.76B | 2.72B | 1.16B | 375.84M | -52.34M | -662.61M | -54.80M | -9.15M |

| EBITDA Ratio | 10.22% | 6.75% | 5.34% | 6.19% | 5.67% | 3.15% | 3.83% | 4.97% | 5.81% | 4.94% | 4.10% | -1.21% | -46.41% | -25.36% | -47.75% |

| Operating Income | 9.10B | 6.20B | 5.58B | 5.86B | 4.77B | 2.42B | 2.69B | 2.71B | 2.07B | 843.74M | 326.20M | -74.55M | -671.98M | -55.49M | -9.43M |

| Operating Income Ratio | 8.07% | 6.01% | 4.77% | 5.75% | 5.13% | 2.86% | 3.69% | 4.78% | 5.15% | 3.60% | 3.17% | -1.73% | -47.07% | -25.68% | -49.23% |

| Total Other Income/Expenses | 963.17M | 1.87B | 333.16M | 1.19B | 196.61M | 278.96M | -149.59M | -41.63M | -20.03M | 163.94M | 104.55M | 19.83M | -2.22M | 3.74K | 320.92 |

| Income Before Tax | 10.07B | 8.08B | 5.87B | 7.02B | 4.94B | 2.75B | 2.54B | 2.67B | 2.05B | 1.07B | 429.37M | -54.72M | -674.20M | -55.49M | -9.43M |

| Income Before Tax Ratio | 8.92% | 7.83% | 5.02% | 6.89% | 5.32% | 3.25% | 3.48% | 4.71% | 5.10% | 4.58% | 4.18% | -1.27% | -47.23% | -25.68% | -49.23% |

| Income Tax Expense | 1.87B | 1.76B | 1.22B | 1.13B | 983.55M | 566.60M | 626.14M | 601.83M | 457.75M | 247.99M | 112.42M | 4.41M | 3.11M | 3.74K | 320.92 |

| Net Income | 8.12B | 6.30B | 4.68B | 5.91B | 4.02B | 2.13B | 1.95B | 2.04B | 1.59B | 851.44M | 316.95M | -59.12M | -674.20M | -55.49M | -9.43M |

| Net Income Ratio | 7.19% | 6.11% | 4.00% | 5.80% | 4.32% | 2.52% | 2.67% | 3.60% | 3.95% | 3.64% | 3.08% | -1.37% | -47.23% | -25.68% | -49.23% |

| EPS | 14.42 | 9.25 | 6.88 | 8.75 | 6.02 | 3.12 | 3.32 | 3.51 | 2.75 | 1.50 | 0.58 | -0.14 | -1.33 | -0.15 | -0.03 |

| EPS Diluted | 14.42 | 9.08 | 6.75 | 8.56 | 5.90 | 3.04 | 3.19 | 3.37 | 2.65 | 1.41 | 0.55 | -0.13 | -1.33 | -0.15 | -0.03 |

| Weighted Avg Shares Out | 562.79M | 693.73M | 680.88M | 675.39M | 667.62M | 682.06M | 587.77M | 579.79M | 578.68M | 566.55M | 544.81M | 430.55M | 505.69M | 373.17M | 373.17M |

| Weighted Avg Shares Out (Dil) | 562.76M | 693.73M | 693.73M | 690.18M | 680.41M | 700.42M | 628.58M | 629.09M | 600.84M | 601.14M | 577.48M | 444.25M | 505.69M | 373.17M | 373.17M |

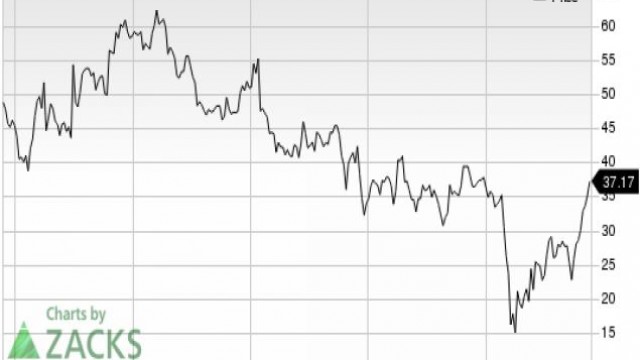

Vipshop Holdings Limited (VIPS) Suffers a Larger Drop Than the General Market: Key Insights

Buy These 4 Low-Beta Stocks to Counter Market Volatility

Vipshop Holdings Limited (VIPS) Stock Dips While Market Gains: Key Facts

Vipshop Holdings Limited (VIPS) Stock Dips While Market Gains: Key Facts

Investors Heavily Search Vipshop Holdings Limited (VIPS): Here is What You Need to Know

Buy These Chinese Tech Stocks as Risk to Reward Becomes Favorable

Here is What to Know Beyond Why Vipshop Holdings Limited (VIPS) is a Trending Stock

All You Need to Know About Vipshop Holdings Limited (VIPS) Rating Upgrade to Strong Buy

Best Value Stocks to Buy for September 15th

The 3 Best Value Stocks to Buy Now: September 2023

Source: https://incomestatements.info

Category: Stock Reports