See more : Sansei Technologies, Inc. (SKUYF) Income Statement Analysis – Financial Results

Complete financial analysis of ViewRay, Inc. (VRAY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ViewRay, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- ReWalk Robotics Ltd. (RWLK) Income Statement Analysis – Financial Results

- AVerMedia Technologies, Inc. (2417.TW) Income Statement Analysis – Financial Results

- Samsung Electronics Co., Ltd. (005930.KS) Income Statement Analysis – Financial Results

- Banco di Desio e della Brianza S.p.A. (BDB.MI) Income Statement Analysis – Financial Results

- PVR INOX Limited (PVRINOX.NS) Income Statement Analysis – Financial Results

ViewRay, Inc. (VRAY)

About ViewRay, Inc.

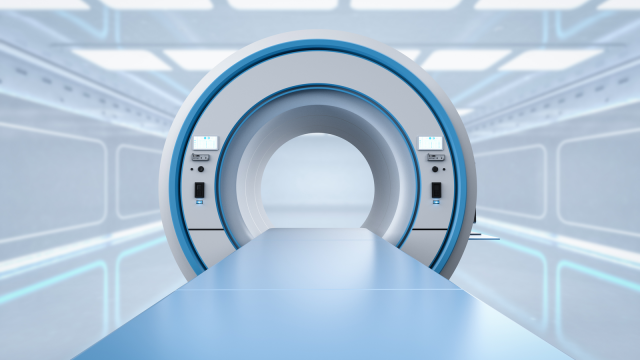

ViewRay, Inc. designs, manufactures, and markets magnetic resonance imaging (MRI) guided radiation therapy systems to image and treat cancer patients in the United States, France, Taiwan, the United Kingdom, and internationally. The company provides MRIdian, which is an MRI guided radiation therapy system that addresses beam distortion, skin toxicity, and other concerns. The company serves university research and teaching hospitals, community hospitals, private practices, government institutions, and freestanding cancer centers. ViewRay, Inc. markets its MRIdian through a direct sales force and distribution network. The company was founded in 2004 and is headquartered in Oakwood, Ohio.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 102.21M | 70.12M | 57.02M | 87.78M | 80.96M | 34.04M | 22.24M | 10.39M | 0.00 | 3.16M |

| Cost of Revenue | 92.16M | 69.78M | 61.08M | 93.26M | 74.36M | 27.71M | 25.87M | 14.54M | 0.00 | 8.19M |

| Gross Profit | 10.05M | 335.00K | -4.06M | -5.48M | 6.60M | 6.33M | -3.63M | -4.15M | 0.00 | -5.03M |

| Gross Profit Ratio | 9.83% | 0.48% | -7.12% | -6.24% | 8.16% | 18.60% | -16.32% | -39.98% | 0.00% | -159.16% |

| Research & Development | 32.43M | 31.85M | 25.01M | 23.79M | 16.52M | 14.71M | 11.44M | 10.45M | 0.00 | 8.78M |

| General & Administrative | 52.44M | 56.09M | 61.73M | 65.72M | 50.11M | 31.38M | 23.50M | 21.69M | 0.00 | 9.51M |

| Selling & Marketing | 30.49M | 16.04M | 15.18M | 25.81M | 15.06M | 8.41M | 5.60M | 5.14M | 0.00 | 3.78M |

| SG&A | 82.93M | 72.14M | 76.91M | 91.52M | 65.18M | 39.79M | 29.10M | 26.82M | 0.00 | 13.29M |

| Other Expenses | 3.17M | -2.17M | 585.00K | 3.20M | 6.39M | -16.77M | -512.00K | -117.00K | 0.00 | 0.00 |

| Operating Expenses | 115.36M | 103.98M | 101.92M | 115.32M | 81.70M | 54.50M | 40.55M | 37.27M | 0.00 | 22.07M |

| Cost & Expenses | 207.52M | 173.77M | 162.99M | 208.58M | 156.05M | 82.21M | 66.41M | 51.82M | 0.00 | 30.26M |

| Interest Income | 1.69M | 13.00K | 791.00K | 1.72M | 8.00K | 5.00K | 2.00K | 2.00K | 0.00 | 4.00K |

| Interest Expense | 5.06M | 4.24M | 3.31M | 4.33M | 7.70M | 7.25M | 5.95M | 3.45M | 0.00 | 97.00K |

| Depreciation & Amortization | 4.85M | -2.16M | 1.38M | 4.92M | 3.50M | 2.20M | 1.71M | 1.26M | 0.00 | 1.15M |

| EBITDA | -100.46M | -105.81M | -104.60M | -115.87M | -68.70M | -62.73M | -44.69M | -41.54M | 0.00 | -26.04M |

| EBITDA Ratio | -98.29% | -150.90% | -183.46% | -132.00% | -84.85% | -184.28% | -200.95% | -399.83% | 0.00% | -824.34% |

| Operating Income | -107.13M | -103.65M | -105.98M | -120.80M | -75.09M | -48.16M | -44.18M | -41.43M | 0.00 | -27.10M |

| Operating Income Ratio | -104.81% | -147.82% | -185.87% | -137.61% | -92.75% | -141.48% | -198.66% | -398.72% | 0.00% | -857.77% |

| Total Other Income/Expenses | -203.00K | -6.40M | -1.93M | 596.00K | -1.30M | -24.01M | -6.46M | -3.57M | 0.00 | -125.00K |

| Income Before Tax | -107.33M | -110.05M | -107.91M | -120.20M | -76.40M | -72.18M | -50.64M | -44.99M | 0.00 | -27.22M |

| Income Before Tax Ratio | -105.01% | -156.94% | -189.26% | -136.93% | -94.36% | -212.02% | -227.71% | -433.05% | 0.00% | -861.73% |

| Income Tax Expense | 203.00K | -3.91M | -2.53M | 2.87M | 1.30M | -9.52M | 3.73M | 1.00K | 0.00 | 0.00 |

| Net Income | -107.53M | -106.13M | -105.38M | -123.07M | -76.40M | -72.18M | -50.64M | -45.00M | 0.00 | -27.22M |

| Net Income Ratio | -105.21% | -151.36% | -184.82% | -140.20% | -94.36% | -212.02% | -227.71% | -433.06% | 0.00% | -861.73% |

| EPS | -0.60 | -0.65 | -0.71 | -1.21 | -0.94 | -1.23 | -1.26 | -2.58 | 0.00 | -33.39 |

| EPS Diluted | -0.60 | -0.65 | -0.71 | -1.21 | -0.94 | -1.23 | -1.26 | -2.58 | 0.00 | -33.39 |

| Weighted Avg Shares Out | 180.70M | 164.52M | 147.90M | 102.00M | 81.12M | 58.46M | 40.07M | 17.43M | 892.32K | 815.34K |

| Weighted Avg Shares Out (Dil) | 180.70M | 164.52M | 147.90M | 102.00M | 81.12M | 58.46M | 40.07M | 17.43M | 892.32K | 815.34K |

Open Letter to ViewRay Customers, Service, Software Engineers and Suppliers—Let's Preserve ViewRay Technology

Letter to ViewRay Lenders/Investment Bankers and Customers From Krishnan Suthanthiran, President/Founder of TeamBest Global Companies

Open Letter to ViewRay Customers From Krishnan Suthanthiran, President/Founder of TeamBest Global Companies

ViewRay® Announces Commencement of Nasdaq Delisting Proceedings: Common Stock Expected to Begin Trading on the OTC Markets

Why Is ViewRay (VRAY) Stock Down 69% Today?

ViewRay® Files Voluntary Chapter 11 Petitions

VA Oklahoma City Healthcare System Chooses ViewRay's MRIdian® MRI-Guided Radiation Therapy System

Top 5 Health Care Stocks That Could Blast Off In May - Coherus BioSciences (NASDAQ:CHRS), Intercept Pharma (NASDAQ:ICPT)

ViewRay's MRIdian® to be Featured at Leading European Radiation Oncology Meeting

ViewRay (VRAY) Reports Q1 Loss, Misses Revenue Estimates

Source: https://incomestatements.info

Category: Stock Reports