See more : Arizona Silver Exploration Inc. (AZASF) Income Statement Analysis – Financial Results

Complete financial analysis of Voyageur Pharmaceuticals Ltd. (VYYRF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Voyageur Pharmaceuticals Ltd., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- SHANTI GURU INDUSTRIES LIMITED (SHANTIGURU.BO) Income Statement Analysis – Financial Results

- Aurinia Pharmaceuticals Inc. (AUP.TO) Income Statement Analysis – Financial Results

- Television Broadcasts Limited (TVBCF) Income Statement Analysis – Financial Results

- Uoki Co.,Ltd. (2683.T) Income Statement Analysis – Financial Results

- Golden Falcon Acquisition Corp. (GFX-WT) Income Statement Analysis – Financial Results

Voyageur Pharmaceuticals Ltd. (VYYRF)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://voyageurpharmaceuticals.ca

About Voyageur Pharmaceuticals Ltd.

Voyageur Pharmaceuticals Ltd. focuses on the development of active pharmaceutical ingredients minerals. The company intends to develop barium and iodine radiocontrast products and bromine based pharmaceutical products. It holds 100% interest in three barium sulfate deposits, including two properties suitable in grade for the pharmaceutical barite marketplace located in British Columbia, Canada; and interests in a high-grade iodine, lithium, and bromine brine project in Utah, the United States. The company was formerly known as Voyageur Minerals Ltd. and changed its name to Voyageur Pharmaceuticals Ltd. in December 2019. Voyageur Pharmaceuticals Ltd. is headquartered in Calgary, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 2.19K | 2.91K | 2.25K | 1.48K | 2.12K | 0.00 | 0.00 | 113.54K | 137.22K | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -2.19K | -2.91K | -2.25K | -1.48K | -2.12K | 0.00 | 0.00 | -113.54K | -137.22K | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 527.56K | 496.51K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 376.16K | 1.22M | 1.55M | 999.56K | 552.77K | 866.03K | 655.74K | 571.39K | 108.83K | 0.00 | 45.33K | 85.52K | 0.00 |

| Selling & Marketing | 280.94K | 527.56 | 496.51 | 0.00 | 0.00 | 0.00 | 0.00 | -519.07K | -107.35K | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.22M | 1.22M | 1.55M | 999.56K | 552.77K | 866.03K | 655.74K | 52.32K | 1.48K | 94.46K | 45.33K | 85.52K | 0.00 |

| Other Expenses | 0.00 | 0.00 | 0.00 | 13.73K | 2.60K | 26.88K | 40.38K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.22M | 1.75M | 2.05M | 1.00M | 554.89K | 866.03K | 655.74K | 52.32K | 1.48K | 94.46K | 45.33K | 85.52K | 0.00 |

| Cost & Expenses | 1.22M | 1.75M | 2.05M | 1.00M | 554.89K | 866.03K | 655.74K | 52.32K | 1.48K | 94.46K | 45.33K | 85.52K | 0.00 |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 3.28K | 18.65K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.19K | 2.91K | 2.25K | 1.48K | 2.12K | 845.76K | 615.01K | 698.17K | 246.05K | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | -1.22M | -1.75M | -2.05M | -1.12M | -550.17K | 0.00 | 0.00 | -520.00 | 0.00 | -94.46K | -45.33K | -85.52K | 0.00 |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -1.22M | -1.75M | -2.05M | -848.94K | -554.89K | -1.15M | -615.36K | -52.32K | -1.48K | -94.46K | -45.33K | -85.52K | 0.00 |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -178.52K | -1.97K | -3.28K | -154.84K | -21.83K | 289.90K | -55.74K | -516.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -1.40M | -1.75M | -2.05M | -1.14M | -552.29K | -555.86K | -670.75K | -52.32K | -1.48K | -94.46K | -45.33K | -85.52K | 0.00 |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | 1.97K | -1.00 | 152.10K | -169.74K | -444.43K | -40.38K | -5.49K | -246.06K | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | -1.40M | -1.75M | -2.05M | -1.14M | -552.29K | -555.86K | -670.75K | -52.32K | -1.48K | -94.46K | -45.33K | -85.52K | 0.00 |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.01 | -0.02 | -0.02 | -0.02 | -0.01 | -0.01 | -0.02 | -0.05 | 0.00 | -0.09 | -0.05 | -0.14 | 0.00 |

| EPS Diluted | -0.01 | -0.02 | -0.02 | -0.02 | -0.01 | -0.01 | -0.02 | -0.05 | 0.00 | -0.09 | -0.05 | -0.14 | 0.00 |

| Weighted Avg Shares Out | 130.51M | 107.83M | 94.68M | 70.53M | 57.54M | 47.52M | 36.40M | 1.01M | 1.01M | 1.01M | 1.01M | 626.52K | 925.00K |

| Weighted Avg Shares Out (Dil) | 130.50M | 107.83M | 94.68M | 70.53M | 57.54M | 47.52M | 36.40M | 1.01M | 1.01M | 1.01M | 1.01M | 626.52K | 925.00K |

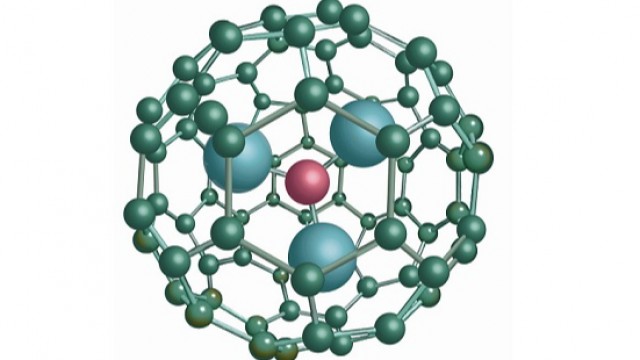

Voyageur Pharmaceuticals signs MOU to develop fullerene contrast agents for medical imaging applications and carbon capture technology

Voyageur Pharmaceuticals Ltd. Issuance of 5th Product License for MultiXThick Radiographic Barium Contrast

Voyageur Pharmaceuticals Ltd. Issued 4th Health Canada License For Radiographic Barium Contrast Product

Source: https://incomestatements.info

Category: Stock Reports