See more : Simply Better Brands Corp. (SBBC.V) Income Statement Analysis – Financial Results

Complete financial analysis of West Pharmaceutical Services, Inc. (WST) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of West Pharmaceutical Services, Inc., a leading company in the Medical – Instruments & Supplies industry within the Healthcare sector.

- Jiamei Food Packaging (Chuzhou) Co.,Ltd (002969.SZ) Income Statement Analysis – Financial Results

- Sera Prognostics, Inc. (SERA) Income Statement Analysis – Financial Results

- Tontek Design Technology Ltd. (5487.TWO) Income Statement Analysis – Financial Results

- Hemisphere Properties India Limited (HEMIPROP.NS) Income Statement Analysis – Financial Results

- Calima Energy Limited (CE1.AX) Income Statement Analysis – Financial Results

West Pharmaceutical Services, Inc. (WST)

About West Pharmaceutical Services, Inc.

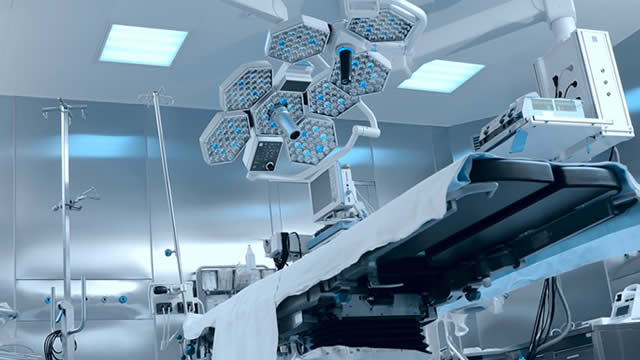

West Pharmaceutical Services, Inc. designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It operates in two segments, Proprietary Products and Contract-Manufactured Products. The Proprietary Products segment offers stoppers and seals for injectable packaging systems; syringe and cartridge components, including custom solutions for the needs of injectable drug applications, as well as administration systems that enhance the safe delivery of drugs through advanced reconstitution, mixing, and transfer technologies; and films, coatings, washing, and vision inspection and sterilization processes and services to enhance the quality of packaging components. It also provides drug containment solutions, including Crystal Zenith, a cyclic olefin polymer in the form of vials, syringes, and cartridges; and self-injection devices, as well as a range of integrated solutions, including analytical lab services, pre-approval primary packaging support and engineering development, regulatory expertise, and after-sales technical support. This segment serves biologic, generic, and pharmaceutical drug companies. The Contract-Manufactured Products segment is involved in the design, manufacture, and automated assembly of devices used in surgical, diagnostic, ophthalmic, injectable, and other drug delivery systems, as well as consumer products. It serves pharmaceutical, diagnostic, and medical device companies. The company distributes its products through its sales force and distribution network, as well as contract sales agents and regional distributors. West Pharmaceutical Services, Inc. was incorporated in 1923 and is headquartered in Exton, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.95B | 2.89B | 2.83B | 2.15B | 1.84B | 1.72B | 1.60B | 1.51B | 1.40B | 1.42B | 1.37B | 1.27B | 1.19B | 1.10B | 1.06B | 1.05B | 1.02B | 913.30M | 699.70M | 541.60M | 490.70M | 419.70M | 396.90M | 430.10M | 469.10M | 449.70M | 452.50M | 458.80M | 412.90M | 365.10M | 348.70M | 338.20M | 329.60M | 323.20M | 308.70M | 288.20M | 253.30M | 235.60M | 190.10M |

| Cost of Revenue | 1.82B | 1.75B | 1.66B | 1.38B | 1.23B | 1.17B | 1.09B | 1.01B | 944.00M | 973.60M | 933.70M | 878.70M | 853.00M | 786.60M | 752.10M | 748.50M | 728.30M | 651.50M | 507.10M | 385.70M | 334.90M | 302.10M | 280.80M | 289.70M | 289.10M | 282.20M | 288.50M | 302.00M | 265.10M | 225.90M | 222.10M | 217.80M | 221.40M | 221.50M | 206.70M | 197.40M | 174.40M | 160.20M | 128.00M |

| Gross Profit | 1.13B | 1.14B | 1.18B | 767.80M | 605.70M | 545.40M | 512.60M | 501.10M | 455.80M | 447.80M | 434.70M | 387.70M | 339.30M | 318.10M | 303.60M | 302.60M | 291.80M | 261.80M | 192.60M | 155.90M | 155.80M | 117.60M | 116.10M | 140.40M | 180.00M | 167.50M | 164.00M | 156.80M | 147.80M | 139.20M | 126.60M | 120.40M | 108.20M | 101.70M | 102.00M | 90.80M | 78.90M | 75.40M | 62.10M |

| Gross Profit Ratio | 38.28% | 39.36% | 41.52% | 35.76% | 32.92% | 31.76% | 32.06% | 33.21% | 32.56% | 31.50% | 31.77% | 30.61% | 28.46% | 28.80% | 28.76% | 28.79% | 28.61% | 28.67% | 27.53% | 28.79% | 31.75% | 28.02% | 29.25% | 32.64% | 38.37% | 37.25% | 36.24% | 34.18% | 35.80% | 38.13% | 36.31% | 35.60% | 32.83% | 31.47% | 33.04% | 31.51% | 31.15% | 32.00% | 32.67% |

| Research & Development | 68.40M | 58.50M | 52.80M | 46.90M | 38.90M | 40.30M | 39.10M | 36.80M | 34.10M | 37.30M | 37.90M | 33.20M | 29.10M | 23.90M | 19.90M | 18.70M | 16.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 262.90M | 242.60M | 239.80M | 233.00M | 228.70M | 234.90M | 218.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 353.40M | 316.90M | 362.80M | 302.00M | 272.70M | 262.90M | 242.60M | 239.80M | 233.00M | 228.70M | 234.90M | 218.10M | 191.10M | 187.70M | 177.70M | 159.30M | 152.50M | 155.90M | 120.30M | 105.20M | 111.00M | 82.60M | 73.40M | 67.70M | 77.90M | 70.50M | 70.20M | 72.80M | 69.90M | 69.00M | 63.50M | 57.10M | 85.00M | 57.80M | 45.60M | 41.50M | 32.20M | 29.90M | 26.60M |

| Other Expenses | 31.50M | 26.80M | 7.90M | 12.00M | 2.40M | 4.80M | -2.00M | -27.70M | -60.10M | 200.00K | 500.00K | 5.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 454.00M | 402.20M | 423.50M | 360.90M | 311.60M | 303.20M | 281.70M | 276.60M | 267.10M | 266.00M | 272.80M | 251.30M | 221.70M | 213.30M | 197.60M | 191.90M | 168.60M | 160.80M | 121.70M | 106.70M | 94.30M | 81.00M | 71.90M | 104.70M | 113.60M | 102.80M | 102.10M | 103.50M | 99.50M | 92.10M | 85.50M | 80.70M | 109.50M | 80.50M | 65.90M | 60.40M | 49.00M | 44.60M | 38.60M |

| Cost & Expenses | 2.27B | 2.15B | 2.08B | 1.74B | 1.55B | 1.48B | 1.37B | 1.28B | 1.21B | 1.24B | 1.21B | 1.13B | 1.07B | 999.90M | 949.70M | 940.40M | 896.90M | 812.30M | 628.80M | 492.40M | 429.20M | 383.10M | 352.70M | 394.40M | 402.70M | 385.00M | 390.60M | 405.50M | 364.60M | 318.00M | 307.60M | 298.50M | 330.90M | 302.00M | 272.60M | 257.80M | 223.40M | 204.80M | 166.60M |

| Interest Income | 28.00M | 5.10M | 1.00M | 1.40M | 3.80M | 2.10M | 1.30M | 1.10M | 1.60M | 3.50M | 1.90M | 1.80M | 1.30M | 600.00K | 800.00K | 1.40M | 6.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.00M | 7.90M | 7.20M | 6.80M | 4.70M | 6.30M | 6.50M | 7.00M | 12.50M | 13.00M | 15.10M | 14.90M | 18.20M | 16.80M | 14.40M | 16.00M | 14.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 137.30M | 120.60M | 122.30M | 109.10M | 103.40M | 104.40M | 96.70M | 90.70M | 89.90M | 90.00M | 85.20M | 76.90M | 75.70M | 73.20M | 68.10M | 60.60M | 56.60M | 52.70M | 47.40M | 33.20M | 33.00M | 33.00M | 32.00M | 37.00M | 35.70M | 32.30M | 31.90M | 30.70M | 29.60M | 23.10M | 22.00M | 23.60M | 24.50M | 22.70M | 20.30M | 18.90M | 16.80M | 14.70M | 12.00M |

| EBITDA | 844.10M | 887.90M | 895.20M | 531.70M | 399.40M | 355.30M | 335.90M | 319.60M | 220.00M | 273.30M | 249.00M | 200.00M | 183.40M | 161.30M | 166.40M | 186.10M | 157.50M | 149.90M | 122.90M | 94.50M | 84.80M | 82.80M | 74.70M | 75.90M | 102.10M | 97.00M | 93.80M | 84.00M | 77.90M | 70.20M | 63.10M | 63.30M | 23.20M | 43.90M | 56.40M | 49.30M | 46.70M | 45.50M | 35.50M |

| EBITDA Ratio | 28.62% | 29.60% | 31.02% | 24.09% | 21.73% | 14.38% | 14.31% | 13.04% | 9.19% | 12.80% | 11.87% | 11.20% | 10.53% | 10.76% | 9.95% | 10.65% | 20.40% | 18.01% | 19.39% | 15.68% | 17.28% | 18.56% | 19.55% | 21.39% | 21.49% | 28.13% | 20.38% | 22.47% | 18.29% | 19.56% | 17.95% | 18.72% | 6.71% | 14.91% | 16.94% | 16.20% | 19.31% | 18.34% | 16.99% |

| Operating Income | 676.00M | 734.00M | 752.30M | 406.90M | 296.60M | 240.30M | 228.90M | 196.80M | 128.60M | 182.00M | 162.40M | 135.10M | 109.60M | 90.70M | 97.50M | 124.10M | 94.90M | 101.00M | 72.20M | 48.20M | 54.50M | 26.70M | 41.30M | 35.70M | 66.40M | 64.70M | 61.90M | 53.30M | 48.30M | 47.10M | 41.10M | 39.70M | -1.30M | 21.20M | 36.10M | 30.40M | 29.90M | 30.80M | 23.50M |

| Operating Income Ratio | 22.92% | 25.43% | 26.57% | 18.95% | 16.12% | 13.99% | 14.31% | 13.04% | 9.19% | 12.80% | 11.87% | 10.67% | 9.19% | 8.21% | 9.24% | 11.81% | 9.30% | 11.06% | 10.32% | 8.90% | 11.11% | 6.36% | 10.41% | 8.30% | 14.15% | 14.39% | 13.68% | 11.62% | 11.70% | 12.90% | 11.79% | 11.74% | -0.39% | 6.56% | 11.69% | 10.55% | 11.80% | 13.07% | 12.36% |

| Total Other Income/Expenses | 22.00M | -54.10M | -3.40M | -5.60M | -4.80M | 400.00K | -3.40M | -5.40M | -12.50M | -13.00M | -15.30M | -26.50M | -23.20M | -31.50M | -14.40M | -15.10M | -8.50M | -16.50M | -12.00M | -8.20M | -7.50M | -9.50M | -13.40M | -11.10M | -9.30M | -36.80M | -4.20M | -26.10M | -5.70M | -6.40M | -4.30M | -5.70M | -2.50M | -10.50M | -2.20M | -2.90M | -6.70M | -600.00K | 1.90M |

| Income Before Tax | 698.00M | 679.90M | 748.90M | 401.30M | 291.80M | 240.70M | 222.40M | 189.80M | 116.10M | 169.00M | 147.10M | 108.60M | 92.70M | 74.50M | 83.10M | 109.50M | 86.40M | 84.50M | 45.20M | 41.20M | 47.00M | 17.20M | 27.80M | 3.10M | 57.10M | 27.90M | 57.70M | 27.20M | 42.60M | 40.70M | 36.80M | 34.00M | -3.80M | 10.70M | 33.90M | 27.50M | 23.20M | 30.20M | 25.40M |

| Income Before Tax Ratio | 23.66% | 23.55% | 26.45% | 18.69% | 15.86% | 14.02% | 13.91% | 12.58% | 8.29% | 11.89% | 10.75% | 8.58% | 7.77% | 6.74% | 7.87% | 10.42% | 8.47% | 9.25% | 6.46% | 7.61% | 9.58% | 4.10% | 7.00% | 0.72% | 12.17% | 6.20% | 12.75% | 5.93% | 10.32% | 11.15% | 10.55% | 10.05% | -1.15% | 3.31% | 10.98% | 9.54% | 9.16% | 12.82% | 13.36% |

| Income Tax Expense | 122.30M | 114.70M | 107.20M | 72.50M | 59.00M | 41.40M | 80.90M | 54.40M | 26.30M | 47.20M | 40.20M | 32.70M | 23.50M | 13.60M | 13.50M | 23.70M | 17.20M | 24.60M | -400.00K | 11.10M | 16.70M | 4.10M | 8.60M | 1.50M | 18.40M | 21.20M | 13.30M | 10.80M | 13.90M | 13.40M | 14.30M | 14.30M | 4.70M | 6.40M | 13.20M | 10.10M | 9.50M | 13.20M | 10.40M |

| Net Income | 593.40M | 585.90M | 661.80M | 346.20M | 241.70M | 206.90M | 150.70M | 143.60M | 95.60M | 127.10M | 112.30M | 80.70M | 75.50M | 65.30M | 72.60M | 86.00M | 70.70M | 67.10M | 45.60M | 19.40M | 31.90M | 18.40M | -5.20M | 1.60M | 38.70M | 6.70M | 44.40M | 16.40M | 28.70M | 27.30M | 23.50M | 19.70M | -8.50M | 4.30M | 20.70M | 17.40M | 13.70M | 17.00M | 15.00M |

| Net Income Ratio | 20.12% | 20.30% | 23.37% | 16.13% | 13.14% | 12.05% | 9.42% | 9.52% | 6.83% | 8.94% | 8.21% | 6.37% | 6.33% | 5.91% | 6.88% | 8.18% | 6.93% | 7.35% | 6.52% | 3.58% | 6.50% | 4.38% | -1.31% | 0.37% | 8.25% | 1.49% | 9.81% | 3.57% | 6.95% | 7.48% | 6.74% | 5.82% | -2.58% | 1.33% | 6.71% | 6.04% | 5.41% | 7.22% | 7.89% |

| EPS | 7.99 | 7.88 | 8.90 | 4.68 | 3.27 | 2.80 | 2.04 | 1.96 | 1.33 | 1.79 | 1.61 | 1.19 | 1.12 | 0.98 | 1.11 | 1.33 | 1.08 | 1.05 | 0.75 | 0.57 | 0.75 | 0.33 | -0.09 | 0.03 | 0.65 | 0.10 | 0.67 | 0.25 | 0.43 | 0.43 | 0.37 | 0.32 | -0.14 | 0.07 | 0.32 | 0.27 | 0.21 | 0.27 | 0.24 |

| EPS Diluted | 7.88 | 7.73 | 8.67 | 4.57 | 3.21 | 2.74 | 1.99 | 1.91 | 1.30 | 1.75 | 1.57 | 1.15 | 1.08 | 0.95 | 1.06 | 1.25 | 1.02 | 1.00 | 0.71 | 0.56 | 0.75 | 0.33 | -0.09 | 0.03 | 0.64 | 0.10 | 0.67 | 0.25 | 0.43 | 0.43 | 0.37 | 0.31 | -0.14 | 0.07 | 0.32 | 0.27 | 0.21 | 0.27 | 0.24 |

| Weighted Avg Shares Out | 74.30M | 74.40M | 74.40M | 73.90M | 74.00M | 73.90M | 73.90M | 73.30M | 72.00M | 70.90M | 69.60M | 68.00M | 67.40M | 66.60M | 65.60M | 64.80M | 65.40M | 64.40M | 62.20M | 60.00M | 58.00M | 57.80M | 57.34M | 57.63M | 59.66M | 65.74M | 65.90M | 65.67M | 66.23M | 64.22M | 63.51M | 62.54M | 61.82M | 63.70M | 64.69M | 65.05M | 64.47M | 64.15M | 63.16M |

| Weighted Avg Shares Out (Dil) | 75.30M | 75.80M | 76.30M | 75.80M | 75.40M | 75.40M | 75.80M | 75.00M | 73.80M | 72.80M | 71.40M | 71.80M | 74.00M | 73.40M | 72.60M | 72.20M | 72.40M | 67.20M | 65.00M | 61.60M | 58.20M | 57.80M | 57.39M | 57.64M | 60.19M | 66.02M | 66.29M | 65.67M | 66.23M | 64.22M | 63.95M | 63.04M | 61.82M | 63.70M | 65.20M | 65.05M | 64.47M | 64.15M | 63.16M |

MMSI or WST: Which Is the Better Value Stock Right Now?

Reasons to Hold West Pharmaceutical Stock in Your Portfolio Now

Final Trade: West Pharma, Cameco, iShares Biotechnology ETF and Applied Digital Corp

17 Upcoming Dividend Increases

West to Participate in Upcoming Investor Conferences

The Zacks Analyst Blog The Gorman-Rupp, Kontoor Brands, Kontoor Brands and Standex International

Buy These 4 Stocks With New Dividend Hikes Amid Market Volatility

West Pharmaceutical Services, Inc. (WST) Q3 2024 Earnings Call Transcript

West Pharmaceutical's Q3 Performance Shows Rising Demand For Syringes, Company Boosts Annual Forecast And Dividend

West Pharmaceutical Stock Gains on Q3 Earnings Beat & Raised Guidance

Source: https://incomestatements.info

Category: Stock Reports