See more : James Maritime Holdings, Inc. (JMTM) Income Statement Analysis – Financial Results

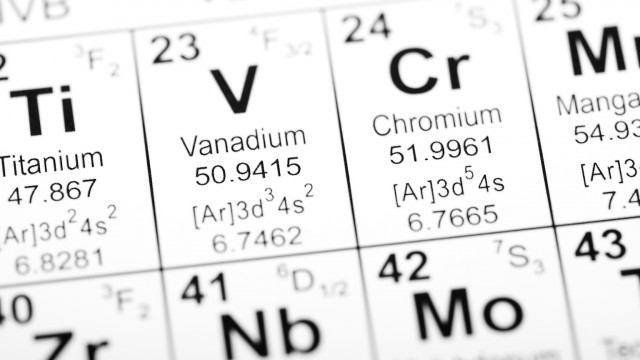

Complete financial analysis of Western Uranium & Vanadium Corp. (WSTRF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Western Uranium & Vanadium Corp., a leading company in the Uranium industry within the Energy sector.

- SeaStar Medical Holding Corporation (ICUCW) Income Statement Analysis – Financial Results

- Charlotte’s Web Holdings, Inc. (CWBHF) Income Statement Analysis – Financial Results

- Candelaria Mining Corp. (CDELF) Income Statement Analysis – Financial Results

- Golden Agri-Resources Ltd (E5H.SI) Income Statement Analysis – Financial Results

- The Bank of Toyama, Ltd. (8365.T) Income Statement Analysis – Financial Results

Western Uranium & Vanadium Corp. (WSTRF)

About Western Uranium & Vanadium Corp.

Western Uranium & Vanadium Corp. engages in the acquisition and development of uranium and vanadium resource properties in the states of Utah and Colorado, the United States. The company holds interests in the San Rafael uranium project located in Emery County, Utah; the Sunday Mine Complex situated in western San Miguel County, Colorado; the Van 4 mine located in western Montrose County, Colorado; the Sage mine project situated in San Juan County, Utah, and San Miguel County, Colorado; and the Dunn Project located in San Juan County, Utah. It also has interests in the Hansen, North Hansen, High Park, and Hansen Picnic Tree projects located in Fremont and Teller Counties, Colorado; the Keota project situated in Weld County, Colorado; and Ferris Haggerty project located in Carbon County, Wyoming. The company was formerly known as Western Uranium Corporation and changed its name to Western Uranium & Vanadium Corp. in October 2018. Western Uranium & Vanadium Corp. is based in Toronto, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 431.07K | 7.86M | 272.14K | 54.62K | 44.62K | 48.25K | 20.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 2.95M | 4.04M | 29.26K | 393.18K | 466.12K | 177.72K | 154.72K | 181.30K | 28.25K | 114.45K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -2.52M | 3.81M | 242.88K | -338.56K | -421.50K | -129.47K | -134.72K | -181.30K | -28.25K | -114.45K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | -584.72% | 48.54% | 89.25% | -619.85% | -944.64% | -268.36% | -673.62% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 170.00K | 290.00K | 270.00K | 890.00K | 90.00K | 30.00K | 130.00K | 0.00 | 0.00 |

| General & Administrative | 2.58M | 3.83M | 1.57M | 1.48M | 1.62M | 1.88M | 1.57M | 1.61M | 1.02M | 104.00K | 230.00K | 220.00K | 330.00K | 590.00K | 1.46M | 2.30M | 1.04M | 50.00K | 30.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.58M | 3.83M | 1.57M | 1.48M | 1.62M | 1.88M | 1.57M | 1.61M | 1.02M | 104.00K | 230.00K | 220.00K | 330.00K | 590.00K | 1.46M | 2.30M | 1.04M | 50.00K | 30.00K |

| Other Expenses | 0.00 | 762.33K | 717.66K | 393.18K | 466.12K | 188.75K | 475.26K | 389.83K | 457.21K | 95.37K | 0.00 | 30.00K | 60.00K | 40.00K | 2.96M | 3.82M | 20.00K | 0.00 | 10.00K |

| Operating Expenses | 5.53M | 4.59M | 2.29M | 1.87M | 2.09M | 2.07M | 1.73M | 2.00M | 1.47M | 199.37K | 400.00K | 540.00K | 660.00K | 1.52M | 4.51M | 6.15M | 1.19M | 50.00K | 40.00K |

| Cost & Expenses | 5.53M | 8.64M | 2.29M | 1.87M | 2.09M | 2.07M | 1.73M | 2.00M | 1.47M | 199.37K | 400.00K | 540.00K | 660.00K | 1.52M | 4.51M | 6.15M | 1.19M | 50.00K | 40.00K |

| Interest Income | 0.00 | 61.41K | 16.96K | 0.00 | 0.00 | 1.29K | 1.93K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 13.34K | 65.35K | 26.38K | 62.17K | 118.48K | 114.64K | 24.89K | -80.00K | -20.00K | -740.00K | 210.00K | 220.00K | 910.00K | 230.00K | -150.00K | 0.00 |

| Depreciation & Amortization | 262.83K | 53.33K | 29.26K | 27.73K | 77.97K | 26.41K | 9.49K | 181.30K | 28.25K | 406.46K | -160.00K | 30.00K | 50.00K | 110.00K | 50.00K | 50.00K | 20.00K | -300.00K | 0.00 |

| EBITDA | -4.83M | -752.30K | -1.99M | -2.48M | -2.04M | -1.89M | -1.71M | -1.66M | -1.33M | 0.00 | -467.19K | -526.04K | -1.32M | 4.73M | -4.00M | -4.28M | -700.00K | -350.00K | -40.00K |

| EBITDA Ratio | -1,121.19% | -9.57% | -732.18% | -3,301.04% | -4,568.06% | -4,182.44% | -8,532.83% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -5.10M | -779.18K | -2.01M | -1.81M | -2.04M | -2.01M | -1.71M | -1.87M | -1.47M | -199.37K | -400.00K | -540.00K | -660.00K | -1.52M | -4.51M | -6.15M | -1.19M | -50.00K | -40.00K |

| Operating Income Ratio | -1,182.17% | -9.91% | -739.67% | -3,320.50% | -4,582.88% | -4,162.24% | -8,542.50% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 153.31K | 65.41K | -61.09K | -579.23K | -65.35K | -36.13K | -60.23K | -301.99K | -114.64K | -639.91K | -80.00K | -10.00K | -750.00K | 6.43M | 230.00K | 910.00K | 240.00K | -150.00K | 0.00 |

| Income Before Tax | -4.94M | -713.77K | -2.07M | -2.39M | -2.11M | -2.04M | -1.77M | -2.17M | -1.59M | -1.05M | -480.00K | -550.00K | -1.41M | 4.91M | -4.28M | -5.24M | -950.00K | -200.00K | -40.00K |

| Income Before Tax Ratio | -1,146.60% | -9.08% | -762.12% | -4,380.98% | -4,729.33% | -4,237.12% | -8,843.66% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -65.41K | -16.96K | 13.34K | 65.35K | -170.89K | -1.35M | 429.99K | -28.25K | -381.57K | 0.00 | -30.00K | -1.49M | -750.00K | -150.00K | 1.82M | 140.00K | 0.00 | 0.00 |

| Net Income | -4.94M | -648.35K | -2.06M | -2.41M | -2.18M | -2.04M | -414.29K | -2.17M | -1.59M | -1.05M | -480.00K | -550.00K | -1.41M | 5.16M | -4.12M | -5.24M | -1.09M | -200.00K | -40.00K |

| Net Income Ratio | -1,146.60% | -8.25% | -755.88% | -4,405.40% | -4,875.78% | -4,237.12% | -2,071.44% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.11 | -0.02 | -0.06 | -0.08 | -0.08 | -0.09 | -0.02 | -0.13 | -0.12 | -0.10 | 0.00 | 0.00 | -0.02 | 0.09 | -0.09 | -0.10 | -0.03 | -0.01 | 0.00 |

| EPS Diluted | -0.11 | -0.02 | -0.06 | -0.08 | -0.08 | -0.09 | -0.02 | -0.13 | -0.12 | -0.10 | 0.00 | 0.00 | -0.02 | 0.09 | -0.09 | -0.10 | -0.03 | -0.01 | 0.00 |

| Weighted Avg Shares Out | 44.07M | 42.82M | 36.84M | 30.08M | 28.86M | 23.02M | 19.57M | 17.05M | 13.21M | 10.63M | 209.20M | 132.81M | 74.86M | 56.18M | 46.73M | 52.83M | 35.79M | 35.79M | 35.79M |

| Weighted Avg Shares Out (Dil) | 44.07M | 42.82M | 36.84M | 30.08M | 28.86M | 23.02M | 19.57M | 17.05M | 13.21M | 10.63M | 209.20M | 132.81M | 74.86M | 56.18M | 46.73M | 52.83M | 35.79M | 35.79M | 35.79M |

Vanadium Miners News For The Month Of June 2023

Vanadium Miners News For The Month Of May 2023

Vanadium Miners News For The Month Of March 2023

Vanadium Miners News For The Month Of February 2023

Vanadium Miners News For The Month Of January 2023

Western Uranium & Vanadium has its sights set on becoming a global leader in low-cost production of uranium and vanadium

Vanadium Miners News For The Month Of December 2022

Vanadium Miners News For The Month Of November 2022

Vanadium Miners News For The Month Of May 2022

Vanadium Miners News For The Month Of February 2022

Source: https://incomestatements.info

Category: Stock Reports