See more : Jiangsu Yinhe Electronics Co.,Ltd. (002519.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Gates Industrial Corporation plc (GTES) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Gates Industrial Corporation plc, a leading company in the Industrial – Machinery industry within the Industrials sector.

- RISE Inc. (8836.T) Income Statement Analysis – Financial Results

- SINOLONG NEW MATER (301565.SZ) Income Statement Analysis – Financial Results

- Guangzhou KDT Machinery Co.,Ltd. (002833.SZ) Income Statement Analysis – Financial Results

- Flexible Solutions International, Inc. (FSI) Income Statement Analysis – Financial Results

- Buzz Technologies, Inc. (BZTG) Income Statement Analysis – Financial Results

Gates Industrial Corporation plc (GTES)

About Gates Industrial Corporation plc

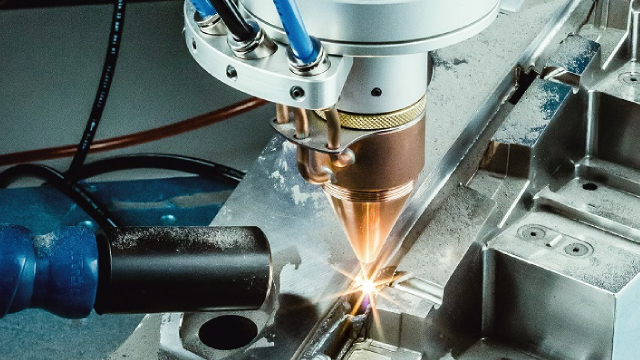

Gates Industrial Corporation plc manufactures and sells engineered power transmission and fluid power solutions worldwide. It operates in two segments, Power Transmission and Fluid Power. The company offers synchronous or asynchronous belts, including V-belts, CVT belts, and Micro-V belts, as well as related components, such as sprockets, pulleys, water pumps, tensioners, or other accessories; solutions for stationary and mobile drives, engine systems, personal mobility, and vertical lifts application platforms; metal drive components; and kits for automotive replacement channels. It also provides fluid power solutions comprising stationary hydraulics, mobile hydraulics, engine systems, and other industrial application platforms; and hydraulics, including hoses, tubing, and fittings, as well as assemblies. The company serves construction, agriculture, energy and resources, automotive, transportation, mobility and recreation, consumer products, and various industrial applications, such as automated manufacturing and logistics systems. It sells its engineered products under the Gates brand. The company offers its products to replacement channel customers, as well as to original equipment manufacturers. Gates Industrial Corporation plc was founded in 1911 and is headquartered in Denver, Colorado.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.57B | 3.55B | 3.47B | 2.79B | 3.09B | 3.35B | 3.04B | 2.75B | 2.75B | 3.04B | 2.95B | 2.92B |

| Cost of Revenue | 2.21B | 2.30B | 2.14B | 1.76B | 1.94B | 2.02B | 1.82B | 1.69B | 1.71B | 2.02B | 1.83B | 1.87B |

| Gross Profit | 1.36B | 1.25B | 1.34B | 1.03B | 1.14B | 1.33B | 1.22B | 1.06B | 1.04B | 1.03B | 1.11B | 1.05B |

| Gross Profit Ratio | 38.06% | 35.19% | 38.54% | 37.05% | 37.01% | 39.75% | 40.04% | 38.62% | 37.74% | 33.76% | 37.81% | 35.99% |

| Research & Development | 0.00 | 69.40M | 70.70M | 67.20M | 67.90M | 71.40M | 68.60M | 68.50M | 67.40M | 53.80M | 47.20M | 45.60M |

| General & Administrative | 879.20M | 847.20M | 852.70M | 776.90M | 777.30M | 805.80M | 779.60M | 744.10M | 784.50M | 815.70M | 462.40M | 491.00M |

| Selling & Marketing | 3.00M | 6.50M | 12.00M | 6.70M | 10.20M | 170.30M | 10.40M | 0.00 | 305.60M | 0.00 | 322.10M | 319.90M |

| SG&A | 882.20M | 853.70M | 852.70M | 776.90M | 777.30M | 805.80M | 779.60M | 744.10M | 784.50M | 815.70M | 784.50M | 810.90M |

| Other Expenses | 14.10M | 200.00K | -9.30M | -1.00M | 9.10M | -17.40M | -56.30M | 200.00K | 200.00K | -400.00K | 0.00 | 0.00 |

| Operating Expenses | 896.30M | 853.90M | 843.40M | 775.90M | 786.40M | 820.10M | 779.30M | 747.00M | 784.10M | 810.20M | 808.30M | 936.60M |

| Cost & Expenses | 3.11B | 3.16B | 2.98B | 2.53B | 2.73B | 2.84B | 2.60B | 2.43B | 2.49B | 2.83B | 2.64B | 2.81B |

| Interest Income | 17.50M | 3.60M | 3.20M | 4.30M | 5.70M | 3.70M | 4.60M | 3.00M | 1.80M | 2.00M | 131.20M | 205.40M |

| Interest Expense | 163.20M | 139.40M | 133.50M | 154.30M | 157.80M | 175.90M | 234.60M | 216.30M | 212.60M | 173.10M | 0.00 | 0.00 |

| Depreciation & Amortization | 217.50M | 217.20M | 222.60M | 218.60M | 222.20M | 218.50M | 212.20M | 240.80M | 269.90M | 248.50M | 208.70M | 228.90M |

| EBITDA | 676.30M | 620.20M | 720.50M | 489.70M | 583.90M | 734.50M | 656.80M | 554.70M | 521.90M | 586.70M | 538.70M | 469.80M |

| EBITDA Ratio | 18.94% | 17.64% | 20.65% | 17.60% | 19.05% | 21.26% | 19.55% | 20.31% | 19.08% | 15.36% | 18.28% | 16.07% |

| Operating Income | 462.60M | 384.00M | 484.10M | 211.10M | 346.80M | 496.80M | 400.40M | 298.80M | 184.60M | -400.00K | 330.00M | 240.90M |

| Operating Income Ratio | 12.96% | 10.80% | 13.93% | 7.56% | 11.23% | 14.84% | 13.16% | 10.88% | 6.72% | -0.01% | 11.20% | 8.24% |

| Total Other Income/Expenses | -177.30M | -126.20M | -134.40M | -140.10M | -148.00M | -193.30M | -293.40M | -212.30M | -142.90M | -124.60M | -125.30M | -331.10M |

| Income Before Tax | 285.30M | 257.80M | 349.70M | 71.00M | 198.80M | 303.50M | 109.50M | 92.90M | 41.70M | -125.00M | 175.00M | -90.20M |

| Income Before Tax Ratio | 7.99% | 7.25% | 10.07% | 2.54% | 6.44% | 9.07% | 3.60% | 3.38% | 1.52% | -4.11% | 5.94% | -3.09% |

| Income Tax Expense | 28.30M | 14.90M | 18.40M | -19.30M | -495.90M | 31.80M | -72.50M | 21.10M | -9.20M | -51.90M | 39.20M | 74.30M |

| Net Income | 232.90M | 220.80M | 297.10M | 79.40M | 690.10M | 245.30M | 151.30M | 57.70M | 24.90M | -142.10M | 107.30M | -39.00M |

| Net Income Ratio | 6.52% | 6.21% | 8.55% | 2.84% | 22.35% | 7.33% | 4.97% | 2.10% | 0.91% | -4.67% | 3.64% | -1.33% |

| EPS | 0.86 | 0.78 | 1.02 | 0.27 | 2.38 | 0.86 | 0.53 | 0.20 | 0.09 | -0.50 | 98.68 | -35.86 |

| EPS Diluted | 0.85 | 0.77 | 1.00 | 0.27 | 2.37 | 0.84 | 0.53 | 0.20 | 0.09 | -0.50 | 98.68 | -35.86 |

| Weighted Avg Shares Out | 271.88M | 284.06M | 291.62M | 290.68M | 290.06M | 285.91M | 283.97M | 283.97M | 283.97M | 283.97M | 1.09M | 1.09M |

| Weighted Avg Shares Out (Dil) | 275.65M | 287.59M | 297.29M | 292.12M | 291.63M | 291.70M | 283.97M | 283.97M | 283.97M | 283.97M | 1.09M | 1.09M |

How Should You Play Gates Stock as It Hits a New 52-Week High?

Gates Industrial to Participate in Upcoming Investor Conferences

Gates Industrial Corporation plc (GTES) Q3 2024 Earnings Call Transcript

Compared to Estimates, Gates Industrial (GTES) Q3 Earnings: A Look at Key Metrics

Gates Industrial (GTES) Q3 Earnings and Revenues Top Estimates

Gates Industrial Reports Third-Quarter 2024 Results

Earnings Preview: Gates Industrial (GTES) Q3 Earnings Expected to Decline

Gates Industrial Announces Third-Quarter 2024 Earnings Release Date

Allspring Global Investments Holdings, LLC Expands Stake in Gates Industrial Corp PLC

GTES Enhances Data Center Solutions With New Cooling Hose

Source: https://incomestatements.info

Category: Stock Reports