See more : Ascendant Resources Inc. (ASDRF) Income Statement Analysis – Financial Results

Complete financial analysis of Gates Industrial Corporation plc (GTES) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Gates Industrial Corporation plc, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Euroconsultants S.A. (EUROC.AT) Income Statement Analysis – Financial Results

- TOM Group Limited (TOCOF) Income Statement Analysis – Financial Results

- Cal-Comp Electronics (Thailand) Public Company Limited (CCET.BK) Income Statement Analysis – Financial Results

- Yamashita Health Care Holdings,Inc. (9265.T) Income Statement Analysis – Financial Results

- Capital Product Partners L.P. (CPLP) Income Statement Analysis – Financial Results

Gates Industrial Corporation plc (GTES)

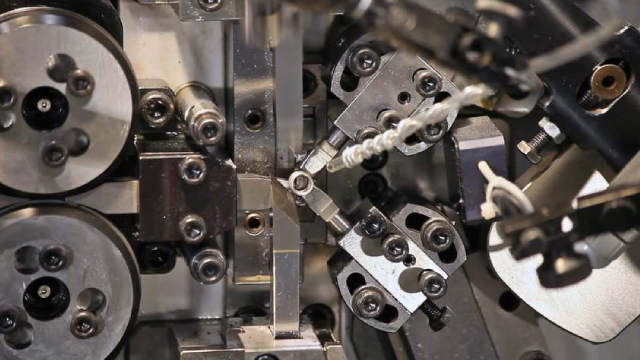

About Gates Industrial Corporation plc

Gates Industrial Corporation plc manufactures and sells engineered power transmission and fluid power solutions worldwide. It operates in two segments, Power Transmission and Fluid Power. The company offers synchronous or asynchronous belts, including V-belts, CVT belts, and Micro-V belts, as well as related components, such as sprockets, pulleys, water pumps, tensioners, or other accessories; solutions for stationary and mobile drives, engine systems, personal mobility, and vertical lifts application platforms; metal drive components; and kits for automotive replacement channels. It also provides fluid power solutions comprising stationary hydraulics, mobile hydraulics, engine systems, and other industrial application platforms; and hydraulics, including hoses, tubing, and fittings, as well as assemblies. The company serves construction, agriculture, energy and resources, automotive, transportation, mobility and recreation, consumer products, and various industrial applications, such as automated manufacturing and logistics systems. It sells its engineered products under the Gates brand. The company offers its products to replacement channel customers, as well as to original equipment manufacturers. Gates Industrial Corporation plc was founded in 1911 and is headquartered in Denver, Colorado.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.57B | 3.55B | 3.47B | 2.79B | 3.09B | 3.35B | 3.04B | 2.75B | 2.75B | 3.04B | 2.95B | 2.92B |

| Cost of Revenue | 2.21B | 2.30B | 2.14B | 1.76B | 1.94B | 2.02B | 1.82B | 1.69B | 1.71B | 2.02B | 1.83B | 1.87B |

| Gross Profit | 1.36B | 1.25B | 1.34B | 1.03B | 1.14B | 1.33B | 1.22B | 1.06B | 1.04B | 1.03B | 1.11B | 1.05B |

| Gross Profit Ratio | 38.06% | 35.19% | 38.54% | 37.05% | 37.01% | 39.75% | 40.04% | 38.62% | 37.74% | 33.76% | 37.81% | 35.99% |

| Research & Development | 0.00 | 69.40M | 70.70M | 67.20M | 67.90M | 71.40M | 68.60M | 68.50M | 67.40M | 53.80M | 47.20M | 45.60M |

| General & Administrative | 879.20M | 847.20M | 852.70M | 776.90M | 777.30M | 805.80M | 779.60M | 744.10M | 784.50M | 815.70M | 462.40M | 491.00M |

| Selling & Marketing | 3.00M | 6.50M | 12.00M | 6.70M | 10.20M | 170.30M | 10.40M | 0.00 | 305.60M | 0.00 | 322.10M | 319.90M |

| SG&A | 882.20M | 853.70M | 852.70M | 776.90M | 777.30M | 805.80M | 779.60M | 744.10M | 784.50M | 815.70M | 784.50M | 810.90M |

| Other Expenses | 14.10M | 200.00K | -9.30M | -1.00M | 9.10M | -17.40M | -56.30M | 200.00K | 200.00K | -400.00K | 0.00 | 0.00 |

| Operating Expenses | 896.30M | 853.90M | 843.40M | 775.90M | 786.40M | 820.10M | 779.30M | 747.00M | 784.10M | 810.20M | 808.30M | 936.60M |

| Cost & Expenses | 3.11B | 3.16B | 2.98B | 2.53B | 2.73B | 2.84B | 2.60B | 2.43B | 2.49B | 2.83B | 2.64B | 2.81B |

| Interest Income | 17.50M | 3.60M | 3.20M | 4.30M | 5.70M | 3.70M | 4.60M | 3.00M | 1.80M | 2.00M | 131.20M | 205.40M |

| Interest Expense | 163.20M | 139.40M | 133.50M | 154.30M | 157.80M | 175.90M | 234.60M | 216.30M | 212.60M | 173.10M | 0.00 | 0.00 |

| Depreciation & Amortization | 217.50M | 217.20M | 222.60M | 218.60M | 222.20M | 218.50M | 212.20M | 240.80M | 269.90M | 248.50M | 208.70M | 228.90M |

| EBITDA | 676.30M | 620.20M | 720.50M | 489.70M | 583.90M | 734.50M | 656.80M | 554.70M | 521.90M | 586.70M | 538.70M | 469.80M |

| EBITDA Ratio | 18.94% | 17.64% | 20.65% | 17.60% | 19.05% | 21.26% | 19.55% | 20.31% | 19.08% | 15.36% | 18.28% | 16.07% |

| Operating Income | 462.60M | 384.00M | 484.10M | 211.10M | 346.80M | 496.80M | 400.40M | 298.80M | 184.60M | -400.00K | 330.00M | 240.90M |

| Operating Income Ratio | 12.96% | 10.80% | 13.93% | 7.56% | 11.23% | 14.84% | 13.16% | 10.88% | 6.72% | -0.01% | 11.20% | 8.24% |

| Total Other Income/Expenses | -177.30M | -126.20M | -134.40M | -140.10M | -148.00M | -193.30M | -293.40M | -212.30M | -142.90M | -124.60M | -125.30M | -331.10M |

| Income Before Tax | 285.30M | 257.80M | 349.70M | 71.00M | 198.80M | 303.50M | 109.50M | 92.90M | 41.70M | -125.00M | 175.00M | -90.20M |

| Income Before Tax Ratio | 7.99% | 7.25% | 10.07% | 2.54% | 6.44% | 9.07% | 3.60% | 3.38% | 1.52% | -4.11% | 5.94% | -3.09% |

| Income Tax Expense | 28.30M | 14.90M | 18.40M | -19.30M | -495.90M | 31.80M | -72.50M | 21.10M | -9.20M | -51.90M | 39.20M | 74.30M |

| Net Income | 232.90M | 220.80M | 297.10M | 79.40M | 690.10M | 245.30M | 151.30M | 57.70M | 24.90M | -142.10M | 107.30M | -39.00M |

| Net Income Ratio | 6.52% | 6.21% | 8.55% | 2.84% | 22.35% | 7.33% | 4.97% | 2.10% | 0.91% | -4.67% | 3.64% | -1.33% |

| EPS | 0.86 | 0.78 | 1.02 | 0.27 | 2.38 | 0.86 | 0.53 | 0.20 | 0.09 | -0.50 | 98.68 | -35.86 |

| EPS Diluted | 0.85 | 0.77 | 1.00 | 0.27 | 2.37 | 0.84 | 0.53 | 0.20 | 0.09 | -0.50 | 98.68 | -35.86 |

| Weighted Avg Shares Out | 271.88M | 284.06M | 291.62M | 290.68M | 290.06M | 285.91M | 283.97M | 283.97M | 283.97M | 283.97M | 1.09M | 1.09M |

| Weighted Avg Shares Out (Dil) | 275.65M | 287.59M | 297.29M | 292.12M | 291.63M | 291.70M | 283.97M | 283.97M | 283.97M | 283.97M | 1.09M | 1.09M |

Gates Industrial Corporation plc (GTES) CEO Ivo Jurek on Q1 2022 Results - Earnings Call Transcript

Gates Industrial Corp.: Underappreciated Earnings Power

Gates Industrial Announces First-Quarter 2022 Earnings Release Date

Gates Industrial Stock Slips On Secondary Offering by Selling Stockholders

New Strong Sell Stocks for February 9th

Analysts Cut Price Target For Gates Industrial Post Q4 Results

Gates Industrial Corporation plc (GTES) CEO Ivo Jurek on Q4 2021 Results - Earnings Call Transcript

Gates Industrial (GTES) Q4 Earnings and Revenues Surpass Estimates

Gates Industrial Q4 Top-Line Misses Street View; Guides FY22 EPS Below Consensus

I Am A Buyer Of Gates Industrial Because Of Potential Synergies And Future FCF Generation

Source: https://incomestatements.info

Category: Stock Reports