See more : SEATech Ventures Corp. (SEAV) Income Statement Analysis – Financial Results

Complete financial analysis of Gates Industrial Corporation plc (GTES) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Gates Industrial Corporation plc, a leading company in the Industrial – Machinery industry within the Industrials sector.

- KB Financial Group Inc. (105560.KS) Income Statement Analysis – Financial Results

- Warrior Technologies Acquisition Company (WARR) Income Statement Analysis – Financial Results

- Newtek Business Services Corp. (NEWT) Income Statement Analysis – Financial Results

- Microsoft Corporation (MSF.BR) Income Statement Analysis – Financial Results

- Osia Hyper Retail Limited (OSIAHYPER.NS) Income Statement Analysis – Financial Results

Gates Industrial Corporation plc (GTES)

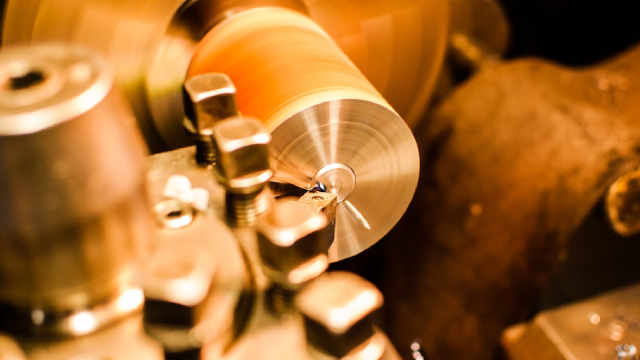

About Gates Industrial Corporation plc

Gates Industrial Corporation plc manufactures and sells engineered power transmission and fluid power solutions worldwide. It operates in two segments, Power Transmission and Fluid Power. The company offers synchronous or asynchronous belts, including V-belts, CVT belts, and Micro-V belts, as well as related components, such as sprockets, pulleys, water pumps, tensioners, or other accessories; solutions for stationary and mobile drives, engine systems, personal mobility, and vertical lifts application platforms; metal drive components; and kits for automotive replacement channels. It also provides fluid power solutions comprising stationary hydraulics, mobile hydraulics, engine systems, and other industrial application platforms; and hydraulics, including hoses, tubing, and fittings, as well as assemblies. The company serves construction, agriculture, energy and resources, automotive, transportation, mobility and recreation, consumer products, and various industrial applications, such as automated manufacturing and logistics systems. It sells its engineered products under the Gates brand. The company offers its products to replacement channel customers, as well as to original equipment manufacturers. Gates Industrial Corporation plc was founded in 1911 and is headquartered in Denver, Colorado.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.57B | 3.55B | 3.47B | 2.79B | 3.09B | 3.35B | 3.04B | 2.75B | 2.75B | 3.04B | 2.95B | 2.92B |

| Cost of Revenue | 2.21B | 2.30B | 2.14B | 1.76B | 1.94B | 2.02B | 1.82B | 1.69B | 1.71B | 2.02B | 1.83B | 1.87B |

| Gross Profit | 1.36B | 1.25B | 1.34B | 1.03B | 1.14B | 1.33B | 1.22B | 1.06B | 1.04B | 1.03B | 1.11B | 1.05B |

| Gross Profit Ratio | 38.06% | 35.19% | 38.54% | 37.05% | 37.01% | 39.75% | 40.04% | 38.62% | 37.74% | 33.76% | 37.81% | 35.99% |

| Research & Development | 0.00 | 69.40M | 70.70M | 67.20M | 67.90M | 71.40M | 68.60M | 68.50M | 67.40M | 53.80M | 47.20M | 45.60M |

| General & Administrative | 879.20M | 847.20M | 852.70M | 776.90M | 777.30M | 805.80M | 779.60M | 744.10M | 784.50M | 815.70M | 462.40M | 491.00M |

| Selling & Marketing | 3.00M | 6.50M | 12.00M | 6.70M | 10.20M | 170.30M | 10.40M | 0.00 | 305.60M | 0.00 | 322.10M | 319.90M |

| SG&A | 882.20M | 853.70M | 852.70M | 776.90M | 777.30M | 805.80M | 779.60M | 744.10M | 784.50M | 815.70M | 784.50M | 810.90M |

| Other Expenses | 14.10M | 200.00K | -9.30M | -1.00M | 9.10M | -17.40M | -56.30M | 200.00K | 200.00K | -400.00K | 0.00 | 0.00 |

| Operating Expenses | 896.30M | 853.90M | 843.40M | 775.90M | 786.40M | 820.10M | 779.30M | 747.00M | 784.10M | 810.20M | 808.30M | 936.60M |

| Cost & Expenses | 3.11B | 3.16B | 2.98B | 2.53B | 2.73B | 2.84B | 2.60B | 2.43B | 2.49B | 2.83B | 2.64B | 2.81B |

| Interest Income | 17.50M | 3.60M | 3.20M | 4.30M | 5.70M | 3.70M | 4.60M | 3.00M | 1.80M | 2.00M | 131.20M | 205.40M |

| Interest Expense | 163.20M | 139.40M | 133.50M | 154.30M | 157.80M | 175.90M | 234.60M | 216.30M | 212.60M | 173.10M | 0.00 | 0.00 |

| Depreciation & Amortization | 217.50M | 217.20M | 222.60M | 218.60M | 222.20M | 218.50M | 212.20M | 240.80M | 269.90M | 248.50M | 208.70M | 228.90M |

| EBITDA | 676.30M | 620.20M | 720.50M | 489.70M | 583.90M | 734.50M | 656.80M | 554.70M | 521.90M | 586.70M | 538.70M | 469.80M |

| EBITDA Ratio | 18.94% | 17.64% | 20.65% | 17.60% | 19.05% | 21.26% | 19.55% | 20.31% | 19.08% | 15.36% | 18.28% | 16.07% |

| Operating Income | 462.60M | 384.00M | 484.10M | 211.10M | 346.80M | 496.80M | 400.40M | 298.80M | 184.60M | -400.00K | 330.00M | 240.90M |

| Operating Income Ratio | 12.96% | 10.80% | 13.93% | 7.56% | 11.23% | 14.84% | 13.16% | 10.88% | 6.72% | -0.01% | 11.20% | 8.24% |

| Total Other Income/Expenses | -177.30M | -126.20M | -134.40M | -140.10M | -148.00M | -193.30M | -293.40M | -212.30M | -142.90M | -124.60M | -125.30M | -331.10M |

| Income Before Tax | 285.30M | 257.80M | 349.70M | 71.00M | 198.80M | 303.50M | 109.50M | 92.90M | 41.70M | -125.00M | 175.00M | -90.20M |

| Income Before Tax Ratio | 7.99% | 7.25% | 10.07% | 2.54% | 6.44% | 9.07% | 3.60% | 3.38% | 1.52% | -4.11% | 5.94% | -3.09% |

| Income Tax Expense | 28.30M | 14.90M | 18.40M | -19.30M | -495.90M | 31.80M | -72.50M | 21.10M | -9.20M | -51.90M | 39.20M | 74.30M |

| Net Income | 232.90M | 220.80M | 297.10M | 79.40M | 690.10M | 245.30M | 151.30M | 57.70M | 24.90M | -142.10M | 107.30M | -39.00M |

| Net Income Ratio | 6.52% | 6.21% | 8.55% | 2.84% | 22.35% | 7.33% | 4.97% | 2.10% | 0.91% | -4.67% | 3.64% | -1.33% |

| EPS | 0.86 | 0.78 | 1.02 | 0.27 | 2.38 | 0.86 | 0.53 | 0.20 | 0.09 | -0.50 | 98.68 | -35.86 |

| EPS Diluted | 0.85 | 0.77 | 1.00 | 0.27 | 2.37 | 0.84 | 0.53 | 0.20 | 0.09 | -0.50 | 98.68 | -35.86 |

| Weighted Avg Shares Out | 271.88M | 284.06M | 291.62M | 290.68M | 290.06M | 285.91M | 283.97M | 283.97M | 283.97M | 283.97M | 1.09M | 1.09M |

| Weighted Avg Shares Out (Dil) | 275.65M | 287.59M | 297.29M | 292.12M | 291.63M | 291.70M | 283.97M | 283.97M | 283.97M | 283.97M | 1.09M | 1.09M |

Gates (GTES) vs. Sterling (STRL): Which is a More Profitable Pick?

Gates Welcomes Chief Accounting Officer

Gates Industrial: Maintaining Robust Margin With Plans For Market Extension

GATES ANNOUNCES PRICING OF $500 MILLION OF 6.875% SENIOR NOTES DUE 2029

GATES ANNOUNCES INTENTION TO OFFER $500 MILLION OF SENIOR NOTES

Panagora Asset Management Inc. Buys 46,482 Shares of Gates Industrial Corp PLC (NYSE:GTES)

Swiss National Bank Sells 58,400 Shares of Gates Industrial Corp PLC (NYSE:GTES)

Gates Industrial Corporation plc (GTES) Q1 2024 Earnings Call Transcript

Gates Industrial (GTES) Q1 Earnings Beat Estimates

Gates Industrial Reports First-Quarter 2024 Results

Source: https://incomestatements.info

Category: Stock Reports