See more : Akzo Nobel India Limited (AKZOINDIA.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Hillenbrand, Inc. (HI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Hillenbrand, Inc., a leading company in the Industrial – Machinery industry within the Industrials sector.

- Navigator Global Investments Limited (NGI.AX) Income Statement Analysis – Financial Results

- Mufin Green Finance Limited (MUFIN.BO) Income Statement Analysis – Financial Results

- Aedas Homes, S.A. (AEDAS.MC) Income Statement Analysis – Financial Results

- Stockland (SGP.AX) Income Statement Analysis – Financial Results

- Diffusion Engineers Limited (DIFFNKG.BO) Income Statement Analysis – Financial Results

Hillenbrand, Inc. (HI)

About Hillenbrand, Inc.

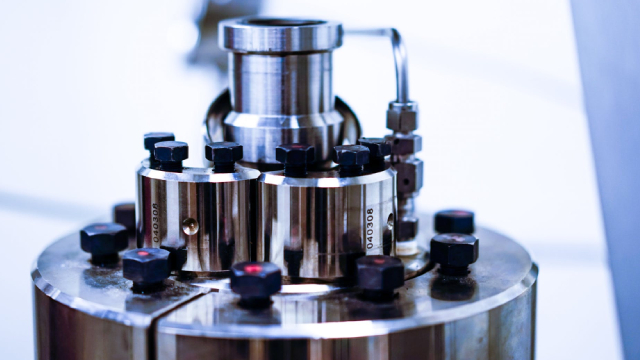

Hillenbrand, Inc. operates as a diversified industrial company in the United States and internationally. It operates in three segments: Advanced Process Solutions, Molding Technology Solutions, and Batesville. The Advanced Process Solutions segment designs, engineers, manufactures, markets, and services process and material handling equipment and systems comprising compounding, extrusion, and material handling equipment, as well as offers equipment system design services; and provides screening and separating equipment for various industries, including plastics, food and pharmaceuticals, chemicals, fertilizers, minerals, energy, wastewater treatment, forest products, and other general industrials. The Molding Technology Solutions segment offers injection molding and extrusion equipment; hot runner systems; process control systems; and mold bases and components for various industries, including automotive, consumer goods, medical, packaging, construction, and electronics. The Batesville segment designs, manufactures, distributes, and sells funeral services products and solutions, such as burial caskets, cremation caskets, containers and urns, other personalization and memorialization products, and web-based technology applications. The company was founded in 1906 and is headquartered in Batesville, Indiana.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.18B | 2.83B | 2.94B | 2.86B | 2.52B | 1.81B | 1.77B | 1.59B | 1.54B | 1.60B | 1.67B | 1.55B | 983.20M | 883.40M | 749.20M | 649.10M | 678.10M | 667.20M | 1.96B | 659.40M | 640.30M | 1.69B | 1.74B | 1.67B | 1.64B |

| Cost of Revenue | 2.13B | 1.88B | 1.99B | 1.91B | 1.70B | 1.18B | 1.13B | 998.90M | 967.80M | 1.03B | 1.08B | 1.03B | 594.30M | 513.50M | 435.90M | 374.70M | 397.60M | 388.60M | 1.11B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 1.06B | 948.20M | 954.60M | 957.30M | 813.30M | 623.00M | 642.90M | 591.30M | 570.60M | 570.40M | 589.20M | 527.20M | 388.90M | 369.90M | 313.30M | 274.40M | 280.50M | 278.60M | 849.80M | 659.40M | 640.30M | 1.69B | 1.74B | 1.67B | 1.64B |

| Gross Profit Ratio | 33.19% | 33.55% | 32.46% | 33.42% | 32.31% | 34.47% | 36.32% | 37.18% | 37.09% | 35.72% | 35.34% | 33.94% | 39.55% | 41.87% | 41.82% | 42.27% | 41.37% | 41.76% | 43.29% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 25.40M | 19.80M | 21.40M | 18.60M | 10.60M | 11.70M | 11.90M | 12.60M | 12.70M | 14.40M | 0.00 | 5.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 17.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 544.20M | 420.20M | 464.90M | 433.40M | 343.50M | 362.40M | 327.90M | 322.30M | 17.70M | 348.40M | 318.60M | 240.10M | 211.30M | 0.00 | 0.00 | 130.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 1.06B | 574.00M | 576.10M | 582.10M | 610.10M | 412.20M | -600.00K | -4.20M | -1.70M | -1.40M | 2.20M | -500.00K | 240.10M | 211.30M | 175.40M | 119.40M | 0.00 | 117.90M | 526.80M | 0.00 | 0.00 | 1.36B | 1.69B | 1.43B | 1.43B |

| Operating Expenses | 1.06B | 948.20M | 576.10M | 582.10M | 610.10M | 412.20M | 409.10M | 373.60M | 379.50M | 376.40M | 414.70M | 409.10M | 240.10M | 211.30M | 175.40M | 119.40M | 130.90M | 117.90M | 526.80M | 0.00 | 0.00 | 1.36B | 1.69B | 1.43B | 1.43B |

| Cost & Expenses | 3.18B | 2.41B | 2.56B | 2.49B | 2.31B | 1.60B | 1.54B | 1.37B | 1.35B | 1.40B | 1.49B | 1.44B | 834.40M | 724.80M | 611.30M | 494.10M | 528.50M | 506.50M | 1.64B | 0.00 | 0.00 | 1.36B | 1.69B | 1.43B | 1.43B |

| Interest Income | 0.00 | 0.00 | 5.50M | 3.40M | 3.20M | 32.70M | 1.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.80M | 12.20M | 13.50M | 7.50M | 1.40M | 42.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 121.50M | 77.70M | 69.80M | 77.60M | 77.40M | 27.40M | 23.30M | 25.20M | 25.30M | 23.80M | 23.30M | 24.00M | 12.40M | 11.00M | 4.20M | 2.10M | 2.20M | 1.40M | 21.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 158.00M | 125.60M | 98.60M | 115.10M | 130.60M | 58.50M | 56.50M | 56.60M | 60.40M | 54.30M | 58.40M | 89.40M | 40.40M | 36.10M | 28.50M | 18.60M | 19.10M | 18.50M | 108.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | 140.10M | 420.20M | 401.50M | 546.50M | 330.40M | 269.20M | 296.10M | 286.90M | 269.90M | 278.90M | 267.70M | 250.60M | 187.70M | 204.90M | 179.10M | 181.50M | 174.60M | 175.50M | 195.10M | 659.40M | 640.30M | 331.30M | 46.00M | 242.00M | 204.00M |

| EBITDA Ratio | 4.40% | 14.87% | 14.99% | 15.05% | 10.95% | 13.09% | 14.88% | 15.26% | 14.46% | 15.33% | 14.27% | 13.24% | 19.41% | 23.38% | 23.84% | 28.82% | 24.88% | 26.86% | 24.17% | 100.00% | 100.00% | 19.56% | 2.65% | 14.47% | 12.46% |

| Operating Income | 0.00 | 411.80M | 386.90M | 375.50M | 203.70M | 204.10M | 233.80M | 217.70M | 191.10M | 194.00M | 174.50M | 118.10M | 148.80M | 158.60M | 137.90M | 155.00M | 149.60M | 160.70M | 323.00M | 659.40M | 640.30M | 331.30M | 46.00M | 242.00M | 204.00M |

| Operating Income Ratio | 0.00% | 14.57% | 13.16% | 13.11% | 8.09% | 11.29% | 13.21% | 13.69% | 12.42% | 12.15% | 10.47% | 7.60% | 15.13% | 17.95% | 18.41% | 23.88% | 22.06% | 24.09% | 16.46% | 100.00% | 100.00% | 19.56% | 2.65% | 14.47% | 12.46% |

| Total Other Income/Expenses | -139.40M | -194.90M | -137.40M | -21.70M | -271.60M | -34.10M | -86.50M | -29.80M | -27.00M | -31.70M | -14.60M | -24.40M | -13.90M | -800.00K | 8.50M | 5.80M | 3.70M | 1.40M | -144.20M | -659.40M | -640.30M | -51.00M | -27.00M | -21.00M | 0.00 |

| Income Before Tax | -139.40M | 216.90M | 314.00M | 353.80M | -18.50M | 176.70M | 146.50M | 188.30M | 164.10M | 162.30M | 159.90M | 93.70M | 134.90M | 157.80M | 146.40M | 160.80M | 153.30M | 157.00M | 339.00M | 0.00 | 0.00 | 280.30M | 19.00M | 221.00M | 204.00M |

| Income Before Tax Ratio | -4.38% | 7.68% | 10.68% | 12.35% | -0.74% | 9.78% | 8.28% | 11.84% | 10.67% | 10.16% | 9.59% | 6.03% | 13.72% | 17.86% | 19.54% | 24.77% | 22.61% | 23.53% | 17.27% | 0.00% | 0.00% | 16.55% | 1.09% | 13.21% | 12.46% |

| Income Tax Expense | 64.80M | 102.80M | 98.80M | 98.60M | 34.90M | 50.50M | 65.30M | 59.90M | 47.30M | 49.10M | 48.70M | 28.30M | 30.10M | 51.70M | 54.10M | 58.50M | 60.10M | 57.50M | 117.50M | -102.80M | -113.80M | 99.70M | -37.00M | 52.00M | 74.00M |

| Net Income | -204.20M | 569.70M | 208.90M | 249.90M | -53.40M | 121.40M | 76.60M | 126.20M | 112.80M | 111.40M | 109.70M | 63.40M | 104.80M | 106.10M | 92.30M | 102.30M | 93.20M | 99.50M | 221.20M | 102.80M | 113.80M | 189.00M | 44.00M | 170.00M | 154.00M |

| Net Income Ratio | -6.42% | 20.16% | 7.10% | 8.72% | -2.12% | 6.72% | 4.33% | 7.94% | 7.33% | 6.98% | 6.58% | 4.08% | 10.66% | 12.01% | 12.32% | 15.76% | 13.74% | 14.91% | 11.27% | 15.59% | 17.77% | 11.16% | 2.53% | 10.16% | 9.41% |

| EPS | -2.90 | 8.16 | 2.91 | 3.34 | -0.73 | 1.93 | 1.21 | 1.99 | 1.78 | 1.76 | 1.74 | 1.01 | 1.68 | 1.71 | 1.49 | 1.66 | 1.49 | 1.59 | 1.82 | 1.64 | 1.82 | 3.02 | 0.70 | 2.72 | 2.46 |

| EPS Diluted | -2.90 | 8.13 | 2.89 | 3.31 | -0.73 | 1.92 | 1.20 | 1.97 | 1.77 | 1.74 | 1.72 | 1.01 | 1.68 | 1.71 | 1.49 | 1.66 | 1.49 | 1.59 | 1.82 | 1.64 | 1.82 | 3.02 | 0.70 | 2.72 | 2.46 |

| Weighted Avg Shares Out | 70.40M | 69.80M | 71.70M | 74.90M | 73.40M | 62.90M | 63.10M | 63.60M | 63.30M | 63.20M | 63.20M | 62.70M | 62.20M | 62.00M | 61.90M | 61.70M | 62.50M | 62.50M | 62.30M | 62.68M | 62.53M | 62.50M | 62.50M | 62.50M | 62.50M |

| Weighted Avg Shares Out (Dil) | 70.40M | 70.10M | 72.20M | 75.40M | 73.40M | 63.30M | 63.80M | 64.00M | 63.80M | 63.90M | 63.80M | 63.00M | 62.40M | 62.00M | 61.90M | 61.70M | 62.50M | 62.50M | 62.30M | 62.68M | 62.53M | 62.68M | 62.68M | 62.68M | 62.68M |

Hillenbrand Declares First Quarter Dividend of $0.225 Per Share

Newsweek Names Hillenbrand to America's Most Responsible Companies 2025 List

Hillenbrand Q4 Earnings Beat Estimates, Decline Y/Y on Low Volumes

Hillenbrand, Inc. (HI) Q4 2024 Earnings Call Transcript

Hillenbrand (HI) Q4 Earnings and Revenues Beat Estimates

Hillenbrand Reports Fiscal Fourth Quarter and Full Year 2024 Results

Hillenbrand Schedules Fourth Quarter 2024 Earnings Call for November 14, 2024

Hillenbrand Elects Joseph Lower to the Board of Directors and Establishes Vice Chairperson Roles

Hillenbrand Declares Fourth Quarter Dividend of $0.2225 Per Share

Eli Lilly To Rally Around 15%? Here Are 10 Top Analyst Forecasts For Monday

Source: https://incomestatements.info

Category: Stock Reports