See more : Makkah Construction & Development Company (4100.SR) Income Statement Analysis – Financial Results

Complete financial analysis of Abiomed, Inc. (ABMD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Abiomed, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- SFLMaven Corp. (SFLM) Income Statement Analysis – Financial Results

- ROY Asset Holding SE (RY8.DE) Income Statement Analysis – Financial Results

- Zenas BioPharma, Inc. (ZBIO) Income Statement Analysis – Financial Results

- IDFC Limited (IDFC.BO) Income Statement Analysis – Financial Results

- Unicorn Mineral Resources Public Limited Company (UMR.L) Income Statement Analysis – Financial Results

Abiomed, Inc. (ABMD)

About Abiomed, Inc.

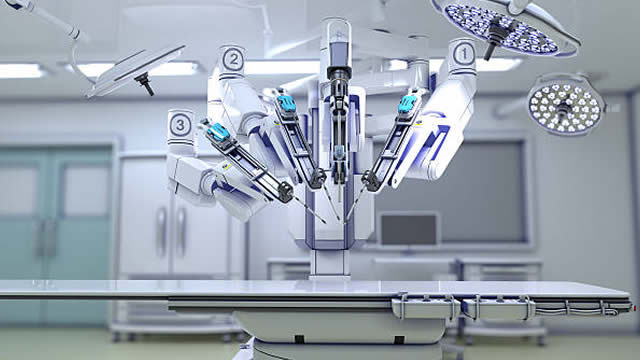

Abiomed, Inc. engages in the research, development, and sale of medical devices to assist or replace the pumping function of the failing heart. It also provides a continuum of care to heart failure patients. The company offers Impella 2.5, a percutaneous micro heart pump with integrated motor and sensors; and Impella CP, a device for use by interventional cardiologists to support patients in the cath lab, as well as by cardiac surgeons in the heart surgery suite. It also provides Impella 5.0, Impella LD, and Impella 5.5, which are percutaneous micro heart pumps with integrated motors and sensors for use primarily in the heart surgery suite; Impella RP, a percutaneous catheter-based axial flow pump; Impella SmartAssist platform that includes optical sensor technology for improved pump positioning and the use of algorithms that enable improved native heart assessment during the weaning process; Impella Connect, a cloud-based technology that enables secure and remote viewing of the automated impella controller for physicians and hospital staffs; and OXY-1 System, a portable external respiratory assistance device. In addition, the company is developing Impella ECP, a pump for blood flow of greater than three liters per minute; Impella XR Sheath, a sheath that expands and recoils allowing small bore access and closure with Impella heart pumps; Impella BTR, a percutaneous micro heart pump with integrated motors and sensors; and preCARDIA, a catheter-mounted superior vena cava therapy system designed to rapidly treat acutely decompensated heart failure. Abiomed, Inc. sells its products through direct sales and clinical support personnel in the Germany, France, United States, Japan, Europe, Canada, Latin America, the Asia-Pacific, and the Middle East. The company was founded in 1981 and is headquartered in Danvers, Massachusetts. As of December 22, 2022, Abiomed, Inc. operates as a subsidiary of Johnson & Johnson.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.03B | 847.52M | 840.88M | 769.43M | 593.75M | 445.30M | 329.54M | 230.31M | 183.64M | 158.12M | 126.38M | 101.15M | 85.71M | 73.21M | 58.94M | 50.65M | 43.67M | 38.22M | 25.74M | 23.31M | 26.86M | 24.90M | 22.52M | 22.09M | 22.45M | 16.46M | 12.84M | 9.20M | 6.70M | 3.40M | 2.70M | 2.00M | 3.00M | 2.90M | 4.20M | 4.70M |

| Cost of Revenue | 188.16M | 161.91M | 151.31M | 129.57M | 98.58M | 70.63M | 50.42M | 39.95M | 37.32M | 31.60M | 24.51M | 21.98M | 22.53M | 20.44M | 15.07M | 12.01M | 11.69M | 9.37M | 7.59M | 7.50M | 7.92M | 7.38M | 5.88M | 6.77M | 6.50M | 5.36M | 3.92M | 2.90M | 1.90M | 3.00M | 2.00M | 1.30M | 1.00M | 1.10M | 200.00K | 3.70M |

| Gross Profit | 843.60M | 685.62M | 689.58M | 639.87M | 495.17M | 374.68M | 279.12M | 190.37M | 146.32M | 126.53M | 101.87M | 79.17M | 63.18M | 52.77M | 43.88M | 38.64M | 31.99M | 28.85M | 18.15M | 15.81M | 18.94M | 17.52M | 16.64M | 15.32M | 15.94M | 11.10M | 8.92M | 6.30M | 4.80M | 400.00K | 700.00K | 700.00K | 2.00M | 1.80M | 4.00M | 1.00M |

| Gross Profit Ratio | 81.76% | 80.90% | 82.01% | 83.16% | 83.40% | 84.14% | 84.70% | 82.66% | 79.68% | 80.02% | 80.61% | 78.27% | 73.72% | 72.08% | 74.44% | 76.28% | 73.24% | 75.49% | 70.51% | 67.82% | 70.53% | 70.38% | 73.88% | 69.34% | 71.03% | 67.44% | 69.47% | 68.48% | 71.64% | 11.76% | 25.93% | 35.00% | 66.67% | 62.07% | 95.24% | 21.28% |

| Research & Development | 163.40M | 121.88M | 98.76M | 93.50M | 75.30M | 66.39M | 49.76M | 35.97M | 30.71M | 25.65M | 27.16M | 26.68M | 25.95M | 25.33M | 24.92M | 22.29M | 30.05M | 13.50M | 14.30M | 20.55M | 27.37M | 22.67M | 15.63M | 13.45M | 9.09M | 3.83M | 3.22M | 2.50M | 2.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 321.55M | 262.73M | 218.15M | 164.26M | 125.73M | 107.25M | 84.23M | 71.71M | 62.29M | 60.84M | 55.36M | 52.66M | 42.45M | 30.92M | 18.61M | 14.10M | 14.75M | 16.20M | 12.41M | 12.56M | 9.77M | 9.05M | 7.07M | 5.74M | 4.30M | 4.40M | 4.60M | 6.40M | 8.80M | 5.20M | 4.80M | 5.10M | 900.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 423.49M | 334.18M | 341.60M | 321.55M | 262.73M | 218.15M | 164.26M | 125.73M | 107.25M | 84.23M | 71.71M | 62.29M | 60.84M | 55.36M | 52.66M | 42.45M | 30.92M | 18.61M | 14.10M | 14.75M | 16.20M | 12.41M | 12.56M | 9.77M | 9.05M | 7.07M | 5.74M | 4.30M | 4.40M | 4.60M | 6.40M | 8.80M | 5.20M | 4.80M | 5.10M | 900.00K |

| Other Expenses | 0.00 | 51.95M | -4.56M | 30.38M | -388.00K | -349.00K | 339.00K | -97.00K | 49.00K | 326.00K | 1.48M | 1.40M | 1.47M | 1.61M | 2.79M | 1.61M | 1.31M | 13.23M | 13.63M | 20.37M | 0.00 | 0.00 | 0.00 | 0.00 | -1.21M | 0.00 | 0.00 | 400.00K | 300.00K | 300.00K | 600.00K | 300.00K | 200.00K | 200.00K | 200.00K | 200.00K |

| Operating Expenses | 586.89M | 456.06M | 440.36M | 415.05M | 338.03M | 284.54M | 214.02M | 161.70M | 137.96M | 109.99M | 100.35M | 90.36M | 88.26M | 82.29M | 80.36M | 66.35M | 62.28M | 32.10M | 28.40M | 35.30M | 43.56M | 35.08M | 28.20M | 23.22M | 16.94M | 10.90M | 8.96M | 7.20M | 7.10M | 4.90M | 7.00M | 9.10M | 5.40M | 5.00M | 5.30M | 1.10M |

| Cost & Expenses | 775.05M | 617.97M | 591.66M | 544.62M | 436.61M | 355.17M | 264.44M | 201.65M | 175.28M | 141.58M | 124.86M | 112.34M | 110.79M | 102.73M | 95.43M | 78.36M | 73.96M | 41.47M | 35.99M | 42.80M | 51.48M | 42.46M | 34.08M | 29.99M | 23.44M | 16.26M | 12.88M | 10.10M | 9.00M | 7.90M | 9.00M | 10.40M | 6.40M | 6.10M | 5.50M | 4.80M |

| Interest Income | 49.84M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 49.84M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 28.09M | 17.38M | 8.26M | 14.12M | 11.01M | 6.20M | 3.28M | 2.77M | 2.51M | 2.72M | 4.34M | 3.95M | 4.90M | 5.02M | 6.12M | 3.92M | 2.74M | 1.24M | 1.39M | 1.70M | 1.77M | 2.97M | 1.69M | 1.39M | 876.94K | 429.61K | 349.76K | 400.00K | 300.00K | 300.00K | 600.00K | 300.00K | 200.00K | 200.00K | 200.00K | 200.00K |

| EBITDA | 400.78M | 246.94M | 257.48M | 230.77M | 164.45M | 94.79M | 67.99M | 31.24M | 10.75M | 19.27M | 4.83M | -7.56M | -26.90M | -23.18M | -25.24M | -24.10M | -27.55M | -2.12M | -9.04M | -17.96M | -22.85M | -14.59M | -9.88M | -6.52M | -118.18K | 629.77K | 313.01K | -900.00K | -2.40M | -4.80M | -6.90M | -9.80M | -4.70M | -3.90M | -1.80M | -100.00K |

| EBITDA Ratio | 38.84% | 29.14% | 30.62% | 29.99% | 27.70% | 21.29% | 20.63% | 13.56% | 5.86% | 12.19% | 3.82% | -7.47% | -31.38% | -31.66% | -42.82% | -47.58% | -63.09% | -5.56% | -35.11% | -77.05% | -85.08% | -58.62% | -43.86% | -29.51% | -0.53% | 3.83% | 2.44% | -9.78% | -35.82% | -141.18% | -255.56% | -490.00% | -156.67% | -134.48% | -42.86% | -2.13% |

| Operating Income | 372.69M | 229.56M | 249.22M | 224.81M | 157.14M | 90.14M | 65.10M | 28.67M | 8.36M | 16.54M | 1.52M | -11.19M | -25.08M | -29.52M | -36.49M | -28.51M | -30.29M | -3.25M | -10.25M | -19.49M | -24.62M | -17.56M | -11.56M | -7.90M | -995.12K | 200.16K | -36.75K | -900.00K | -2.30M | -4.50M | -6.30M | -8.40M | -3.40M | -3.20M | -1.30M | -100.00K |

| Operating Income Ratio | 36.12% | 27.09% | 29.64% | 29.22% | 26.47% | 20.24% | 19.76% | 12.45% | 4.55% | 10.46% | 1.20% | -11.06% | -29.26% | -40.32% | -61.90% | -56.29% | -69.36% | -8.51% | -39.83% | -83.62% | -91.67% | -70.54% | -51.34% | -35.78% | -4.43% | 1.22% | -0.29% | -9.78% | -34.33% | -132.35% | -233.33% | -420.00% | -113.33% | -110.34% | -30.95% | -2.13% |

| Total Other Income/Expenses | -182.13M | 58.66M | 7.61M | 38.55M | 3.30M | 1.21M | 734.00K | 99.00K | 167.00K | 319.00K | 1.02M | 322.00K | 6.72M | -1.33M | -3.92M | 1.11M | 1.20M | 911.00K | 806.00K | 1.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 400.00K | 400.00K | 600.00K | 1.20M | 1.70M | 1.50M | 900.00K | 700.00K | 200.00K |

| Income Before Tax | 190.56M | 288.22M | 256.83M | 263.36M | 160.44M | 91.34M | 65.84M | 28.77M | 8.53M | 16.86M | 2.54M | -10.86M | -18.35M | -30.85M | -40.40M | -27.41M | -29.09M | -2.34M | -9.45M | -18.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -500.00K | -1.90M | -3.90M | -5.10M | -6.70M | -1.90M | -2.30M | -600.00K | 100.00K |

| Income Before Tax Ratio | 18.47% | 34.01% | 30.54% | 34.23% | 27.02% | 20.51% | 19.98% | 12.49% | 4.64% | 10.66% | 2.01% | -10.74% | -21.41% | -42.13% | -68.55% | -54.11% | -66.62% | -6.13% | -36.70% | -77.95% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -5.43% | -28.36% | -114.71% | -188.89% | -335.00% | -63.33% | -79.31% | -14.29% | 2.13% |

| Income Tax Expense | 54.06M | 62.70M | 53.82M | 4.34M | 48.27M | 39.23M | 27.69M | -84.92M | 1.18M | 1.85M | 1.05M | 892.00K | 671.00K | 752.00K | 527.00K | 475.00K | 356.00K | 110.00K | 172.00K | 173.00K | -2.95M | -6.16M | -1.11M | -1.19M | 1.51M | -535.10K | -527.87K | -500.00K | 400.00K | 600.00K | 1.20M | 1.70M | 1.50M | 900.00K | 700.00K | 200.00K |

| Net Income | 136.51M | 225.53M | 203.01M | 259.02M | 112.17M | 52.12M | 38.15M | 113.69M | 7.35M | 15.01M | 1.50M | -11.76M | -19.02M | -31.60M | -40.93M | -27.88M | -29.45M | -2.34M | -9.45M | -18.17M | -21.68M | -11.40M | -10.45M | -6.71M | -2.51M | 735.26K | 491.12K | -400.00K | -2.00M | -3.90M | -5.10M | -6.60M | -1.90M | -2.20M | -600.00K | 100.00K |

| Net Income Ratio | 13.23% | 26.61% | 24.14% | 33.66% | 18.89% | 11.70% | 11.58% | 49.36% | 4.00% | 9.50% | 1.18% | -11.62% | -22.19% | -43.16% | -69.44% | -55.05% | -67.44% | -6.13% | -36.70% | -77.95% | -80.71% | -45.79% | -46.43% | -30.39% | -11.17% | 4.47% | 3.82% | -4.35% | -29.85% | -114.71% | -188.89% | -330.00% | -63.33% | -75.86% | -14.29% | 2.13% |

| EPS | 3.00 | 5.00 | 4.49 | 5.77 | 2.54 | 1.21 | 0.90 | 2.80 | 0.19 | 0.38 | 0.04 | -0.32 | -0.52 | -0.91 | -1.26 | -1.03 | -1.15 | -0.11 | -0.45 | -0.87 | -1.04 | -0.55 | -0.59 | -0.39 | -0.16 | 0.05 | 0.04 | -0.03 | -0.16 | -0.30 | -0.40 | -0.54 | -0.18 | -0.24 | -0.07 | 0.01 |

| EPS Diluted | 2.98 | 4.94 | 4.43 | 5.61 | 2.45 | 1.17 | 0.85 | 2.65 | 0.18 | 0.37 | 0.04 | -0.32 | -0.52 | -0.91 | -1.26 | -1.03 | -1.15 | -0.11 | -0.45 | -0.87 | -1.04 | -0.55 | -0.59 | -0.39 | -0.16 | 0.05 | 0.04 | -0.03 | -0.16 | -0.30 | -0.40 | -0.54 | -0.18 | -0.24 | -0.07 | 0.01 |

| Weighted Avg Shares Out | 45.45M | 45.14M | 45.18M | 44.91M | 44.15M | 43.24M | 42.20M | 40.63M | 39.33M | 39.11M | 38.37M | 37.17M | 36.68M | 34.88M | 32.47M | 27.12M | 25.65M | 21.84M | 21.15M | 20.99M | 20.87M | 20.58M | 17.58M | 17.24M | 16.15M | 14.32M | 13.99M | 13.02M | 12.50M | 13.00M | 12.75M | 12.22M | 10.56M | 9.17M | 8.57M | 6.90M |

| Weighted Avg Shares Out (Dil) | 45.88M | 45.67M | 45.82M | 46.15M | 45.85M | 44.66M | 44.90M | 42.86M | 41.61M | 41.05M | 40.17M | 37.17M | 36.68M | 34.88M | 32.47M | 27.12M | 25.65M | 21.84M | 21.15M | 20.99M | 20.87M | 20.58M | 17.58M | 17.24M | 16.15M | 14.32M | 13.99M | 13.02M | 12.50M | 13.00M | 12.75M | 12.22M | 10.56M | 9.17M | 8.57M | 6.90M |

Here's Why You Should Retain Abiomed (ABMD) Stock For Now

Early Feasibility Study Demonstrates Successful Use of Abiomed's preCARDIA Technology

Regulators Approve Impella 5.5 With SmartAssist in Japan and Hong Kong; US FDA Grants Impella BTR Conditional IDE Approval for First-in-Human Early Feasibility Study

Has Abiomed (ABMD) Outpaced Other Medical Stocks This Year?

Abiomed to Present at the 40th Annual J.P. Morgan Healthcare Conference

4 Stocks Growing Earnings Faster Than Sales

Here's Why You Should Retain Abiomed (ABMD) Stock for Now

Two Large Studies Demonstrate Complete Revascularization with Impella Heart Pumps Improves Ejection Fraction and Long-Term Patient Outcomes

Impella Advances to Higher Level of Recommendation in Newest ESC Guidelines

TCT 2021 to Highlight Improved Patient Outcomes with Impella's Small, Smart and Connected Technology

Source: https://incomestatements.info

Category: Stock Reports