See more : West Vault Mining Inc. (WVMDF) Income Statement Analysis – Financial Results

Complete financial analysis of Abiomed, Inc. (ABMD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Abiomed, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- StartEngine Crowdfunding, Inc. (STGC) Income Statement Analysis – Financial Results

- Andrew Peller Limited (ADW-A.TO) Income Statement Analysis – Financial Results

- Alset EHome International Inc. (AEI) Income Statement Analysis – Financial Results

- Hycroft Mining Holding Corporation (HYMCZ) Income Statement Analysis – Financial Results

- BOA Acquisition Corp. (BOAS-UN) Income Statement Analysis – Financial Results

Abiomed, Inc. (ABMD)

About Abiomed, Inc.

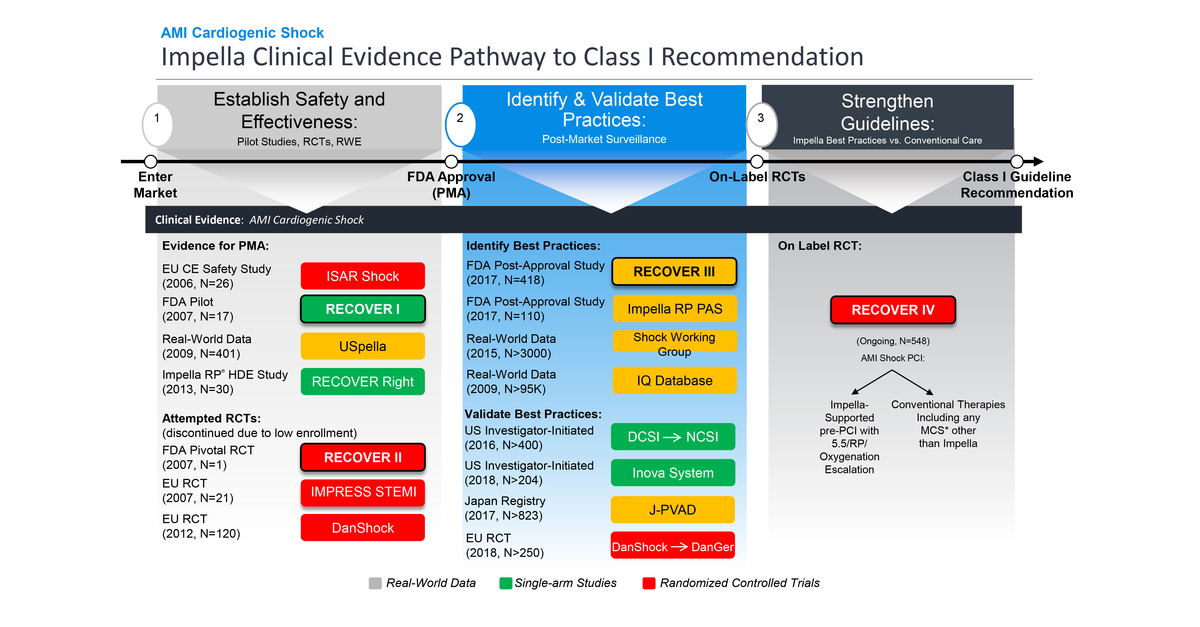

Abiomed, Inc. engages in the research, development, and sale of medical devices to assist or replace the pumping function of the failing heart. It also provides a continuum of care to heart failure patients. The company offers Impella 2.5, a percutaneous micro heart pump with integrated motor and sensors; and Impella CP, a device for use by interventional cardiologists to support patients in the cath lab, as well as by cardiac surgeons in the heart surgery suite. It also provides Impella 5.0, Impella LD, and Impella 5.5, which are percutaneous micro heart pumps with integrated motors and sensors for use primarily in the heart surgery suite; Impella RP, a percutaneous catheter-based axial flow pump; Impella SmartAssist platform that includes optical sensor technology for improved pump positioning and the use of algorithms that enable improved native heart assessment during the weaning process; Impella Connect, a cloud-based technology that enables secure and remote viewing of the automated impella controller for physicians and hospital staffs; and OXY-1 System, a portable external respiratory assistance device. In addition, the company is developing Impella ECP, a pump for blood flow of greater than three liters per minute; Impella XR Sheath, a sheath that expands and recoils allowing small bore access and closure with Impella heart pumps; Impella BTR, a percutaneous micro heart pump with integrated motors and sensors; and preCARDIA, a catheter-mounted superior vena cava therapy system designed to rapidly treat acutely decompensated heart failure. Abiomed, Inc. sells its products through direct sales and clinical support personnel in the Germany, France, United States, Japan, Europe, Canada, Latin America, the Asia-Pacific, and the Middle East. The company was founded in 1981 and is headquartered in Danvers, Massachusetts. As of December 22, 2022, Abiomed, Inc. operates as a subsidiary of Johnson & Johnson.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.03B | 847.52M | 840.88M | 769.43M | 593.75M | 445.30M | 329.54M | 230.31M | 183.64M | 158.12M | 126.38M | 101.15M | 85.71M | 73.21M | 58.94M | 50.65M | 43.67M | 38.22M | 25.74M | 23.31M | 26.86M | 24.90M | 22.52M | 22.09M | 22.45M | 16.46M | 12.84M | 9.20M | 6.70M | 3.40M | 2.70M | 2.00M | 3.00M | 2.90M | 4.20M | 4.70M |

| Cost of Revenue | 188.16M | 161.91M | 151.31M | 129.57M | 98.58M | 70.63M | 50.42M | 39.95M | 37.32M | 31.60M | 24.51M | 21.98M | 22.53M | 20.44M | 15.07M | 12.01M | 11.69M | 9.37M | 7.59M | 7.50M | 7.92M | 7.38M | 5.88M | 6.77M | 6.50M | 5.36M | 3.92M | 2.90M | 1.90M | 3.00M | 2.00M | 1.30M | 1.00M | 1.10M | 200.00K | 3.70M |

| Gross Profit | 843.60M | 685.62M | 689.58M | 639.87M | 495.17M | 374.68M | 279.12M | 190.37M | 146.32M | 126.53M | 101.87M | 79.17M | 63.18M | 52.77M | 43.88M | 38.64M | 31.99M | 28.85M | 18.15M | 15.81M | 18.94M | 17.52M | 16.64M | 15.32M | 15.94M | 11.10M | 8.92M | 6.30M | 4.80M | 400.00K | 700.00K | 700.00K | 2.00M | 1.80M | 4.00M | 1.00M |

| Gross Profit Ratio | 81.76% | 80.90% | 82.01% | 83.16% | 83.40% | 84.14% | 84.70% | 82.66% | 79.68% | 80.02% | 80.61% | 78.27% | 73.72% | 72.08% | 74.44% | 76.28% | 73.24% | 75.49% | 70.51% | 67.82% | 70.53% | 70.38% | 73.88% | 69.34% | 71.03% | 67.44% | 69.47% | 68.48% | 71.64% | 11.76% | 25.93% | 35.00% | 66.67% | 62.07% | 95.24% | 21.28% |

| Research & Development | 163.40M | 121.88M | 98.76M | 93.50M | 75.30M | 66.39M | 49.76M | 35.97M | 30.71M | 25.65M | 27.16M | 26.68M | 25.95M | 25.33M | 24.92M | 22.29M | 30.05M | 13.50M | 14.30M | 20.55M | 27.37M | 22.67M | 15.63M | 13.45M | 9.09M | 3.83M | 3.22M | 2.50M | 2.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 321.55M | 262.73M | 218.15M | 164.26M | 125.73M | 107.25M | 84.23M | 71.71M | 62.29M | 60.84M | 55.36M | 52.66M | 42.45M | 30.92M | 18.61M | 14.10M | 14.75M | 16.20M | 12.41M | 12.56M | 9.77M | 9.05M | 7.07M | 5.74M | 4.30M | 4.40M | 4.60M | 6.40M | 8.80M | 5.20M | 4.80M | 5.10M | 900.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 423.49M | 334.18M | 341.60M | 321.55M | 262.73M | 218.15M | 164.26M | 125.73M | 107.25M | 84.23M | 71.71M | 62.29M | 60.84M | 55.36M | 52.66M | 42.45M | 30.92M | 18.61M | 14.10M | 14.75M | 16.20M | 12.41M | 12.56M | 9.77M | 9.05M | 7.07M | 5.74M | 4.30M | 4.40M | 4.60M | 6.40M | 8.80M | 5.20M | 4.80M | 5.10M | 900.00K |

| Other Expenses | 0.00 | 51.95M | -4.56M | 30.38M | -388.00K | -349.00K | 339.00K | -97.00K | 49.00K | 326.00K | 1.48M | 1.40M | 1.47M | 1.61M | 2.79M | 1.61M | 1.31M | 13.23M | 13.63M | 20.37M | 0.00 | 0.00 | 0.00 | 0.00 | -1.21M | 0.00 | 0.00 | 400.00K | 300.00K | 300.00K | 600.00K | 300.00K | 200.00K | 200.00K | 200.00K | 200.00K |

| Operating Expenses | 586.89M | 456.06M | 440.36M | 415.05M | 338.03M | 284.54M | 214.02M | 161.70M | 137.96M | 109.99M | 100.35M | 90.36M | 88.26M | 82.29M | 80.36M | 66.35M | 62.28M | 32.10M | 28.40M | 35.30M | 43.56M | 35.08M | 28.20M | 23.22M | 16.94M | 10.90M | 8.96M | 7.20M | 7.10M | 4.90M | 7.00M | 9.10M | 5.40M | 5.00M | 5.30M | 1.10M |

| Cost & Expenses | 775.05M | 617.97M | 591.66M | 544.62M | 436.61M | 355.17M | 264.44M | 201.65M | 175.28M | 141.58M | 124.86M | 112.34M | 110.79M | 102.73M | 95.43M | 78.36M | 73.96M | 41.47M | 35.99M | 42.80M | 51.48M | 42.46M | 34.08M | 29.99M | 23.44M | 16.26M | 12.88M | 10.10M | 9.00M | 7.90M | 9.00M | 10.40M | 6.40M | 6.10M | 5.50M | 4.80M |

| Interest Income | 49.84M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 49.84M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 28.09M | 17.38M | 8.26M | 14.12M | 11.01M | 6.20M | 3.28M | 2.77M | 2.51M | 2.72M | 4.34M | 3.95M | 4.90M | 5.02M | 6.12M | 3.92M | 2.74M | 1.24M | 1.39M | 1.70M | 1.77M | 2.97M | 1.69M | 1.39M | 876.94K | 429.61K | 349.76K | 400.00K | 300.00K | 300.00K | 600.00K | 300.00K | 200.00K | 200.00K | 200.00K | 200.00K |

| EBITDA | 400.78M | 246.94M | 257.48M | 230.77M | 164.45M | 94.79M | 67.99M | 31.24M | 10.75M | 19.27M | 4.83M | -7.56M | -26.90M | -23.18M | -25.24M | -24.10M | -27.55M | -2.12M | -9.04M | -17.96M | -22.85M | -14.59M | -9.88M | -6.52M | -118.18K | 629.77K | 313.01K | -900.00K | -2.40M | -4.80M | -6.90M | -9.80M | -4.70M | -3.90M | -1.80M | -100.00K |

| EBITDA Ratio | 38.84% | 29.14% | 30.62% | 29.99% | 27.70% | 21.29% | 20.63% | 13.56% | 5.86% | 12.19% | 3.82% | -7.47% | -31.38% | -31.66% | -42.82% | -47.58% | -63.09% | -5.56% | -35.11% | -77.05% | -85.08% | -58.62% | -43.86% | -29.51% | -0.53% | 3.83% | 2.44% | -9.78% | -35.82% | -141.18% | -255.56% | -490.00% | -156.67% | -134.48% | -42.86% | -2.13% |

| Operating Income | 372.69M | 229.56M | 249.22M | 224.81M | 157.14M | 90.14M | 65.10M | 28.67M | 8.36M | 16.54M | 1.52M | -11.19M | -25.08M | -29.52M | -36.49M | -28.51M | -30.29M | -3.25M | -10.25M | -19.49M | -24.62M | -17.56M | -11.56M | -7.90M | -995.12K | 200.16K | -36.75K | -900.00K | -2.30M | -4.50M | -6.30M | -8.40M | -3.40M | -3.20M | -1.30M | -100.00K |

| Operating Income Ratio | 36.12% | 27.09% | 29.64% | 29.22% | 26.47% | 20.24% | 19.76% | 12.45% | 4.55% | 10.46% | 1.20% | -11.06% | -29.26% | -40.32% | -61.90% | -56.29% | -69.36% | -8.51% | -39.83% | -83.62% | -91.67% | -70.54% | -51.34% | -35.78% | -4.43% | 1.22% | -0.29% | -9.78% | -34.33% | -132.35% | -233.33% | -420.00% | -113.33% | -110.34% | -30.95% | -2.13% |

| Total Other Income/Expenses | -182.13M | 58.66M | 7.61M | 38.55M | 3.30M | 1.21M | 734.00K | 99.00K | 167.00K | 319.00K | 1.02M | 322.00K | 6.72M | -1.33M | -3.92M | 1.11M | 1.20M | 911.00K | 806.00K | 1.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 400.00K | 400.00K | 600.00K | 1.20M | 1.70M | 1.50M | 900.00K | 700.00K | 200.00K |

| Income Before Tax | 190.56M | 288.22M | 256.83M | 263.36M | 160.44M | 91.34M | 65.84M | 28.77M | 8.53M | 16.86M | 2.54M | -10.86M | -18.35M | -30.85M | -40.40M | -27.41M | -29.09M | -2.34M | -9.45M | -18.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -500.00K | -1.90M | -3.90M | -5.10M | -6.70M | -1.90M | -2.30M | -600.00K | 100.00K |

| Income Before Tax Ratio | 18.47% | 34.01% | 30.54% | 34.23% | 27.02% | 20.51% | 19.98% | 12.49% | 4.64% | 10.66% | 2.01% | -10.74% | -21.41% | -42.13% | -68.55% | -54.11% | -66.62% | -6.13% | -36.70% | -77.95% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -5.43% | -28.36% | -114.71% | -188.89% | -335.00% | -63.33% | -79.31% | -14.29% | 2.13% |

| Income Tax Expense | 54.06M | 62.70M | 53.82M | 4.34M | 48.27M | 39.23M | 27.69M | -84.92M | 1.18M | 1.85M | 1.05M | 892.00K | 671.00K | 752.00K | 527.00K | 475.00K | 356.00K | 110.00K | 172.00K | 173.00K | -2.95M | -6.16M | -1.11M | -1.19M | 1.51M | -535.10K | -527.87K | -500.00K | 400.00K | 600.00K | 1.20M | 1.70M | 1.50M | 900.00K | 700.00K | 200.00K |

| Net Income | 136.51M | 225.53M | 203.01M | 259.02M | 112.17M | 52.12M | 38.15M | 113.69M | 7.35M | 15.01M | 1.50M | -11.76M | -19.02M | -31.60M | -40.93M | -27.88M | -29.45M | -2.34M | -9.45M | -18.17M | -21.68M | -11.40M | -10.45M | -6.71M | -2.51M | 735.26K | 491.12K | -400.00K | -2.00M | -3.90M | -5.10M | -6.60M | -1.90M | -2.20M | -600.00K | 100.00K |

| Net Income Ratio | 13.23% | 26.61% | 24.14% | 33.66% | 18.89% | 11.70% | 11.58% | 49.36% | 4.00% | 9.50% | 1.18% | -11.62% | -22.19% | -43.16% | -69.44% | -55.05% | -67.44% | -6.13% | -36.70% | -77.95% | -80.71% | -45.79% | -46.43% | -30.39% | -11.17% | 4.47% | 3.82% | -4.35% | -29.85% | -114.71% | -188.89% | -330.00% | -63.33% | -75.86% | -14.29% | 2.13% |

| EPS | 3.00 | 5.00 | 4.49 | 5.77 | 2.54 | 1.21 | 0.90 | 2.80 | 0.19 | 0.38 | 0.04 | -0.32 | -0.52 | -0.91 | -1.26 | -1.03 | -1.15 | -0.11 | -0.45 | -0.87 | -1.04 | -0.55 | -0.59 | -0.39 | -0.16 | 0.05 | 0.04 | -0.03 | -0.16 | -0.30 | -0.40 | -0.54 | -0.18 | -0.24 | -0.07 | 0.01 |

| EPS Diluted | 2.98 | 4.94 | 4.43 | 5.61 | 2.45 | 1.17 | 0.85 | 2.65 | 0.18 | 0.37 | 0.04 | -0.32 | -0.52 | -0.91 | -1.26 | -1.03 | -1.15 | -0.11 | -0.45 | -0.87 | -1.04 | -0.55 | -0.59 | -0.39 | -0.16 | 0.05 | 0.04 | -0.03 | -0.16 | -0.30 | -0.40 | -0.54 | -0.18 | -0.24 | -0.07 | 0.01 |

| Weighted Avg Shares Out | 45.45M | 45.14M | 45.18M | 44.91M | 44.15M | 43.24M | 42.20M | 40.63M | 39.33M | 39.11M | 38.37M | 37.17M | 36.68M | 34.88M | 32.47M | 27.12M | 25.65M | 21.84M | 21.15M | 20.99M | 20.87M | 20.58M | 17.58M | 17.24M | 16.15M | 14.32M | 13.99M | 13.02M | 12.50M | 13.00M | 12.75M | 12.22M | 10.56M | 9.17M | 8.57M | 6.90M |

| Weighted Avg Shares Out (Dil) | 45.88M | 45.67M | 45.82M | 46.15M | 45.85M | 44.66M | 44.90M | 42.86M | 41.61M | 41.05M | 40.17M | 37.17M | 36.68M | 34.88M | 32.47M | 27.12M | 25.65M | 21.84M | 21.15M | 20.99M | 20.87M | 20.58M | 17.58M | 17.24M | 16.15M | 14.32M | 13.99M | 13.02M | 12.50M | 13.00M | 12.75M | 12.22M | 10.56M | 9.17M | 8.57M | 6.90M |

Abiomed (ABMD) is an Incredible Growth Stock: 3 Reasons Why

Abiomed: Correction Offers Good Buying Opportunity

Abiomed (ABMD) Posts Impellas Positive Study Results in Japan

Abiomed's (ABMD) Impella-Related Research Gets FDA Clearance

Unloading with Impella for 30 Minutes Before PCI Associated with Reduced Infarct Size in STEMI Patients

FDA Approves RECOVER IV Randomized Controlled Trial with Exception from Informed Consent (EFIC)

FDA Approves RECOVER IV Randomized Controlled Trial with Exception from Informed Consent (EFIC)

TCT 2022: Impella Enables Complete Revascularization, Improved Quality of Life and Native Heart Recovery

3 Reasons to Hold Abiomed (ABMD) Stock in Your Portfolio

Abiomed's (ABMD) Impella Favored by Latest Study Result

Source: https://incomestatements.info

Category: Stock Reports