See more : India Capital Growth Fund Limited (IGC.L) Income Statement Analysis – Financial Results

Complete financial analysis of Apollo Endosurgery, Inc. (APEN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Apollo Endosurgery, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- Platinum Investment Management Limited (PTM.AX) Income Statement Analysis – Financial Results

- Zaplox AB (ZAPLOX.ST) Income Statement Analysis – Financial Results

- Prospera Energy Inc. (PEI.V) Income Statement Analysis – Financial Results

- Misen Energy AB (publ) (MISE.ST) Income Statement Analysis – Financial Results

- Invion Limited (IVX.AX) Income Statement Analysis – Financial Results

Apollo Endosurgery, Inc. (APEN)

About Apollo Endosurgery, Inc.

Apollo Endosurgery, Inc., a medical technology company, focuses on the design, development, and commercialization of medical devices. The company offers OverStitch and OverStitch Sx Endoscopic Suturing Systems that enable advanced endoscopic procedures by allowing physicians to sutures and secure the approximation of tissue through a flexible endoscope. It also provides Orbera, an intragastric balloon system that reduces stomach capacity causing patients to consume less following the procedure, as well as delays gastric content emptying under the Orbera Intragastric Balloon System, BIB, and Orbera365 Managed Weight Loss System brands. Additionally, the company offers X-Tack Endoscopic HeliX Tacking System, a suture-based device for closing and healing defects in the lower and upper gastrointestinal tract. The company sells its products to medical services providers; and hospitals, outpatient surgical centers, clinics, and physicians in the United States, Australia, Costa Rica, and other European countries. Apollo Endosurgery, Inc. was founded in 2005 and is headquartered in Austin, Texas.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 76.86M | 62.99M | 42.05M | 50.71M | 60.85M | 64.31M | 64.87M | 1.60M | 5.08M | 7.99M | 6.69M | 9.39M | 7.84M | 11.91M | 2.86M | 372.35K | 511.86K | 743.27K |

| Cost of Revenue | 34.43M | 28.03M | 19.81M | 25.04M | 27.66M | 24.58M | 25.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 42.43M | 34.96M | 22.24M | 25.68M | 33.19M | 39.73M | 39.61M | 1.60M | 5.08M | 7.99M | 6.69M | 9.39M | 7.84M | 11.91M | 2.86M | 372.35K | 511.86K | 743.27K |

| Gross Profit Ratio | 55.20% | 55.50% | 52.90% | 50.63% | 54.55% | 61.78% | 61.07% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 11.91M | 9.52M | 7.67M | 10.38M | 12.18M | 8.30M | 7.81M | 8.51M | 18.13M | 11.34M | 8.16M | 9.73M | 7.82M | 6.63M | 10.12M | 12.42M | 4.04M | 1.48M |

| General & Administrative | 20.58M | 18.45M | 11.06M | 13.59M | 13.44M | 13.72M | 13.63M | 3.95M | 4.76M | 4.23M | 4.09M | 0.00 | 4.50M | 3.48M | 4.48M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 36.01M | 24.31M | 17.36M | 28.73M | 32.83M | 32.91M | 31.75M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 56.59M | 42.76M | 28.42M | 42.32M | 46.27M | 46.63M | 45.38M | 3.95M | 4.76M | 4.23M | 4.09M | 3.37M | 4.50M | 3.48M | 4.48M | 3.43M | 2.23M | 1.66M |

| Other Expenses | 1.75M | 1.88M | 1.95M | 2.10M | 7.07M | 7.24M | 7.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 70.25M | 54.16M | 38.04M | 54.80M | 65.52M | 62.17M | 60.37M | 12.46M | 22.89M | 15.58M | 12.25M | 13.10M | 12.32M | 10.11M | 14.60M | 15.85M | 6.28M | 3.15M |

| Cost & Expenses | 104.68M | 82.19M | 57.84M | 79.84M | 93.18M | 86.75M | 85.63M | 12.46M | 22.89M | 15.58M | 12.25M | 13.10M | 12.32M | 10.11M | 14.60M | 15.85M | 6.28M | 3.15M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 124.04K | 398.02K | 161.24K | 7.95K |

| Interest Expense | 4.67M | 8.32M | 5.25M | 4.05M | 4.06M | 4.51M | 18.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 12.12K | 27.95K | 0.00 | 157.13K |

| Depreciation & Amortization | -196.00K | 2.01M | 2.31M | 2.50M | 9.29M | 9.72M | 9.09M | 466.99K | 216.09K | 196.22K | 187.50K | 141.99K | 165.30K | 176.69K | 215.02K | 156.44K | 49.57K | 81.18K |

| EBITDA | -31.42M | -17.19M | -13.49M | -26.62M | -40.09M | -12.76M | -20.76M | -9.54M | -17.81M | -7.59M | -5.56M | -2.97M | 0.00 | 0.00 | -11.23M | -15.48M | -5.56M | -2.40M |

| EBITDA Ratio | -36.46% | -27.28% | -32.08% | -52.49% | -52.98% | -19.85% | -20.84% | -596.55% | -321.60% | -79.74% | -38.35% | -31.66% | -56.62% | 34.93% | -392.60% | -4,003.61% | -1,085.29% | -344.22% |

| Operating Income | -27.82M | -19.20M | -15.79M | -29.12M | -40.09M | -22.44M | -20.76M | -10.86M | -17.81M | -7.59M | -5.56M | -3.71M | -4.49M | 1.80M | -11.74M | -15.48M | -5.77M | -2.40M |

| Operating Income Ratio | -36.20% | -30.48% | -37.56% | -57.43% | -65.88% | -34.89% | -32.00% | -678.87% | -350.46% | -95.05% | -83.16% | -39.52% | -57.29% | 15.13% | -410.16% | -4,156.30% | -1,126.47% | -323.39% |

| Total Other Income/Expenses | -7.83M | -5.33M | -6.68M | 1.97M | -5.50M | -4.55M | -20.02M | 850.05K | 1.25M | 1.03M | 2.81M | 595.91K | -113.38K | 2.18M | 163.33K | 384.12K | 0.00 | -402.84K |

| Income Before Tax | -39.26M | -24.53M | -22.47M | -27.16M | -45.60M | -26.99M | -40.78M | -10.01M | -16.56M | -6.56M | -2.75M | -3.11M | -4.60M | 3.98M | -11.57M | -15.46M | 0.00 | -2.65M |

| Income Before Tax Ratio | -51.08% | -38.94% | -53.44% | -53.55% | -74.93% | -41.97% | -62.87% | -625.74% | -325.86% | -82.19% | -41.15% | -33.18% | -58.73% | 33.44% | -404.45% | -4,152.52% | 0.00% | -356.21% |

| Income Tax Expense | 584.00K | 156.00K | 142.00K | 275.00K | 191.00K | 304.00K | 387.00K | 850.05K | 1.25M | 1.03M | 2.81M | 595.91K | -113.38K | 2.18M | 175.45K | 42.00K | 0.00 | -86.79K |

| Net Income | -39.84M | -24.68M | -22.61M | -27.43M | -45.79M | -27.29M | -41.17M | -10.01M | -16.56M | -6.56M | -2.75M | -3.11M | -4.60M | 3.98M | -11.46M | -15.09M | -5.60M | -2.80M |

| Net Income Ratio | -51.84% | -39.18% | -53.77% | -54.09% | -75.24% | -42.44% | -63.46% | -625.74% | -325.86% | -82.19% | -41.15% | -33.18% | -58.73% | 33.44% | -400.54% | -4,053.13% | -1,094.97% | -376.28% |

| EPS | -0.98 | -0.82 | -0.99 | -1.27 | -2.31 | -2.01 | -105.69 | -29.95 | -77.00 | -37.61 | -19.74 | -26.65 | -44.48 | 39.63 | -128.50 | -209.81 | -123.52 | -365.69 |

| EPS Diluted | -0.98 | -0.82 | -0.99 | -1.27 | -2.31 | -2.01 | -105.69 | -29.95 | -77.00 | -37.61 | -19.74 | -26.65 | -44.48 | 37.78 | -128.50 | -209.81 | -123.52 | -365.69 |

| Weighted Avg Shares Out | 40.65M | 30.24M | 22.76M | 21.54M | 19.79M | 13.57M | 389.50K | 334.22K | 215.01K | 174.53K | 139.44K | 116.83K | 103.46K | 100.52K | 89.18K | 71.93K | 45.38K | 7.65K |

| Weighted Avg Shares Out (Dil) | 40.65M | 30.24M | 22.76M | 21.54M | 19.79M | 13.57M | 389.50K | 334.22K | 215.01K | 174.53K | 139.44K | 116.83K | 103.46K | 105.43K | 89.18K | 71.93K | 45.38K | 7.65K |

Apollo Endosurgery's Earnings: A Preview

Apollo Endosurgery to Present at HC Wainwright Bioconnect Conference

Only 3% sugar cut out from food products in three years, PHE finds

Revisiting Novo Nordisk (NYSE:NVO)

Apollo Endosurgery (APEN) Presents At LD 500 Investor Virtual Conference - Slideshow

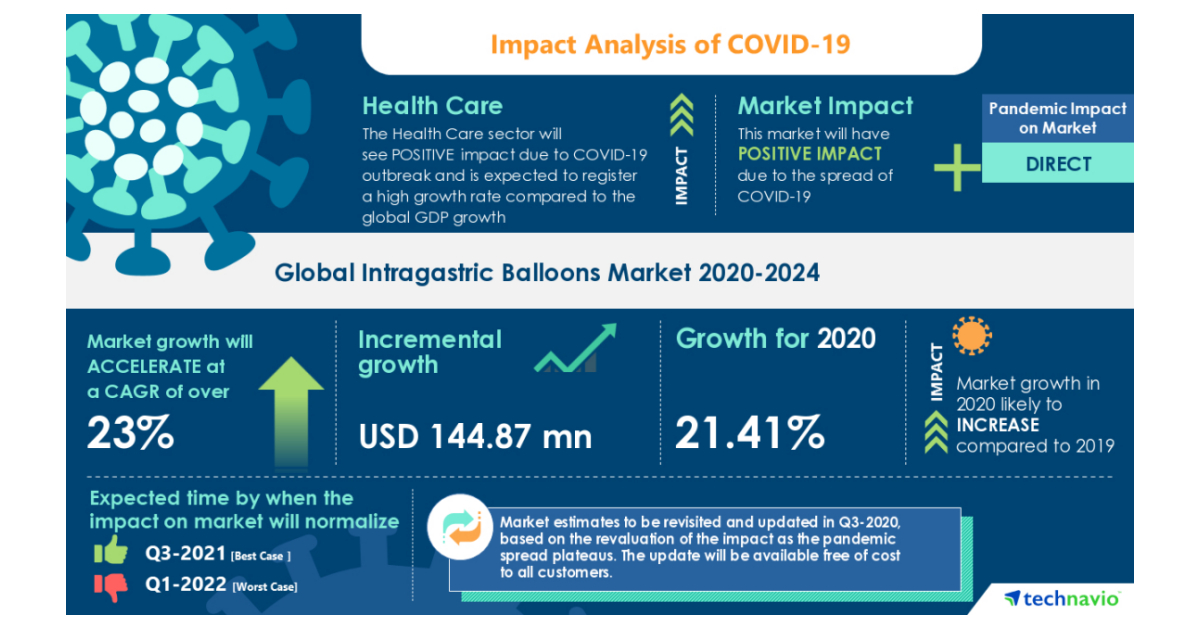

COVID-19 Impacts: Intragastric Balloons Market will Accelerate at a CAGR of over 23% through 2020-2024|Increasing Prevalence of Obesity to Boost Growth| Technavio

Insights on the Worldwide Bariatric Surgery Industry to 2028 - Rise in Government Initiatives Pertaining to Obesity Presents Opportunities

Source: https://incomestatements.info

Category: Stock Reports