See more : Pepper Money Limited (PPM.AX) Income Statement Analysis – Financial Results

Complete financial analysis of Apollo Endosurgery, Inc. (APEN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Apollo Endosurgery, Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- Accrete Inc. (4395.T) Income Statement Analysis – Financial Results

- Xemex Group, Inc. (XMEX) Income Statement Analysis – Financial Results

- Free Flow, Inc. (FFLO) Income Statement Analysis – Financial Results

- BOE Technology Group Company Limited (000725.SZ) Income Statement Analysis – Financial Results

- Central Petroleum Limited (CNPTF) Income Statement Analysis – Financial Results

Apollo Endosurgery, Inc. (APEN)

About Apollo Endosurgery, Inc.

Apollo Endosurgery, Inc., a medical technology company, focuses on the design, development, and commercialization of medical devices. The company offers OverStitch and OverStitch Sx Endoscopic Suturing Systems that enable advanced endoscopic procedures by allowing physicians to sutures and secure the approximation of tissue through a flexible endoscope. It also provides Orbera, an intragastric balloon system that reduces stomach capacity causing patients to consume less following the procedure, as well as delays gastric content emptying under the Orbera Intragastric Balloon System, BIB, and Orbera365 Managed Weight Loss System brands. Additionally, the company offers X-Tack Endoscopic HeliX Tacking System, a suture-based device for closing and healing defects in the lower and upper gastrointestinal tract. The company sells its products to medical services providers; and hospitals, outpatient surgical centers, clinics, and physicians in the United States, Australia, Costa Rica, and other European countries. Apollo Endosurgery, Inc. was founded in 2005 and is headquartered in Austin, Texas.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 76.86M | 62.99M | 42.05M | 50.71M | 60.85M | 64.31M | 64.87M | 1.60M | 5.08M | 7.99M | 6.69M | 9.39M | 7.84M | 11.91M | 2.86M | 372.35K | 511.86K | 743.27K |

| Cost of Revenue | 34.43M | 28.03M | 19.81M | 25.04M | 27.66M | 24.58M | 25.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 42.43M | 34.96M | 22.24M | 25.68M | 33.19M | 39.73M | 39.61M | 1.60M | 5.08M | 7.99M | 6.69M | 9.39M | 7.84M | 11.91M | 2.86M | 372.35K | 511.86K | 743.27K |

| Gross Profit Ratio | 55.20% | 55.50% | 52.90% | 50.63% | 54.55% | 61.78% | 61.07% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 11.91M | 9.52M | 7.67M | 10.38M | 12.18M | 8.30M | 7.81M | 8.51M | 18.13M | 11.34M | 8.16M | 9.73M | 7.82M | 6.63M | 10.12M | 12.42M | 4.04M | 1.48M |

| General & Administrative | 20.58M | 18.45M | 11.06M | 13.59M | 13.44M | 13.72M | 13.63M | 3.95M | 4.76M | 4.23M | 4.09M | 0.00 | 4.50M | 3.48M | 4.48M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 36.01M | 24.31M | 17.36M | 28.73M | 32.83M | 32.91M | 31.75M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 56.59M | 42.76M | 28.42M | 42.32M | 46.27M | 46.63M | 45.38M | 3.95M | 4.76M | 4.23M | 4.09M | 3.37M | 4.50M | 3.48M | 4.48M | 3.43M | 2.23M | 1.66M |

| Other Expenses | 1.75M | 1.88M | 1.95M | 2.10M | 7.07M | 7.24M | 7.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 70.25M | 54.16M | 38.04M | 54.80M | 65.52M | 62.17M | 60.37M | 12.46M | 22.89M | 15.58M | 12.25M | 13.10M | 12.32M | 10.11M | 14.60M | 15.85M | 6.28M | 3.15M |

| Cost & Expenses | 104.68M | 82.19M | 57.84M | 79.84M | 93.18M | 86.75M | 85.63M | 12.46M | 22.89M | 15.58M | 12.25M | 13.10M | 12.32M | 10.11M | 14.60M | 15.85M | 6.28M | 3.15M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 124.04K | 398.02K | 161.24K | 7.95K |

| Interest Expense | 4.67M | 8.32M | 5.25M | 4.05M | 4.06M | 4.51M | 18.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 12.12K | 27.95K | 0.00 | 157.13K |

| Depreciation & Amortization | -196.00K | 2.01M | 2.31M | 2.50M | 9.29M | 9.72M | 9.09M | 466.99K | 216.09K | 196.22K | 187.50K | 141.99K | 165.30K | 176.69K | 215.02K | 156.44K | 49.57K | 81.18K |

| EBITDA | -31.42M | -17.19M | -13.49M | -26.62M | -40.09M | -12.76M | -20.76M | -9.54M | -17.81M | -7.59M | -5.56M | -2.97M | 0.00 | 0.00 | -11.23M | -15.48M | -5.56M | -2.40M |

| EBITDA Ratio | -36.46% | -27.28% | -32.08% | -52.49% | -52.98% | -19.85% | -20.84% | -596.55% | -321.60% | -79.74% | -38.35% | -31.66% | -56.62% | 34.93% | -392.60% | -4,003.61% | -1,085.29% | -344.22% |

| Operating Income | -27.82M | -19.20M | -15.79M | -29.12M | -40.09M | -22.44M | -20.76M | -10.86M | -17.81M | -7.59M | -5.56M | -3.71M | -4.49M | 1.80M | -11.74M | -15.48M | -5.77M | -2.40M |

| Operating Income Ratio | -36.20% | -30.48% | -37.56% | -57.43% | -65.88% | -34.89% | -32.00% | -678.87% | -350.46% | -95.05% | -83.16% | -39.52% | -57.29% | 15.13% | -410.16% | -4,156.30% | -1,126.47% | -323.39% |

| Total Other Income/Expenses | -7.83M | -5.33M | -6.68M | 1.97M | -5.50M | -4.55M | -20.02M | 850.05K | 1.25M | 1.03M | 2.81M | 595.91K | -113.38K | 2.18M | 163.33K | 384.12K | 0.00 | -402.84K |

| Income Before Tax | -39.26M | -24.53M | -22.47M | -27.16M | -45.60M | -26.99M | -40.78M | -10.01M | -16.56M | -6.56M | -2.75M | -3.11M | -4.60M | 3.98M | -11.57M | -15.46M | 0.00 | -2.65M |

| Income Before Tax Ratio | -51.08% | -38.94% | -53.44% | -53.55% | -74.93% | -41.97% | -62.87% | -625.74% | -325.86% | -82.19% | -41.15% | -33.18% | -58.73% | 33.44% | -404.45% | -4,152.52% | 0.00% | -356.21% |

| Income Tax Expense | 584.00K | 156.00K | 142.00K | 275.00K | 191.00K | 304.00K | 387.00K | 850.05K | 1.25M | 1.03M | 2.81M | 595.91K | -113.38K | 2.18M | 175.45K | 42.00K | 0.00 | -86.79K |

| Net Income | -39.84M | -24.68M | -22.61M | -27.43M | -45.79M | -27.29M | -41.17M | -10.01M | -16.56M | -6.56M | -2.75M | -3.11M | -4.60M | 3.98M | -11.46M | -15.09M | -5.60M | -2.80M |

| Net Income Ratio | -51.84% | -39.18% | -53.77% | -54.09% | -75.24% | -42.44% | -63.46% | -625.74% | -325.86% | -82.19% | -41.15% | -33.18% | -58.73% | 33.44% | -400.54% | -4,053.13% | -1,094.97% | -376.28% |

| EPS | -0.98 | -0.82 | -0.99 | -1.27 | -2.31 | -2.01 | -105.69 | -29.95 | -77.00 | -37.61 | -19.74 | -26.65 | -44.48 | 39.63 | -128.50 | -209.81 | -123.52 | -365.69 |

| EPS Diluted | -0.98 | -0.82 | -0.99 | -1.27 | -2.31 | -2.01 | -105.69 | -29.95 | -77.00 | -37.61 | -19.74 | -26.65 | -44.48 | 37.78 | -128.50 | -209.81 | -123.52 | -365.69 |

| Weighted Avg Shares Out | 40.65M | 30.24M | 22.76M | 21.54M | 19.79M | 13.57M | 389.50K | 334.22K | 215.01K | 174.53K | 139.44K | 116.83K | 103.46K | 100.52K | 89.18K | 71.93K | 45.38K | 7.65K |

| Weighted Avg Shares Out (Dil) | 40.65M | 30.24M | 22.76M | 21.54M | 19.79M | 13.57M | 389.50K | 334.22K | 215.01K | 174.53K | 139.44K | 116.83K | 103.46K | 105.43K | 89.18K | 71.93K | 45.38K | 7.65K |

Short Interest in Apollo Endosurgery Inc (NASDAQ:APEN) Declines By 10.8%

Covid-19 lockdowns worsen childhood obesity globally: Study

As the belly expands with age, the memory may shrink

Quantum Brakes to Learn About the Forces Within Molecules

As Boris Johnson vows to lose weight - the 6 ways to do it safely

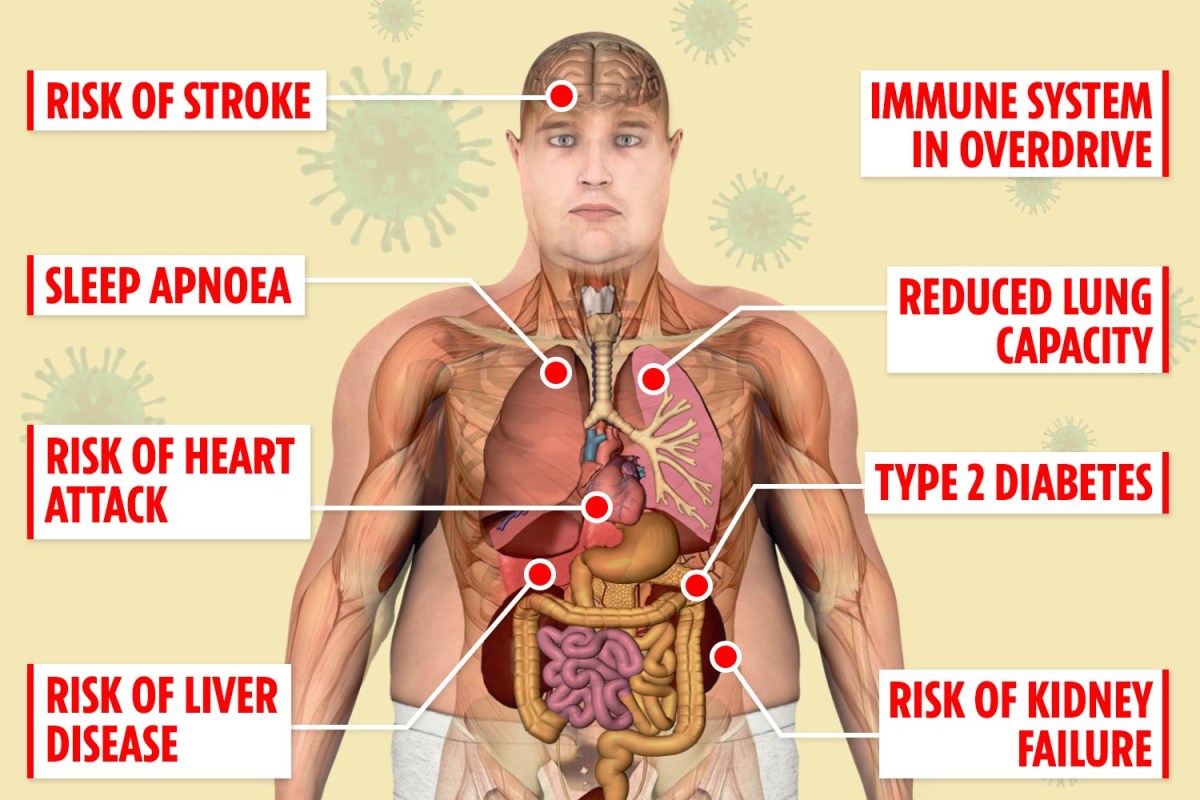

The truth about obesity and coronavirus - from 'crushed lungs' to organ failure

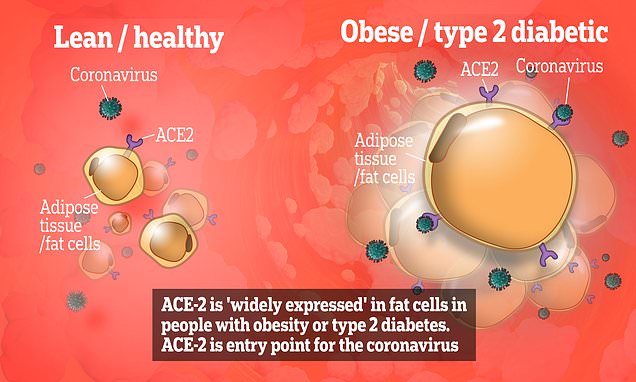

Obese may be at risk of coronavirus because fat cells are virus target

Top Ranked Momentum Stocks to Buy for April 14th

Apollo Endosurgery, Inc. to Report Third Quarter Results on October 30, 2019

Source: https://incomestatements.info

Category: Stock Reports