See more : Comfort Systems USA, Inc. (FIX) Income Statement Analysis – Financial Results

Complete financial analysis of ATS Corporation (ATSAF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ATS Corporation, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Compañía de Distribución Integral Logista Holdings, S.A. (CDNIF) Income Statement Analysis – Financial Results

- Zinc Media Group plc (ZIN.L) Income Statement Analysis – Financial Results

- Precise Corporation Public Company Limited (PCC.BK) Income Statement Analysis – Financial Results

- North-West Oil Group Inc. (NWOL) Income Statement Analysis – Financial Results

- Amfil Technologies Inc. (FUNN) Income Statement Analysis – Financial Results

ATS Corporation (ATSAF)

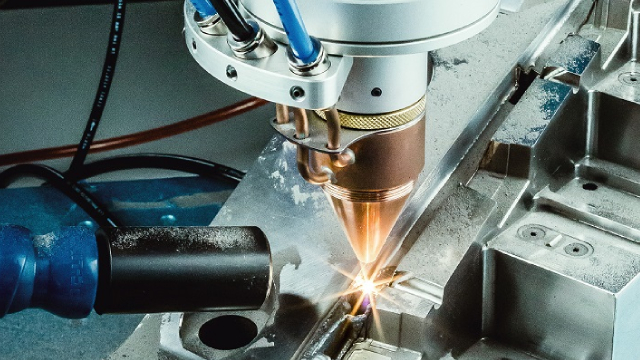

About ATS Corporation

ATS Corporation, together with its subsidiaries, provides automation solutions worldwide. The company is also involved in the planning, designing, building, commissioning, and servicing automated manufacturing and assembly systems, including automation products and test solutions. It offers enterprise solutions in the areas of project management; partners/suppliers/vendors team selection and coordination; facility layouts and operational design; business case development and project justification; post project service, spare parts, and support; and system design, built, integration, commissioning, validation, training and start up. In addition, the company offers pre-automation services comprising discovery and analysis, concept development, simulation, and total cost of ownership modelling; post automation services, including training, process optimization, preventative maintenance, emergency and on-call support, spare parts, retooling, retrofits, and equipment relocation; and contract manufacturing services. Further, it provides engineering design, prototyping, process verification, specification writing, software and manufacturing process controls development, standard automation products/platforms, equipment design and build, third-party equipment qualification, procurement and integration, automation system installation, product line commissioning, validation, and documentation services. The company serves life sciences, transportation, consumer products, food and beverage, and energy markets. The company was formerly known as ATS Automation Tooling Systems Inc. and changed its name to ATS Corporation in November 2022. ATS Corporation was founded in 1978 and is headquartered in Cambridge, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 2.58B | 2.18B | 1.43B | 1.43B |

| Cost of Revenue | 1.85B | 1.57B | 1.05B | 1.07B |

| Gross Profit | 725.81M | 612.43M | 384.26M | 362.14M |

| Gross Profit Ratio | 28.16% | 28.06% | 26.87% | 25.33% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 393.77M | 419.87M | 250.29M | 239.90M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 393.77M | 419.87M | 250.29M | 239.90M |

| Other Expenses | 82.06M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 475.83M | 419.87M | 250.29M | 239.90M |

| Cost & Expenses | 2.33B | 1.99B | 1.30B | 1.31B |

| Interest Income | 1.96M | 508.00K | 1.62M | 2.07M |

| Interest Expense | 64.68M | 32.71M | 41.77M | 30.14M |

| Depreciation & Amortization | 154.94M | 121.88M | 86.89M | 100.09M |

| EBITDA | 377.43M | 308.49M | 206.50M | 195.70M |

| EBITDA Ratio | 14.64% | 14.13% | 14.44% | 13.69% |

| Operating Income | 222.49M | 186.61M | 119.61M | 95.61M |

| Operating Income Ratio | 8.63% | 8.55% | 8.36% | 6.69% |

| Total Other Income/Expenses | -62.72M | -26.84M | 34.80M | -40.15M |

| Income Before Tax | 159.77M | 154.41M | 79.46M | 67.54M |

| Income Before Tax Ratio | 6.20% | 7.07% | 5.56% | 4.72% |

| Income Tax Expense | 32.07M | 33.02M | 15.35M | 14.59M |

| Net Income | 127.43M | 122.10M | 64.09M | 52.90M |

| Net Income Ratio | 4.94% | 5.59% | 4.48% | 3.70% |

| EPS | 1.39 | 1.32 | 0.70 | 0.57 |

| EPS Diluted | 1.38 | 1.32 | 0.69 | 0.57 |

| Weighted Avg Shares Out | 91.84M | 92.21M | 92.20M | 92.10M |

| Weighted Avg Shares Out (Dil) | 92.24M | 92.63M | 92.37M | 92.46M |

OTC Markets Group launches MOON ATS for overnight trading of US securities

ATS Corporation (ATS) Q2 2025 Earnings Call Transcript

ATS (ATS) Lags Q2 Earnings and Revenue Estimates

ATS Reports Second Quarter Fiscal 2025 Results

ATS to Participate in the UBS Global Industrials and Transportation Conference

Analysts Estimate ATS (ATS) to Report a Decline in Earnings: What to Look Out for

ATS To Host Second Quarter Earnings Call Wednesday November 6, 2024, at 8:30 a.m. Eastern

ATS to Participate in the Scotiabank Transportation & Industrials Conference

ATS to Participate in the Baird 2024 Global Industrial Conference

ATS Corporation (ATSAF) Q4 2023 Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports