See more : Whirlpool S.A. (WHRL4.SA) Income Statement Analysis – Financial Results

Complete financial analysis of Audacy, Inc. (AUD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Audacy, Inc., a leading company in the Broadcasting industry within the Communication Services sector.

- Goodness Growth Holdings, Inc. (GDNSF) Income Statement Analysis – Financial Results

- M/I Homes, Inc. (MHO) Income Statement Analysis – Financial Results

- Mercialys (MEIYF) Income Statement Analysis – Financial Results

- Almondz Global Securities Limited (ALMONDZ.BO) Income Statement Analysis – Financial Results

- Chalice Brands Ltd. (CHALF) Income Statement Analysis – Financial Results

Audacy, Inc. (AUD)

About Audacy, Inc.

Audacy, Inc., a multi-platform audio content and entertainment company, engages in the radio broadcasting business in the United States. The company owns and operates radio stations in various formats, such as news, sports, talk, classic rock, urban, adult contemporary, alternative, country, and others, as well as offers integrated marketing solutions across its broadcast, digital, podcast, and event platforms. It also creates live and original events, including concerts and live performances, and crafted food and beverage events. The company was formerly known as Entercom Communications Corp. and changed its name to Audacy, Inc. in April 2021. Audacy, Inc. was founded in 1968 and is headquartered in Philadelphia, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.17B | 1.25B | 1.22B | 1.06B | 1.49B | 1.46B | 592.88M | 460.25M | 411.38M | 379.79M | 377.62M | 388.92M | 382.73M | 391.45M | 372.43M | 438.82M | 468.35M | 440.49M | 432.52M | 423.46M | 401.06M | 391.29M | 332.90M | 352.03M | 215.00M | 133.00M |

| Cost of Revenue | 0.00 | 1.03B | 976.97M | 907.80M | 1.09B | 1.10B | 443.51M | 318.74M | 287.71M | 259.18M | 252.60M | 252.93M | 263.42M | 258.90M | 254.04M | 276.19M | 283.54M | 260.24M | 248.20M | 244.67M | 232.18M | 226.03M | 201.26M | 206.61M | 135.94M | 88.60M |

| Gross Profit | 1.17B | 223.18M | 242.43M | 153.10M | 403.31M | 363.29M | 149.37M | 141.50M | 123.67M | 120.61M | 125.02M | 135.99M | 119.31M | 132.55M | 118.39M | 162.64M | 184.81M | 180.24M | 184.32M | 178.78M | 168.87M | 165.26M | 131.64M | 145.42M | 79.06M | 44.40M |

| Gross Profit Ratio | 100.00% | 17.80% | 19.88% | 14.43% | 27.07% | 24.84% | 25.19% | 30.74% | 30.06% | 31.76% | 33.11% | 34.97% | 31.17% | 33.86% | 31.79% | 37.06% | 39.46% | 40.92% | 42.61% | 42.22% | 42.11% | 42.23% | 39.54% | 41.31% | 36.77% | 33.38% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 135.54M | 96.38M | 93.41M | 64.56M | 84.30M | 69.49M | 47.86M | 33.33M | 26.48M | 26.57M | 24.38M | 25.87M | 26.61M | 21.95M | 22.88M | 26.92M | 28.89M | 33.79M | 18.87M | 15.71M | 14.43M | 14.12M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 407.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 781.00K | 1.64M | 7.43M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 135.54M | 96.38M | 93.41M | 64.56M | 84.30M | 69.49M | 47.86M | 33.33M | 26.48M | 26.57M | 24.38M | 25.87M | 27.02M | 21.95M | 22.88M | 26.92M | 28.89M | 33.79M | 18.87M | 16.49M | 16.07M | 21.56M | 12.34M | 12.50M | 8.10M | 4.50M |

| Other Expenses | 878.54M | 66.47M | 53.23M | 50.23M | 45.44M | 43.37M | 395.65M | 2.30M | 261.23M | 232.61M | 165.00K | 118.00K | 236.81M | 236.94M | 231.17M | 249.27M | 254.65M | 226.45M | 229.33M | 228.96M | 217.75M | 211.91M | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.01B | 162.86M | 146.64M | 114.79M | 129.74M | 112.86M | 63.54M | 43.54M | 33.61M | 34.37M | 32.93M | 36.95M | 38.29M | 34.84M | 39.89M | 313.41M | 142.91M | 53.66M | 31.35M | 33.59M | 28.64M | 35.45M | 58.86M | 55.97M | 29.66M | 17.60M |

| Cost & Expenses | 1.01B | 1.19B | 1.12B | 1.02B | 1.22B | 1.21B | 507.05M | 362.28M | 321.32M | 293.55M | 285.52M | 289.89M | 301.71M | 293.74M | 293.94M | 313.41M | 426.45M | 313.91M | 279.55M | 278.26M | 260.82M | 261.48M | 260.12M | 262.58M | 165.61M | 106.20M |

| Interest Income | 0.00 | 1.09M | 1.63M | 3.46M | 3.74M | 703.00K | 1.08M | -255.00K | -334.00K | -305.00K | -271.00K | -237.00K | 31.00K | 19.00K | 58.00K | 323.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 138.13M | 107.49M | 91.51M | 87.10M | 100.10M | 101.12M | 32.52M | 36.64M | 37.96M | 38.82M | 44.23M | 53.45M | 24.92M | 30.51M | 31.23M | 45.04M | 51.18M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 73.94M | 65.79M | 60.57M | 50.23M | 45.33M | 44.29M | 15.55M | 9.79M | 8.42M | 7.79M | 8.55M | 10.84M | 11.28M | 12.66M | 16.60M | 20.44M | 18.33M | 17.17M | 18.00M | 17.00M | 15.74M | 16.27M | 46.51M | 43.48M | 21.56M | 13.10M |

| EBITDA | -1.27B | 126.34M | 147.63M | 88.54M | 314.51M | 294.72M | 99.17M | 109.49M | 98.47M | 94.03M | 100.81M | 110.00M | 92.29M | 110.39M | 95.16M | 146.17M | 156.78M | 147.35M | 162.63M | 163.76M | 158.87M | 147.20M | 130.03M | 106.07M | 71.47M | 42.10M |

| EBITDA Ratio | -109.01% | 10.08% | 12.11% | 8.35% | 21.11% | 20.15% | 16.73% | 23.79% | 23.94% | 24.76% | 26.70% | 28.28% | 24.11% | 28.20% | 25.55% | 33.31% | 33.47% | 33.45% | 37.60% | 38.67% | 39.61% | 37.62% | 39.06% | 30.13% | 33.24% | 31.65% |

| Operating Income | -1.35B | 60.56M | 87.06M | 38.31M | 269.17M | 250.43M | 12.58M | 98.06M | 85.58M | 85.58M | 92.57M | 76.59M | 79.47M | 97.71M | 10.82M | -710.31M | 41.90M | 126.58M | 152.97M | 145.20M | 140.23M | 129.81M | 72.78M | 89.45M | 49.39M | 26.80M |

| Operating Income Ratio | -115.34% | 4.83% | 7.14% | 3.61% | 18.07% | 17.12% | 2.12% | 21.31% | 20.80% | 22.53% | 24.51% | 19.69% | 20.76% | 24.96% | 2.91% | -161.87% | 8.95% | 28.74% | 35.37% | 34.29% | 34.97% | 33.17% | 21.86% | 25.41% | 22.97% | 20.15% |

| Total Other Income/Expenses | -138.13M | -107.25M | -90.87M | -364.41M | -652.18M | -617.17M | -36.66M | -45.20M | -37.96M | -38.84M | -44.07M | -52.85M | -27.41M | -30.68M | -10.95M | -34.86M | -49.60M | -42.90M | -25.38M | -21.67M | -25.02M | -36.46M | -42.75M | -10.40M | -8.44M | -16.90M |

| Income Before Tax | -1.49B | -180.95M | -3.81M | -326.10M | -383.01M | -366.74M | -24.07M | 52.86M | 47.62M | 46.73M | 48.50M | 23.74M | 52.07M | 67.03M | -131.00K | -745.17M | -7.70M | 83.68M | 127.59M | 123.52M | 115.21M | 93.35M | 30.03M | 79.05M | 40.95M | 9.90M |

| Income Before Tax Ratio | -127.15% | -14.43% | -0.31% | -30.74% | -25.71% | -25.08% | -4.06% | 11.48% | 11.58% | 12.31% | 12.84% | 6.10% | 13.60% | 17.12% | -0.04% | -169.81% | -1.64% | 19.00% | 29.50% | 29.17% | 28.73% | 23.86% | 9.02% | 22.46% | 19.05% | 7.44% |

| Income Tax Expense | -349.46M | -40.28M | -238.00K | -83.88M | 37.21M | -4.15M | -257.09M | 14.79M | 18.44M | 19.91M | 22.48M | 12.47M | -16.44M | 20.60M | -5.53M | 291.97M | 695.00K | 35.70M | 49.22M | 47.89M | 43.43M | 37.53M | 12.19M | 31.80M | 100.91M | 500.00K |

| Net Income | -1.14B | -140.67M | -3.57M | -242.22M | -420.21M | -362.59M | 233.85M | 38.07M | 29.18M | 26.82M | 26.02M | 11.27M | 68.51M | 46.44M | 5.40M | -516.65M | -8.36M | 47.98M | 78.36M | 75.63M | 71.78M | -83.05M | 17.27M | 47.25M | -60.88M | 7.00M |

| Net Income Ratio | -97.26% | -11.22% | -0.29% | -22.83% | -28.20% | -24.79% | 39.44% | 8.27% | 7.09% | 7.06% | 6.89% | 2.90% | 17.90% | 11.86% | 1.45% | -117.74% | -1.78% | 10.89% | 18.12% | 17.86% | 17.90% | -21.23% | 5.19% | 13.42% | -28.31% | 5.26% |

| EPS | -0.24 | -1.01 | -0.03 | -1.80 | -3.07 | -2.63 | 4.49 | 0.94 | 0.75 | 0.71 | 0.70 | 0.31 | 1.95 | 1.30 | 0.15 | -14.05 | -0.22 | 1.20 | 1.70 | 1.51 | 1.41 | -1.70 | 0.38 | 1.05 | -1.61 | 0.06 |

| EPS Diluted | -0.24 | -1.01 | -0.03 | -1.80 | -3.07 | -2.63 | 4.37 | 0.91 | 0.73 | 0.69 | 0.68 | 0.30 | 1.88 | 1.23 | 0.15 | -14.05 | -0.22 | 1.19 | 1.70 | 1.50 | 1.39 | -1.67 | 0.38 | 1.04 | -1.61 | 0.06 |

| Weighted Avg Shares Out | 4.71B | 138.65M | 135.98M | 134.57M | 136.97M | 138.07M | 51.39M | 38.50M | 38.08M | 37.76M | 37.42M | 36.91M | 36.37M | 35.71M | 35.32M | 36.78M | 38.23M | 39.97M | 46.05M | 50.22M | 50.96M | 48.97M | 45.29M | 45.21M | 37.81M | 116.67M |

| Weighted Avg Shares Out (Dil) | 4.71B | 138.65M | 135.98M | 134.57M | 136.97M | 138.07M | 52.89M | 39.57M | 39.04M | 38.66M | 38.30M | 37.81M | 37.76M | 37.68M | 36.40M | 36.78M | 38.23M | 40.20M | 46.22M | 50.53M | 51.61M | 49.77M | 45.99M | 45.61M | 37.81M | 116.67M |

Audacy Announces Launch of Exclusive Station Collection on Digital Platform

Audacy Launches 2400Sports, A New Dedicated Sports Podcast Studio Building on the Company's Leadership Position in Sports Audio

Audacy: A Multi-Platform Leader In Audio, Contending With Debt

Entravision: A High Growth, Low Valuation Bargain

Cadence13 Partners with Globally Renowned Thought Leader, Bestselling Author, and Activist Glennon Doyle for First-Ever Podcast

Beasley Broadcast: Compelling Upside Amid Economic Reopening, Insider Buying, & eSports

Audacy, Inc. (AUD) CEO David Field on Q1 2021 Results - Earnings Call Transcript

Audacy, Inc. to Report 2021 First Quarter Financial Results, Host Conference Call on May 7

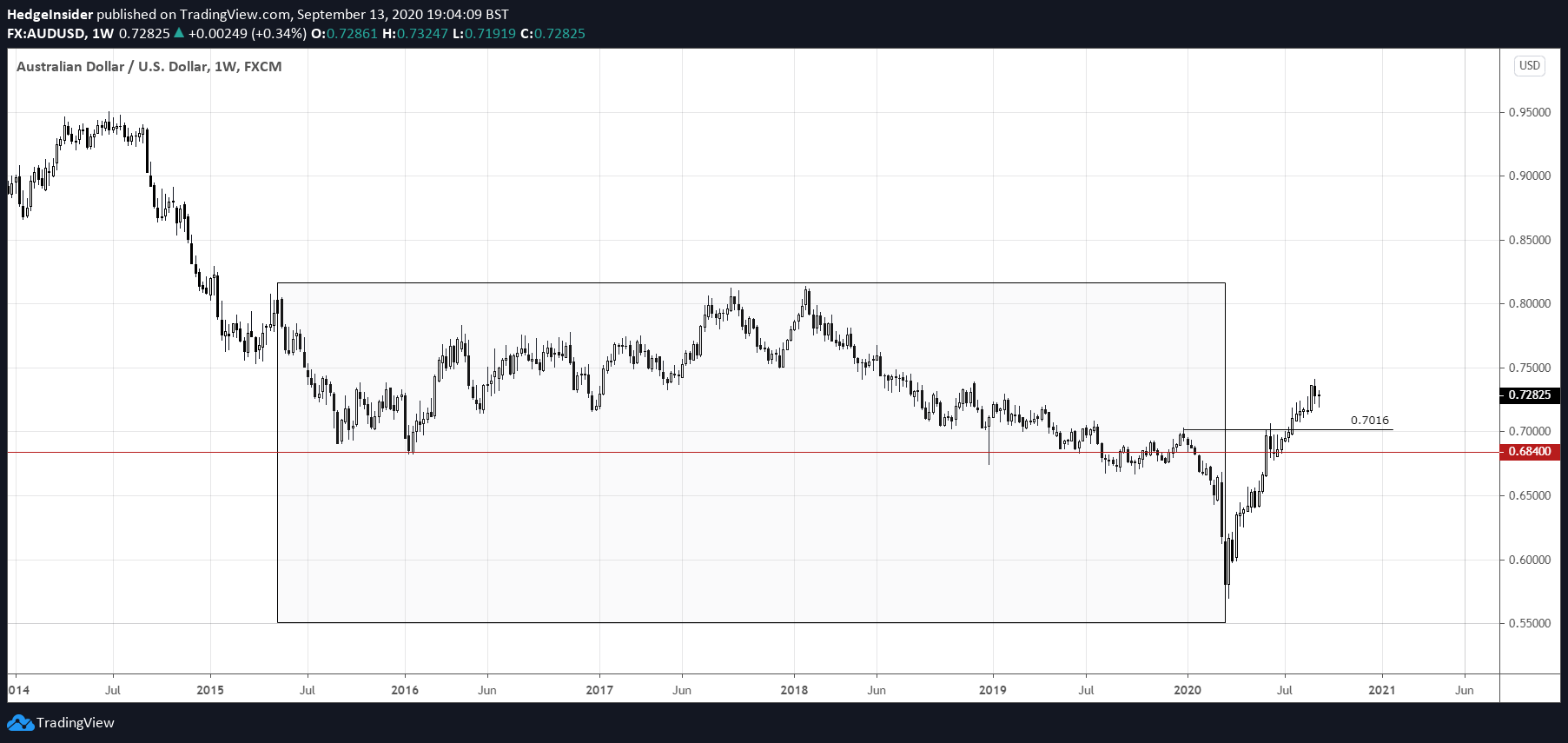

AUD/USD Could Find 0.80 As Fundamentals Appear Supportive

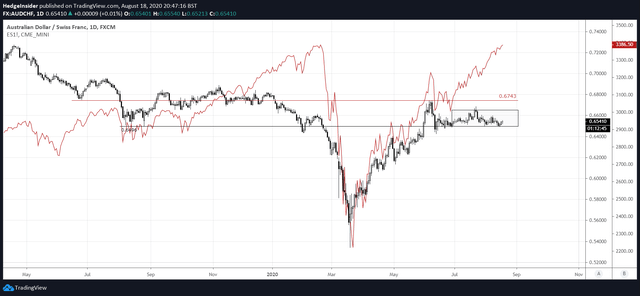

AUD/CHF Remains Positioned For Upside In Spite Of Recent Softness

Source: https://incomestatements.info

Category: Stock Reports