See more : Global Kids Company Corp. (6189.T) Income Statement Analysis – Financial Results

Complete financial analysis of Audacy, Inc. (AUD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Audacy, Inc., a leading company in the Broadcasting industry within the Communication Services sector.

- HMN Financial, Inc. (HMNF) Income Statement Analysis – Financial Results

- Nextlink (6997.TWO) Income Statement Analysis – Financial Results

- Vitro Biopharma, Inc. (VTRO) Income Statement Analysis – Financial Results

- Passus S.A. (PAS.WA) Income Statement Analysis – Financial Results

- Wacker Neuson SE (WAC.SW) Income Statement Analysis – Financial Results

Audacy, Inc. (AUD)

About Audacy, Inc.

Audacy, Inc., a multi-platform audio content and entertainment company, engages in the radio broadcasting business in the United States. The company owns and operates radio stations in various formats, such as news, sports, talk, classic rock, urban, adult contemporary, alternative, country, and others, as well as offers integrated marketing solutions across its broadcast, digital, podcast, and event platforms. It also creates live and original events, including concerts and live performances, and crafted food and beverage events. The company was formerly known as Entercom Communications Corp. and changed its name to Audacy, Inc. in April 2021. Audacy, Inc. was founded in 1968 and is headquartered in Philadelphia, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.17B | 1.25B | 1.22B | 1.06B | 1.49B | 1.46B | 592.88M | 460.25M | 411.38M | 379.79M | 377.62M | 388.92M | 382.73M | 391.45M | 372.43M | 438.82M | 468.35M | 440.49M | 432.52M | 423.46M | 401.06M | 391.29M | 332.90M | 352.03M | 215.00M | 133.00M |

| Cost of Revenue | 0.00 | 1.03B | 976.97M | 907.80M | 1.09B | 1.10B | 443.51M | 318.74M | 287.71M | 259.18M | 252.60M | 252.93M | 263.42M | 258.90M | 254.04M | 276.19M | 283.54M | 260.24M | 248.20M | 244.67M | 232.18M | 226.03M | 201.26M | 206.61M | 135.94M | 88.60M |

| Gross Profit | 1.17B | 223.18M | 242.43M | 153.10M | 403.31M | 363.29M | 149.37M | 141.50M | 123.67M | 120.61M | 125.02M | 135.99M | 119.31M | 132.55M | 118.39M | 162.64M | 184.81M | 180.24M | 184.32M | 178.78M | 168.87M | 165.26M | 131.64M | 145.42M | 79.06M | 44.40M |

| Gross Profit Ratio | 100.00% | 17.80% | 19.88% | 14.43% | 27.07% | 24.84% | 25.19% | 30.74% | 30.06% | 31.76% | 33.11% | 34.97% | 31.17% | 33.86% | 31.79% | 37.06% | 39.46% | 40.92% | 42.61% | 42.22% | 42.11% | 42.23% | 39.54% | 41.31% | 36.77% | 33.38% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 135.54M | 96.38M | 93.41M | 64.56M | 84.30M | 69.49M | 47.86M | 33.33M | 26.48M | 26.57M | 24.38M | 25.87M | 26.61M | 21.95M | 22.88M | 26.92M | 28.89M | 33.79M | 18.87M | 15.71M | 14.43M | 14.12M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 407.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 781.00K | 1.64M | 7.43M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 135.54M | 96.38M | 93.41M | 64.56M | 84.30M | 69.49M | 47.86M | 33.33M | 26.48M | 26.57M | 24.38M | 25.87M | 27.02M | 21.95M | 22.88M | 26.92M | 28.89M | 33.79M | 18.87M | 16.49M | 16.07M | 21.56M | 12.34M | 12.50M | 8.10M | 4.50M |

| Other Expenses | 878.54M | 66.47M | 53.23M | 50.23M | 45.44M | 43.37M | 395.65M | 2.30M | 261.23M | 232.61M | 165.00K | 118.00K | 236.81M | 236.94M | 231.17M | 249.27M | 254.65M | 226.45M | 229.33M | 228.96M | 217.75M | 211.91M | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.01B | 162.86M | 146.64M | 114.79M | 129.74M | 112.86M | 63.54M | 43.54M | 33.61M | 34.37M | 32.93M | 36.95M | 38.29M | 34.84M | 39.89M | 313.41M | 142.91M | 53.66M | 31.35M | 33.59M | 28.64M | 35.45M | 58.86M | 55.97M | 29.66M | 17.60M |

| Cost & Expenses | 1.01B | 1.19B | 1.12B | 1.02B | 1.22B | 1.21B | 507.05M | 362.28M | 321.32M | 293.55M | 285.52M | 289.89M | 301.71M | 293.74M | 293.94M | 313.41M | 426.45M | 313.91M | 279.55M | 278.26M | 260.82M | 261.48M | 260.12M | 262.58M | 165.61M | 106.20M |

| Interest Income | 0.00 | 1.09M | 1.63M | 3.46M | 3.74M | 703.00K | 1.08M | -255.00K | -334.00K | -305.00K | -271.00K | -237.00K | 31.00K | 19.00K | 58.00K | 323.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 138.13M | 107.49M | 91.51M | 87.10M | 100.10M | 101.12M | 32.52M | 36.64M | 37.96M | 38.82M | 44.23M | 53.45M | 24.92M | 30.51M | 31.23M | 45.04M | 51.18M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 73.94M | 65.79M | 60.57M | 50.23M | 45.33M | 44.29M | 15.55M | 9.79M | 8.42M | 7.79M | 8.55M | 10.84M | 11.28M | 12.66M | 16.60M | 20.44M | 18.33M | 17.17M | 18.00M | 17.00M | 15.74M | 16.27M | 46.51M | 43.48M | 21.56M | 13.10M |

| EBITDA | -1.27B | 126.34M | 147.63M | 88.54M | 314.51M | 294.72M | 99.17M | 109.49M | 98.47M | 94.03M | 100.81M | 110.00M | 92.29M | 110.39M | 95.16M | 146.17M | 156.78M | 147.35M | 162.63M | 163.76M | 158.87M | 147.20M | 130.03M | 106.07M | 71.47M | 42.10M |

| EBITDA Ratio | -109.01% | 10.08% | 12.11% | 8.35% | 21.11% | 20.15% | 16.73% | 23.79% | 23.94% | 24.76% | 26.70% | 28.28% | 24.11% | 28.20% | 25.55% | 33.31% | 33.47% | 33.45% | 37.60% | 38.67% | 39.61% | 37.62% | 39.06% | 30.13% | 33.24% | 31.65% |

| Operating Income | -1.35B | 60.56M | 87.06M | 38.31M | 269.17M | 250.43M | 12.58M | 98.06M | 85.58M | 85.58M | 92.57M | 76.59M | 79.47M | 97.71M | 10.82M | -710.31M | 41.90M | 126.58M | 152.97M | 145.20M | 140.23M | 129.81M | 72.78M | 89.45M | 49.39M | 26.80M |

| Operating Income Ratio | -115.34% | 4.83% | 7.14% | 3.61% | 18.07% | 17.12% | 2.12% | 21.31% | 20.80% | 22.53% | 24.51% | 19.69% | 20.76% | 24.96% | 2.91% | -161.87% | 8.95% | 28.74% | 35.37% | 34.29% | 34.97% | 33.17% | 21.86% | 25.41% | 22.97% | 20.15% |

| Total Other Income/Expenses | -138.13M | -107.25M | -90.87M | -364.41M | -652.18M | -617.17M | -36.66M | -45.20M | -37.96M | -38.84M | -44.07M | -52.85M | -27.41M | -30.68M | -10.95M | -34.86M | -49.60M | -42.90M | -25.38M | -21.67M | -25.02M | -36.46M | -42.75M | -10.40M | -8.44M | -16.90M |

| Income Before Tax | -1.49B | -180.95M | -3.81M | -326.10M | -383.01M | -366.74M | -24.07M | 52.86M | 47.62M | 46.73M | 48.50M | 23.74M | 52.07M | 67.03M | -131.00K | -745.17M | -7.70M | 83.68M | 127.59M | 123.52M | 115.21M | 93.35M | 30.03M | 79.05M | 40.95M | 9.90M |

| Income Before Tax Ratio | -127.15% | -14.43% | -0.31% | -30.74% | -25.71% | -25.08% | -4.06% | 11.48% | 11.58% | 12.31% | 12.84% | 6.10% | 13.60% | 17.12% | -0.04% | -169.81% | -1.64% | 19.00% | 29.50% | 29.17% | 28.73% | 23.86% | 9.02% | 22.46% | 19.05% | 7.44% |

| Income Tax Expense | -349.46M | -40.28M | -238.00K | -83.88M | 37.21M | -4.15M | -257.09M | 14.79M | 18.44M | 19.91M | 22.48M | 12.47M | -16.44M | 20.60M | -5.53M | 291.97M | 695.00K | 35.70M | 49.22M | 47.89M | 43.43M | 37.53M | 12.19M | 31.80M | 100.91M | 500.00K |

| Net Income | -1.14B | -140.67M | -3.57M | -242.22M | -420.21M | -362.59M | 233.85M | 38.07M | 29.18M | 26.82M | 26.02M | 11.27M | 68.51M | 46.44M | 5.40M | -516.65M | -8.36M | 47.98M | 78.36M | 75.63M | 71.78M | -83.05M | 17.27M | 47.25M | -60.88M | 7.00M |

| Net Income Ratio | -97.26% | -11.22% | -0.29% | -22.83% | -28.20% | -24.79% | 39.44% | 8.27% | 7.09% | 7.06% | 6.89% | 2.90% | 17.90% | 11.86% | 1.45% | -117.74% | -1.78% | 10.89% | 18.12% | 17.86% | 17.90% | -21.23% | 5.19% | 13.42% | -28.31% | 5.26% |

| EPS | -0.24 | -1.01 | -0.03 | -1.80 | -3.07 | -2.63 | 4.49 | 0.94 | 0.75 | 0.71 | 0.70 | 0.31 | 1.95 | 1.30 | 0.15 | -14.05 | -0.22 | 1.20 | 1.70 | 1.51 | 1.41 | -1.70 | 0.38 | 1.05 | -1.61 | 0.06 |

| EPS Diluted | -0.24 | -1.01 | -0.03 | -1.80 | -3.07 | -2.63 | 4.37 | 0.91 | 0.73 | 0.69 | 0.68 | 0.30 | 1.88 | 1.23 | 0.15 | -14.05 | -0.22 | 1.19 | 1.70 | 1.50 | 1.39 | -1.67 | 0.38 | 1.04 | -1.61 | 0.06 |

| Weighted Avg Shares Out | 4.71B | 138.65M | 135.98M | 134.57M | 136.97M | 138.07M | 51.39M | 38.50M | 38.08M | 37.76M | 37.42M | 36.91M | 36.37M | 35.71M | 35.32M | 36.78M | 38.23M | 39.97M | 46.05M | 50.22M | 50.96M | 48.97M | 45.29M | 45.21M | 37.81M | 116.67M |

| Weighted Avg Shares Out (Dil) | 4.71B | 138.65M | 135.98M | 134.57M | 136.97M | 138.07M | 52.89M | 39.57M | 39.04M | 38.66M | 38.30M | 37.81M | 37.76M | 37.68M | 36.40M | 36.78M | 38.23M | 40.20M | 46.22M | 50.53M | 51.61M | 49.77M | 45.99M | 45.61M | 37.81M | 116.67M |

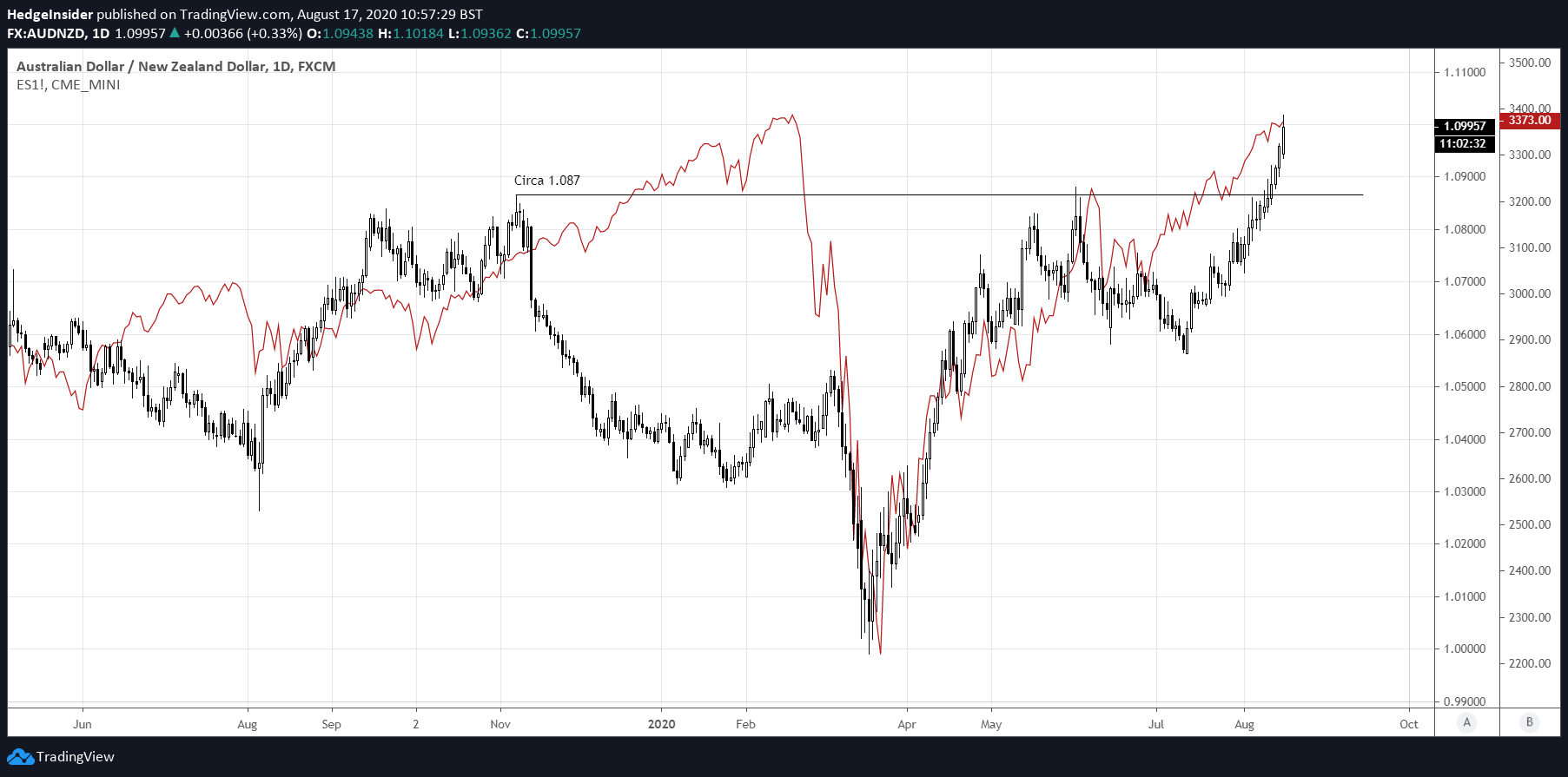

AUD/NZD Could Trade Higher As Global Risk Sentiment Continues To Favor AUD

AUD/USD Could Keep Pushing Higher As Fundamentals Support The Australian Dollar

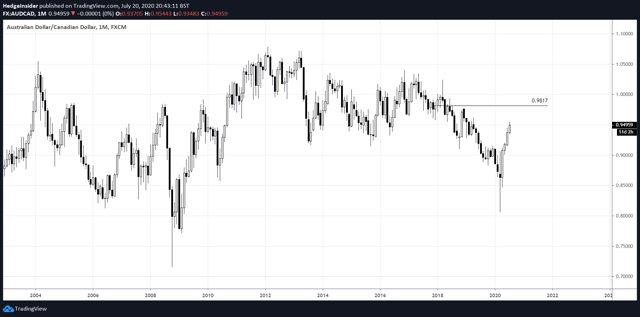

AUD/CAD Could Continue To Grind Higher As Terms Of Trade Differentials Favor Upside

AUD/CHF Has Further Upside Potential

AUD/USD Forecast May 18-22 - Aussie slides After Huge Job Losses | Forex Crunch

Source: https://incomestatements.info

Category: Stock Reports