See more : Carimin Petroleum Berhad (5257.KL) Income Statement Analysis – Financial Results

Complete financial analysis of BHP Group Limited (BBL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BHP Group Limited, a leading company in the Industrial Materials industry within the Basic Materials sector.

- Rhinomed Limited (RHNMF) Income Statement Analysis – Financial Results

- National Storage Affiliates Trust (NSA) Income Statement Analysis – Financial Results

- Kairous Acquisition Corp. Limited (KACLU) Income Statement Analysis – Financial Results

- Copper Lake Resources Ltd. (CPL.V) Income Statement Analysis – Financial Results

- Huagong Tech Company Limited (000988.SZ) Income Statement Analysis – Financial Results

BHP Group Limited (BBL)

About BHP Group Limited

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally. It operates through Petroleum, Copper, Iron Ore, and Coal segments. The company engages in the exploration, development, and production of oil and gas properties; and mining of copper, silver, zinc, molybdenum, uranium, gold, iron ore, and metallurgical and energy coal. It is also involved in mining, smelting, and refining of nickel; and potash development activities. In addition, the company provides towing, freight, marketing and trading, marketing support, finance, administrative, and other services. The company was founded in 1851 and is headquartered in Melbourne, Australia.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 60.82B | 42.93B | 44.29B | 43.64B | 38.29B | 30.91B | 44.64B | 67.21B | 65.97B | 72.23B | 71.74B | 52.80B | 50.21B | 59.47B | 39.50B | 39.10B | 29.59B | 22.89B | 15.61B | 14.70B | 17.79B | 4.99B | 4.62B | 5.44B | 5.31B | 5.21B | 4.36B | 1.41B |

| Cost of Revenue | 0.00 | 13.66B | 13.45B | 12.70B | 5.15B | 14.07B | 15.67B | 20.18B | 19.26B | 18.03B | 15.68B | 12.56B | 21.73B | 23.55B | 17.81B | 15.15B | 19.50B | 16.47B | 10.97B | 9.97B | 6.15B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 60.82B | 29.27B | 30.83B | 30.94B | 33.14B | 16.84B | 28.96B | 47.03B | 46.71B | 54.19B | 56.06B | 40.24B | 28.49B | 35.93B | 21.69B | 23.95B | 10.09B | 6.42B | 4.64B | 4.73B | 11.64B | 4.99B | 4.62B | 5.44B | 5.31B | 5.21B | 4.36B | 1.41B |

| Gross Profit Ratio | 100.00% | 68.19% | 69.62% | 70.89% | 86.55% | 54.47% | 64.89% | 69.98% | 70.80% | 75.03% | 78.14% | 76.21% | 56.73% | 60.41% | 54.91% | 61.25% | 34.11% | 28.06% | 29.75% | 32.18% | 65.43% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 430.00M | 13.00M | 43.00M | 64.00M | 75.00M | 74.00M | 65.00M | 156.00M | 244.00M | 169.00M | 76.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 46.58M | 36.63M | 18.42M |

| General & Administrative | 0.00 | 4.73B | 4.44B | 4.41B | 11.37B | 35.49B | 16.60B | 41.00M | 16.00M | 3.05B | -10.00M | 1.65B | 1.91B | 1.37B | 971.00M | 776.00M | 192.00M | 48.00M | 125.00M | 174.00M | 185.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 1.98B | 2.38B | 2.29B | 2.28B | 2.23B | 8.93B | 7.62B | 8.17B | 4.25B | 5.76B | 3.40B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.76B | 6.71B | 6.82B | 6.71B | 13.65B | 37.71B | 25.53B | 7.66B | 8.19B | 7.30B | 5.75B | 5.05B | 1.91B | 1.37B | 971.00M | 776.00M | 192.00M | 48.00M | 125.00M | 174.00M | 185.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 28.74B | 7.78B | 7.27B | 8.13B | 8.07B | -24.40B | -8.31B | 17.18B | 18.32B | 20.25B | 17.33B | 15.63B | 9.53B | 9.24B | 6.60B | 5.91B | 2.08B | 899.00M | 1.82B | 1.88B | 14.09B | 4.31B | 4.14B | 4.80B | 4.89B | 4.58B | 4.02B | 1.43B |

| Operating Expenses | 35.50B | 14.49B | 14.08B | 14.84B | 21.72B | 13.74B | 17.24B | 24.88B | 26.57B | 27.63B | 23.16B | 20.75B | 11.59B | 10.85B | 7.74B | 6.77B | 2.27B | 947.00M | 1.95B | 2.06B | 14.28B | 4.31B | 4.14B | 4.80B | 4.89B | 4.63B | 4.05B | 1.45B |

| Cost & Expenses | 35.50B | 28.14B | 27.53B | 27.54B | 26.87B | 27.82B | 32.91B | 45.06B | 45.83B | 45.66B | 38.84B | 33.31B | 33.32B | 34.40B | 25.55B | 21.92B | 21.77B | 17.41B | 12.91B | 12.02B | 20.42B | 4.31B | 4.14B | 4.80B | 4.89B | 4.63B | 4.05B | 1.45B |

| Interest Income | 73.00M | 351.00M | 446.00M | 322.00M | 143.00M | 137.00M | 88.00M | 97.00M | 77.00M | 122.00M | 141.00M | 117.00M | 309.00M | 168.00M | 260.00M | 226.00M | 107.00M | 78.00M | 65.00M | 289.64M | 254.00M | 146.01M | 101.00M | 240.70M | 78.21M | 125.78M | 65.29M | 32.24M |

| Interest Expense | 938.00M | 1.35B | 1.57B | 1.44B | 1.48B | 1.16B | 751.00M | 1.07B | 1.23B | 922.00M | 657.00M | 556.00M | 852.00M | 518.00M | 650.00M | 731.00M | 302.00M | 485.00M | 302.00M | 465.00M | 667.00M | 157.01M | 163.00M | 212.74M | 164.74M | 178.57M | 191.10M | 39.91M |

| Depreciation & Amortization | 6.82B | 6.11B | 5.83B | 6.29B | 7.72B | 8.66B | 9.16B | 8.70B | 6.95B | 6.41B | 5.04B | 4.76B | 3.87B | 3.61B | 2.42B | 2.26B | 2.08B | 1.87B | 1.73B | 1.73B | 1.67B | 388.02M | 350.00M | 400.51M | 326.16M | 211.18M | 143.33M | 69.08M |

| EBITDA | 30.22B | 20.19B | 21.23B | 18.44B | 19.19B | 2.39B | 15.49B | 30.62B | 25.85B | 30.24B | 36.65B | 24.60B | 15.88B | 27.04B | 21.00B | 17.08B | 10.61B | 6.77B | 4.38B | 4.32B | 4.68B | 1.34B | 1.03B | 1.35B | 1.29B | 1.04B | 680.00M | 326.96M |

| EBITDA Ratio | 49.68% | 47.03% | 47.93% | 42.26% | 50.12% | 7.72% | 34.69% | 45.55% | 39.18% | 41.86% | 51.09% | 46.59% | 31.62% | 45.47% | 53.17% | 43.68% | 35.85% | 29.59% | 28.08% | 29.38% | 26.30% | 26.83% | 22.24% | 24.77% | 24.31% | 20.00% | 15.58% | 23.13% |

| Operating Income | 25.91B | 14.42B | 16.11B | 16.00B | 11.75B | -6.24B | 8.67B | 23.41B | 19.23B | 23.75B | 31.82B | 20.03B | 12.16B | 24.15B | 18.40B | 14.67B | 7.43B | 4.99B | 2.70B | 2.67B | 3.18B | 688.04M | 492.00M | 646.20M | 634.02M | 669.25M | 396.53M | 67.54M |

| Operating Income Ratio | 42.60% | 33.59% | 36.38% | 36.66% | 30.70% | -20.17% | 19.42% | 34.84% | 29.14% | 32.89% | 44.35% | 37.94% | 24.22% | 40.60% | 46.59% | 37.52% | 25.11% | 21.82% | 17.29% | 18.19% | 17.86% | 13.78% | 10.64% | 11.88% | 11.95% | 12.85% | 9.09% | 4.78% |

| Total Other Income/Expenses | -1.31B | -911.00M | -1.06B | -1.25B | -1.43B | -1.02B | -614.00M | -1.18B | -1.35B | -730.00M | -561.00M | -459.00M | -543.00M | -662.00M | -390.00M | -505.00M | 510.00M | -475.00M | -476.00M | -465.00M | -1.11B | 149.01M | 86.00M | 190.76M | 311.18M | 254.66M | 125.81M | 210.30M |

| Income Before Tax | 24.60B | 13.51B | 15.05B | 14.75B | 10.32B | -7.26B | 8.06B | 22.24B | 17.87B | 23.02B | 31.26B | 19.57B | 11.62B | 23.48B | 18.01B | 14.17B | 7.94B | 4.52B | 2.22B | 2.21B | 2.06B | 837.05M | 578.00M | 836.97M | 945.20M | 923.91M | 522.34M | 277.84M |

| Income Before Tax Ratio | 40.45% | 31.47% | 33.98% | 33.80% | 26.96% | -23.48% | 18.05% | 33.09% | 27.09% | 31.87% | 43.57% | 37.07% | 23.14% | 39.49% | 45.60% | 36.23% | 26.84% | 19.74% | 14.24% | 15.03% | 11.60% | 16.77% | 12.51% | 15.39% | 17.82% | 17.73% | 11.97% | 19.65% |

| Income Tax Expense | 11.15B | 4.77B | 5.53B | 7.01B | 4.10B | -1.05B | 3.67B | 7.01B | 6.80B | 7.49B | 7.31B | 6.56B | 5.28B | 7.52B | 4.52B | 3.63B | 1.84B | 1.04B | 774.00M | 1.00B | 811.00M | 217.01M | 132.00M | 253.69M | 261.26M | 217.39M | 79.63M | 38.38M |

| Net Income | 11.30B | 7.96B | 8.31B | 3.71B | 5.89B | -6.39B | 1.91B | 13.83B | 10.88B | 15.42B | 23.65B | 12.72B | 5.88B | 15.39B | 13.42B | 10.45B | 6.39B | 3.38B | 1.58B | 1.13B | 1.53B | 577.03M | 383.00M | 480.41M | 537.50M | 434.78M | 265.95M | 179.60M |

| Net Income Ratio | 18.59% | 18.53% | 18.75% | 8.49% | 15.38% | -20.66% | 4.28% | 20.58% | 16.49% | 21.35% | 32.96% | 24.10% | 11.70% | 25.88% | 33.97% | 26.73% | 21.59% | 14.76% | 10.13% | 7.67% | 8.60% | 11.56% | 8.29% | 8.83% | 10.13% | 8.35% | 6.09% | 12.70% |

| EPS | 4.47 | 3.15 | 3.21 | 1.39 | 2.21 | -2.40 | 0.72 | 5.20 | 4.09 | 5.79 | 8.58 | 4.57 | 2.11 | 5.51 | 4.59 | 3.46 | 2.09 | 1.09 | 0.84 | 0.36 | 0.51 | 0.56 | 0.36 | 0.46 | 0.51 | 0.41 | 0.25 | 0.17 |

| EPS Diluted | 4.46 | 3.14 | 3.20 | 1.39 | 2.21 | -2.40 | 0.72 | 5.18 | 4.07 | 5.77 | 8.54 | 4.55 | 2.10 | 5.49 | 4.57 | 3.45 | 2.08 | 1.08 | 0.84 | 0.36 | 0.51 | 0.56 | 0.36 | 0.46 | 0.51 | 0.41 | 0.25 | 0.17 |

| Weighted Avg Shares Out | 2.53B | 2.53B | 2.59B | 2.66B | 2.66B | 2.66B | 2.66B | 2.66B | 2.66B | 2.66B | 2.76B | 2.78B | 2.78B | 2.80B | 2.92B | 3.02B | 3.06B | 3.11B | 1.89B | 3.10B | 2.97B | 1.04B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B |

| Weighted Avg Shares Out (Dil) | 2.53B | 2.53B | 2.60B | 2.67B | 2.67B | 2.66B | 2.67B | 2.67B | 2.67B | 2.67B | 2.77B | 2.80B | 2.80B | 2.80B | 2.93B | 3.03B | 3.08B | 3.12B | 1.89B | 3.10B | 2.99B | 1.04B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B |

3 High Earnings Return Stock Picks for the Value Investor

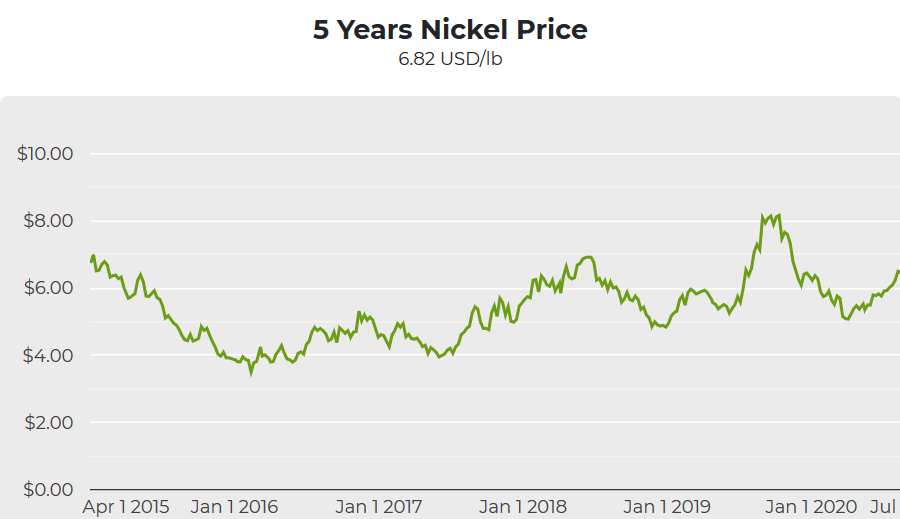

Nickel Monthly News For The Month Of November 2020

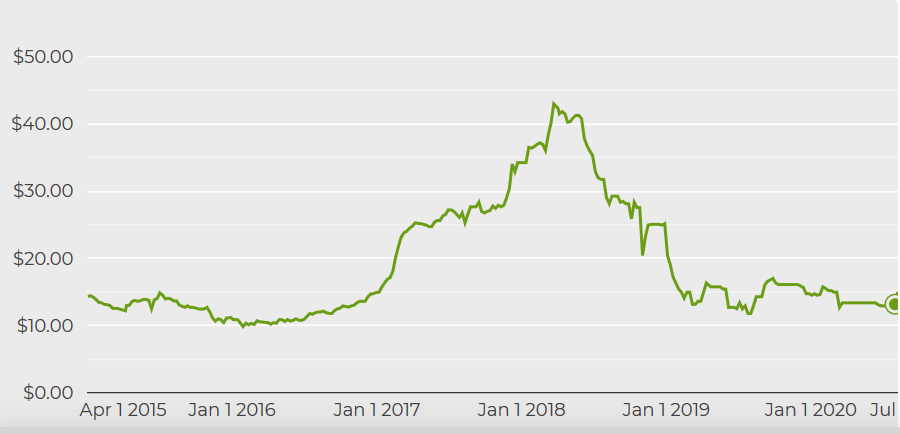

My Top 2 Battery Metal Miners For Lithium, Cobalt, Nickel; 1 For Graphite And Manganese

10 Best Dividend Stocks To Buy According To Billionaire Ken Fisher

Nickel Monthly News For The Month Of October 2020

Nickel Monthly News For The Month Of August 2020

Cobalt Miners News For The Month Of August 2020

Can 'Floating Rate Investments' And Commodities Protect Against Inflation?

BHP Group (BHP) CEO Mike Henry on Q4 2020 Results - Earnings Call Transcript

BHP Group 2020 Q4 - Results - Earnings Call Presentation

Source: https://incomestatements.info

Category: Stock Reports