See more : Anam Electronics Co.,Ltd. (008700.KS) Income Statement Analysis – Financial Results

Complete financial analysis of BHP Group Limited (BBL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BHP Group Limited, a leading company in the Industrial Materials industry within the Basic Materials sector.

- Shanghai Shine-Link International Logistics Co., Ltd. (603648.SS) Income Statement Analysis – Financial Results

- hVIVO plc (OPORF) Income Statement Analysis – Financial Results

- Arteris, Inc. (AIP) Income Statement Analysis – Financial Results

- ISPAC 1 LTD. (ISPC.TA) Income Statement Analysis – Financial Results

- Goldenmax International Technology Ltd. (002636.SZ) Income Statement Analysis – Financial Results

BHP Group Limited (BBL)

About BHP Group Limited

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally. It operates through Petroleum, Copper, Iron Ore, and Coal segments. The company engages in the exploration, development, and production of oil and gas properties; and mining of copper, silver, zinc, molybdenum, uranium, gold, iron ore, and metallurgical and energy coal. It is also involved in mining, smelting, and refining of nickel; and potash development activities. In addition, the company provides towing, freight, marketing and trading, marketing support, finance, administrative, and other services. The company was founded in 1851 and is headquartered in Melbourne, Australia.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 60.82B | 42.93B | 44.29B | 43.64B | 38.29B | 30.91B | 44.64B | 67.21B | 65.97B | 72.23B | 71.74B | 52.80B | 50.21B | 59.47B | 39.50B | 39.10B | 29.59B | 22.89B | 15.61B | 14.70B | 17.79B | 4.99B | 4.62B | 5.44B | 5.31B | 5.21B | 4.36B | 1.41B |

| Cost of Revenue | 0.00 | 13.66B | 13.45B | 12.70B | 5.15B | 14.07B | 15.67B | 20.18B | 19.26B | 18.03B | 15.68B | 12.56B | 21.73B | 23.55B | 17.81B | 15.15B | 19.50B | 16.47B | 10.97B | 9.97B | 6.15B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 60.82B | 29.27B | 30.83B | 30.94B | 33.14B | 16.84B | 28.96B | 47.03B | 46.71B | 54.19B | 56.06B | 40.24B | 28.49B | 35.93B | 21.69B | 23.95B | 10.09B | 6.42B | 4.64B | 4.73B | 11.64B | 4.99B | 4.62B | 5.44B | 5.31B | 5.21B | 4.36B | 1.41B |

| Gross Profit Ratio | 100.00% | 68.19% | 69.62% | 70.89% | 86.55% | 54.47% | 64.89% | 69.98% | 70.80% | 75.03% | 78.14% | 76.21% | 56.73% | 60.41% | 54.91% | 61.25% | 34.11% | 28.06% | 29.75% | 32.18% | 65.43% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 430.00M | 13.00M | 43.00M | 64.00M | 75.00M | 74.00M | 65.00M | 156.00M | 244.00M | 169.00M | 76.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 46.58M | 36.63M | 18.42M |

| General & Administrative | 0.00 | 4.73B | 4.44B | 4.41B | 11.37B | 35.49B | 16.60B | 41.00M | 16.00M | 3.05B | -10.00M | 1.65B | 1.91B | 1.37B | 971.00M | 776.00M | 192.00M | 48.00M | 125.00M | 174.00M | 185.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 1.98B | 2.38B | 2.29B | 2.28B | 2.23B | 8.93B | 7.62B | 8.17B | 4.25B | 5.76B | 3.40B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.76B | 6.71B | 6.82B | 6.71B | 13.65B | 37.71B | 25.53B | 7.66B | 8.19B | 7.30B | 5.75B | 5.05B | 1.91B | 1.37B | 971.00M | 776.00M | 192.00M | 48.00M | 125.00M | 174.00M | 185.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 28.74B | 7.78B | 7.27B | 8.13B | 8.07B | -24.40B | -8.31B | 17.18B | 18.32B | 20.25B | 17.33B | 15.63B | 9.53B | 9.24B | 6.60B | 5.91B | 2.08B | 899.00M | 1.82B | 1.88B | 14.09B | 4.31B | 4.14B | 4.80B | 4.89B | 4.58B | 4.02B | 1.43B |

| Operating Expenses | 35.50B | 14.49B | 14.08B | 14.84B | 21.72B | 13.74B | 17.24B | 24.88B | 26.57B | 27.63B | 23.16B | 20.75B | 11.59B | 10.85B | 7.74B | 6.77B | 2.27B | 947.00M | 1.95B | 2.06B | 14.28B | 4.31B | 4.14B | 4.80B | 4.89B | 4.63B | 4.05B | 1.45B |

| Cost & Expenses | 35.50B | 28.14B | 27.53B | 27.54B | 26.87B | 27.82B | 32.91B | 45.06B | 45.83B | 45.66B | 38.84B | 33.31B | 33.32B | 34.40B | 25.55B | 21.92B | 21.77B | 17.41B | 12.91B | 12.02B | 20.42B | 4.31B | 4.14B | 4.80B | 4.89B | 4.63B | 4.05B | 1.45B |

| Interest Income | 73.00M | 351.00M | 446.00M | 322.00M | 143.00M | 137.00M | 88.00M | 97.00M | 77.00M | 122.00M | 141.00M | 117.00M | 309.00M | 168.00M | 260.00M | 226.00M | 107.00M | 78.00M | 65.00M | 289.64M | 254.00M | 146.01M | 101.00M | 240.70M | 78.21M | 125.78M | 65.29M | 32.24M |

| Interest Expense | 938.00M | 1.35B | 1.57B | 1.44B | 1.48B | 1.16B | 751.00M | 1.07B | 1.23B | 922.00M | 657.00M | 556.00M | 852.00M | 518.00M | 650.00M | 731.00M | 302.00M | 485.00M | 302.00M | 465.00M | 667.00M | 157.01M | 163.00M | 212.74M | 164.74M | 178.57M | 191.10M | 39.91M |

| Depreciation & Amortization | 6.82B | 6.11B | 5.83B | 6.29B | 7.72B | 8.66B | 9.16B | 8.70B | 6.95B | 6.41B | 5.04B | 4.76B | 3.87B | 3.61B | 2.42B | 2.26B | 2.08B | 1.87B | 1.73B | 1.73B | 1.67B | 388.02M | 350.00M | 400.51M | 326.16M | 211.18M | 143.33M | 69.08M |

| EBITDA | 30.22B | 20.19B | 21.23B | 18.44B | 19.19B | 2.39B | 15.49B | 30.62B | 25.85B | 30.24B | 36.65B | 24.60B | 15.88B | 27.04B | 21.00B | 17.08B | 10.61B | 6.77B | 4.38B | 4.32B | 4.68B | 1.34B | 1.03B | 1.35B | 1.29B | 1.04B | 680.00M | 326.96M |

| EBITDA Ratio | 49.68% | 47.03% | 47.93% | 42.26% | 50.12% | 7.72% | 34.69% | 45.55% | 39.18% | 41.86% | 51.09% | 46.59% | 31.62% | 45.47% | 53.17% | 43.68% | 35.85% | 29.59% | 28.08% | 29.38% | 26.30% | 26.83% | 22.24% | 24.77% | 24.31% | 20.00% | 15.58% | 23.13% |

| Operating Income | 25.91B | 14.42B | 16.11B | 16.00B | 11.75B | -6.24B | 8.67B | 23.41B | 19.23B | 23.75B | 31.82B | 20.03B | 12.16B | 24.15B | 18.40B | 14.67B | 7.43B | 4.99B | 2.70B | 2.67B | 3.18B | 688.04M | 492.00M | 646.20M | 634.02M | 669.25M | 396.53M | 67.54M |

| Operating Income Ratio | 42.60% | 33.59% | 36.38% | 36.66% | 30.70% | -20.17% | 19.42% | 34.84% | 29.14% | 32.89% | 44.35% | 37.94% | 24.22% | 40.60% | 46.59% | 37.52% | 25.11% | 21.82% | 17.29% | 18.19% | 17.86% | 13.78% | 10.64% | 11.88% | 11.95% | 12.85% | 9.09% | 4.78% |

| Total Other Income/Expenses | -1.31B | -911.00M | -1.06B | -1.25B | -1.43B | -1.02B | -614.00M | -1.18B | -1.35B | -730.00M | -561.00M | -459.00M | -543.00M | -662.00M | -390.00M | -505.00M | 510.00M | -475.00M | -476.00M | -465.00M | -1.11B | 149.01M | 86.00M | 190.76M | 311.18M | 254.66M | 125.81M | 210.30M |

| Income Before Tax | 24.60B | 13.51B | 15.05B | 14.75B | 10.32B | -7.26B | 8.06B | 22.24B | 17.87B | 23.02B | 31.26B | 19.57B | 11.62B | 23.48B | 18.01B | 14.17B | 7.94B | 4.52B | 2.22B | 2.21B | 2.06B | 837.05M | 578.00M | 836.97M | 945.20M | 923.91M | 522.34M | 277.84M |

| Income Before Tax Ratio | 40.45% | 31.47% | 33.98% | 33.80% | 26.96% | -23.48% | 18.05% | 33.09% | 27.09% | 31.87% | 43.57% | 37.07% | 23.14% | 39.49% | 45.60% | 36.23% | 26.84% | 19.74% | 14.24% | 15.03% | 11.60% | 16.77% | 12.51% | 15.39% | 17.82% | 17.73% | 11.97% | 19.65% |

| Income Tax Expense | 11.15B | 4.77B | 5.53B | 7.01B | 4.10B | -1.05B | 3.67B | 7.01B | 6.80B | 7.49B | 7.31B | 6.56B | 5.28B | 7.52B | 4.52B | 3.63B | 1.84B | 1.04B | 774.00M | 1.00B | 811.00M | 217.01M | 132.00M | 253.69M | 261.26M | 217.39M | 79.63M | 38.38M |

| Net Income | 11.30B | 7.96B | 8.31B | 3.71B | 5.89B | -6.39B | 1.91B | 13.83B | 10.88B | 15.42B | 23.65B | 12.72B | 5.88B | 15.39B | 13.42B | 10.45B | 6.39B | 3.38B | 1.58B | 1.13B | 1.53B | 577.03M | 383.00M | 480.41M | 537.50M | 434.78M | 265.95M | 179.60M |

| Net Income Ratio | 18.59% | 18.53% | 18.75% | 8.49% | 15.38% | -20.66% | 4.28% | 20.58% | 16.49% | 21.35% | 32.96% | 24.10% | 11.70% | 25.88% | 33.97% | 26.73% | 21.59% | 14.76% | 10.13% | 7.67% | 8.60% | 11.56% | 8.29% | 8.83% | 10.13% | 8.35% | 6.09% | 12.70% |

| EPS | 4.47 | 3.15 | 3.21 | 1.39 | 2.21 | -2.40 | 0.72 | 5.20 | 4.09 | 5.79 | 8.58 | 4.57 | 2.11 | 5.51 | 4.59 | 3.46 | 2.09 | 1.09 | 0.84 | 0.36 | 0.51 | 0.56 | 0.36 | 0.46 | 0.51 | 0.41 | 0.25 | 0.17 |

| EPS Diluted | 4.46 | 3.14 | 3.20 | 1.39 | 2.21 | -2.40 | 0.72 | 5.18 | 4.07 | 5.77 | 8.54 | 4.55 | 2.10 | 5.49 | 4.57 | 3.45 | 2.08 | 1.08 | 0.84 | 0.36 | 0.51 | 0.56 | 0.36 | 0.46 | 0.51 | 0.41 | 0.25 | 0.17 |

| Weighted Avg Shares Out | 2.53B | 2.53B | 2.59B | 2.66B | 2.66B | 2.66B | 2.66B | 2.66B | 2.66B | 2.66B | 2.76B | 2.78B | 2.78B | 2.80B | 2.92B | 3.02B | 3.06B | 3.11B | 1.89B | 3.10B | 2.97B | 1.04B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B |

| Weighted Avg Shares Out (Dil) | 2.53B | 2.53B | 2.60B | 2.67B | 2.67B | 2.66B | 2.67B | 2.67B | 2.67B | 2.67B | 2.77B | 2.80B | 2.80B | 2.80B | 2.93B | 3.03B | 3.08B | 3.12B | 1.89B | 3.10B | 2.99B | 1.04B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B | 1.05B |

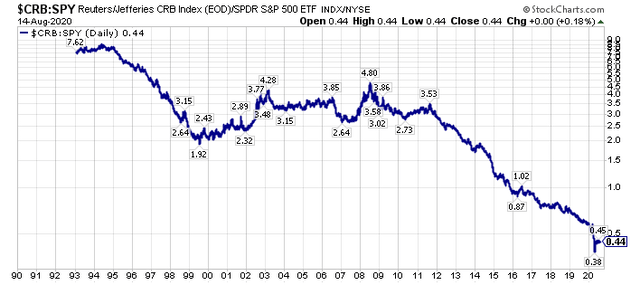

A Sharp Market Selloff Looms Amidst A Historic Capital Rotation

BHP Group Offers A Fat Dividend Yield And Protection From Higher Inflation

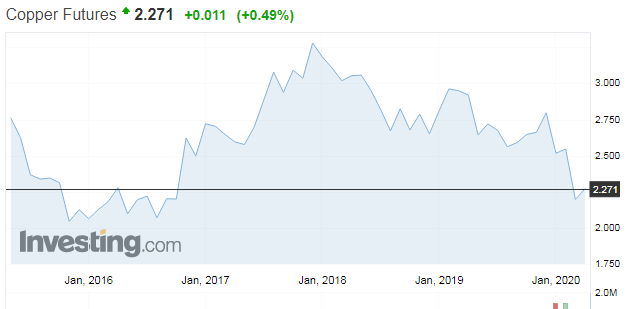

BHP Group: Improving Metal Prices Pave Way For Gradual But Sustainable Price Recovery

8,375 Shares in BHP Group PLC (NYSE:BBL) Purchased by Altium Wealth Management LLC

The EV Metals Miners Are The Cheapest They Have Been Since 2015/2016

Freeport-McMoRan: Copper Supply Disruptions And Use Of Metal To Fight COVID-19 Will Increase Price

BofA Downgrades Caterpillar, Says Energy Problem Is Here To Stay

Australian startup SafetyCulture nabs $800 million valuation on $35.5 million round

Stocks - Xerox, HP Lower in Premarket After Merger Plan Breaks up

Report Report: Toxic air, ride sharing, carbon removal and rating the raters

Source: https://incomestatements.info

Category: Stock Reports