See more : PT MNC Investama Tbk (BHIT.JK) Income Statement Analysis – Financial Results

Complete financial analysis of Berkshire Hathaway Inc. (BRK-B) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Berkshire Hathaway Inc., a leading company in the Insurance – Diversified industry within the Financial Services sector.

- Yamaha Corporation (7951.T) Income Statement Analysis – Financial Results

- Tenth Avenue Petroleum Corp. (URXZF) Income Statement Analysis – Financial Results

- Fidelity China Special Situations PLC (FCSS.L) Income Statement Analysis – Financial Results

- AGCO Corporation (AGCO) Income Statement Analysis – Financial Results

- Taliworks Corporation Berhad (8524.KL) Income Statement Analysis – Financial Results

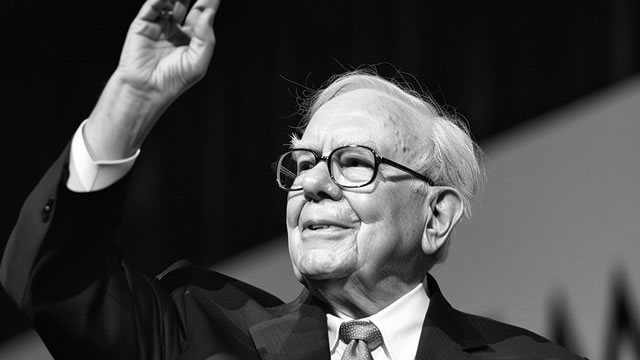

Berkshire Hathaway Inc. (BRK-B)

Industry: Insurance - Diversified

Sector: Financial Services

Website: https://www.berkshirehathaway.com

About Berkshire Hathaway Inc.

Berkshire Hathaway Inc., through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide. The company provides property, casualty, life, accident, and health insurance and reinsurance; and operates railroad systems in North America. It also generates, transmits, stores, and distributes electricity from natural gas, coal, wind, solar, hydroelectric, nuclear, and geothermal sources; operates natural gas distribution and storage facilities, interstate pipelines, liquefied natural gas facilities, and compressor and meter stations; and holds interest in coal mining assets. In addition, the company manufactures boxed chocolates and other confectionery products; specialty chemicals, metal cutting tools, and components for aerospace and power generation applications; flooring products; insulation, roofing, and engineered products; building and engineered components; paints and coatings; and bricks and masonry products, as well as offers manufactured and site-built home construction, and related lending and financial services. Further, it provides recreational vehicles, apparel and footwear products, jewelry, and custom picture framing products, as well as alkaline batteries; castings, forgings, fasteners/fastener systems, aerostructures, and precision components; and cobalt, nickel, and titanium alloys. Additionally, the company distributes televisions and information; franchises and services quick service restaurants; distributes electronic components; and offers logistics services, grocery and foodservice distribution services, and professional aviation training and shared aircraft ownership programs. It also retails automobiles; furniture, bedding, and accessories; household appliances, electronics, and computers; jewelry, watches, crystal, china, stemware, flatware, gifts, and collectibles; kitchenware; and motorcycle clothing and equipment. The company was incorporated in 1998 and is headquartered in Omaha, Nebraska.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 364.48B | 302.09B | 354.64B | 286.26B | 327.22B | 247.84B | 242.14B | 223.60B | 210.82B | 194.67B | 182.15B | 162.46B | 143.69B | 136.19B | 112.49B | 107.79B | 118.25B | 98.54B | 81.66B | 74.38B | 63.86B | 42.35B | 37.50B | 33.87B | 24.03B | 13.83B | 10.74B | 10.80B | 3.71B | 3.85B | 2.62B | 3.03B | 2.43B | 1.58B | 2.48B | 2.46B |

| Cost of Revenue | 241.29B | 124.32B | 161.23B | 175.79B | 149.04B | 197.12B | 197.66B | 169.15B | 163.39B | 160.20B | 147.03B | 136.66B | 75.22B | 75.22B | 61.39B | 63.94B | 57.17B | 50.61B | 0.00 | 0.00 | 25.74B | 12.08B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 123.20B | 177.77B | 193.41B | 110.47B | 178.18B | 50.71B | 44.48B | 54.46B | 47.43B | 34.48B | 35.12B | 25.81B | 68.47B | 60.96B | 51.11B | 43.84B | 61.07B | 47.93B | 81.66B | 74.38B | 38.12B | 30.28B | 37.50B | 33.87B | 24.03B | 13.83B | 10.74B | 10.80B | 3.71B | 3.85B | 2.62B | 3.03B | 2.43B | 1.58B | 2.48B | 2.46B |

| Gross Profit Ratio | 33.80% | 58.85% | 54.54% | 38.59% | 54.45% | 20.46% | 18.37% | 24.35% | 22.50% | 17.71% | 19.28% | 15.88% | 47.65% | 44.76% | 45.43% | 40.68% | 51.65% | 48.64% | 100.00% | 100.00% | 59.70% | 71.48% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.04B | 5.55B | 4.20B | 3.52B | 4.00B | 4.06B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 8.05B | 7.10B | 5.93B | 0.00 | 4.99B | 0.00 | 0.00 | 0.00 | 1.70B | 1.16B | 1.06B | 21.00M | 20.40M | 0.00 | 0.00 | 0.00 | 0.00 | 1.45B | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 22.61B | 19.51B | 18.84B | 19.81B | 19.32B | 18.24B | 18.18B | 18.22B | 15.31B | 13.72B | 11.92B | 10.50B | 8.67B | 7.70B | 8.12B | 0.00 | 0.00 | 5.93B | 5.33B | 0.00 | 4.23B | 3.31B | 3.00B | 0.00 | 0.00 | 0.00 | 920.80M | 861.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 28.64B | 25.06B | 23.04B | 23.33B | 23.33B | 22.30B | 18.18B | 18.22B | 15.31B | 13.72B | 11.92B | 10.50B | 8.67B | 7.70B | 8.12B | 8.05B | 7.10B | 5.93B | 5.33B | 4.99B | 4.23B | 3.31B | 3.00B | 1.70B | 1.16B | 1.06B | 941.80M | 882.30M | 775.90M | 1.68B | 1.20B | 531.30M | 1.45B | 541.10M | 0.00 | 0.00 |

| Other Expenses | 0.00 | 239.71B | 219.91B | 207.23B | 201.20B | 199.08B | 200.12B | 171.72B | 160.57B | 152.85B | 141.44B | 129.72B | 119.70B | 109.43B | 92.82B | 92.16B | 90.99B | 75.83B | 63.54B | 58.46B | 47.61B | 32.61B | 33.03B | 26.58B | 20.41B | 8.46B | 6.97B | 6.21B | 135.00M | 122.60M | 130.90M | 165.60M | 227.80M | 169.40M | -2.04B | -2.07B |

| Operating Expenses | 118.72B | 264.77B | 242.95B | 230.56B | 224.53B | 221.38B | 218.30B | 189.94B | 175.88B | 166.57B | 153.35B | 140.23B | 128.37B | 117.13B | 100.94B | 100.21B | 98.08B | 81.76B | 68.87B | 63.45B | 51.84B | 35.92B | 36.03B | 28.28B | 21.58B | 9.52B | 7.91B | 7.09B | 910.90M | 1.80B | 1.33B | 696.90M | 1.68B | 710.50M | -2.04B | -2.07B |

| Cost & Expenses | 241.29B | 264.77B | 242.95B | 230.56B | 224.53B | 221.38B | 218.30B | 189.94B | 175.88B | 166.57B | 153.35B | 140.23B | 128.37B | 117.13B | 100.94B | 100.21B | 98.08B | 81.76B | 68.87B | 63.45B | 51.84B | 35.92B | 36.03B | 28.28B | 21.58B | 9.52B | 7.91B | 7.09B | 910.90M | 1.80B | 1.33B | 696.90M | 1.68B | 710.50M | -2.04B | -2.07B |

| Interest Income | 15.56B | 10.26B | 7.47B | 8.09B | 9.24B | 7.68B | 6.58B | 6.18B | 6.75B | 6.46B | 6.41B | 6.11B | 6.41B | 6.90B | 7.13B | 6.76B | 6.70B | 5.99B | 5.04B | 4.02B | 4.19B | 4.56B | 2.77B | 2.69B | 2.31B | 1.05B | 1.04B | 874.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 5.00B | 4.35B | 4.17B | 4.08B | 3.96B | 3.85B | 5.39B | 3.50B | 3.52B | 3.25B | 2.80B | 2.74B | 2.66B | 2.56B | 1.99B | 1.96B | 1.91B | 1.72B | 723.00M | 721.00M | 472.00M | 725.00M | 209.00M | 144.00M | 134.00M | 109.00M | 111.90M | 99.70M | 59.30M | 60.10M | 80.70M | 124.50M | 121.80M | 112.70M | 0.00 | 0.00 |

| Depreciation & Amortization | 12.49B | 10.90B | 10.72B | 10.60B | 10.06B | 9.78B | 9.19B | 8.90B | 7.78B | 7.37B | 6.51B | 5.15B | 4.68B | 4.28B | 3.13B | 2.81B | 2.41B | 2.07B | 982.00M | 911.00M | 520.00M | 811.00M | 1.08B | 997.00M | 688.00M | 265.00M | 227.30M | 151.60M | 75.70M | 62.50M | 50.20M | 41.10M | 37.20M | 56.70M | -4.07B | -4.13B |

| EBITDA | 137.66B | -15.25B | 126.58B | 80.39B | 115.64B | 20.18B | 34.40B | 46.07B | 45.96B | 38.30B | 37.56B | 31.13B | 23.47B | 26.58B | 16.67B | 12.35B | 24.48B | 20.57B | 14.50B | 12.57B | 2.13B | 1.96B | 0.00 | 6.49B | 3.23B | 4.66B | 3.17B | 3.96B | 1.13B | 122.60M | 130.90M | 165.60M | 159.00M | 169.40M | 447.50M | 399.30M |

| EBITDA Ratio | 37.77% | -5.32% | -20.22% | -35.98% | -20.53% | 6.99% | 15.70% | 20.44% | 21.78% | 19.74% | 20.72% | 18.24% | 15.43% | 18.66% | 14.86% | 10.90% | 20.40% | 20.61% | 17.62% | 16.82% | 20.28% | 18.78% | 7.20% | 19.15% | 13.45% | 33.70% | 29.23% | 36.46% | 30.44% | 20.17% | 47.33% | 23.47% | 30.53% | 42.75% | 18.02% | 16.20% |

| Operating Income | 123.20B | 37.32B | 111.69B | 55.69B | 102.70B | 26.46B | 23.84B | 33.67B | 34.95B | 28.11B | 28.80B | 22.24B | 15.31B | 19.05B | 11.55B | 7.57B | 20.16B | 16.78B | 12.79B | 10.94B | 12.02B | 6.44B | 1.47B | 5.59B | 2.45B | 4.31B | 2.83B | 3.71B | 2.80B | 2.05B | 1.29B | 2.33B | 747.50M | 869.60M | 4.52B | 4.53B |

| Operating Income Ratio | 33.80% | 12.35% | 31.49% | 19.46% | 31.38% | 10.67% | 9.84% | 15.06% | 16.58% | 14.44% | 15.81% | 13.69% | 10.66% | 13.99% | 10.27% | 7.03% | 17.05% | 17.03% | 15.66% | 14.70% | 18.82% | 15.19% | 3.92% | 16.49% | 10.20% | 31.19% | 26.33% | 34.32% | 75.47% | 53.27% | 49.10% | 76.99% | 30.79% | 55.03% | 181.98% | 183.80% |

| Total Other Income/Expenses | -3.03B | -30.50B | 78.54B | -14.10B | -2.88B | -22.46B | -1.37B | -2.63B | -3.24B | -2.82B | -2.26B | -2.11B | -5.68B | 19.05B | 0.00 | -10.60B | -2.00B | -1.04B | -1.10B | -3.06B | 0.00 | -76.00M | 1.44B | 0.00 | 0.00 | 0.00 | -600.00K | 0.00 | 1.08B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 120.17B | -30.58B | 111.69B | 55.69B | 102.70B | 4.00B | 23.84B | 33.67B | 34.95B | 28.11B | 28.80B | 22.24B | 15.31B | 19.05B | 11.55B | 7.57B | 20.16B | 16.78B | 12.79B | 10.94B | 12.02B | 6.44B | 1.47B | 5.59B | 2.45B | 4.31B | 2.83B | 3.71B | 4.77B | 4.10B | 3.81B | 4.66B | 1.87B | 2.20B | 9.04B | 9.06B |

| Income Before Tax Ratio | 32.97% | -10.12% | 31.49% | 19.46% | 31.38% | 1.61% | 9.84% | 15.06% | 16.58% | 14.44% | 15.81% | 13.69% | 10.66% | 13.99% | 10.27% | 7.03% | 17.05% | 17.03% | 15.66% | 14.70% | 18.82% | 15.19% | 3.92% | 16.49% | 10.20% | 31.19% | 26.33% | 34.32% | 128.41% | 106.55% | 145.41% | 153.99% | 77.16% | 139.16% | 363.97% | 367.60% |

| Income Tax Expense | 23.02B | -8.52B | 20.88B | 12.44B | 20.90B | -321.00M | -21.52B | 9.24B | 10.53B | 7.94B | 8.95B | 6.92B | 4.57B | 5.61B | 3.54B | 1.98B | 6.59B | 5.51B | 4.16B | 3.57B | 3.81B | 2.13B | 620.00M | 2.02B | 852.00M | 1.46B | 897.70M | 1.20B | 270.30M | 158.70M | 420.70M | 138.10M | 142.10M | 112.00M | -447.50M | -399.30M |

| Net Income | 96.22B | -22.82B | 89.94B | 42.52B | 81.42B | 4.02B | 44.94B | 24.07B | 24.08B | 19.87B | 19.48B | 14.82B | 10.25B | 12.97B | 8.06B | 4.99B | 13.21B | 11.02B | 8.53B | 7.31B | 8.15B | 4.29B | 795.00M | 3.33B | 1.56B | 2.83B | 1.90B | 2.49B | 725.20M | 494.80M | 688.10M | 407.30M | 439.90M | 394.10M | 447.50M | 399.30M |

| Net Income Ratio | 26.40% | -7.55% | 25.36% | 14.85% | 24.88% | 1.62% | 18.56% | 10.77% | 11.42% | 10.21% | 10.69% | 9.12% | 7.14% | 9.52% | 7.16% | 4.63% | 11.17% | 11.18% | 10.44% | 9.82% | 12.76% | 10.12% | 2.12% | 9.83% | 6.48% | 20.46% | 17.71% | 23.05% | 19.53% | 12.86% | 26.27% | 13.45% | 18.12% | 24.94% | 18.02% | 16.20% |

| EPS | 44.27 | -10.36 | 39.64 | 17.78 | 33.22 | 1.63 | 18.22 | 9.76 | 9.77 | 8.06 | 7.90 | 5.98 | 4.14 | 5.29 | 3.46 | 2.15 | 5.70 | 4.76 | 3.69 | 3.17 | 3.54 | 1.86 | 0.35 | 1.46 | 0.68 | 1.51 | 1.03 | 1.38 | 0.45 | 0.31 | 0.45 | 0.24 | 0.26 | 0.23 | 0.26 | 0.23 |

| EPS Diluted | 44.27 | -10.36 | 39.64 | 17.78 | 33.22 | 1.63 | 18.22 | 9.76 | 9.77 | 8.06 | 7.90 | 5.98 | 4.14 | 5.29 | 3.46 | 2.15 | 5.70 | 4.76 | 3.69 | 3.17 | 3.54 | 1.86 | 0.35 | 1.46 | 0.68 | 1.51 | 1.03 | 1.38 | 0.45 | 0.31 | 0.45 | 0.24 | 0.26 | 0.23 | 0.26 | 0.23 |

| Weighted Avg Shares Out | 2.17B | 2.20B | 2.27B | 2.39B | 2.45B | 2.47B | 2.47B | 2.47B | 2.46B | 2.47B | 2.47B | 2.48B | 2.47B | 2.45B | 2.33B | 2.32B | 2.32B | 2.31B | 2.31B | 2.31B | 2.30B | 2.30B | 2.29B | 2.28B | 2.28B | 1.88B | 1.85B | 1.81B | 1.78B | 1.77B | 1.77B | 1.72B | 1.72B | 1.72B | 1.72B | 1.72B |

| Weighted Avg Shares Out (Dil) | 2.17B | 2.20B | 2.27B | 2.39B | 2.45B | 2.47B | 2.47B | 2.47B | 2.46B | 2.47B | 2.47B | 2.48B | 2.47B | 2.45B | 2.33B | 2.32B | 2.32B | 2.31B | 2.31B | 2.31B | 2.30B | 2.30B | 2.29B | 2.28B | 2.28B | 1.88B | 1.85B | 1.81B | 1.78B | 1.77B | 1.77B | 1.72B | 1.72B | 1.72B | 1.72B | 1.72B |

2 Warren Buffett Stocks to Buy Hand Over Fist in November

Warren Buffett's AI Bets: 24.1% of Berkshire Hathaway's $287 Billion Stock Portfolio Is Invested in These 2 Artificial Intelligence Stocks

Billionaire Warren Buffett Is Hinting at a Market Correction -- but There Is a Silver Lining

Buffett Bails Out of Some Big Berkshire Stock Bets

Warren Buffett Didn't Buy Shares of His Favorite Stock For the First Time in 25 Quarters, Which Is Telling (and Worrisome) for Wall Street

Warren Buffett Just Sent a $325 Billion Warning to Stock Investors

3 Things Warren Buffett's BRK Should Do With $325 Billion in Cash

Warren Buffett Continues to Sell Apple and Bank of America, And It Could All Be Due to This One Big Risk

Is It Time to Buy Berkshire Hathaway Stock as the Company Builds Its Cash Stockpile?

Billionaire Warren Buffett Just Sold More Than 300 Million Shares of 2 Favorite Stocks and Piled Into This Ultra-Safe Asset

Source: https://incomestatements.info

Category: Stock Reports