See more : Prima Industries Limited (PRIMAIN.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Banyan Gold Corp. (BYAGF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Banyan Gold Corp., a leading company in the Gold industry within the Basic Materials sector.

- RWC, Inc. (RWCI) Income Statement Analysis – Financial Results

- Bank Norwegian Asa (BANO.OL) Income Statement Analysis – Financial Results

- Intco Medical Technology Co., Ltd. (300677.SZ) Income Statement Analysis – Financial Results

- Space Incubatrics Technologies (SPACEINCUBA.BO) Income Statement Analysis – Financial Results

- Biotage AB (publ) (BITGF) Income Statement Analysis – Financial Results

Banyan Gold Corp. (BYAGF)

About Banyan Gold Corp.

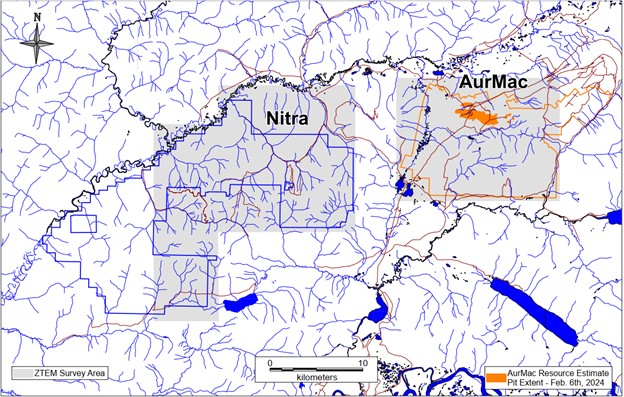

Banyan Gold Corp. engages in the exploration and development of precious metals. The company explores for gold and silver deposits. The Company's flagship asset is the AurMac Project that consists of 506 quartz mineral claims covering an area of approximately 9,230 hectares located in the Mayo Mining District, Yukon Territory. Banyan Gold Corp. was incorporated in 2010 and is headquartered in Whitehorse, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 135.70K | 91.48K | 27.28K | 12.41K | 14.51K | 19.45K | 11.33K | 2.41K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -135.70K | -91.48K | -27.28K | -12.41K | -14.51K | -19.45K | -11.33K | -2.41K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.11M | 2.55M | 1.76M | 841.13K | 414.39K | 616.70K | 720.85K | 395.38K | 225.86K | 285.12K | 219.61 | 0.00 | 81.91K |

| Selling & Marketing | 711.80K | 0.00 | 0.00 | 0.00 | 88.39 | 97.94 | 71.79 | 22.81 | 25.23 | 9.81 | 242.92K | 0.00 | -15.27K |

| SG&A | 2.82M | 2.55M | 1.76M | 841.13K | 414.39K | 616.70K | 720.85K | 395.38K | 225.86K | 285.12K | 243.14K | 80.29K | 66.65K |

| Other Expenses | 0.00 | 207.28K | 60.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 2.82M | 2.55M | 1.76M | 841.13K | 414.39K | 616.70K | 720.85K | 490.83K | 225.86K | 285.12K | 243.14K | 80.29K | 81.91K |

| Cost & Expenses | 2.82M | 2.55M | 1.76M | 841.13K | 414.39K | 616.70K | 720.85K | 490.83K | 225.86K | 285.12K | 243.14K | 80.29K | 81.91K |

| Interest Income | 465.17K | 110.43K | 22.08K | 7.92K | 579.00 | 1.95K | 2.74K | 0.00 | 70.00 | 1.16K | 2.91K | 2.49K | 1.90K |

| Interest Expense | 2.61K | 1.91K | 2.11K | 2.22K | 815.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 135.70K | 91.48K | 27.28K | 12.41K | 14.51K | 19.45K | 11.33K | 2.41K | 1.42K | 273.30 | 219.61 | 0.00 | 0.00 |

| EBITDA | -2.69M | -2.41M | -1.71M | -816.24K | -390.26K | -581.31K | -690.81K | -381.64K | -215.03K | -285.12K | -243.14K | -80.29K | -81.91K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -2.82M | -2.55M | -1.76M | -841.13K | -505.27K | -854.03K | -720.85K | -490.83K | -225.86K | -285.12K | -243.14K | -80.29K | -81.91K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 1.10M | 272.65K | 60.20K | -4.57K | 81.84K | 223.33K | 299.79K | -95.45K | 70.00 | 1.16K | 2.91K | 2.49K | 1.90K |

| Income Before Tax | -1.72M | -2.23M | -1.68M | -833.21K | -322.94K | -377.43K | -421.06K | -490.83K | -225.79K | -283.96K | -240.23K | -77.80K | -80.01K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 2.09M | -777.28K | 1.24M | 1.03M | -90.88K | -237.33K | -299.79K | 95.45K | 0.00 | -273.29 | -219.61 | 0.00 | 80.01K |

| Net Income | 367.91K | -1.46M | -2.92M | -1.86M | -322.94K | -377.43K | -421.06K | -490.83K | -225.79K | -283.96K | -240.23K | -77.80K | -80.01K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | 0.00 | -0.01 | -0.02 | -0.01 | 0.00 | 0.00 | -0.01 | -0.02 | -0.01 | -0.02 | -0.02 | -0.02 | -0.03 |

| EPS Diluted | 0.00 | -0.01 | -0.02 | -0.01 | 0.00 | 0.00 | -0.01 | -0.02 | -0.01 | -0.02 | -0.02 | -0.02 | -0.03 |

| Weighted Avg Shares Out | 278.09M | 235.54M | 176.58M | 132.74M | 94.71M | 78.41M | 58.67M | 28.97M | 19.90M | 14.48M | 10.14M | 3.33M | 2.70M |

| Weighted Avg Shares Out (Dil) | 277.92M | 235.54M | 176.58M | 132.74M | 94.71M | 78.41M | 58.67M | 28.97M | 19.90M | 14.48M | 10.14M | 3.33M | 2.70M |

Banyan Announces Grant of Incentive Stock Options

Banyan Drilling Confirms High Grade Structural Controls and Grade Continuity at Powerline, AurMac Project

Banyan Announces Commencement of ZTEM Airborne Geophysical Survey, AurMac and Nitra Projects, Yukon

Banyan Welcomes Federal Funding Announcement on Yukon Grid Connectivity and Issues Incentive Options

Banyan Metallurgy Update with 93% Recovery from Powerline, AurMac Project, Mayo, Yukon

Gold Mining Optionality Plays (September 2024)

Banyan Gold Announces Voting Results From Annual General and Special Meeting of Shareholders

Banyan Intersects 0.72 g/t gold over 197.0 metres from Surface, Powerline Deposit, AurMac Property, Yukon, Canada

Banyan Strengthens Board of Directors With Appointment of Hayley Halsall-Whitney and Appointment of Marc Blythe As Chair

Banyan Gold Corp. to Present at the Battery & Precious Metals Virtual Investor Conference July 23rd

Source: https://incomestatements.info

Category: Stock Reports