See more : Yamashin-Filter Corp. (YMFCF) Income Statement Analysis – Financial Results

Complete financial analysis of Central Securities Corp. (CET) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Central Securities Corp., a leading company in the Asset Management industry within the Financial Services sector.

- Edify Acquisition Corp. (EAC) Income Statement Analysis – Financial Results

- Rockhopper Exploration plc (RCKHF) Income Statement Analysis – Financial Results

- AGS Transact Technologies Limited (AGSTRA.NS) Income Statement Analysis – Financial Results

- MilDef Group AB (publ) (MILDEF.ST) Income Statement Analysis – Financial Results

- Zulu-Tek Inc (ZULU) Income Statement Analysis – Financial Results

Central Securities Corp. (CET)

About Central Securities Corp.

Central Securities Corp. is a publicly owned investment manager. The firm invests in the public equity markets of the United States. It also invests on bonds, convertible bonds, preferred stocks, convertible preferred stocks, warrants, options real estate, or short-term obligations of governments, banks and corporations. Central Securities Corp. was founded on October 1, 1929 and is based in New York, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 230.44M | -152.65M | 360.31M | 79.89M | 256.96M | -28.49M | 174.85M | 118.04M | -12.61M | 34.50M | 147.86M | 17.45M | 3.05M | 109.47M | 10.26M | 12.05M | 11.64M | 10.41M | 8.67M | 4.85M | 4.05M | 4.85M | 5.84M | 7.85M | 6.77M | 7.00M | 6.14M | 6.03M |

| Cost of Revenue | 4.80M | 4.63M | 5.57M | 4.69M | 4.57M | 4.44M | 4.25M | 4.14M | 3.16M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 225.64M | -157.28M | 354.74M | 75.21M | 252.40M | -32.92M | 170.59M | 113.90M | -15.77M | 34.50M | 147.86M | 17.45M | 3.05M | 109.47M | 10.26M | 12.05M | 11.64M | 10.41M | 8.67M | 4.85M | 4.05M | 4.85M | 5.84M | 7.85M | 6.77M | 7.00M | 6.14M | 6.03M |

| Gross Profit Ratio | 97.92% | 103.03% | 98.45% | 94.13% | 98.22% | 115.58% | 97.57% | 96.49% | 125.09% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | -2.16 | 3.40 | 1.50 | 5.92 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.63M | 5.82M | 6.53M | 5.98M | 5.77M | 5.61M | 5.49M | 5.25M | 4.27M | 4.22M | 4.55M | 4.34M | 3.63M | 3.50M | 3.51M | 3.44M | 3.57M | 2.93M | 2.77M | 2.52M | 2.09M | 2.06M | 2.22M | 2.23M | 2.06M | 2.06M | 2.00M | 1.60M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.63M | 5.82M | 6.53M | 5.98M | 5.77M | 5.61M | 5.49M | 5.25M | 4.27M | 4.22M | 4.55M | 4.34M | 3.63M | 3.50M | 3.51M | 3.44M | 3.57M | 2.93M | 2.77M | 2.52M | 2.09M | 2.06M | 2.22M | 2.23M | 2.06M | 2.06M | 2.00M | 1.60M |

| Other Expenses | 223.81M | 201.47K | 203.13K | 202.75K | 182.21K | 182.93K | 147.27K | 155.99K | 159.52K | 156.20K | 144.17K | 163.03K | 655.22K | 667.07K | 370.00K | 360.00K | 260.00K | 210.00K | 210.00K | 260.00K | 230.00K | 210.00K | 280.00K | 210.00K | 190.00K | 160.00K | 180.00K | 180.00K |

| Operating Expenses | 230.44M | 6.02M | 6.73M | 6.18M | 5.95M | 5.79M | 5.64M | 5.40M | 4.43M | 4.38M | 4.69M | 4.51M | 4.29M | 4.17M | 3.88M | 3.80M | 3.83M | 3.14M | 2.98M | 2.78M | 2.32M | 2.27M | 2.50M | 2.44M | 2.25M | 2.22M | 2.18M | 1.78M |

| Cost & Expenses | 230.44M | 6.02M | 6.73M | 6.18M | 5.95M | 5.79M | 5.64M | 5.40M | 4.43M | 4.38M | 4.69M | 4.51M | 4.29M | 4.17M | 3.88M | 3.80M | 3.83M | 3.14M | 2.98M | 2.78M | 2.32M | 2.27M | 2.50M | 2.44M | 2.25M | 2.22M | 2.18M | 1.78M |

| Interest Income | 3.86M | 905.87K | 5.60K | 199.06K | 829.96K | 785.44K | 419.77K | 119.26K | 19.58K | 14.11K | 10.79K | 0.00 | 0.00 | 4.45K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.66M | 43.58M | 42.12M | 36.47M | 31.67M | 25.10M | 24.76M | 22.87M | 13.66M | 65.92M | 43.21M | 22.91M | 30.13M | 18.15M |

| Depreciation & Amortization | 218.28K | 180.68K | 394.20K | 7.32K | 3.73K | 4.40K | 6.31K | 8.90K | 10.66K | 29.34K | 47.67K | 46.69K | 46.52K | 47.51K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K | 92.52M | 159.41M | -139.65M | -31.06M | 100.83M | 178.95M | 73.81M | 119.30M | 89.01M |

| EBITDA | 223.85M | -158.66M | 353.97M | 73.72M | 251.02M | -34.27M | 169.21M | 112.64M | -17.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 124.31M | -209.88M | 54.65M | 129.85M | 99.79M | 94.60M | 161.15M | -137.06M | -27.72M | 106.23M | 183.47M | 78.59M | 123.27M | 93.26M |

| EBITDA Ratio | 97.14% | 103.94% | 98.13% | 92.28% | 97.69% | 120.32% | 96.78% | 95.43% | 135.09% | 87.40% | 96.86% | 74.43% | -39.28% | 96.24% | 1,211.60% | -1,379.92% | 831.53% | 1,247.36% | 1,150.98% | 1,950.52% | 3,979.01% | -2,825.98% | -474.66% | 1,353.25% | 2,710.04% | 1,122.71% | 2,007.65% | 1,546.60% |

| Operating Income | 223.64M | -158.67M | 353.58M | 73.72M | 251.01M | -34.28M | 169.21M | 112.64M | -17.04M | 30.13M | 143.17M | 12.94M | -1.24M | 105.31M | 6.38M | 8.25M | 7.82M | 7.27M | 5.68M | 2.08M | 1.74M | 2.59M | 3.34M | 5.40M | 4.52M | 4.78M | 3.97M | 4.25M |

| Operating Income Ratio | 97.05% | 103.95% | 98.13% | 92.27% | 97.68% | 120.34% | 96.77% | 95.42% | 135.17% | 87.32% | 96.83% | 74.16% | -40.80% | 96.19% | 62.18% | 68.46% | 67.18% | 69.84% | 65.51% | 42.89% | 42.96% | 53.40% | 57.19% | 68.79% | 66.77% | 68.29% | 64.66% | 70.48% |

| Total Other Income/Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 110.17M | -218.21M | 46.75M | 86.01M | 62.34M | 67.42M | 134.65M | -162.52M | -44.72M | 34.91M | 135.74M | 50.90M | 89.17M | 70.86M |

| Income Before Tax | 223.64M | -158.67M | 353.58M | 73.72M | 251.01M | -34.28M | 169.21M | 112.64M | -17.04M | 30.13M | 143.17M | 12.94M | -1.24M | 105.31M | 116.55M | -209.96M | 54.57M | 93.28M | 68.02M | 69.50M | 136.39M | -159.93M | -41.38M | 40.31M | 140.26M | 55.68M | 93.14M | 75.11M |

| Income Before Tax Ratio | 97.05% | 103.95% | 98.13% | 92.27% | 97.68% | 120.34% | 96.77% | 95.42% | 135.17% | 87.32% | 96.83% | 74.16% | -40.80% | 96.19% | 1,135.96% | -1,742.41% | 468.81% | 896.06% | 784.54% | 1,432.99% | 3,367.65% | -3,297.53% | -708.56% | 513.50% | 2,071.79% | 795.43% | 1,516.94% | 1,245.61% |

| Income Tax Expense | 0.00 | 2.00 | 7.00 | 2.00 | 4.00 | 1.00 | 1.00 | 3.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 117.83M | -174.63M | 88.87M | 122.48M | 94.01M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 223.64M | -158.67M | 353.58M | 73.72M | 251.01M | -34.28M | 169.21M | 112.64M | -17.04M | 30.13M | 143.17M | 12.94M | -1.24M | 105.31M | 116.55M | -209.96M | 54.57M | 93.28M | 68.02M | 69.50M | 136.39M | -159.93M | -41.38M | 40.31M | 140.26M | 55.68M | 93.14M | 75.11M |

| Net Income Ratio | 97.05% | 103.95% | 98.13% | 92.27% | 97.68% | 120.34% | 96.77% | 95.42% | 135.17% | 87.32% | 96.83% | 74.16% | -40.80% | 96.19% | 1,135.96% | -1,742.41% | 468.81% | 896.06% | 784.54% | 1,432.99% | 3,367.65% | -3,297.53% | -708.56% | 513.50% | 2,071.79% | 795.43% | 1,516.94% | 1,245.61% |

| EPS | 7.88 | -5.81 | 13.47 | 2.81 | 9.70 | -1.37 | 6.80 | 4.60 | -0.69 | 1.15 | 5.95 | 0.51 | -0.05 | 4.62 | 5.16 | -9.40 | 2.55 | 4.48 | 3.28 | 3.47 | 6.93 | -8.27 | -2.19 | 2.23 | 8.32 | 3.74 | 6.56 | 5.20 |

| EPS Diluted | 7.88 | -5.81 | 12.97 | 2.81 | 9.70 | -1.37 | 6.80 | 4.60 | -0.69 | 1.15 | 5.95 | 0.51 | -0.05 | 4.62 | 5.16 | -9.40 | 2.55 | 4.48 | 3.28 | 3.47 | 6.93 | -8.27 | -2.19 | 2.23 | 8.32 | 3.74 | 6.56 | 5.20 |

| Weighted Avg Shares Out | 28.39M | 27.31M | 26.25M | 26.24M | 25.89M | 25.02M | 24.88M | 24.49M | 24.70M | 26.20M | 24.06M | 25.37M | 23.01M | 22.78M | 22.59M | 22.33M | 21.39M | 20.82M | 20.76M | 20.02M | 19.69M | 19.34M | 18.91M | 18.10M | 16.85M | 14.87M | 14.19M | 14.44M |

| Weighted Avg Shares Out (Dil) | 28.39M | 27.31M | 27.27M | 26.24M | 25.89M | 25.02M | 24.88M | 24.49M | 24.70M | 26.20M | 24.06M | 25.37M | 23.01M | 22.78M | 22.59M | 22.33M | 21.39M | 20.82M | 20.76M | 20.02M | 19.69M | 19.34M | 18.91M | 18.10M | 16.85M | 14.87M | 14.19M | 14.44M |

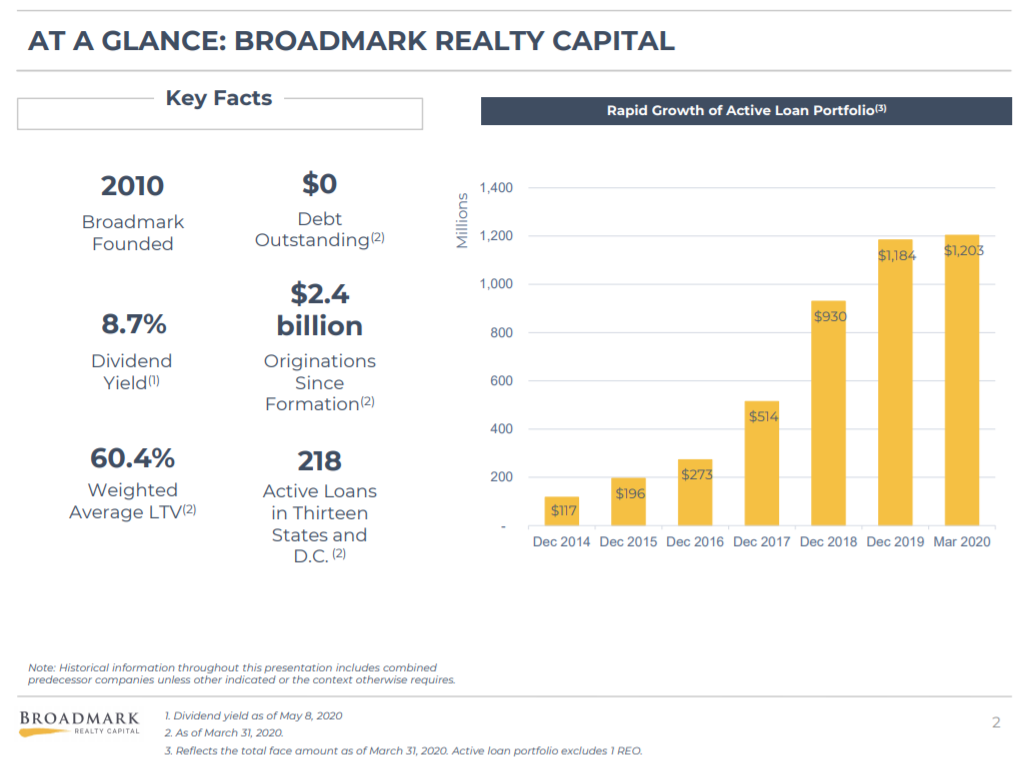

Monthly Dividend Stock In Focus: Broadmark Realty Capital - Sure Dividend

Sebi extends compliance deadline for REITs, InvITs

How Will Low Interest Rates Impact the Stock Market? | The Motley Fool

Sebi relaxes compliance deadline for REITs, InvITs in wake of COVID-19

Les dix convictions d'investissement pour le second semestre 2020

Income Lab Ideas: Dividend Changes Review And Discussion Through The Pandemic

The Reopening Killed The V-Shaped Recovery

A-Z of investing in Federal Govt of Nigeria’s Savings Bonds

Nigerian Treasury Bills: Here’s what you need to know investing in TBills

Source: https://incomestatements.info

Category: Stock Reports