See more : Pure Storage, Inc. (0KSA.L) Income Statement Analysis – Financial Results

Complete financial analysis of C&F Financial Corporation (CFFI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of C&F Financial Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Tokyo Rope Mfg. Co., Ltd. (5981.T) Income Statement Analysis – Financial Results

- Sentry Technology Corp. (SKVY) Income Statement Analysis – Financial Results

- Bebop Channel Corp (BBOP) Income Statement Analysis – Financial Results

- FireFly Metals Ltd (FFM.AX) Income Statement Analysis – Financial Results

- Yelp Inc. (YELP) Income Statement Analysis – Financial Results

C&F Financial Corporation (CFFI)

About C&F Financial Corporation

C&F Financial Corporation operates as a bank holding company for Citizens and Farmers Bank that provides banking services to individuals and businesses. The company's Retail Banking offers various banking services, including checking and savings deposit accounts, as well as business, real estate, development, mortgage, home equity, and installment loans. It also provides ATMs, Internet and mobile banking, and debit and credit cards, as well as safe deposit box rentals, notary public, electronic transfer, and other customary bank services. This segment offers its services through its main office in West Point, Virginia, as well as through 30 Virginia branches located 1 each in Albermarle, Goochland, Hanover, Middlesex, Powhatan, Stafford, York, Charlottesville, Hampton, Montross, Newport News, Richmond, Warsaw, and Williamsburg; 2 each in the counties of Cumberland, James City, King George, and New Kent; and four each in the counties of Chesterfield and Henrico. The company's Mortgage Banking segment provides various residential mortgage loans; originates conventional mortgage loans, mortgage loans insured by the Federal Housing Administration, and mortgage loans guaranteed by the United States Department of Agriculture and the Veterans Administration; and ancillary mortgage loan origination services for residential appraisals, as well as various mortgage origination functions to third parties. It provides mortgage loan origination services through 11 offices in Virginia, 1 office in Maryland, and 2 offices in North Carolina, as well as through 1 each in South Carolina and West Virginia. The company's Consumer Finance segment provides automobile loans through its offices in Richmond and Hampton, Virginia. It also offers brokerage and wealth management services; and insurance products. In addition, the company provides title and settlement agency, and insurance services. C&F Financial Corporation was founded in 1927 and is headquartered in West Point, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 119.05M | 1.68M | 134.53M | 138.95M | 112.47M | 107.28M | 106.73M | 106.10M | 99.07M | 97.31M | 93.81M | 100.36M | 88.96M | 86.31M | 86.20M | 67.88M | 67.33M | 67.51M | 64.36M | 57.98M | 59.16M | 42.89M | 33.67M | 24.06M | 25.90M | 24.10M | 18.50M | 4.71M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 47.20M | 42.00M | 43.10M | 41.93M | 38.93M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.79M | 28.00B | 21.41B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 119.05M | 1.68M | 134.53M | 138.95M | 65.27M | 65.28M | 63.63M | 64.17M | 60.14M | 97.31M | 93.81M | 100.36M | 88.96M | 86.31M | 86.20M | 67.88M | 67.33M | 67.51M | 64.36M | 29.19M | -27.95B | -21.36B | 33.67M | 24.06M | 25.90M | 24.10M | 18.50M | 4.71M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 58.03% | 60.85% | 59.61% | 60.48% | 60.71% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 50.35% | -47,236.70% | -49,811.01% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 56.54M | 47.87M | 58.58M | 57.67M | 47.20M | 42.00M | 43.10M | 41.93M | 38.93M | 36.07M | 31.17M | 40.69M | 34.32M | 34.89M | 35.12M | 27.72M | 30.79M | 29.01M | 28.28M | 25.23M | 24.41M | 18.04M | 13.44M | 9.60M | 9.40M | 8.30M | 6.30M | 5.97M |

| Selling & Marketing | 1.55M | 1.81M | 1.52M | 1.66M | 1.78M | 1.60M | 1.52M | 1.63M | 1.41M | 1.33M | 964.00K | 813.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 79.70M | 47.87M | 58.58M | 57.67M | 47.20M | 42.00M | 43.10M | 41.93M | 38.93M | 36.07M | 31.17M | 40.69M | 34.32M | 34.89M | 35.12M | 27.72M | 30.79M | 29.01M | 28.28M | 25.23M | 24.41M | 18.04M | 13.44M | 9.60M | 9.40M | 8.30M | 6.30M | 5.97M |

| Other Expenses | 0.00 | -4.91M | -155.03M | -167.40M | -135.74M | -127.33M | 98.37M | 97.15M | 90.38M | -108.01M | -95.24M | -106.91M | -92.68M | -96.91M | -98.39M | -69.42M | -62.91M | -60.50M | -63.67M | 0.00 | 0.00 | 0.00 | -23.82M | -14.69M | -17.00M | -14.30M | -10.30M | 2.01M |

| Operating Expenses | 79.70M | 42.96M | -96.45M | -109.73M | -88.53M | -73.71M | 98.37M | 97.15M | 90.38M | -71.94M | -64.07M | -66.22M | -58.36M | -62.02M | -63.27M | -41.69M | -32.12M | -31.50M | -35.39M | -12.64M | -18.65B | -12.24B | -10.38M | -5.09M | -7.60M | -6.00M | -4.00M | 7.98M |

| Cost & Expenses | 79.70M | 42.96M | -96.45M | -109.73M | -88.53M | -73.71M | 141.47M | 139.07M | 129.31M | -236.00K | -64.07M | -66.22M | -58.36M | -62.02M | -63.27M | -41.69M | -32.12M | -31.50M | -35.39M | 16.15M | 9.35B | 9.17B | -10.38M | -5.09M | -7.60M | -6.00M | -4.00M | 7.98M |

| Interest Income | 124.14M | 101.35M | 93.73M | 96.91M | 95.01M | 92.55M | 89.59M | 89.44M | 87.05M | 86.50M | 80.21M | 76.96M | 73.79M | 69.85M | 64.97M | 64.13M | 64.83M | 58.58M | 48.77M | 40.84M | 38.67M | 30.62M | 28.23M | 26.42M | 23.70M | 22.70M | 19.80M | 18.33M |

| Interest Expense | 26.43M | 7.89M | 8.36M | 13.38M | 14.56M | 11.03M | 9.60M | 8.97M | 8.69M | 8.53M | 8.62M | 10.11M | 11.88M | 13.24M | 15.46M | 21.40M | 23.38M | 18.46M | 12.00M | 7.55M | 8.83M | 9.18M | 11.98M | 11.31M | 9.10M | 9.60M | 8.00M | 7.67M |

| Depreciation & Amortization | 3.88M | 4.36M | 4.74M | 4.19M | 3.87M | 3.67M | 3.45M | 3.31M | 2.51M | 2.74M | 2.35M | 2.27M | 2.12M | 1.89M | 2.07M | 2.44M | 2.56M | 2.01M | 1.55M | 1.45M | 1.69M | 1.74M | 1.60M | 1.29M | 1.20M | 1.20M | 1.20M | 1.14M |

| EBITDA | 0.00 | 41.32M | 42.82M | 33.41M | 27.80M | 118.31M | 0.00 | 0.00 | 0.00 | 0.00 | 23.46M | 26.30M | 20.83M | 12.95M | 14.68M | 0.00 | 14.39M | 19.57M | 18.52M | 24.69M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 2,913.20% | 31.83% | 24.04% | 24.72% | 34.71% | 28.49% | 27.77% | 28.86% | 29.12% | 34.20% | 36.28% | 36.77% | 30.33% | 29.00% | 42.17% | 56.09% | 56.32% | 47.42% | 43.46% | 50.31% | 57.88% | 73.94% | 84.22% | 75.29% | 80.08% | 84.86% | 293.70% |

| Operating Income | 39.35M | 44.64M | 38.08M | 29.22M | 23.93M | 33.57M | 116.33M | 115.07M | 107.76M | 25.60M | 29.74M | 34.14M | 30.59M | 24.29M | 22.93M | 26.19M | 35.20M | 36.02M | 28.97M | 24.69M | 29.32B | 21.45B | 23.29M | 18.97M | 18.30M | 18.10M | 14.50M | 12.69M |

| Operating Income Ratio | 33.05% | 2,654.22% | 28.31% | 21.03% | 21.28% | 31.29% | 109.00% | 108.45% | 108.78% | 26.31% | 31.70% | 34.02% | 34.39% | 28.15% | 26.60% | 38.58% | 52.29% | 53.35% | 45.01% | 42.58% | 49,556.38% | 50,020.00% | 69.17% | 78.85% | 70.66% | 75.10% | 78.38% | 269.44% |

| Total Other Income/Expenses | -10.18M | 0.00 | -281.00K | -2.20M | -22.56M | -23.02M | -98.37M | -97.15M | -90.38M | -315.00K | -2.35M | -2.27M | -2.12M | -1.89M | 0.00 | -1.58M | 0.00 | -2.01M | -1.55M | -8.49M | -10.07B | -7.55B | -11.98M | -11.31M | -9.10M | -9.60M | -8.00M | -7.67M |

| Income Before Tax | 29.16M | 36.96M | 38.08M | 29.22M | 23.93M | 22.54M | 17.97M | 17.92M | 17.38M | 17.08M | 21.11M | 24.03M | 18.71M | 11.06M | 7.47M | 4.80M | 11.82M | 17.56M | 16.97M | 16.20M | 19.25M | 13.90M | 11.31M | 7.66M | 9.20M | 8.50M | 6.50M | 5.02M |

| Income Before Tax Ratio | 24.50% | 2,197.62% | 28.31% | 21.03% | 21.28% | 21.01% | 16.83% | 16.89% | 17.55% | 17.55% | 22.51% | 23.94% | 21.03% | 12.81% | 8.67% | 7.07% | 17.56% | 26.01% | 26.37% | 27.95% | 32.53% | 32.41% | 33.58% | 31.84% | 35.52% | 35.27% | 35.14% | 106.61% |

| Income Tax Expense | 5.42M | 7.60M | 8.96M | 6.80M | 5.08M | 4.52M | 11.39M | 4.46M | 4.85M | 4.73M | 6.71M | 7.65M | 5.74M | 2.95M | 1.95M | 617.00K | 3.34M | 5.43M | 5.18M | 5.01M | 6.33M | 4.14M | 3.32M | 1.82M | 2.40M | 2.40M | 1.60M | 958.90K |

| Net Income | 23.60M | 29.16M | 28.67M | 22.12M | 18.85M | 18.02M | 6.57M | 13.46M | 12.53M | 12.35M | 14.40M | 16.38M | 12.98M | 8.11M | 5.53M | 4.18M | 8.48M | 12.13M | 11.79M | 11.20M | 12.92M | 9.76M | 7.99M | 5.84M | 6.80M | 6.10M | 4.90M | 4.06M |

| Net Income Ratio | 19.83% | 1,733.59% | 21.31% | 15.92% | 16.76% | 16.80% | 6.16% | 12.69% | 12.65% | 12.69% | 15.35% | 16.32% | 14.59% | 9.40% | 6.41% | 6.16% | 12.60% | 17.97% | 18.32% | 19.31% | 21.84% | 22.77% | 23.73% | 24.26% | 26.25% | 25.31% | 26.49% | 86.24% |

| EPS | 6.92 | 8.29 | 7.95 | 6.06 | 5.47 | 5.15 | 1.89 | 3.90 | 3.68 | 3.63 | 4.37 | 5.00 | 3.76 | 2.26 | 1.44 | 1.38 | 2.79 | 3.85 | 3.49 | 3.14 | 3.58 | 2.73 | 2.25 | 1.62 | 1.83 | 1.59 | 1.25 | 0.92 |

| EPS Diluted | 6.92 | 8.29 | 7.95 | 6.06 | 5.47 | 5.15 | 1.88 | 3.89 | 3.68 | 3.59 | 4.19 | 4.86 | 3.72 | 2.24 | 1.44 | 1.37 | 2.68 | 3.71 | 3.36 | 3.00 | 3.42 | 2.67 | 2.23 | 1.60 | 1.81 | 1.56 | 1.25 | 0.92 |

| Weighted Avg Shares Out | 3.41M | 3.52M | 3.60M | 3.65M | 3.45M | 3.50M | 3.49M | 3.45M | 3.40M | 3.40M | 3.31M | 3.22M | 3.14M | 3.09M | 3.04M | 3.03M | 3.04M | 3.15M | 3.38M | 3.57M | 3.61M | 3.58M | 3.55M | 3.60M | 3.72M | 3.84M | 3.90M | 4.41M |

| Weighted Avg Shares Out (Dil) | 3.41M | 3.52M | 3.60M | 3.65M | 3.45M | 3.50M | 3.49M | 3.46M | 3.40M | 3.44M | 3.44M | 3.31M | 3.17M | 3.10M | 3.05M | 3.06M | 3.16M | 3.27M | 3.51M | 3.73M | 3.78M | 3.66M | 3.58M | 3.65M | 3.76M | 3.91M | 4.41M | 4.41M |

C&F Financial Corporation Announces Record Net Income for First Quarter

C&F Financial Corporation Announces Quarterly Dividend

C&F Financial Corporation Announces Record Net Income for 2020

C&F Financial Corporation Declares Quarterly Dividend and Authorizes Share Repurchase Program

C&F Financial Corporation Announces Record Third Quarter Net Income

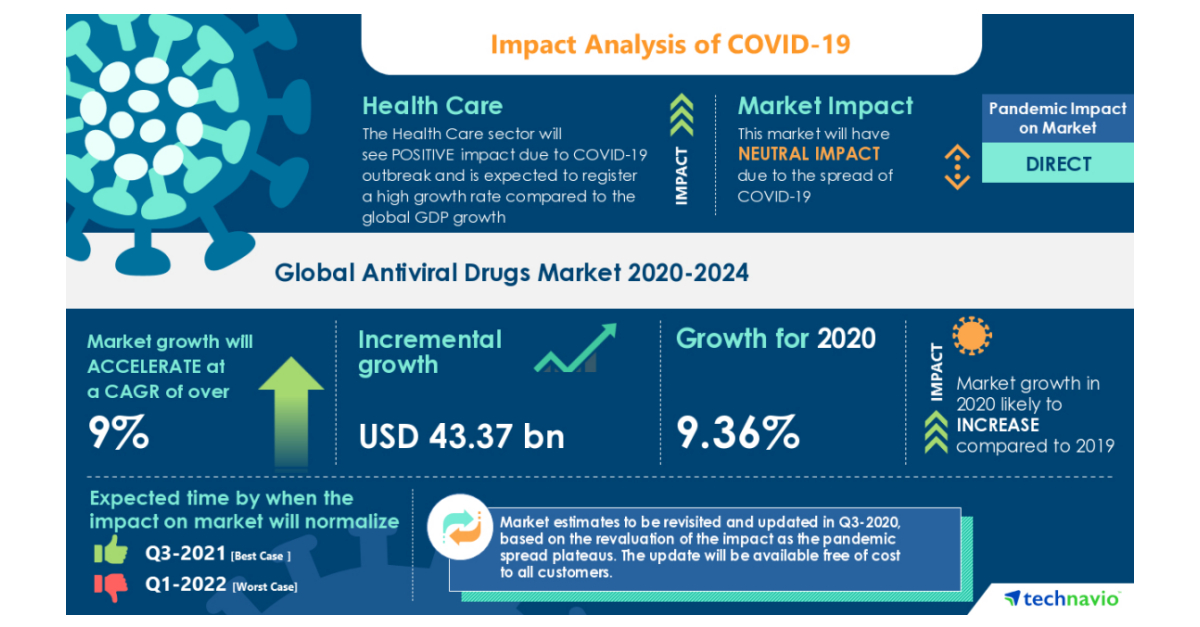

Antiviral Drugs Market will Exhibit Neutral Impact during 2020-2024 | Growing Cases of Viral Infections to Improve the Market Growth | Technavio

Source: https://incomestatements.info

Category: Stock Reports