See more : Qingdao Copton Technology Company Limited (603798.SS) Income Statement Analysis – Financial Results

Complete financial analysis of C&F Financial Corporation (CFFI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of C&F Financial Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Elmera Group ASA (ELMRA.OL) Income Statement Analysis – Financial Results

- Sahakol Equipment Public Company Limited (SQ.BK) Income Statement Analysis – Financial Results

- Metro Pacific Investments Corporation (MPCFF) Income Statement Analysis – Financial Results

- TOM Group Limited (TOCOF) Income Statement Analysis – Financial Results

- Le Tanneur & Cie Société anonyme (ALTAN.PA) Income Statement Analysis – Financial Results

C&F Financial Corporation (CFFI)

About C&F Financial Corporation

C&F Financial Corporation operates as a bank holding company for Citizens and Farmers Bank that provides banking services to individuals and businesses. The company's Retail Banking offers various banking services, including checking and savings deposit accounts, as well as business, real estate, development, mortgage, home equity, and installment loans. It also provides ATMs, Internet and mobile banking, and debit and credit cards, as well as safe deposit box rentals, notary public, electronic transfer, and other customary bank services. This segment offers its services through its main office in West Point, Virginia, as well as through 30 Virginia branches located 1 each in Albermarle, Goochland, Hanover, Middlesex, Powhatan, Stafford, York, Charlottesville, Hampton, Montross, Newport News, Richmond, Warsaw, and Williamsburg; 2 each in the counties of Cumberland, James City, King George, and New Kent; and four each in the counties of Chesterfield and Henrico. The company's Mortgage Banking segment provides various residential mortgage loans; originates conventional mortgage loans, mortgage loans insured by the Federal Housing Administration, and mortgage loans guaranteed by the United States Department of Agriculture and the Veterans Administration; and ancillary mortgage loan origination services for residential appraisals, as well as various mortgage origination functions to third parties. It provides mortgage loan origination services through 11 offices in Virginia, 1 office in Maryland, and 2 offices in North Carolina, as well as through 1 each in South Carolina and West Virginia. The company's Consumer Finance segment provides automobile loans through its offices in Richmond and Hampton, Virginia. It also offers brokerage and wealth management services; and insurance products. In addition, the company provides title and settlement agency, and insurance services. C&F Financial Corporation was founded in 1927 and is headquartered in West Point, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 119.05M | 1.68M | 134.53M | 138.95M | 112.47M | 107.28M | 106.73M | 106.10M | 99.07M | 97.31M | 93.81M | 100.36M | 88.96M | 86.31M | 86.20M | 67.88M | 67.33M | 67.51M | 64.36M | 57.98M | 59.16M | 42.89M | 33.67M | 24.06M | 25.90M | 24.10M | 18.50M | 4.71M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 47.20M | 42.00M | 43.10M | 41.93M | 38.93M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.79M | 28.00B | 21.41B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 119.05M | 1.68M | 134.53M | 138.95M | 65.27M | 65.28M | 63.63M | 64.17M | 60.14M | 97.31M | 93.81M | 100.36M | 88.96M | 86.31M | 86.20M | 67.88M | 67.33M | 67.51M | 64.36M | 29.19M | -27.95B | -21.36B | 33.67M | 24.06M | 25.90M | 24.10M | 18.50M | 4.71M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 58.03% | 60.85% | 59.61% | 60.48% | 60.71% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 50.35% | -47,236.70% | -49,811.01% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 56.54M | 47.87M | 58.58M | 57.67M | 47.20M | 42.00M | 43.10M | 41.93M | 38.93M | 36.07M | 31.17M | 40.69M | 34.32M | 34.89M | 35.12M | 27.72M | 30.79M | 29.01M | 28.28M | 25.23M | 24.41M | 18.04M | 13.44M | 9.60M | 9.40M | 8.30M | 6.30M | 5.97M |

| Selling & Marketing | 1.55M | 1.81M | 1.52M | 1.66M | 1.78M | 1.60M | 1.52M | 1.63M | 1.41M | 1.33M | 964.00K | 813.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 79.70M | 47.87M | 58.58M | 57.67M | 47.20M | 42.00M | 43.10M | 41.93M | 38.93M | 36.07M | 31.17M | 40.69M | 34.32M | 34.89M | 35.12M | 27.72M | 30.79M | 29.01M | 28.28M | 25.23M | 24.41M | 18.04M | 13.44M | 9.60M | 9.40M | 8.30M | 6.30M | 5.97M |

| Other Expenses | 0.00 | -4.91M | -155.03M | -167.40M | -135.74M | -127.33M | 98.37M | 97.15M | 90.38M | -108.01M | -95.24M | -106.91M | -92.68M | -96.91M | -98.39M | -69.42M | -62.91M | -60.50M | -63.67M | 0.00 | 0.00 | 0.00 | -23.82M | -14.69M | -17.00M | -14.30M | -10.30M | 2.01M |

| Operating Expenses | 79.70M | 42.96M | -96.45M | -109.73M | -88.53M | -73.71M | 98.37M | 97.15M | 90.38M | -71.94M | -64.07M | -66.22M | -58.36M | -62.02M | -63.27M | -41.69M | -32.12M | -31.50M | -35.39M | -12.64M | -18.65B | -12.24B | -10.38M | -5.09M | -7.60M | -6.00M | -4.00M | 7.98M |

| Cost & Expenses | 79.70M | 42.96M | -96.45M | -109.73M | -88.53M | -73.71M | 141.47M | 139.07M | 129.31M | -236.00K | -64.07M | -66.22M | -58.36M | -62.02M | -63.27M | -41.69M | -32.12M | -31.50M | -35.39M | 16.15M | 9.35B | 9.17B | -10.38M | -5.09M | -7.60M | -6.00M | -4.00M | 7.98M |

| Interest Income | 124.14M | 101.35M | 93.73M | 96.91M | 95.01M | 92.55M | 89.59M | 89.44M | 87.05M | 86.50M | 80.21M | 76.96M | 73.79M | 69.85M | 64.97M | 64.13M | 64.83M | 58.58M | 48.77M | 40.84M | 38.67M | 30.62M | 28.23M | 26.42M | 23.70M | 22.70M | 19.80M | 18.33M |

| Interest Expense | 26.43M | 7.89M | 8.36M | 13.38M | 14.56M | 11.03M | 9.60M | 8.97M | 8.69M | 8.53M | 8.62M | 10.11M | 11.88M | 13.24M | 15.46M | 21.40M | 23.38M | 18.46M | 12.00M | 7.55M | 8.83M | 9.18M | 11.98M | 11.31M | 9.10M | 9.60M | 8.00M | 7.67M |

| Depreciation & Amortization | 3.88M | 4.36M | 4.74M | 4.19M | 3.87M | 3.67M | 3.45M | 3.31M | 2.51M | 2.74M | 2.35M | 2.27M | 2.12M | 1.89M | 2.07M | 2.44M | 2.56M | 2.01M | 1.55M | 1.45M | 1.69M | 1.74M | 1.60M | 1.29M | 1.20M | 1.20M | 1.20M | 1.14M |

| EBITDA | 0.00 | 41.32M | 42.82M | 33.41M | 27.80M | 118.31M | 0.00 | 0.00 | 0.00 | 0.00 | 23.46M | 26.30M | 20.83M | 12.95M | 14.68M | 0.00 | 14.39M | 19.57M | 18.52M | 24.69M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 2,913.20% | 31.83% | 24.04% | 24.72% | 34.71% | 28.49% | 27.77% | 28.86% | 29.12% | 34.20% | 36.28% | 36.77% | 30.33% | 29.00% | 42.17% | 56.09% | 56.32% | 47.42% | 43.46% | 50.31% | 57.88% | 73.94% | 84.22% | 75.29% | 80.08% | 84.86% | 293.70% |

| Operating Income | 39.35M | 44.64M | 38.08M | 29.22M | 23.93M | 33.57M | 116.33M | 115.07M | 107.76M | 25.60M | 29.74M | 34.14M | 30.59M | 24.29M | 22.93M | 26.19M | 35.20M | 36.02M | 28.97M | 24.69M | 29.32B | 21.45B | 23.29M | 18.97M | 18.30M | 18.10M | 14.50M | 12.69M |

| Operating Income Ratio | 33.05% | 2,654.22% | 28.31% | 21.03% | 21.28% | 31.29% | 109.00% | 108.45% | 108.78% | 26.31% | 31.70% | 34.02% | 34.39% | 28.15% | 26.60% | 38.58% | 52.29% | 53.35% | 45.01% | 42.58% | 49,556.38% | 50,020.00% | 69.17% | 78.85% | 70.66% | 75.10% | 78.38% | 269.44% |

| Total Other Income/Expenses | -10.18M | 0.00 | -281.00K | -2.20M | -22.56M | -23.02M | -98.37M | -97.15M | -90.38M | -315.00K | -2.35M | -2.27M | -2.12M | -1.89M | 0.00 | -1.58M | 0.00 | -2.01M | -1.55M | -8.49M | -10.07B | -7.55B | -11.98M | -11.31M | -9.10M | -9.60M | -8.00M | -7.67M |

| Income Before Tax | 29.16M | 36.96M | 38.08M | 29.22M | 23.93M | 22.54M | 17.97M | 17.92M | 17.38M | 17.08M | 21.11M | 24.03M | 18.71M | 11.06M | 7.47M | 4.80M | 11.82M | 17.56M | 16.97M | 16.20M | 19.25M | 13.90M | 11.31M | 7.66M | 9.20M | 8.50M | 6.50M | 5.02M |

| Income Before Tax Ratio | 24.50% | 2,197.62% | 28.31% | 21.03% | 21.28% | 21.01% | 16.83% | 16.89% | 17.55% | 17.55% | 22.51% | 23.94% | 21.03% | 12.81% | 8.67% | 7.07% | 17.56% | 26.01% | 26.37% | 27.95% | 32.53% | 32.41% | 33.58% | 31.84% | 35.52% | 35.27% | 35.14% | 106.61% |

| Income Tax Expense | 5.42M | 7.60M | 8.96M | 6.80M | 5.08M | 4.52M | 11.39M | 4.46M | 4.85M | 4.73M | 6.71M | 7.65M | 5.74M | 2.95M | 1.95M | 617.00K | 3.34M | 5.43M | 5.18M | 5.01M | 6.33M | 4.14M | 3.32M | 1.82M | 2.40M | 2.40M | 1.60M | 958.90K |

| Net Income | 23.60M | 29.16M | 28.67M | 22.12M | 18.85M | 18.02M | 6.57M | 13.46M | 12.53M | 12.35M | 14.40M | 16.38M | 12.98M | 8.11M | 5.53M | 4.18M | 8.48M | 12.13M | 11.79M | 11.20M | 12.92M | 9.76M | 7.99M | 5.84M | 6.80M | 6.10M | 4.90M | 4.06M |

| Net Income Ratio | 19.83% | 1,733.59% | 21.31% | 15.92% | 16.76% | 16.80% | 6.16% | 12.69% | 12.65% | 12.69% | 15.35% | 16.32% | 14.59% | 9.40% | 6.41% | 6.16% | 12.60% | 17.97% | 18.32% | 19.31% | 21.84% | 22.77% | 23.73% | 24.26% | 26.25% | 25.31% | 26.49% | 86.24% |

| EPS | 6.92 | 8.29 | 7.95 | 6.06 | 5.47 | 5.15 | 1.89 | 3.90 | 3.68 | 3.63 | 4.37 | 5.00 | 3.76 | 2.26 | 1.44 | 1.38 | 2.79 | 3.85 | 3.49 | 3.14 | 3.58 | 2.73 | 2.25 | 1.62 | 1.83 | 1.59 | 1.25 | 0.92 |

| EPS Diluted | 6.92 | 8.29 | 7.95 | 6.06 | 5.47 | 5.15 | 1.88 | 3.89 | 3.68 | 3.59 | 4.19 | 4.86 | 3.72 | 2.24 | 1.44 | 1.37 | 2.68 | 3.71 | 3.36 | 3.00 | 3.42 | 2.67 | 2.23 | 1.60 | 1.81 | 1.56 | 1.25 | 0.92 |

| Weighted Avg Shares Out | 3.41M | 3.52M | 3.60M | 3.65M | 3.45M | 3.50M | 3.49M | 3.45M | 3.40M | 3.40M | 3.31M | 3.22M | 3.14M | 3.09M | 3.04M | 3.03M | 3.04M | 3.15M | 3.38M | 3.57M | 3.61M | 3.58M | 3.55M | 3.60M | 3.72M | 3.84M | 3.90M | 4.41M |

| Weighted Avg Shares Out (Dil) | 3.41M | 3.52M | 3.60M | 3.65M | 3.45M | 3.50M | 3.49M | 3.46M | 3.40M | 3.44M | 3.44M | 3.31M | 3.17M | 3.10M | 3.05M | 3.06M | 3.16M | 3.27M | 3.51M | 3.73M | 3.78M | 3.66M | 3.58M | 3.65M | 3.76M | 3.91M | 4.41M | 4.41M |

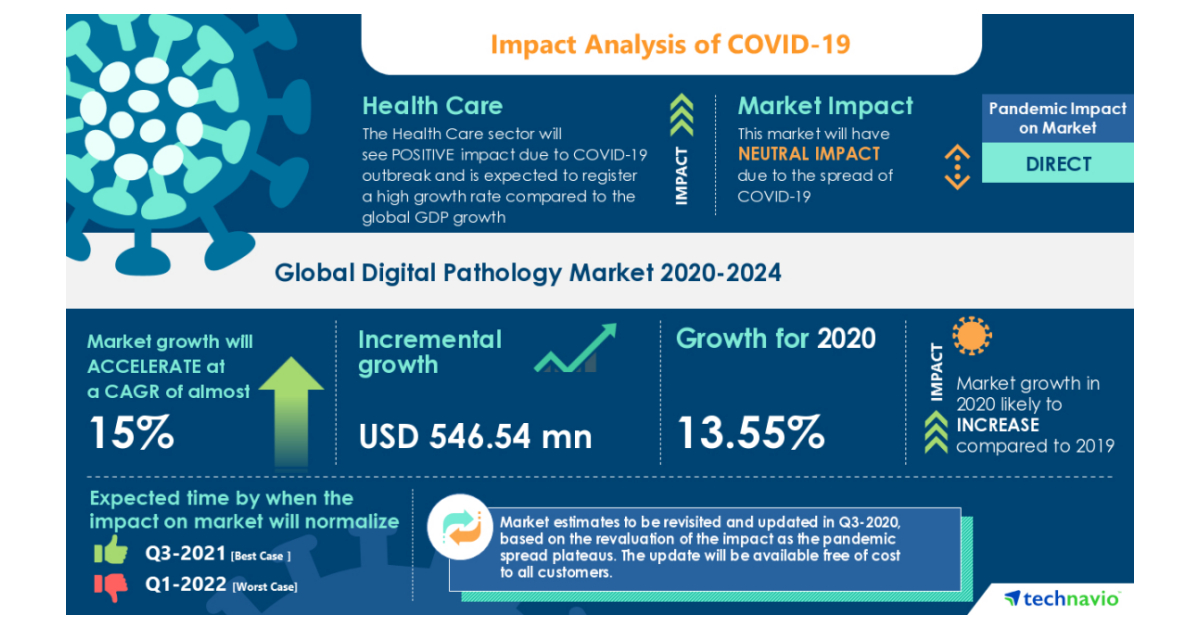

Digital Pathology Market 2020-2024: Forecasting Strategy to Undergo a Paradigm Shift From Crisis to New Normal During COVID-19 Pandemic | Technavio

Anti-nuclear Antibody Testing Market- Roadmap for Recovery From COVID-19 | Increased Prevalence of Autoimmune Diseases to Boost the Market Growth | Technavio

Angina Market 2020 Global Trends, Share, Growth, Analysis, Opportunities and Forecast To 2026

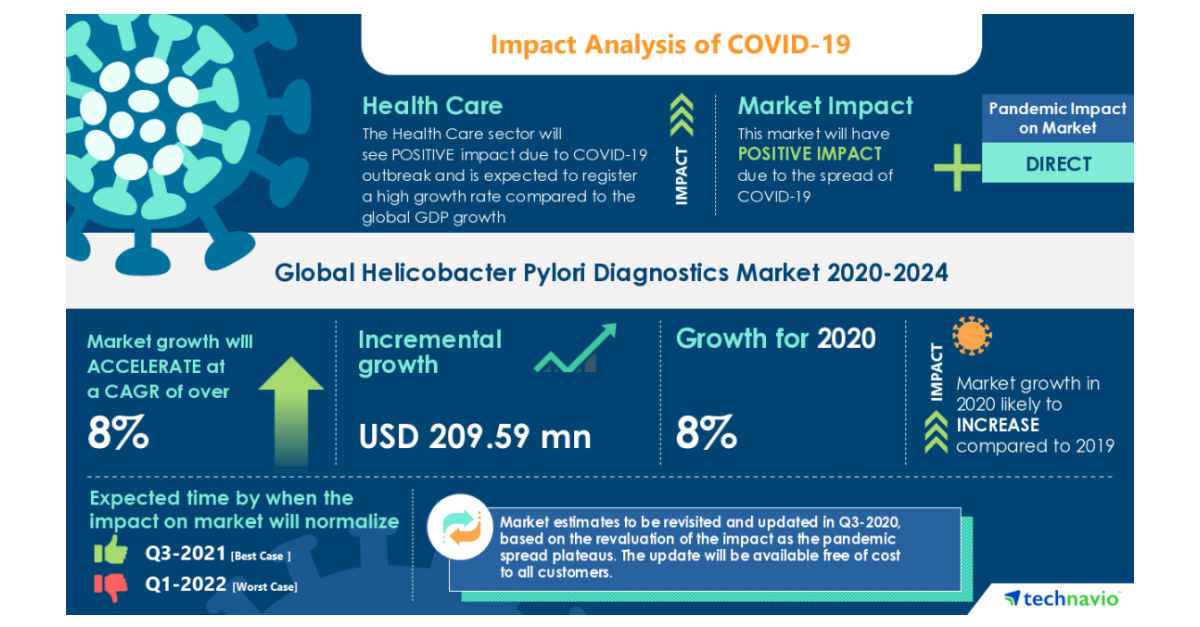

COVID-19 Recovery Analysis: Helicobacter Pylori Diagnostics Market | Resistance Of H. Pylori To Antibiotics to boost the Market Growth | Technavio

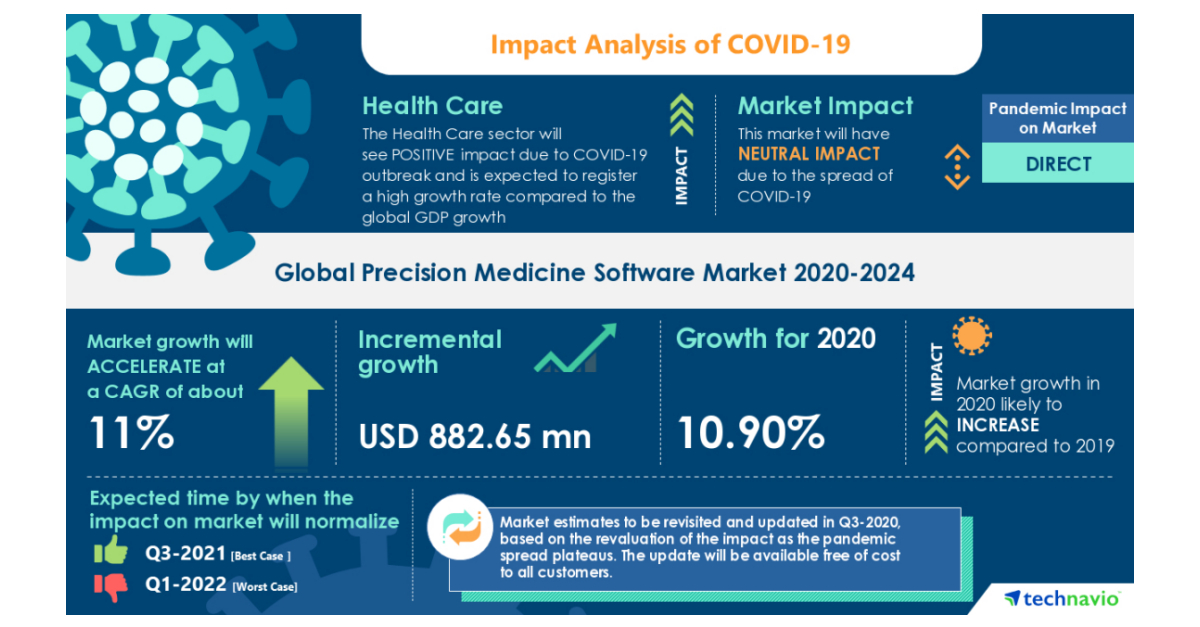

Precision Medicine Software Market- Roadmap for Recovery from COVID-19|Benefits Of Precision Medicine to Boost the Market Growth | Technavio

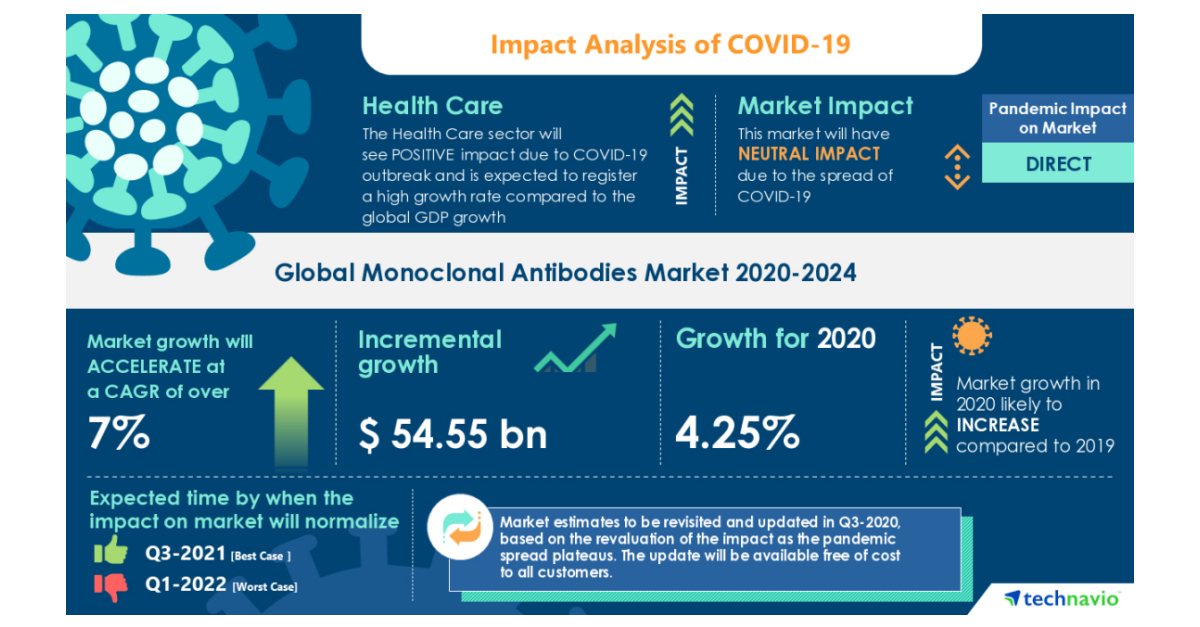

COVID-19 Recovery Analysis: Monoclonal Antibodies Market | Advent of Low-priced Biosimilar Monoclonal Antibodies to Boost the Market Growth | Technavio

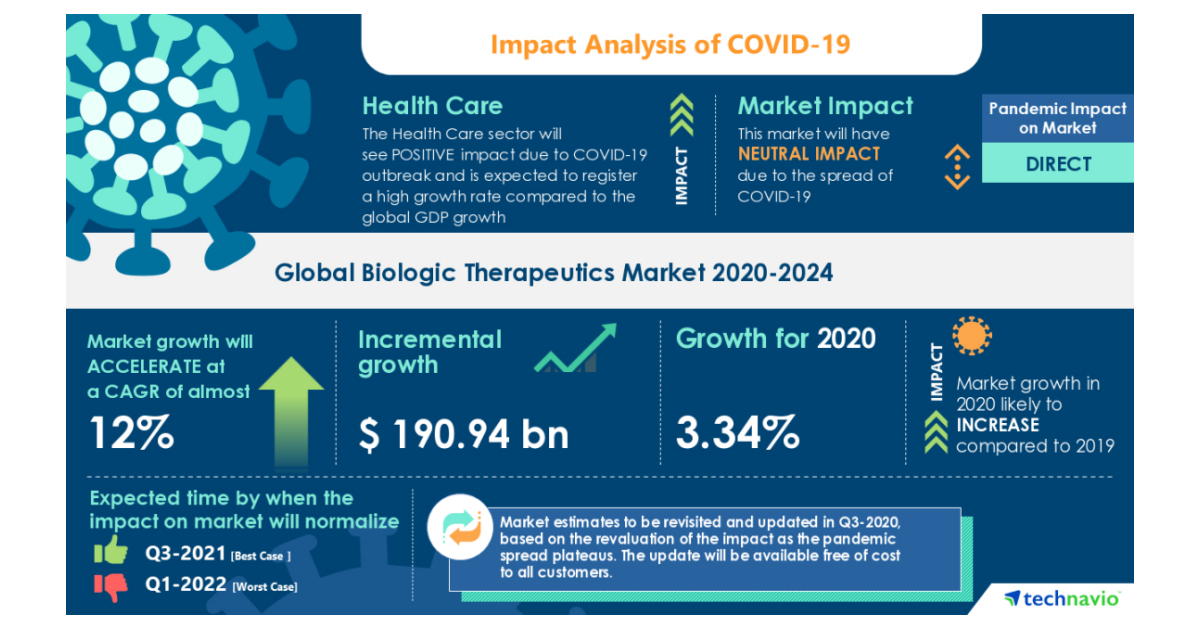

COVID-19 Recovery Analysis: Biologic Therapeutics Market | Strong R&D Pipeline to Boost the Market Growth | Technavio

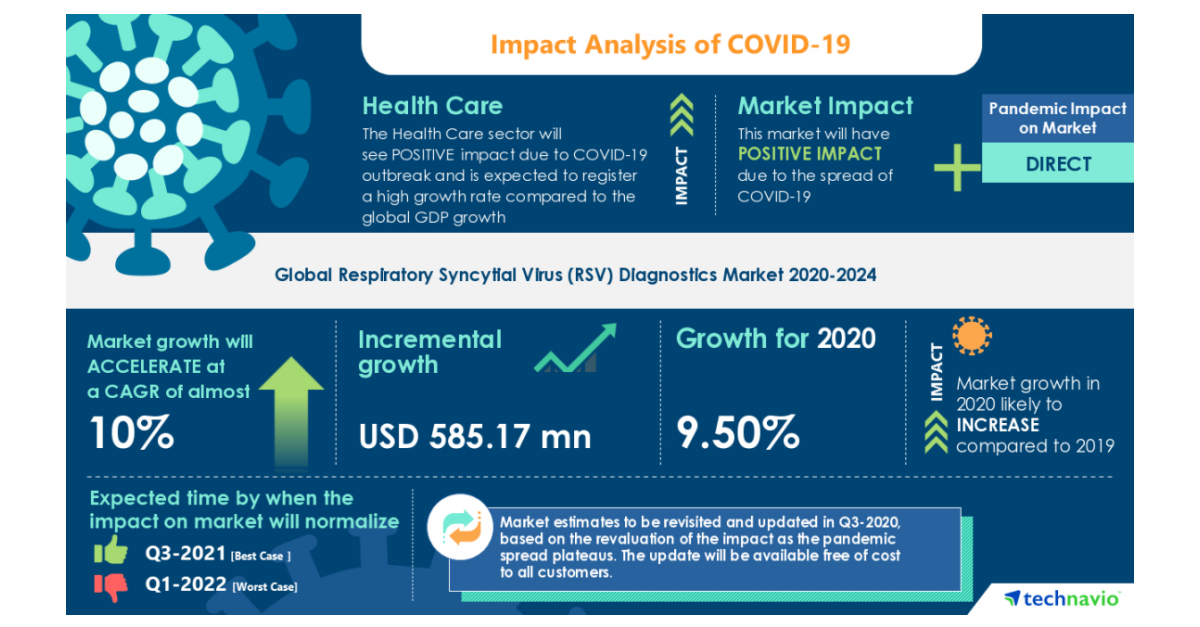

Respiratory Syncytial Virus Diagnostics Market- Roadmap for Recovery from COVID-19 | Increase in Product Launches to boost the Market Growth | Technavio

Source: https://incomestatements.info

Category: Stock Reports