See more : ZeU Technologies Inc. (ZEUCF) Income Statement Analysis – Financial Results

Complete financial analysis of Capitol Federal Financial, Inc. (CFFN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Capitol Federal Financial, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Hershey Creamery Company, Inc. (HRCR) Income Statement Analysis – Financial Results

- Toplus Global Co., Ltd. (3522.TWO) Income Statement Analysis – Financial Results

- True Partner Capital Holding Limited (8657.HK) Income Statement Analysis – Financial Results

- Crocodile Garments Limited (0122.HK) Income Statement Analysis – Financial Results

- Kearny Financial Corp. (KRNY) Income Statement Analysis – Financial Results

Capitol Federal Financial, Inc. (CFFN)

About Capitol Federal Financial, Inc.

Capitol Federal Financial, Inc. operates as the holding company for Capitol Federal Savings Bank that provides various retail banking products and services in the United States. The company accepts a range of deposit products, including savings accounts, money market deposit accounts, interest-bearing and non-interest-bearing checking accounts, and certificates of deposit. It also provides various loan products, such as one- to four-family residential real estate loans, commercial real estate, commercial and industrial, and construction loans, as well as consumer loans, which include home equity, loans and lines of credit, home improvement loans, vehicle loans, and loans secured by saving deposits. In addition, the company offers mobile, telephone, and online banking services, as well as bill payment services; operates a call center; and invests in various securities. It operates a network of 54 branches, including 45 traditional branches and nine in-store branches located in nine counties throughout Kansas and two counties in Missouri. The company serves the metropolitan areas of Topeka, Wichita, Lawrence, Manhattan, Emporia, and Salina, Kansas, and a portion of the metropolitan area of greater Kansas City. Capitol Federal Financial, Inc. was founded in 1893 and is headquartered in Topeka, Kansas.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 164.59M | -25.02M | 220.05M | 210.66M | 186.63M | 227.60M | 220.81M | 217.58M | 216.24M | 210.14M | 205.69M | 202.52M | 207.07M | 193.73M | 203.98M | 205.24M | 164.20M | 130.41M | 152.29M | 179.25M | 139.78M | 157.85M | 215.83M | 186.62M | 183.03M | 156.80M | 15.26M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 164.59M | -25.02M | 220.05M | 210.66M | 186.63M | 227.60M | 220.81M | 217.58M | 216.24M | 210.14M | 205.69M | 202.52M | 207.07M | 193.73M | 203.98M | 205.24M | 164.20M | 130.41M | 152.29M | 179.25M | 139.78M | 157.85M | 215.83M | 186.62M | 183.03M | 156.80M | 15.26M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 58.32M | 25.92M | 20.26M | 19.64M | 19.17M | 20.05M | 15.89M | 13.26M | 13.18M | 12.45M | 11.53M | 8.86M | 7.58M | 66.19M | 68.14M | 53.51M | 43.50M | 41.27M | 40.03M | 40.45M | 41.91M | 39.55M | 38.84M | 36.12M | 36.61M | 31.80M | 0.00 |

| Selling & Marketing | 4.26M | 4.31M | 5.18M | 5.13M | 4.89M | 5.24M | 5.03M | 4.67M | 4.61M | 4.55M | 4.20M | 5.03M | 3.93M | 3.72M | 6.03M | 6.92M | 4.93M | 4.32M | 4.04M | 4.31M | 3.68M | 3.96M | 4.23M | 2.96M | 2.17M | 2.70M | 2.56M |

| SG&A | 62.59M | 95.96M | 96.41M | 94.82M | 90.92M | 91.48M | 78.94M | 72.19M | 70.74M | 70.25M | 69.75M | 72.91M | 64.50M | 69.91M | 74.16M | 60.43M | 48.42M | 45.59M | 44.06M | 44.76M | 45.59M | 43.51M | 43.08M | 39.08M | 38.77M | 34.50M | 2.56M |

| Other Expenses | 102.00M | -48.21M | -41.88M | -40.77M | -39.14M | -40.77M | -38.88M | -35.41M | -41.35M | 0.00 | 0.00 | 0.00 | 0.00 | -28.16M | 31.71M | 75.70M | 144.18M | 182.02M | 166.25M | 125.56M | -86.05M | 210.78M | 258.87M | 308.11M | 249.19M | 131.10M | 305.85M |

| Operating Expenses | 164.59M | 113.93M | 112.85M | 114.63M | 106.00M | 106.94M | 96.90M | 89.66M | 94.31M | 94.37M | 90.54M | 96.95M | 91.08M | 41.75M | 105.88M | 136.13M | 192.60M | 227.61M | 210.32M | 170.32M | -40.46M | 254.29M | 301.95M | 347.19M | 287.96M | 165.60M | 308.41M |

| Cost & Expenses | 164.59M | 113.93M | 112.85M | 114.63M | 106.00M | 106.94M | 96.90M | 89.66M | 94.31M | 94.37M | 90.54M | 96.95M | -91.08M | 41.75M | 105.88M | 136.13M | 192.60M | 227.61M | 210.32M | 170.32M | -40.46M | 254.29M | 301.95M | 347.19M | 287.96M | 165.60M | 308.41M |

| Interest Income | 376.84M | 359.79M | 279.54M | 258.18M | 304.98M | 329.95M | 321.89M | 313.19M | 301.11M | 297.36M | 290.25M | 298.55M | 328.05M | 346.87M | 374.05M | 412.79M | 410.81M | 411.55M | 410.93M | 400.11M | 384.83M | 441.54M | 557.13M | 580.74M | 518.36M | 396.10M | 363.64M |

| Interest Expense | 214.78M | 206.52M | 86.95M | 83.18M | 115.64M | 123.56M | 123.12M | 117.80M | 108.93M | 107.59M | 106.10M | 120.39M | 143.17M | 178.13M | 204.49M | 236.14M | 276.64M | 305.11M | 283.91M | 244.20M | 268.64M | 326.85M | 370.74M | 410.46M | 350.12M | 253.00M | 234.90M |

| Depreciation & Amortization | 0.00 | 10.11M | 10.74M | 10.95M | 11.10M | 11.46M | 8.69M | 7.80M | 7.14M | -125.84M | -122.10M | -111.99M | 4.95M | 4.40M | 4.58M | 5.13M | 6.15M | 4.39M | 9.97M | 15.46M | 29.94M | 31.05M | 3.06M | 7.38M | 1.30M | -1.90M | -970.00K |

| EBITDA | 0.00 | -128.85M | 117.94M | 106.98M | 91.73M | 132.11M | 132.60M | 135.72M | 129.08M | 122.61M | 121.47M | 111.02M | 120.95M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | -280.51% | -1.39% | -1.23% | -0.52% | -0.54% | -1.50% | -1.65% | -4.17% | -4.85% | -3.47% | -3.27% | 55.98% | 123.82% | 154.15% | 168.83% | 221.04% | 277.91% | 244.65% | 203.64% | 92.47% | 280.77% | 241.31% | 290.00% | 258.04% | 204.40% | 2,115.37% |

| Operating Income | 54.10M | -134.50M | 110.22M | 98.57M | 81.54M | 121.83M | 127.18M | 131.46M | 130.89M | 125.84M | 122.10M | 111.99M | 110.98M | 235.48M | 309.85M | 341.37M | 356.79M | 358.02M | 362.61M | 349.58M | 99.32M | 412.14M | 517.78M | 533.81M | 470.99M | 322.40M | 323.67M |

| Operating Income Ratio | 32.87% | 537.54% | 50.09% | 46.79% | 43.69% | 53.53% | 57.60% | 60.42% | 60.53% | 59.88% | 59.36% | 55.30% | 53.59% | 121.55% | 151.91% | 166.33% | 217.30% | 274.54% | 238.10% | 195.02% | 71.05% | 261.09% | 239.90% | 286.04% | 257.33% | 205.61% | 2,121.72% |

| Total Other Income/Expenses | 0.00 | -17.98M | -16.44M | -19.81M | -15.08M | -15.47M | -17.96M | -17.47M | -23.56M | -24.12M | -20.79M | -24.04M | -4.95M | -182.53M | -209.07M | -241.28M | 0.00 | 0.00 | -472.00K | -280.00K | -268.64M | -326.85M | -370.74M | -410.46M | -350.12M | -253.00M | -234.90M |

| Income Before Tax | 54.10M | -138.96M | 107.20M | 96.03M | 80.63M | 120.65M | 123.91M | 127.92M | 121.94M | 115.77M | 115.15M | 105.57M | 116.00M | 57.35M | 105.37M | 105.22M | 80.16M | 52.91M | 78.70M | 105.38M | -169.33M | 85.29M | 147.04M | 123.35M | 120.87M | 69.40M | 88.77M |

| Income Before Tax Ratio | 32.87% | 555.35% | 48.72% | 45.59% | 43.20% | 53.01% | 56.11% | 58.79% | 56.39% | 55.09% | 55.98% | 52.13% | 56.02% | 29.60% | 51.66% | 51.27% | 48.82% | 40.57% | 51.68% | 58.79% | -121.14% | 54.03% | 68.12% | 66.10% | 66.04% | 44.26% | 581.92% |

| Income Tax Expense | 16.09M | 37.30M | 22.75M | 19.95M | 16.09M | 26.41M | 24.98M | 43.78M | 38.45M | 37.68M | 37.46M | 36.23M | 41.49M | 18.95M | 37.53M | 38.93M | 29.20M | 20.61M | 30.59M | 40.32M | -63.05M | 33.26M | 57.44M | 45.57M | 44.53M | 26.50M | 34.78M |

| Net Income | 38.01M | -101.61M | 84.45M | 76.08M | 64.54M | 94.24M | 98.93M | 84.14M | 83.49M | 78.09M | 77.69M | 69.34M | 74.51M | 38.40M | 67.84M | 66.30M | 50.95M | 32.30M | 48.12M | 65.06M | -106.28M | 52.03M | 89.59M | 77.78M | 76.34M | 42.90M | 53.99M |

| Net Income Ratio | 23.09% | 406.09% | 38.38% | 36.12% | 34.58% | 41.41% | 44.80% | 38.67% | 38.61% | 37.16% | 37.77% | 34.24% | 35.98% | 19.82% | 33.26% | 32.30% | 31.03% | 24.77% | 31.60% | 36.29% | -76.03% | 32.96% | 41.51% | 41.68% | 41.71% | 27.36% | 353.92% |

| EPS | 0.29 | -0.76 | 0.62 | 0.56 | 0.47 | 0.68 | 0.73 | 0.63 | 0.63 | 0.58 | 0.56 | 0.48 | 0.47 | 0.24 | 0.41 | 0.40 | 0.31 | 0.19 | 0.29 | 0.40 | -0.66 | 0.33 | 0.55 | 0.45 | 0.40 | 0.17 | 0.26 |

| EPS Diluted | 0.29 | -0.76 | 0.62 | 0.56 | 0.47 | 0.68 | 0.73 | 0.63 | 0.63 | 0.58 | 0.56 | 0.48 | 0.47 | 0.24 | 0.41 | 0.40 | 0.31 | 0.19 | 0.29 | 0.39 | -0.66 | 0.32 | 0.54 | 0.44 | 0.40 | 0.17 | 0.26 |

| Weighted Avg Shares Out | 129.87M | 133.56M | 135.70M | 135.48M | 137.90M | 137.68M | 134.70M | 134.08M | 133.05M | 135.38M | 139.44M | 144.85M | 157.92M | 162.63M | 165.86M | 165.58M | 165.11M | 164.91M | 165.03M | 164.13M | 162.08M | 159.17M | 162.25M | 174.33M | 189.90M | 249.01M | 207.16M |

| Weighted Avg Shares Out (Dil) | 129.87M | 133.56M | 135.70M | 135.50M | 137.90M | 137.74M | 134.76M | 134.24M | 133.18M | 135.41M | 139.44M | 144.85M | 158.39M | 162.63M | 165.90M | 165.72M | 165.28M | 165.18M | 165.03M | 165.44M | 162.08M | 163.59M | 166.24M | 177.85M | 192.01M | 249.01M | 207.16M |

Charles Schwab Investment Management Inc. Has $13.16 Million Position in Capitol Federal Financial, Inc. (NASDAQ:CFFN)

Global Architecture Curtain Wall Market 2020 Research Reports by Manufacturers, Regions, Type and Application, Covid-19 Impact Forecast to 2024 | Absolute Reports

Church Sues D.C. over Virus Restrictions on Worship Services

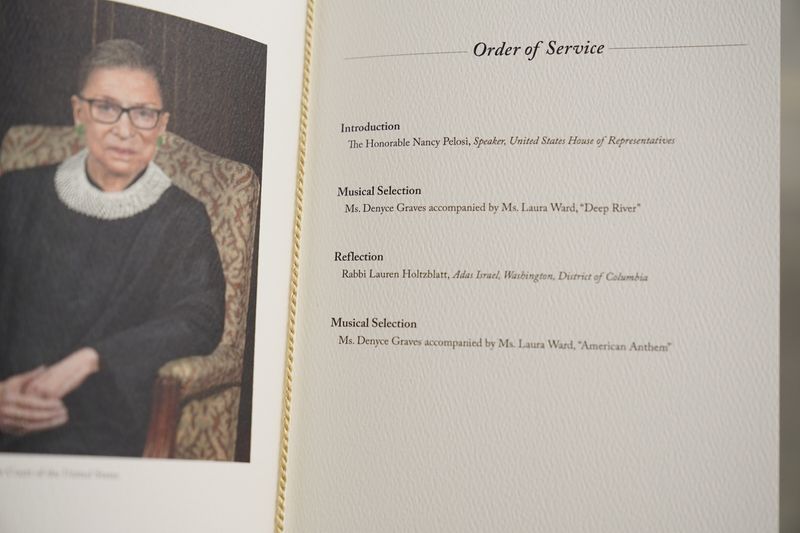

Pioneering Justice Ginsburg makes history again with U.S. Capitol honor

Walmart is hiring 20,000 seasonal workers — here’s how a seasonal job could affect your unemployment benefits

Mourners pay respects to Ginsburg at U.S. Supreme Court

Zacks: Brokerages Expect Capitol Federal Financial, Inc. (NASDAQ:CFFN) Will Post Quarterly Sales of $50.25 Million

Powell's Back, Palantir's IPO, Cereal Profits: 3 Things for the Day Ahead

Trump health official says ‘biology independent of politics’ as US nears 200,000 Covid deaths

Democrats face quandary on vaccine support as election nears

Source: https://incomestatements.info

Category: Stock Reports