See more : St. James’s Place plc (STJPF) Income Statement Analysis – Financial Results

Complete financial analysis of Capitol Federal Financial, Inc. (CFFN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Capitol Federal Financial, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Phoenix Global Resources plc (PGR.L) Income Statement Analysis – Financial Results

- Hornby PLC (HRN.L) Income Statement Analysis – Financial Results

- Meson Valves India Limited (MESON.BO) Income Statement Analysis – Financial Results

- BroadBand Security, Inc. (4398.T) Income Statement Analysis – Financial Results

- Daewoong Co., Ltd. (003090.KS) Income Statement Analysis – Financial Results

Capitol Federal Financial, Inc. (CFFN)

About Capitol Federal Financial, Inc.

Capitol Federal Financial, Inc. operates as the holding company for Capitol Federal Savings Bank that provides various retail banking products and services in the United States. The company accepts a range of deposit products, including savings accounts, money market deposit accounts, interest-bearing and non-interest-bearing checking accounts, and certificates of deposit. It also provides various loan products, such as one- to four-family residential real estate loans, commercial real estate, commercial and industrial, and construction loans, as well as consumer loans, which include home equity, loans and lines of credit, home improvement loans, vehicle loans, and loans secured by saving deposits. In addition, the company offers mobile, telephone, and online banking services, as well as bill payment services; operates a call center; and invests in various securities. It operates a network of 54 branches, including 45 traditional branches and nine in-store branches located in nine counties throughout Kansas and two counties in Missouri. The company serves the metropolitan areas of Topeka, Wichita, Lawrence, Manhattan, Emporia, and Salina, Kansas, and a portion of the metropolitan area of greater Kansas City. Capitol Federal Financial, Inc. was founded in 1893 and is headquartered in Topeka, Kansas.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 164.59M | -25.02M | 220.05M | 210.66M | 186.63M | 227.60M | 220.81M | 217.58M | 216.24M | 210.14M | 205.69M | 202.52M | 207.07M | 193.73M | 203.98M | 205.24M | 164.20M | 130.41M | 152.29M | 179.25M | 139.78M | 157.85M | 215.83M | 186.62M | 183.03M | 156.80M | 15.26M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 164.59M | -25.02M | 220.05M | 210.66M | 186.63M | 227.60M | 220.81M | 217.58M | 216.24M | 210.14M | 205.69M | 202.52M | 207.07M | 193.73M | 203.98M | 205.24M | 164.20M | 130.41M | 152.29M | 179.25M | 139.78M | 157.85M | 215.83M | 186.62M | 183.03M | 156.80M | 15.26M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 58.32M | 25.92M | 20.26M | 19.64M | 19.17M | 20.05M | 15.89M | 13.26M | 13.18M | 12.45M | 11.53M | 8.86M | 7.58M | 66.19M | 68.14M | 53.51M | 43.50M | 41.27M | 40.03M | 40.45M | 41.91M | 39.55M | 38.84M | 36.12M | 36.61M | 31.80M | 0.00 |

| Selling & Marketing | 4.26M | 4.31M | 5.18M | 5.13M | 4.89M | 5.24M | 5.03M | 4.67M | 4.61M | 4.55M | 4.20M | 5.03M | 3.93M | 3.72M | 6.03M | 6.92M | 4.93M | 4.32M | 4.04M | 4.31M | 3.68M | 3.96M | 4.23M | 2.96M | 2.17M | 2.70M | 2.56M |

| SG&A | 62.59M | 95.96M | 96.41M | 94.82M | 90.92M | 91.48M | 78.94M | 72.19M | 70.74M | 70.25M | 69.75M | 72.91M | 64.50M | 69.91M | 74.16M | 60.43M | 48.42M | 45.59M | 44.06M | 44.76M | 45.59M | 43.51M | 43.08M | 39.08M | 38.77M | 34.50M | 2.56M |

| Other Expenses | 102.00M | -48.21M | -41.88M | -40.77M | -39.14M | -40.77M | -38.88M | -35.41M | -41.35M | 0.00 | 0.00 | 0.00 | 0.00 | -28.16M | 31.71M | 75.70M | 144.18M | 182.02M | 166.25M | 125.56M | -86.05M | 210.78M | 258.87M | 308.11M | 249.19M | 131.10M | 305.85M |

| Operating Expenses | 164.59M | 113.93M | 112.85M | 114.63M | 106.00M | 106.94M | 96.90M | 89.66M | 94.31M | 94.37M | 90.54M | 96.95M | 91.08M | 41.75M | 105.88M | 136.13M | 192.60M | 227.61M | 210.32M | 170.32M | -40.46M | 254.29M | 301.95M | 347.19M | 287.96M | 165.60M | 308.41M |

| Cost & Expenses | 164.59M | 113.93M | 112.85M | 114.63M | 106.00M | 106.94M | 96.90M | 89.66M | 94.31M | 94.37M | 90.54M | 96.95M | -91.08M | 41.75M | 105.88M | 136.13M | 192.60M | 227.61M | 210.32M | 170.32M | -40.46M | 254.29M | 301.95M | 347.19M | 287.96M | 165.60M | 308.41M |

| Interest Income | 376.84M | 359.79M | 279.54M | 258.18M | 304.98M | 329.95M | 321.89M | 313.19M | 301.11M | 297.36M | 290.25M | 298.55M | 328.05M | 346.87M | 374.05M | 412.79M | 410.81M | 411.55M | 410.93M | 400.11M | 384.83M | 441.54M | 557.13M | 580.74M | 518.36M | 396.10M | 363.64M |

| Interest Expense | 214.78M | 206.52M | 86.95M | 83.18M | 115.64M | 123.56M | 123.12M | 117.80M | 108.93M | 107.59M | 106.10M | 120.39M | 143.17M | 178.13M | 204.49M | 236.14M | 276.64M | 305.11M | 283.91M | 244.20M | 268.64M | 326.85M | 370.74M | 410.46M | 350.12M | 253.00M | 234.90M |

| Depreciation & Amortization | 0.00 | 10.11M | 10.74M | 10.95M | 11.10M | 11.46M | 8.69M | 7.80M | 7.14M | -125.84M | -122.10M | -111.99M | 4.95M | 4.40M | 4.58M | 5.13M | 6.15M | 4.39M | 9.97M | 15.46M | 29.94M | 31.05M | 3.06M | 7.38M | 1.30M | -1.90M | -970.00K |

| EBITDA | 0.00 | -128.85M | 117.94M | 106.98M | 91.73M | 132.11M | 132.60M | 135.72M | 129.08M | 122.61M | 121.47M | 111.02M | 120.95M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | -280.51% | -1.39% | -1.23% | -0.52% | -0.54% | -1.50% | -1.65% | -4.17% | -4.85% | -3.47% | -3.27% | 55.98% | 123.82% | 154.15% | 168.83% | 221.04% | 277.91% | 244.65% | 203.64% | 92.47% | 280.77% | 241.31% | 290.00% | 258.04% | 204.40% | 2,115.37% |

| Operating Income | 54.10M | -134.50M | 110.22M | 98.57M | 81.54M | 121.83M | 127.18M | 131.46M | 130.89M | 125.84M | 122.10M | 111.99M | 110.98M | 235.48M | 309.85M | 341.37M | 356.79M | 358.02M | 362.61M | 349.58M | 99.32M | 412.14M | 517.78M | 533.81M | 470.99M | 322.40M | 323.67M |

| Operating Income Ratio | 32.87% | 537.54% | 50.09% | 46.79% | 43.69% | 53.53% | 57.60% | 60.42% | 60.53% | 59.88% | 59.36% | 55.30% | 53.59% | 121.55% | 151.91% | 166.33% | 217.30% | 274.54% | 238.10% | 195.02% | 71.05% | 261.09% | 239.90% | 286.04% | 257.33% | 205.61% | 2,121.72% |

| Total Other Income/Expenses | 0.00 | -17.98M | -16.44M | -19.81M | -15.08M | -15.47M | -17.96M | -17.47M | -23.56M | -24.12M | -20.79M | -24.04M | -4.95M | -182.53M | -209.07M | -241.28M | 0.00 | 0.00 | -472.00K | -280.00K | -268.64M | -326.85M | -370.74M | -410.46M | -350.12M | -253.00M | -234.90M |

| Income Before Tax | 54.10M | -138.96M | 107.20M | 96.03M | 80.63M | 120.65M | 123.91M | 127.92M | 121.94M | 115.77M | 115.15M | 105.57M | 116.00M | 57.35M | 105.37M | 105.22M | 80.16M | 52.91M | 78.70M | 105.38M | -169.33M | 85.29M | 147.04M | 123.35M | 120.87M | 69.40M | 88.77M |

| Income Before Tax Ratio | 32.87% | 555.35% | 48.72% | 45.59% | 43.20% | 53.01% | 56.11% | 58.79% | 56.39% | 55.09% | 55.98% | 52.13% | 56.02% | 29.60% | 51.66% | 51.27% | 48.82% | 40.57% | 51.68% | 58.79% | -121.14% | 54.03% | 68.12% | 66.10% | 66.04% | 44.26% | 581.92% |

| Income Tax Expense | 16.09M | 37.30M | 22.75M | 19.95M | 16.09M | 26.41M | 24.98M | 43.78M | 38.45M | 37.68M | 37.46M | 36.23M | 41.49M | 18.95M | 37.53M | 38.93M | 29.20M | 20.61M | 30.59M | 40.32M | -63.05M | 33.26M | 57.44M | 45.57M | 44.53M | 26.50M | 34.78M |

| Net Income | 38.01M | -101.61M | 84.45M | 76.08M | 64.54M | 94.24M | 98.93M | 84.14M | 83.49M | 78.09M | 77.69M | 69.34M | 74.51M | 38.40M | 67.84M | 66.30M | 50.95M | 32.30M | 48.12M | 65.06M | -106.28M | 52.03M | 89.59M | 77.78M | 76.34M | 42.90M | 53.99M |

| Net Income Ratio | 23.09% | 406.09% | 38.38% | 36.12% | 34.58% | 41.41% | 44.80% | 38.67% | 38.61% | 37.16% | 37.77% | 34.24% | 35.98% | 19.82% | 33.26% | 32.30% | 31.03% | 24.77% | 31.60% | 36.29% | -76.03% | 32.96% | 41.51% | 41.68% | 41.71% | 27.36% | 353.92% |

| EPS | 0.29 | -0.76 | 0.62 | 0.56 | 0.47 | 0.68 | 0.73 | 0.63 | 0.63 | 0.58 | 0.56 | 0.48 | 0.47 | 0.24 | 0.41 | 0.40 | 0.31 | 0.19 | 0.29 | 0.40 | -0.66 | 0.33 | 0.55 | 0.45 | 0.40 | 0.17 | 0.26 |

| EPS Diluted | 0.29 | -0.76 | 0.62 | 0.56 | 0.47 | 0.68 | 0.73 | 0.63 | 0.63 | 0.58 | 0.56 | 0.48 | 0.47 | 0.24 | 0.41 | 0.40 | 0.31 | 0.19 | 0.29 | 0.39 | -0.66 | 0.32 | 0.54 | 0.44 | 0.40 | 0.17 | 0.26 |

| Weighted Avg Shares Out | 129.87M | 133.56M | 135.70M | 135.48M | 137.90M | 137.68M | 134.70M | 134.08M | 133.05M | 135.38M | 139.44M | 144.85M | 157.92M | 162.63M | 165.86M | 165.58M | 165.11M | 164.91M | 165.03M | 164.13M | 162.08M | 159.17M | 162.25M | 174.33M | 189.90M | 249.01M | 207.16M |

| Weighted Avg Shares Out (Dil) | 129.87M | 133.56M | 135.70M | 135.50M | 137.90M | 137.74M | 134.76M | 134.24M | 133.18M | 135.41M | 139.44M | 144.85M | 158.39M | 162.63M | 165.90M | 165.72M | 165.28M | 165.18M | 165.03M | 165.44M | 162.08M | 163.59M | 166.24M | 177.85M | 192.01M | 249.01M | 207.16M |

This Brexit government’s ignorance is steering us towards disaster | Jonathan Freedland

Leave of absence for health official in furor over meddling

Topeka, Kansas Is Looking To Lure Remote Workers With A $10,000 Incentive

Leaders of progressive donor fund launch new PAC focusing on down-ballot races

Sen. Cassidy tests positive for virus, has COVID-19 symptoms

Hunger Games: What Happened To District 13? The History & Disappearance Explained

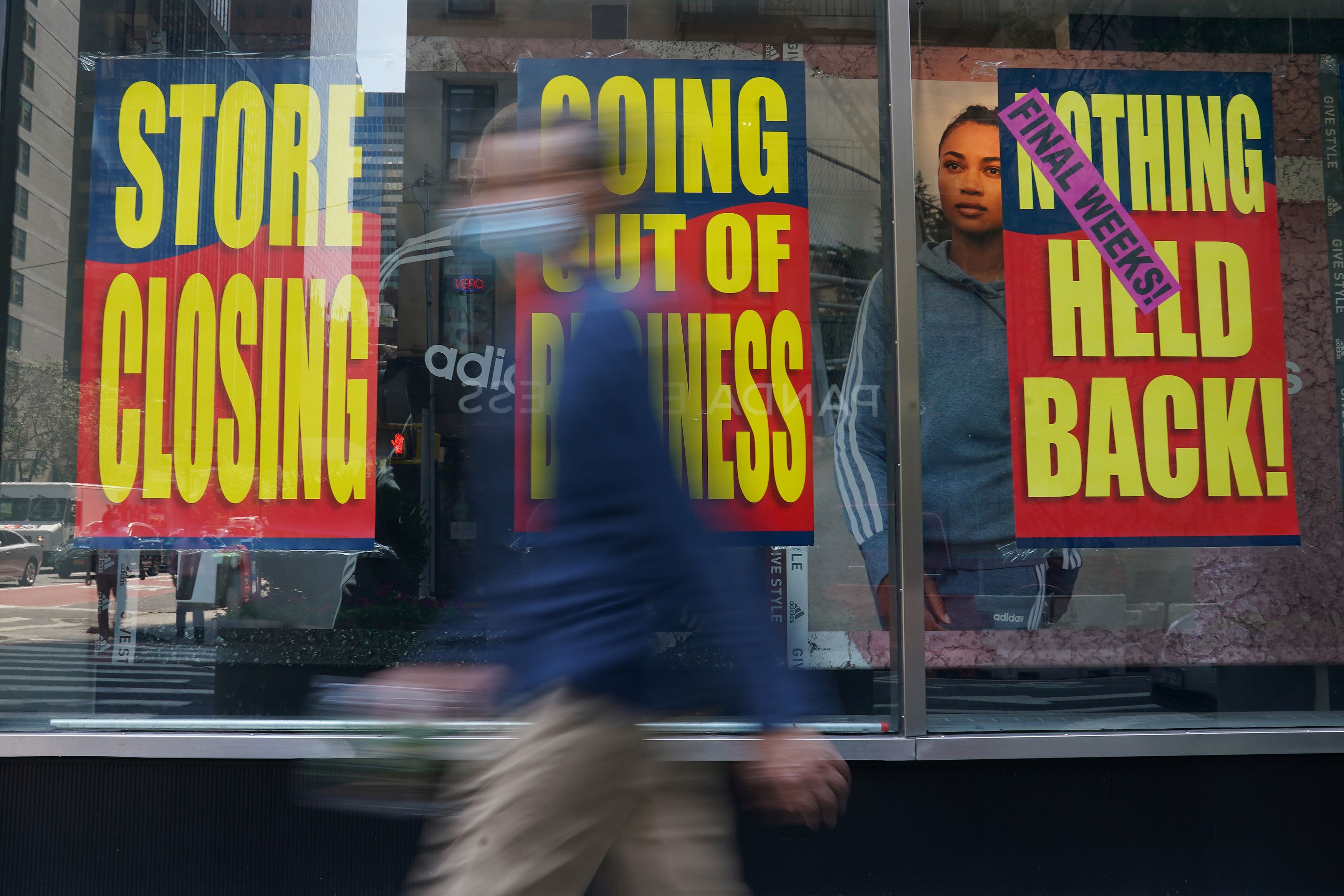

With negotiations on next stimulus package at an impasse, here's what you can actually count on

Virus aid talks collapse in Congress; no help expected for jobless now

Equities Analysts Set Expectations for Capitol Federal Financial, Inc.’s Q1 2021 Earnings (NASDAQ:CFFN)

Short Interest in Capitol Federal Financial, Inc. (NASDAQ:CFFN) Expands By 6.0%

Source: https://incomestatements.info

Category: Stock Reports