See more : Themis G.R.E.N. Ltd (TMIS.TA) Income Statement Analysis – Financial Results

Complete financial analysis of Compagnie Financière Richemont SA (CFRUY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Compagnie Financière Richemont SA, a leading company in the Luxury Goods industry within the Consumer Cyclical sector.

- Archies Limited (ARCHIES.BO) Income Statement Analysis – Financial Results

- Idaho Strategic Resources, Inc. (IDR) Income Statement Analysis – Financial Results

- Marubeni Corporation (MARUY) Income Statement Analysis – Financial Results

- Dover Motorsports, Inc. (DVD) Income Statement Analysis – Financial Results

- discoverIE Group plc (DSCV.L) Income Statement Analysis – Financial Results

Compagnie Financière Richemont SA (CFRUY)

About Compagnie Financière Richemont SA

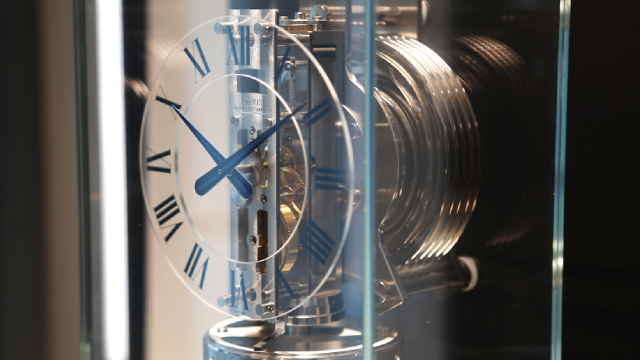

Compagnie Financière Richemont SA engages in the luxury goods business in Europe, the Middle East, Africa, Asia, and the Americas. The company operates through Jewellery Maisons, Specialist Watchmakers, and Online Distributors segments. It designs, manufactures, and distributes jewelry products; and precision timepieces, watches, and writing instruments, as well as clothing, and leather goods and accessories. The company offers its products under the Cartier, Van Cleef & Arpels, Buccellati, A. Lange & Söhne, Baume & Mercier, IWC Schaffhausen, Jaeger LeCoultre, Panerai, Piaget, Roger Dubuis, Vacheron Constantin, Watchfinder & Co., YOOX, NET-A-PORTER, MR PORTER, The Outnet, Alaïa, Chloé, Montblanc, Peter Millar, Purdey, Serapian, TIMEVALLEE, dunhill, Delvaux, and AZ Factory brands through own boutiques and online stores. Compagnie Financière Richemont SA was incorporated in 1979 and is headquartered in Bellevue, Switzerland.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 20.62B | 19.15B | 17.58B | 13.03B | 14.42B | 14.42B | 10.46B | 10.92B | 10.73B | 10.41B | 10.02B | 10.15B | 8.87B | 6.89B | 5.18B | 5.42B | 5.29B | 4.83B | 4.31B | 3.67B | 3.38B | 3.65B | 3.86B |

| Cost of Revenue | 6.67B | 6.04B | 6.00B | 5.58B | 6.04B | 5.81B | 3.69B | 4.01B | 3.89B | 3.53B | 3.53B | 3.63B | 3.22B | 2.50B | 1.99B | 2.00B | 1.88B | 1.75B | 1.59B | 1.42B | 1.28B | 1.37B | 1.38B |

| Gross Profit | 13.95B | 13.11B | 11.58B | 7.45B | 8.38B | 8.61B | 6.78B | 6.91B | 6.83B | 6.88B | 6.49B | 6.52B | 5.65B | 4.39B | 3.19B | 3.42B | 3.42B | 3.07B | 2.72B | 2.26B | 2.09B | 2.28B | 2.48B |

| Gross Profit Ratio | 67.65% | 68.48% | 65.89% | 57.17% | 58.11% | 59.70% | 64.75% | 63.28% | 63.71% | 66.05% | 64.76% | 64.23% | 63.72% | 63.76% | 61.65% | 63.07% | 64.56% | 63.68% | 63.14% | 61.45% | 61.99% | 62.56% | 64.20% |

| Research & Development | 90.44M | 87.32M | 83.97M | 64.45M | 89.10M | 92.77M | 80.77M | 87.17M | 75.54M | 59.00M | 53.00M | 74.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 3.90B | 3.64B | 3.08B | 2.51B | 2.98B | 2.76B | 2.15B | 2.13B | 2.09B | 1.88B | 1.75B | 1.82B | 1.60B | 1.36B | 1.05B | 1.19B | 1.13B | 1.07B | 1.01B | 1.78B | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 5.00B | 4.68B | 3.93B | 3.24B | 3.51B | 3.43B | 3.09B | 3.04B | 2.95B | 2.55B | 2.31B | 2.27B | 1.96B | 1.65B | 1.28B | 1.24B | 1.18B | 1.09B | 1.00B | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 8.90B | 8.12B | 7.35B | 5.85B | 6.65B | 6.39B | 4.86B | 5.16B | 4.72B | 4.44B | 4.06B | 4.08B | 3.56B | 3.01B | 2.33B | 2.42B | 2.31B | 2.16B | 2.01B | 1.78B | 0.00 | 0.00 | 0.00 |

| Other Expenses | 0.00 | 1.00M | 1.00M | 2.00M | 2.00M | 2.00M | 1.00M | 4.00M | 8.00M | 7.00M | 9.00M | 4.00M | -1.00M | 101.00M | 4.00M | 3.00M | 1.00M | 540.00M | 486.00M | -52.00M | 29.00M | 272.00M | 0.00 |

| Operating Expenses | 9.24B | 8.21B | 7.43B | 5.91B | 6.74B | 6.49B | 4.95B | 5.24B | 4.80B | 4.45B | 4.07B | 4.10B | 3.60B | 3.04B | 2.36B | 2.45B | 2.30B | 2.16B | 2.01B | 1.78B | 1.80B | 2.03B | 2.00B |

| Cost & Expenses | 15.82B | 14.25B | 13.43B | 11.49B | 12.78B | 12.30B | 8.63B | 9.25B | 8.69B | 7.98B | 7.61B | 7.73B | 6.82B | 5.54B | 4.35B | 4.45B | 4.17B | 3.92B | 3.60B | 3.19B | 3.08B | 3.39B | 3.38B |

| Interest Income | 422.00M | 176.56M | 78.72M | 82.29M | 109.35M | 91.74M | 63.66M | 68.71M | 47.46M | 19.00M | 16.00M | 17.00M | 31.00M | 111.00M | 24.00M | 127.00M | 161.00M | 89.00M | 62.00M | 21.00M | 5.00M | 5.00M | 14.00M |

| Interest Expense | 444.00M | 290.74M | 231.95M | 213.16M | 194.41M | 155.65M | 61.76M | 64.61M | 58.11M | 47.00M | 46.00M | 38.00M | 30.00M | 292.00M | 161.00M | 228.00M | 114.00M | 58.00M | 57.00M | 17.00M | 28.00M | 41.00M | 60.00M |

| Depreciation & Amortization | 1.43B | 1.29B | 1.28B | 1.51B | 1.51B | 832.86M | 510.25M | 575.30M | 522.03M | 502.00M | 431.00M | 383.00M | 334.00M | 291.00M | 239.00M | 224.00M | 174.00M | 144.00M | 134.00M | 145.00M | 151.00M | 228.00M | 133.00M |

| EBITDA | 6.53B | 6.19B | 5.43B | 3.04B | 2.88B | 2.96B | 2.34B | 2.24B | 2.56B | 2.25B | 2.75B | 2.80B | 2.17B | 1.86B | 1.10B | 1.32B | 1.45B | 1.69B | 1.42B | 1.47B | 481.00M | 744.00M | 629.00M |

| EBITDA Ratio | 31.68% | 32.32% | 30.89% | 23.35% | 21.79% | 20.49% | 22.36% | 20.52% | 23.84% | 23.95% | 27.41% | 28.29% | 25.05% | 26.96% | 21.19% | 24.40% | 27.49% | 34.99% | 33.03% | 40.13% | 14.25% | 20.38% | 16.30% |

| Operating Income | 4.79B | 4.90B | 4.15B | 1.54B | 1.63B | 2.12B | 1.83B | 1.67B | 2.03B | 2.67B | 2.43B | 2.43B | 2.05B | 1.36B | 830.00M | 968.00M | 1.12B | 916.00M | 741.00M | 561.00M | 296.00M | 259.00M | 482.00M |

| Operating Income Ratio | 23.25% | 25.59% | 23.61% | 11.80% | 11.34% | 14.72% | 17.49% | 15.25% | 18.97% | 25.65% | 24.21% | 23.90% | 23.09% | 19.66% | 16.04% | 17.87% | 21.13% | 18.98% | 17.20% | 15.28% | 8.77% | 7.09% | 12.49% |

| Total Other Income/Expenses | -139.00M | -273.00M | -810.00M | 37.00M | -365.00M | 1.23B | -191.00M | -18.00M | -21.00M | -731.00M | 67.00M | -51.00M | -244.00M | -80.00M | -133.00M | -98.00M | 48.00M | 571.00M | 491.00M | 750.00M | 6.00M | 216.00M | -46.00M |

| Income Before Tax | 4.66B | 4.53B | 3.06B | 1.49B | 1.20B | 1.81B | 1.61B | 1.64B | 2.00B | 1.71B | 2.49B | 2.38B | 1.80B | 1.28B | 697.00M | 870.00M | 1.17B | 1.49B | 1.23B | 1.31B | 302.00M | 475.00M | 436.00M |

| Income Before Tax Ratio | 22.58% | 23.64% | 17.39% | 11.43% | 8.29% | 12.58% | 15.38% | 15.07% | 18.63% | 16.38% | 24.88% | 23.40% | 20.34% | 18.50% | 13.47% | 16.06% | 22.04% | 30.81% | 28.60% | 35.71% | 8.95% | 13.01% | 11.30% |

| Income Tax Expense | 837.00M | 812.73M | 518.48M | 224.07M | 270.35M | 392.72M | 410.48M | 369.18M | 358.35M | 369.00M | 415.00M | 370.00M | 264.00M | 196.00M | 94.00M | 133.00M | 194.00M | 158.00M | 136.00M | 97.00M | 64.00M | 50.00M | 107.00M |

| Net Income | 2.36B | 313.00M | 2.07B | 1.30B | 933.00M | 2.78B | 1.22B | 1.21B | 1.54B | 1.33B | 2.07B | 2.01B | 1.54B | 1.09B | 599.00M | 1.08B | 1.57B | 1.33B | 1.09B | 1.21B | 320.00M | 728.00M | 608.00M |

| Net Income Ratio | 11.46% | 1.63% | 11.80% | 9.98% | 6.47% | 19.31% | 11.67% | 11.08% | 14.34% | 12.81% | 20.67% | 19.83% | 17.41% | 15.82% | 11.57% | 19.84% | 29.58% | 27.51% | 25.39% | 33.02% | 9.48% | 19.94% | 15.75% |

| EPS | 4.08 | 6.89 | 4.31 | 2.30 | 1.65 | 4.93 | 2.16 | 2.15 | 2.72 | 2.37 | 3.73 | 3.66 | 3.66 | 0.20 | 0.11 | 0.19 | 0.28 | 0.24 | 0.20 | 0.22 | 0.06 | 0.13 | 0.11 |

| EPS Diluted | 4.08 | 6.80 | 4.26 | 2.30 | 1.65 | 4.93 | 2.16 | 2.14 | 2.72 | 2.36 | 3.70 | 3.60 | 3.60 | 0.19 | 0.11 | 0.19 | 0.28 | 0.23 | 0.20 | 0.22 | 0.06 | 0.13 | 0.11 |

| Weighted Avg Shares Out | 579.37M | 576.68M | 574.36M | 566.64M | 566.83M | 565.05M | 565.80M | 565.16M | 565.87M | 566.34M | 563.66M | 559.94M | 559.94M | 551.30M | 553.00M | 559.50M | 561.10M | 561.40M | 553.20M | 547.90M | 550.20M | 728.00M | 558.30M |

| Weighted Avg Shares Out (Dil) | 579.40M | 576.70M | 574.40M | 566.60M | 566.80M | 565.10M | 565.80M | 565.10M | 565.90M | 566.30M | 563.60M | 560.00M | 560.00M | 566.10M | 559.50M | 561.00M | 569.10M | 569.80M | 560.90M | 554.80M | 553.30M | 728.00M | 574.20M |

Are Retail-Wholesale Stocks Lagging Compagnie Financiere Richemont (CFRUY) This Year?

Is Compagnie Financiere Richemont (CFRUY) Stock Outpacing Its Retail-Wholesale Peers This Year?

Richemont: The Luxury Holding Is Increasingly Earning Its Premium Due To Strong Results

Compagnie Financière Richemont SA (CFRHF) Q4 2023 Earnings Call Transcript

Are Retail-Wholesale Stocks Lagging Compagnie Financiere Richemont (CFRUY) This Year?

5 Ways to Play a Rally in Foreign Stocks

SIG or CFRUY: Which Is the Better Value Stock Right Now?

SIG vs. CFRUY: Which Stock Is the Better Value Option?

Luxury stocks rally from China reopening, but world's largest luxury market may choose to shop 'in-house'

Compagnie Financiere Richemont AG (CFRUY) is a Great Momentum Stock: Should You Buy?

Source: https://incomestatements.info

Category: Stock Reports