See more : China East Education Holdings Limited (0667.HK) Income Statement Analysis – Financial Results

Complete financial analysis of Cornerstone Strategic Value Fund, Inc. (CLM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Cornerstone Strategic Value Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- Consilium Acquisition Corp I, Ltd. (CSLMU) Income Statement Analysis – Financial Results

- Manolete Partners Plc (MANO.L) Income Statement Analysis – Financial Results

- Tsui Wah Holdings Limited (1314.HK) Income Statement Analysis – Financial Results

- Condor Hospitality Trust, Inc. (CDOR) Income Statement Analysis – Financial Results

- Nathan’s Famous, Inc. (NATH) Income Statement Analysis – Financial Results

Cornerstone Strategic Value Fund, Inc. (CLM)

Industry: Asset Management

Sector: Financial Services

About Cornerstone Strategic Value Fund, Inc.

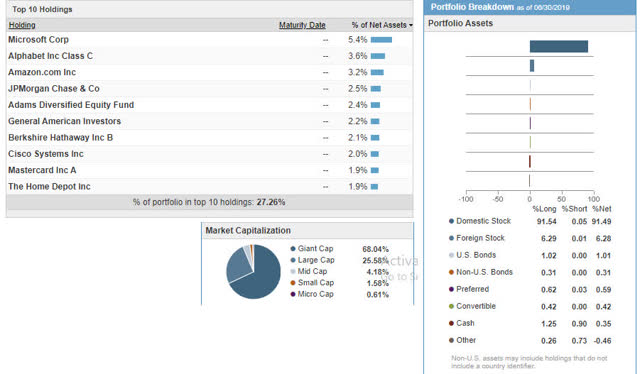

Cornerstone Strategic Value Fund, Inc. is a closed-ended equity mutual fund launched and managed by Cornerstone Advisors, Inc. The fund invests in public equity markets across the globe. It seeks to invest in stocks of companies operating across diversified sectors. The fund primarily invests in value and growth stocks of companies. It also invests through other closed-end investment companies and ETF's. Cornerstone Strategic Value Fund, Inc. was formed on May 1, 1987 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 394.84M | -249.16M | 204.38M | 104.37M | 204.16M | -57.16M | 99.93M | 32.26M | -22.06M | 20.07M | 21.88M | 12.02M | 1.47M | 6.16M |

| Cost of Revenue | 268.36M | 13.99M | 11.10M | 7.92M | 8.60M | 7.67M | 4.64M | 3.26M | 2.65M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 126.47M | -263.15M | 193.28M | 96.45M | 195.56M | -64.83M | 95.29M | 29.00M | -24.71M | 20.07M | 21.88M | 12.02M | 1.47M | 6.16M |

| Gross Profit Ratio | 32.03% | 105.61% | 94.57% | 92.41% | 95.79% | 113.41% | 95.36% | 89.91% | 112.03% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | -4.75 | 1.89 | 1.46 | 3.63 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.54M | 1.37M | 1.17M | 995.29K | 1.12M | 980.91K | 851.14K | 740.21K | 541.86K | 555.86K | 345.49K | 332.07K | 312.51K | 370.30K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.54M | 1.37M | 1.17M | 995.29K | 1.12M | 980.91K | 851.14K | 740.21K | 541.86K | 555.86K | 345.49K | 332.07K | 312.51K | 370.30K |

| Other Expenses | 0.00 | 40.44K | 40.14K | 35.23K | -95.99K | 38.35K | 34.80K | 37.60K | 33.44K | 24.85K | 21.92K | 21.14K | 18.43K | 16.81K |

| Operating Expenses | 394.84M | 1.41M | 1.21M | 1.03M | 1.02M | 1.02M | 885.94K | 777.80K | 575.30K | 580.70K | 367.41K | 353.21K | 330.94K | 387.11K |

| Cost & Expenses | 394.84M | 1.41M | 1.21M | 1.03M | 1.02M | 1.02M | 885.94K | 777.80K | 575.30K | 580.70K | 367.41K | 353.21K | 330.94K | 387.11K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 0.00 | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 52.52K | 22.82K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | 393.25M | -250.57M | 203.17M | 103.34M | 203.14M | -58.18M | 99.04M | 31.48M | -22.85M | 19.49M | 21.51M | 11.67M | 1.14M | 5.78M |

| EBITDA Ratio | 99.60% | 100.57% | 99.41% | 99.01% | 99.50% | 101.78% | 99.11% | 97.59% | 103.61% | 97.11% | 98.32% | 97.06% | 77.54% | 93.72% |

| Operating Income | 393.25M | -250.57M | 203.17M | 103.34M | 203.14M | -58.18M | 99.04M | 31.48M | -22.85M | 19.49M | 21.51M | 11.67M | 1.14M | 5.78M |

| Operating Income Ratio | 99.60% | 100.57% | 99.41% | 99.01% | 99.50% | 101.78% | 99.11% | 97.59% | 103.61% | 97.11% | 98.32% | 97.06% | 77.54% | 93.72% |

| Total Other Income/Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 393.25M | -250.57M | 203.17M | 103.34M | 203.14M | -58.18M | 99.04M | 31.48M | -22.85M | 19.49M | 21.51M | 11.67M | 1.14M | 5.78M |

| Income Before Tax Ratio | 99.60% | 100.57% | 99.41% | 99.01% | 99.50% | 101.78% | 99.11% | 97.59% | 103.61% | 97.11% | 98.32% | 97.06% | 77.54% | 93.72% |

| Income Tax Expense | 0.00 | -228.48K | -236.56K | -206.30K | -171.85K | -161.15K | -52.52K | -22.81K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 393.25M | -250.57M | 203.17M | 103.34M | 203.14M | -58.18M | 99.04M | 31.48M | -22.85M | 19.49M | 21.51M | 11.67M | 1.14M | 5.78M |

| Net Income Ratio | 99.60% | 100.57% | 99.41% | 99.01% | 99.50% | 101.78% | 99.11% | 97.59% | 103.61% | 97.11% | 98.32% | 97.06% | 77.54% | 93.72% |

| EPS | 1.77 | -1.16 | 1.87 | 1.36 | 2.76 | -0.74 | 2.80 | 1.21 | -0.99 | 2.37 | 4.11 | 3.13 | 0.31 | 2.65 |

| EPS Diluted | 1.77 | -1.16 | 1.87 | 1.36 | 2.76 | -0.74 | 2.80 | 1.21 | -0.99 | 2.37 | 4.11 | 3.13 | 0.31 | 2.65 |

| Weighted Avg Shares Out | 222.17M | 216.01M | 108.65M | 75.99M | 73.60M | 78.62M | 35.37M | 25.97M | 23.14M | 8.24M | 8.12M | 3.73M | 3.67M | 2.18M |

| Weighted Avg Shares Out (Dil) | 222.17M | 216.01M | 108.65M | 75.99M | 73.60M | 78.62M | 35.37M | 25.97M | 23.14M | 8.24M | 8.12M | 3.73M | 3.67M | 2.18M |

The Chemist's Closed-End Fund Report: July 2020

Cornerstone Strategic Value Fund: A Consistent Dividend Payer, But...

Jane Street Group LLC Invests $409,000 in Liberty Broadband Corp Series C (NASDAQ:LBRDK)

Axa Purchases 61,878 Shares of Consolidated Edison, Inc. (NYSE:ED)

Ionis Pharmaceuticals Inc (NASDAQ:IONS) Director Breaux Castleman Sells 10,000 Shares

Banks’ $370 Billion Small Business Opportunity

Susquehanna Bancshares Boosts Xilinx (NASDAQ:XLNX) Price Target to $115.00

Traders Purchase Large Volume of Telefonaktiebolaget LM Ericsson Call Options (NASDAQ:ERIC)

Guggenheim Capital LLC Has $6.07 Million Holdings in Packaging Corp Of America (NYSE:PKG)

The Reopening Killed The V-Shaped Recovery

Source: https://incomestatements.info

Category: Stock Reports