See more : Guangdong Haomei New Material Co., Ltd. (002988.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Creative Media & Community Trust Corporation (CMCTP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Creative Media & Community Trust Corporation, a leading company in the REIT – Office industry within the Real Estate sector.

- Tokyo Plast International Limited (TOKYOPLAST.BO) Income Statement Analysis – Financial Results

- Retech Technology Co., Limited (RTE.AX) Income Statement Analysis – Financial Results

- Vikalp Securities Limited (VIKALPS.BO) Income Statement Analysis – Financial Results

- Kanzhun Limited (BZ) Income Statement Analysis – Financial Results

- Acadia Realty Trust (AKR) Income Statement Analysis – Financial Results

Creative Media & Community Trust Corporation (CMCTP)

About Creative Media & Community Trust Corporation

Creative Media & Community Trust Corporation is a real estate investment trust that primarily acquires, owns, and operates Class A and creative office assets in vibrant and improving metropolitan communities throughout the United States (including improving and developing such assets). Its properties are primarily located in Los Angeles and the San Francisco Bay Area. Creative Media & Community Trust Corporation is operated by affiliates of CIM Group, L.P., a vertically-integrated owner and operator of real assets with multi-disciplinary expertise and in-house research, acquisition, credit analysis, development, finance, leasing, and onsite property management capabilities.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 119.26M | 101.91M | 90.93M | 77.21M | 139.99M | 197.72M | 236.38M | 265.93M | 268.43M | 256.15M | 14.56M | 13.53M | 16.08M | 15.46M | 16.27M | 23.12M | 27.30M | 30.68M | 25.58M | 25.36M | 14.59M | 16.04M | 17.17M | 19.78M | 22.00M | 19.31M | 13.81M | 10.15M | 6.23M | 3.70M | 100.00K |

| Cost of Revenue | 122.53M | 54.38M | 43.24M | 43.28M | 62.93M | 80.17M | 101.59M | 124.70M | 133.18M | 126.87M | 2.79M | -3.54M | 0.00 | 0.00 | 0.00 | 0.00 | 239.00K | 2.54M | 1.26M | 0.00 | 283.00K | 663.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -3.27M | 47.53M | 47.68M | 33.93M | 77.06M | 117.55M | 134.79M | 141.23M | 135.25M | 129.28M | 11.77M | 17.07M | 16.08M | 15.46M | 16.27M | 23.12M | 27.06M | 28.14M | 24.33M | 25.36M | 14.30M | 15.37M | 17.17M | 19.78M | 22.00M | 19.31M | 13.81M | 10.15M | 6.23M | 3.70M | 100.00K |

| Gross Profit Ratio | -2.74% | 46.64% | 52.44% | 43.95% | 55.05% | 59.45% | 57.02% | 53.11% | 50.39% | 50.47% | 80.84% | 126.16% | 100.00% | 100.00% | 100.00% | 100.00% | 99.12% | 91.72% | 95.09% | 100.00% | 98.06% | 95.87% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.07 | 0.02 | -0.21 | 1.60 | 0.01 | 1.59 | 0.12 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 10.75M | 10.44M | 15.87M | 16.57M | 24.66M | 33.62M | 35.73M | 41.84M | 37.69M | 32.55M | 6.90M | 6.40M | 6.34M | 6.10M | 5.97M | 8.82M | 2.72M | 2.65M | 3.30M | 1.88M | 526.00K | 255.00K | 226.00K | 146.00K | 185.00K | 182.00K | 134.00K | 117.00K | 96.03K | 100.00K | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 10.75M | 10.44M | 15.87M | 16.57M | 24.66M | 33.62M | 35.73M | 41.84M | 37.69M | 32.55M | 6.90M | 6.40M | 6.34M | 6.10M | 5.97M | 8.82M | 2.72M | 2.65M | 3.30M | 1.88M | 526.00K | 255.00K | 226.00K | 146.00K | 185.00K | 182.00K | 134.00K | 117.00K | 96.03K | 100.00K | 0.00 |

| Other Expenses | 0.00 | 20.35M | 20.11M | 21.41M | 27.37M | -938.00K | -11.86M | -340.00K | -1.38M | -1.56M | 4.03M | -3.87M | 1.24M | 641.00K | 989.00K | 439.00K | 6.51M | 8.17M | 17.36M | 15.58M | 4.74M | 11.39M | 15.10M | 19.89M | 18.57M | 12.04M | 5.02M | 4.66M | 1.02M | -500.00K | 0.00 |

| Operating Expenses | 68.84M | 30.79M | 35.99M | 37.97M | 52.03M | 86.85M | 94.09M | 113.81M | 110.05M | 101.60M | 10.93M | 14.32M | 7.58M | 6.74M | 6.96M | 9.26M | 9.22M | 10.82M | 20.66M | 17.46M | 5.26M | 11.65M | 15.33M | 20.03M | 18.76M | 12.23M | 5.15M | 4.78M | 1.11M | -400.00K | 0.00 |

| Cost & Expenses | 135.07M | 85.17M | 79.23M | 81.25M | 114.96M | 167.02M | 195.68M | 238.51M | 243.23M | 228.48M | 10.93M | 14.32M | 7.58M | 6.74M | 6.96M | 9.26M | 9.22M | 10.82M | 20.66M | 17.46M | 5.26M | 11.65M | 15.33M | 20.03M | 18.76M | 12.23M | 5.15M | 4.78M | 1.11M | -400.00K | 0.00 |

| Interest Income | 0.00 | 9.60M | 9.41M | 11.42M | 12.18M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 14.05M | 13.90M | 13.57M | 13.54M | 11.18M | 14.54M | 16.47M | 15.46M | 11.58M | 8.16M | 5.78M | 6.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 35.10M | 9.60M | 9.41M | 11.42M | 12.18M | 27.70M | 36.34M | 34.39M | 22.79M | 19.07M | 3.35M | 3.54M | 3.69M | 4.02M | 2.87M | 3.91M | 5.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 52.67M | 85.39M | 78.32M | 79.89M | 112.85M | 163.07M | 194.78M | 236.58M | 72.36M | 69.05M | -360.00K | -153.00K | -135.00K | 231.00K | -377.00K | -308.00K | 313.00K | 325.00K | 3.21M | 3.79M | 1.95M | 1.90M | 2.10M | 2.25M | 2.21M | 976.00K | 100.00K | 100.00K | -295.25K | 0.00 | 0.00 |

| EBITDA | 36.68M | 37.25M | 30.62M | 17.37M | 52.40M | 83.94M | 99.06M | 99.39M | 102.91M | 81.01M | 9.77M | -1.36M | 8.50M | 8.96M | 6.06M | 13.34M | 18.07M | 19.25M | 8.14M | 11.68M | 10.98M | 4.57M | 627.00K | -80.00K | 5.45M | 8.06M | 15.50M | 5.09M | 4.82M | 4.10M | 100.00K |

| EBITDA Ratio | 30.75% | 36.55% | 34.98% | 22.49% | 37.43% | 42.45% | 41.91% | 37.37% | 36.35% | 37.76% | 67.09% | 35.94% | 52.87% | 57.93% | 57.24% | 59.96% | 67.35% | 65.94% | 31.80% | 46.07% | 67.52% | 28.47% | 3.65% | -0.40% | 20.61% | 41.73% | 63.44% | 50.13% | 77.40% | 110.81% | 100.00% |

| Operating Income | -15.81M | 16.90M | 11.70M | -4.04M | 25.03M | 30.71M | -7.50M | -7.31M | 1.03M | 7.04M | 3.63M | -791.00K | 8.50M | 8.73M | 9.31M | 13.86M | 18.07M | 19.26M | 4.92M | 7.90M | 10.04M | 4.95M | 4.63M | 1.16M | 3.24M | 7.08M | 8.66M | 5.37M | 5.12M | 4.10M | 100.00K |

| Operating Income Ratio | -13.25% | 16.59% | 12.86% | -5.23% | 17.88% | 15.53% | -3.17% | -2.75% | 0.38% | 2.75% | 24.91% | -5.85% | 52.87% | 56.44% | 57.24% | 59.96% | 66.21% | 62.78% | 19.24% | 31.13% | 68.80% | 30.87% | 26.97% | 5.88% | 14.73% | 36.68% | 62.72% | 52.94% | 82.14% | 110.81% | 100.00% |

| Total Other Income/Expenses | -34.42M | -9.83M | -9.56M | -11.70M | 321.37M | 925.00K | 1.38M | 1.65M | -20.54M | -16.42M | 0.00 | 565.00K | -3.69M | -4.02M | -3.42M | -4.43M | -5.40M | 739.00K | 1.11M | -2.05M | -9.69M | -8.08M | 3.32M | 2.07M | 919.00K | 0.00 | 0.00 | 385.00K | 295.25K | -4.10M | -100.00K |

| Income Before Tax | -50.23M | 7.08M | 2.14M | -15.74M | 346.40M | 2.07M | 381.13M | 32.36M | 4.12M | 11.96M | 3.63M | -791.00K | 4.81M | 4.71M | 5.89M | 9.43M | 12.67M | 14.39M | 9.73M | 12.44M | 349.00K | 315.00K | 11.44M | 3.23M | 4.16M | 0.00 | 0.00 | 5.76M | 5.41M | 0.00 | 0.00 |

| Income Before Tax Ratio | -42.12% | 6.94% | 2.35% | -20.38% | 247.45% | 1.05% | 161.24% | 12.17% | 1.54% | 4.67% | 24.91% | -5.85% | 29.90% | 30.47% | 36.21% | 40.80% | 46.41% | 46.90% | 38.02% | 49.07% | 2.39% | 1.96% | 66.58% | 16.35% | 18.91% | 0.00% | 0.00% | 56.73% | 86.88% | 0.00% | 0.00% |

| Income Tax Expense | 1.23M | 1.13M | 2.99M | -722.00K | 882.00K | 925.00K | 1.38M | 1.65M | 2.52M | 6.66M | 1.21M | 565.00K | 114.00K | -131.00K | -167.00K | 319.00K | 484.00K | 649.00K | 658.00K | 116.00K | 1.15M | -5.55M | -9.59M | -9.62M | -7.02M | -4.29M | -1.73M | -1.81M | 516.95K | -3.20M | 0.00 |

| Net Income | -48.49M | 5.92M | -851.00K | -15.02M | 345.67M | 1.12M | 379.74M | 34.55M | 24.39M | 24.38M | 2.07M | -2.18M | 3.65M | 4.30M | 6.76M | 9.81M | 13.14M | 15.68M | 11.30M | 24.78M | 8.17M | 9.94M | 11.44M | 9.37M | 10.26M | 11.37M | 10.39M | 7.18M | 4.90M | 3.20M | 0.00 |

| Net Income Ratio | -40.66% | 5.81% | -0.94% | -19.45% | 246.93% | 0.57% | 160.65% | 12.99% | 9.09% | 9.52% | 14.20% | -16.11% | 22.69% | 27.79% | 41.56% | 42.42% | 48.12% | 51.13% | 44.16% | 97.72% | 56.04% | 61.96% | 66.58% | 47.36% | 46.65% | 58.89% | 75.21% | 70.72% | 78.58% | 86.49% | 0.00% |

| EPS | -3.33 | 0.26 | -0.04 | -1.02 | 22.11 | 0.08 | 16.41 | 1.14 | 0.75 | 0.75 | 0.45 | -3.09 | 5.10 | 6.15 | 9.60 | 13.65 | 18.30 | 21.90 | 15.60 | 36.60 | 19.05 | 23.10 | 26.70 | 21.60 | 23.55 | 26.25 | 24.90 | 22.65 | 21.30 | 13.95 | 0.15 |

| EPS Diluted | -3.33 | 0.26 | -0.04 | -1.02 | 19.74 | 0.08 | 16.41 | 1.14 | 0.75 | 0.75 | 0.45 | -3.09 | 5.10 | 6.10 | 9.60 | 13.65 | 18.30 | 21.90 | 15.60 | 36.60 | 19.05 | 23.10 | 26.70 | 21.60 | 23.54 | 26.23 | 24.90 | 22.65 | 21.30 | 13.95 | 0.15 |

| Weighted Avg Shares Out | 22.72M | 23.15M | 19.19M | 14.75M | 14.60M | 14.59M | 23.02M | 30.44M | 32.53M | 32.39M | 31.81M | 705.67K | 704.67K | 703.60K | 704.87K | 717.80K | 717.33K | 716.53K | 724.93K | 675.60K | 429.87K | 429.60K | 428.73K | 434.67K | 435.33K | 433.20K | 417.67K | 285.71K | 230.07K | 229.39K | 206.67K |

| Weighted Avg Shares Out (Dil) | 22.72M | 23.15M | 19.19M | 14.75M | 16.49M | 14.60M | 23.02M | 30.44M | 32.53M | 32.39M | 31.81M | 705.67K | 705.60K | 704.67K | 704.87K | 717.80K | 717.60K | 716.73K | 725.27K | 675.60K | 430.40K | 430.53K | 429.40K | 435.80K | 435.93K | 433.53K | 417.67K | 285.71K | 233.01K | 229.39K | 206.67K |

Creative Media & Community Trust Corporation (CMCT) Q3 2022 Earnings Call Transcript

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q2 2022 Results - Earnings Call Transcript

Creative Media & Community Trust Corporation (CMCT) CEO David Thompson on Q1 2022 Earnings Call Transcript

Office REITs: The New Normal

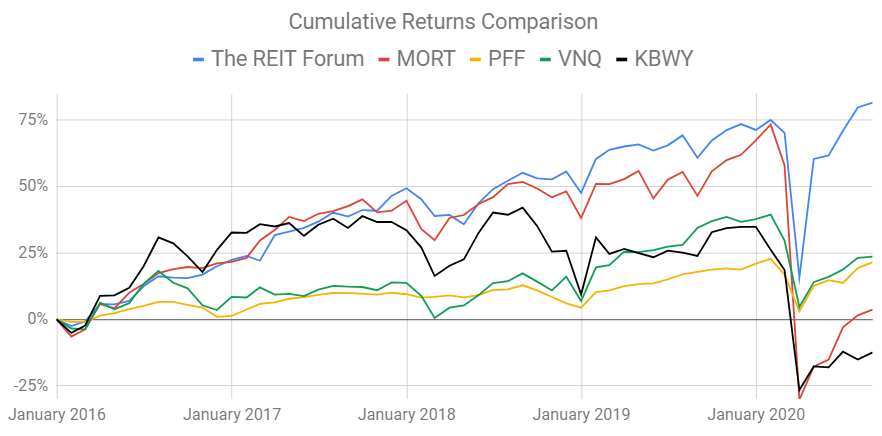

Here's Why My REITs Beat Your REITs

Source: https://incomestatements.info

Category: Stock Reports