See more : Tokyo Rakutenchi Co.,Ltd. (8842.T) Income Statement Analysis – Financial Results

Complete financial analysis of Core Molding Technologies, Inc. (CMT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Core Molding Technologies, Inc., a leading company in the Chemicals – Specialty industry within the Basic Materials sector.

- Wake Up Now, Inc. (WORC) Income Statement Analysis – Financial Results

- Orsero S.p.A. (ORS.MI) Income Statement Analysis – Financial Results

- Pharmacolog i Uppsala AB (publ) (PHLOG-B.ST) Income Statement Analysis – Financial Results

- Nitin Spinners Limited (NITINSPIN.BO) Income Statement Analysis – Financial Results

- ACE Convergence Acquisition Corp. (ACEVU) Income Statement Analysis – Financial Results

Core Molding Technologies, Inc. (CMT)

About Core Molding Technologies, Inc.

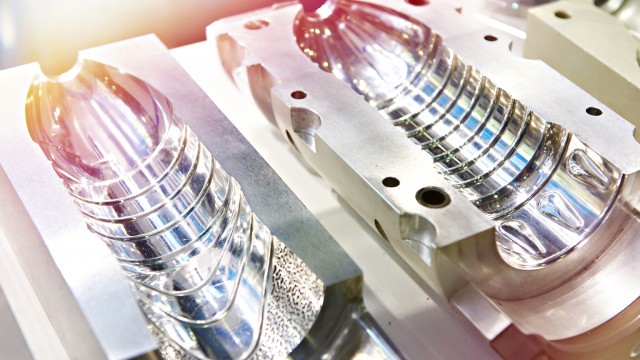

Core Molding Technologies, Inc., together with its subsidiaries, operates as a molder of thermoplastic and thermoset structural products. The company offers a range of manufacturing processes that include compression molding of sheet molding compound, resin transfer molding, liquid molding of dicyclopentadiene, spray-up and hand-lay-up, direct long-fiber thermoplastics, and structural foam and structural web injection molding. It serves various markets, including medium and heavy-duty truck, automobile, power sport, construction, agriculture, building products, and other commercial markets in the United States, Mexico, Canada, and internationally. The company was formerly known as Core Materials Corporation and changed its name to Core Molding Technologies, Inc. in August 2002. Core Molding Technologies, Inc. was incorporated in 1996 and is headquartered in Columbus, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 357.74M | 377.38M | 307.48M | 222.36M | 284.29M | 269.49M | 161.67M | 174.88M | 199.07M | 175.20M | 144.13M | 162.45M | 143.42M | 100.26M | 83.34M | 116.65M | 122.71M | 162.33M | 130.54M | 111.85M | 92.78M | 94.09M | 68.37M | 83.55M | 90.60M | 77.70M | 64.90M |

| Cost of Revenue | 293.22M | 324.97M | 266.14M | 187.88M | 262.78M | 242.34M | 136.99M | 146.96M | 162.82M | 145.02M | 120.55M | 136.60M | 113.54M | 83.91M | 71.91M | 95.45M | 105.74M | 132.46M | 107.06M | 94.54M | 78.89M | 80.27M | 60.53M | 69.96M | 78.29M | 60.70M | 48.80M |

| Gross Profit | 64.52M | 52.40M | 41.34M | 34.47M | 21.51M | 27.14M | 24.68M | 27.92M | 36.25M | 30.19M | 23.57M | 25.85M | 29.88M | 16.35M | 11.43M | 21.21M | 16.97M | 29.87M | 23.48M | 17.31M | 13.90M | 13.82M | 7.83M | 13.58M | 12.31M | 17.00M | 16.10M |

| Gross Profit Ratio | 18.04% | 13.89% | 13.45% | 15.50% | 7.56% | 10.07% | 15.27% | 15.97% | 18.21% | 17.23% | 16.36% | 15.91% | 20.84% | 16.31% | 13.71% | 18.18% | 13.83% | 18.40% | 17.99% | 15.48% | 14.98% | 14.69% | 11.46% | 16.26% | 13.59% | 21.88% | 24.81% |

| Research & Development | 1.70M | 1.60M | 1.30M | 1.17M | 1.17M | 1.03M | 848.00K | 965.00K | 719.00K | 475.00K | 466.00K | 449.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 37.76M | 34.28M | 30.11M | 24.08M | 28.93M | 27.84M | 16.69M | 16.38M | 17.75M | 15.54M | 13.46M | 13.36M | 12.94M | 9.93M | 8.94M | 12.02M | 11.40M | 14.01M | 13.09M | 10.74M | 9.49M | 9.24M | 7.94M | 9.05M | 9.14M | 7.80M | 7.50M |

| Selling & Marketing | 0.00 | 124.00K | 162.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 37.76M | 34.40M | 30.28M | 24.08M | 28.93M | 27.84M | 16.69M | 16.38M | 17.75M | 15.54M | 13.46M | 13.36M | 12.94M | 9.93M | 8.94M | 12.02M | 11.40M | 14.01M | 13.09M | 10.74M | 9.49M | 9.24M | 7.94M | 9.05M | 9.14M | 7.80M | 7.50M |

| Other Expenses | -1.48M | 124.00K | 162.00K | 80.00K | 94.00K | 48.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.67M | 1.45M | 1.50M | 2.00M |

| Operating Expenses | 37.98M | 34.40M | 30.28M | 24.08M | 28.93M | 27.84M | 16.69M | 16.38M | 17.75M | 15.54M | 13.46M | 13.36M | 12.94M | 9.93M | 8.94M | 12.02M | 11.40M | 14.01M | 13.09M | 10.74M | 9.49M | 9.24M | 7.94M | 10.72M | 10.59M | 9.30M | 9.50M |

| Cost & Expenses | 331.20M | 359.37M | 296.42M | 211.97M | 291.72M | 270.18M | 153.68M | 163.34M | 180.57M | 160.56M | 134.01M | 149.96M | 126.48M | 93.84M | 80.85M | 107.47M | 117.14M | 146.47M | 120.15M | 105.27M | 88.38M | 89.51M | 68.47M | 80.68M | 88.88M | 70.00M | 58.30M |

| Interest Income | 0.00 | 1.96M | 2.31M | 5.34M | 4.14M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 542.17K | 645.12K | 226.20K | 6.58K | 87.51K | 132.92K | 305.00K | 339.51K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.01M | 1.96M | 2.31M | 5.92M | 4.14M | 2.39M | 245.00K | 298.00K | 330.00K | 122.00K | 214.00K | 334.00K | 696.00K | 1.34M | 951.05K | 689.14K | 717.16K | 488.31K | 750.76K | 872.30K | 1.85M | 2.03M | 2.00M | 1.97M | 0.00 | 1.70M | 0.00 |

| Depreciation & Amortization | 12.83M | 11.88M | 11.62M | 11.66M | 10.38M | 9.38M | 6.24M | 6.28M | 6.04M | 5.02M | 4.88M | 4.52M | 3.94M | 3.95M | 3.86M | 3.54M | 3.41M | 2.07M | 1.80M | 1.65M | 1.71M | 1.64M | 1.60M | 1.67M | 1.45M | 1.50M | 2.00M |

| EBITDA | 39.67M | 30.41M | 22.85M | 20.93M | -1.13M | 6.17M | 14.80M | 17.74M | 24.54M | 19.67M | 14.99M | 17.02M | 20.89M | 10.37M | 6.34M | 12.73M | 9.52M | 17.92M | 12.20M | 8.22M | 6.11M | 6.22M | 1.48M | 4.53M | 3.17M | 9.20M | 8.64M |

| EBITDA Ratio | 11.09% | 7.95% | 7.43% | 9.95% | -2.58% | -0.24% | 4.94% | 6.60% | 9.29% | 8.36% | 7.17% | 10.47% | 14.56% | 10.34% | 7.61% | 10.92% | 7.32% | 11.04% | 9.34% | 7.35% | 6.59% | 6.08% | 2.18% | 5.42% | 3.49% | 11.45% | 12.94% |

| Operating Income | 26.54M | 18.00M | 11.07M | 10.39M | -7.43M | -3.10M | 7.99M | 11.55M | 18.50M | 14.65M | 10.11M | 12.49M | 16.94M | 6.42M | 2.49M | 9.19M | 5.57M | 15.86M | 10.39M | 6.57M | 4.40M | 4.58M | -108.00K | 2.86M | 1.72M | 7.70M | 6.60M |

| Operating Income Ratio | 7.42% | 4.77% | 3.60% | 4.67% | -2.61% | -1.15% | 4.94% | 6.60% | 9.29% | 8.36% | 7.02% | 7.69% | 11.81% | 6.40% | 2.98% | 7.88% | 4.54% | 9.77% | 7.96% | 5.88% | 4.75% | 4.87% | -0.16% | 3.43% | 1.90% | 9.91% | 10.17% |

| Total Other Income/Expenses | -791.00K | -3.42M | -2.15M | -5.84M | -4.05M | -2.35M | -196.00K | -280.00K | -330.00K | -122.00K | -241.00K | -338.00K | -696.00K | -1.34M | -951.05K | -689.14K | -175.00K | 156.81K | -524.56K | -865.71K | -1.76M | -1.39M | -1.69M | -1.63M | -1.59M | -1.40M | -2.04M |

| Income Before Tax | 25.75M | 14.59M | 8.92M | 4.55M | -15.58M | -5.45M | 7.75M | 11.25M | 18.17M | 14.53M | 9.90M | 12.16M | 16.25M | 5.08M | 1.53M | 8.50M | 5.39M | 16.01M | 9.87M | 5.71M | 2.64M | 3.19M | -1.80M | 1.23M | 128.98K | 6.30M | 4.60M |

| Income Before Tax Ratio | 7.20% | 3.86% | 2.90% | 2.04% | -5.48% | -2.02% | 4.79% | 6.43% | 9.13% | 8.29% | 6.87% | 7.48% | 11.33% | 5.06% | 1.84% | 7.29% | 4.40% | 9.86% | 7.56% | 5.10% | 2.84% | 3.39% | -2.64% | 1.47% | 0.14% | 8.11% | 7.09% |

| Income Tax Expense | 5.42M | 2.38M | 4.25M | -3.62M | -355.00K | -664.00K | 2.29M | 3.84M | 6.12M | 4.89M | 3.03M | 3.97M | 5.72M | 2.64M | 516.74K | 2.86M | 1.67M | 5.60M | 3.58M | 571.29K | 973.35K | 1.18M | 58.00K | 515.63K | 57.64K | 2.60M | 1.90M |

| Net Income | 20.32M | 12.20M | 4.67M | 8.17M | -15.22M | -4.78M | 5.46M | 7.41M | 12.05M | 9.63M | 6.87M | 8.19M | 10.53M | 2.43M | 1.02M | 5.64M | 3.73M | 10.41M | 6.29M | 5.13M | 1.67M | 2.01M | -1.86M | 715.35K | 71.34K | 3.70M | 2.70M |

| Net Income Ratio | 5.68% | 3.23% | 1.52% | 3.67% | -5.35% | -1.77% | 3.38% | 4.24% | 6.05% | 5.50% | 4.76% | 5.04% | 7.34% | 2.43% | 1.22% | 4.84% | 3.04% | 6.41% | 4.82% | 4.59% | 1.79% | 2.13% | -2.72% | 0.86% | 0.08% | 4.76% | 4.16% |

| EPS | 2.37 | 1.44 | 0.55 | 0.98 | -1.94 | -0.62 | 0.71 | 0.97 | 1.59 | 1.28 | 0.95 | 1.15 | 1.51 | 0.36 | 0.16 | 0.84 | 0.43 | 1.03 | 0.63 | 0.53 | 0.17 | 0.21 | -0.19 | 0.07 | 0.01 | 0.38 | 0.29 |

| EPS Diluted | 2.31 | 1.44 | 0.55 | 0.98 | -1.94 | -0.62 | 0.70 | 0.97 | 1.58 | 1.28 | 0.92 | 1.11 | 1.44 | 0.34 | 0.16 | 0.81 | 0.41 | 1.00 | 0.60 | 0.52 | 0.17 | 0.21 | -0.19 | 0.07 | 0.01 | 0.37 | 0.28 |

| Weighted Avg Shares Out | 8.55M | 8.36M | 8.06M | 7.94M | 7.83M | 7.71M | 7.69M | 7.62M | 7.58M | 7.51M | 7.22M | 7.10M | 6.95M | 6.85M | 6.77M | 6.74M | 8.69M | 10.08M | 9.91M | 9.78M | 9.78M | 9.78M | 9.78M | 10.22M | 9.78M | 9.71M | 9.31M |

| Weighted Avg Shares Out (Dil) | 8.77M | 8.37M | 8.06M | 7.94M | 7.83M | 7.75M | 7.75M | 7.66M | 7.62M | 7.55M | 7.44M | 7.38M | 7.30M | 7.07M | 6.82M | 6.99M | 9.00M | 10.39M | 10.41M | 9.82M | 9.78M | 9.78M | 9.78M | 10.22M | 9.82M | 9.98M | 9.64M |

Core Molding Technologies to Participate in the 36th Annual

Core Molding Technologies to Participate in the 36th Annual Roth Conference

Core Molding Technologies, Inc. (CMT) Q4 2023 Earnings Call Transcript

Core Molding Technologies Reports Full Year and Fourth Quarter 2023 Results

Core Molding Technologies Announces $7,500,000 Stock Repurchase Program

Core Molding Technologies Announces Timing of Fourth Quarter and Fiscal Year 2023 Results

Core Molding Technologies: Beneficial Feedback Loop Builds Foundation For Diversification

Core Molding Technologies Presenting at the 15th Annual Southwest IDEAS Investor Conference on November 16th in Dallas, TX

Core Molding Technologies Reports Fiscal 2023 Third Quarter Results

Core Molding Technologies Announces Timing of Third Quarter Fiscal 2023 Results

Source: https://incomestatements.info

Category: Stock Reports