See more : United Corporations Limited (UCPLF) Income Statement Analysis – Financial Results

Complete financial analysis of Core Molding Technologies, Inc. (CMT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Core Molding Technologies, Inc., a leading company in the Chemicals – Specialty industry within the Basic Materials sector.

- Global Cord Blood Corporation (CO) Income Statement Analysis – Financial Results

- Stanmore Resources Limited (STMRF) Income Statement Analysis – Financial Results

- Almuneef Company for Trade, Industry, Agriculture and Contracting (9569.SR) Income Statement Analysis – Financial Results

- United Fiber Optic Communication Inc. (4903.TWO) Income Statement Analysis – Financial Results

- Maternus-Kliniken Aktiengesellschaft (MAK.DE) Income Statement Analysis – Financial Results

Core Molding Technologies, Inc. (CMT)

About Core Molding Technologies, Inc.

Core Molding Technologies, Inc., together with its subsidiaries, operates as a molder of thermoplastic and thermoset structural products. The company offers a range of manufacturing processes that include compression molding of sheet molding compound, resin transfer molding, liquid molding of dicyclopentadiene, spray-up and hand-lay-up, direct long-fiber thermoplastics, and structural foam and structural web injection molding. It serves various markets, including medium and heavy-duty truck, automobile, power sport, construction, agriculture, building products, and other commercial markets in the United States, Mexico, Canada, and internationally. The company was formerly known as Core Materials Corporation and changed its name to Core Molding Technologies, Inc. in August 2002. Core Molding Technologies, Inc. was incorporated in 1996 and is headquartered in Columbus, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 357.74M | 377.38M | 307.48M | 222.36M | 284.29M | 269.49M | 161.67M | 174.88M | 199.07M | 175.20M | 144.13M | 162.45M | 143.42M | 100.26M | 83.34M | 116.65M | 122.71M | 162.33M | 130.54M | 111.85M | 92.78M | 94.09M | 68.37M | 83.55M | 90.60M | 77.70M | 64.90M |

| Cost of Revenue | 293.22M | 324.97M | 266.14M | 187.88M | 262.78M | 242.34M | 136.99M | 146.96M | 162.82M | 145.02M | 120.55M | 136.60M | 113.54M | 83.91M | 71.91M | 95.45M | 105.74M | 132.46M | 107.06M | 94.54M | 78.89M | 80.27M | 60.53M | 69.96M | 78.29M | 60.70M | 48.80M |

| Gross Profit | 64.52M | 52.40M | 41.34M | 34.47M | 21.51M | 27.14M | 24.68M | 27.92M | 36.25M | 30.19M | 23.57M | 25.85M | 29.88M | 16.35M | 11.43M | 21.21M | 16.97M | 29.87M | 23.48M | 17.31M | 13.90M | 13.82M | 7.83M | 13.58M | 12.31M | 17.00M | 16.10M |

| Gross Profit Ratio | 18.04% | 13.89% | 13.45% | 15.50% | 7.56% | 10.07% | 15.27% | 15.97% | 18.21% | 17.23% | 16.36% | 15.91% | 20.84% | 16.31% | 13.71% | 18.18% | 13.83% | 18.40% | 17.99% | 15.48% | 14.98% | 14.69% | 11.46% | 16.26% | 13.59% | 21.88% | 24.81% |

| Research & Development | 1.70M | 1.60M | 1.30M | 1.17M | 1.17M | 1.03M | 848.00K | 965.00K | 719.00K | 475.00K | 466.00K | 449.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 37.76M | 34.28M | 30.11M | 24.08M | 28.93M | 27.84M | 16.69M | 16.38M | 17.75M | 15.54M | 13.46M | 13.36M | 12.94M | 9.93M | 8.94M | 12.02M | 11.40M | 14.01M | 13.09M | 10.74M | 9.49M | 9.24M | 7.94M | 9.05M | 9.14M | 7.80M | 7.50M |

| Selling & Marketing | 0.00 | 124.00K | 162.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 37.76M | 34.40M | 30.28M | 24.08M | 28.93M | 27.84M | 16.69M | 16.38M | 17.75M | 15.54M | 13.46M | 13.36M | 12.94M | 9.93M | 8.94M | 12.02M | 11.40M | 14.01M | 13.09M | 10.74M | 9.49M | 9.24M | 7.94M | 9.05M | 9.14M | 7.80M | 7.50M |

| Other Expenses | -1.48M | 124.00K | 162.00K | 80.00K | 94.00K | 48.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.67M | 1.45M | 1.50M | 2.00M |

| Operating Expenses | 37.98M | 34.40M | 30.28M | 24.08M | 28.93M | 27.84M | 16.69M | 16.38M | 17.75M | 15.54M | 13.46M | 13.36M | 12.94M | 9.93M | 8.94M | 12.02M | 11.40M | 14.01M | 13.09M | 10.74M | 9.49M | 9.24M | 7.94M | 10.72M | 10.59M | 9.30M | 9.50M |

| Cost & Expenses | 331.20M | 359.37M | 296.42M | 211.97M | 291.72M | 270.18M | 153.68M | 163.34M | 180.57M | 160.56M | 134.01M | 149.96M | 126.48M | 93.84M | 80.85M | 107.47M | 117.14M | 146.47M | 120.15M | 105.27M | 88.38M | 89.51M | 68.47M | 80.68M | 88.88M | 70.00M | 58.30M |

| Interest Income | 0.00 | 1.96M | 2.31M | 5.34M | 4.14M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 542.17K | 645.12K | 226.20K | 6.58K | 87.51K | 132.92K | 305.00K | 339.51K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.01M | 1.96M | 2.31M | 5.92M | 4.14M | 2.39M | 245.00K | 298.00K | 330.00K | 122.00K | 214.00K | 334.00K | 696.00K | 1.34M | 951.05K | 689.14K | 717.16K | 488.31K | 750.76K | 872.30K | 1.85M | 2.03M | 2.00M | 1.97M | 0.00 | 1.70M | 0.00 |

| Depreciation & Amortization | 12.83M | 11.88M | 11.62M | 11.66M | 10.38M | 9.38M | 6.24M | 6.28M | 6.04M | 5.02M | 4.88M | 4.52M | 3.94M | 3.95M | 3.86M | 3.54M | 3.41M | 2.07M | 1.80M | 1.65M | 1.71M | 1.64M | 1.60M | 1.67M | 1.45M | 1.50M | 2.00M |

| EBITDA | 39.67M | 30.41M | 22.85M | 20.93M | -1.13M | 6.17M | 14.80M | 17.74M | 24.54M | 19.67M | 14.99M | 17.02M | 20.89M | 10.37M | 6.34M | 12.73M | 9.52M | 17.92M | 12.20M | 8.22M | 6.11M | 6.22M | 1.48M | 4.53M | 3.17M | 9.20M | 8.64M |

| EBITDA Ratio | 11.09% | 7.95% | 7.43% | 9.95% | -2.58% | -0.24% | 4.94% | 6.60% | 9.29% | 8.36% | 7.17% | 10.47% | 14.56% | 10.34% | 7.61% | 10.92% | 7.32% | 11.04% | 9.34% | 7.35% | 6.59% | 6.08% | 2.18% | 5.42% | 3.49% | 11.45% | 12.94% |

| Operating Income | 26.54M | 18.00M | 11.07M | 10.39M | -7.43M | -3.10M | 7.99M | 11.55M | 18.50M | 14.65M | 10.11M | 12.49M | 16.94M | 6.42M | 2.49M | 9.19M | 5.57M | 15.86M | 10.39M | 6.57M | 4.40M | 4.58M | -108.00K | 2.86M | 1.72M | 7.70M | 6.60M |

| Operating Income Ratio | 7.42% | 4.77% | 3.60% | 4.67% | -2.61% | -1.15% | 4.94% | 6.60% | 9.29% | 8.36% | 7.02% | 7.69% | 11.81% | 6.40% | 2.98% | 7.88% | 4.54% | 9.77% | 7.96% | 5.88% | 4.75% | 4.87% | -0.16% | 3.43% | 1.90% | 9.91% | 10.17% |

| Total Other Income/Expenses | -791.00K | -3.42M | -2.15M | -5.84M | -4.05M | -2.35M | -196.00K | -280.00K | -330.00K | -122.00K | -241.00K | -338.00K | -696.00K | -1.34M | -951.05K | -689.14K | -175.00K | 156.81K | -524.56K | -865.71K | -1.76M | -1.39M | -1.69M | -1.63M | -1.59M | -1.40M | -2.04M |

| Income Before Tax | 25.75M | 14.59M | 8.92M | 4.55M | -15.58M | -5.45M | 7.75M | 11.25M | 18.17M | 14.53M | 9.90M | 12.16M | 16.25M | 5.08M | 1.53M | 8.50M | 5.39M | 16.01M | 9.87M | 5.71M | 2.64M | 3.19M | -1.80M | 1.23M | 128.98K | 6.30M | 4.60M |

| Income Before Tax Ratio | 7.20% | 3.86% | 2.90% | 2.04% | -5.48% | -2.02% | 4.79% | 6.43% | 9.13% | 8.29% | 6.87% | 7.48% | 11.33% | 5.06% | 1.84% | 7.29% | 4.40% | 9.86% | 7.56% | 5.10% | 2.84% | 3.39% | -2.64% | 1.47% | 0.14% | 8.11% | 7.09% |

| Income Tax Expense | 5.42M | 2.38M | 4.25M | -3.62M | -355.00K | -664.00K | 2.29M | 3.84M | 6.12M | 4.89M | 3.03M | 3.97M | 5.72M | 2.64M | 516.74K | 2.86M | 1.67M | 5.60M | 3.58M | 571.29K | 973.35K | 1.18M | 58.00K | 515.63K | 57.64K | 2.60M | 1.90M |

| Net Income | 20.32M | 12.20M | 4.67M | 8.17M | -15.22M | -4.78M | 5.46M | 7.41M | 12.05M | 9.63M | 6.87M | 8.19M | 10.53M | 2.43M | 1.02M | 5.64M | 3.73M | 10.41M | 6.29M | 5.13M | 1.67M | 2.01M | -1.86M | 715.35K | 71.34K | 3.70M | 2.70M |

| Net Income Ratio | 5.68% | 3.23% | 1.52% | 3.67% | -5.35% | -1.77% | 3.38% | 4.24% | 6.05% | 5.50% | 4.76% | 5.04% | 7.34% | 2.43% | 1.22% | 4.84% | 3.04% | 6.41% | 4.82% | 4.59% | 1.79% | 2.13% | -2.72% | 0.86% | 0.08% | 4.76% | 4.16% |

| EPS | 2.37 | 1.44 | 0.55 | 0.98 | -1.94 | -0.62 | 0.71 | 0.97 | 1.59 | 1.28 | 0.95 | 1.15 | 1.51 | 0.36 | 0.16 | 0.84 | 0.43 | 1.03 | 0.63 | 0.53 | 0.17 | 0.21 | -0.19 | 0.07 | 0.01 | 0.38 | 0.29 |

| EPS Diluted | 2.31 | 1.44 | 0.55 | 0.98 | -1.94 | -0.62 | 0.70 | 0.97 | 1.58 | 1.28 | 0.92 | 1.11 | 1.44 | 0.34 | 0.16 | 0.81 | 0.41 | 1.00 | 0.60 | 0.52 | 0.17 | 0.21 | -0.19 | 0.07 | 0.01 | 0.37 | 0.28 |

| Weighted Avg Shares Out | 8.55M | 8.36M | 8.06M | 7.94M | 7.83M | 7.71M | 7.69M | 7.62M | 7.58M | 7.51M | 7.22M | 7.10M | 6.95M | 6.85M | 6.77M | 6.74M | 8.69M | 10.08M | 9.91M | 9.78M | 9.78M | 9.78M | 9.78M | 10.22M | 9.78M | 9.71M | 9.31M |

| Weighted Avg Shares Out (Dil) | 8.77M | 8.37M | 8.06M | 7.94M | 7.83M | 7.75M | 7.75M | 7.66M | 7.62M | 7.55M | 7.44M | 7.38M | 7.30M | 7.07M | 6.82M | 6.99M | 9.00M | 10.39M | 10.41M | 9.82M | 9.78M | 9.78M | 9.78M | 10.22M | 9.82M | 9.98M | 9.64M |

Core Molding Technologies (NYSE:CMT) vs. Forward Industries (NYSE:FORD) Financial Contrast

Shin-Etsu Chemical Has Developed an Epoch-making Type of Molding Silicone Rubber That Does Not Require Post Cure

Fmr LLC Buys 4,944 Shares of Core Molding Technologies, Inc. (NYSEAMERICAN:CMT)

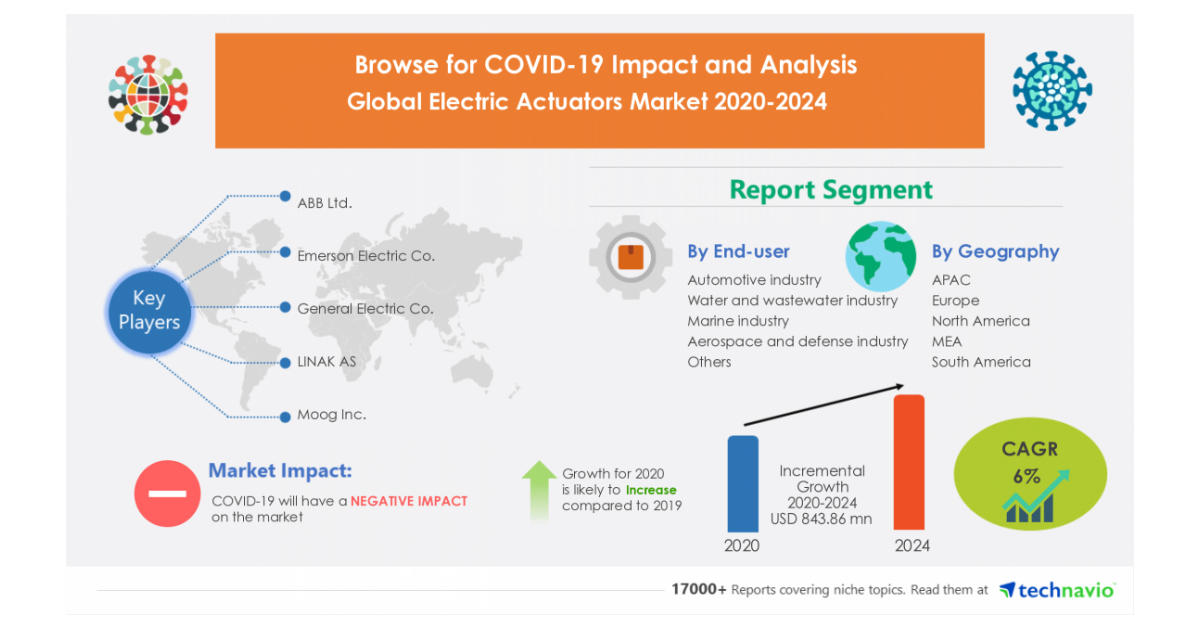

Electric Actuators Market 2020 - 2024: Post-Pandemic Industry Planning Structure | Technavio

American Biltrite (OTCMKTS:ABLT) vs. Core Molding Technologies (OTCMKTS:CMT) Critical Survey

Markets lifted by hopes of economic recovery from Covid-19 slump - business live

China's factory deflation slows in July as recovery gains strength

North Bengal death tally nears 100 mark - The Statesman

SMC cancels MoUs with 3 pvt hospitals over lack of fire safety systems, exits

China industrial output rises 4.8% year-on-year in June; retail sales, investment fall

Source: https://incomestatements.info

Category: Stock Reports