See more : Tien Liang BioTech Co., Ltd. (4127.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Capitala Finance Corp. (CPTAL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Capitala Finance Corp., a leading company in the Asset Management industry within the Financial Services sector.

- Smartvalue Co., Ltd. (9417.T) Income Statement Analysis – Financial Results

- HKS Co., Ltd. (7219.T) Income Statement Analysis – Financial Results

- Jinzisheng Holding Group (JGHG) Income Statement Analysis – Financial Results

- APA Group (APAJF) Income Statement Analysis – Financial Results

- PT Bakrie Sumatera Plantations Tbk (UNSP.JK) Income Statement Analysis – Financial Results

Capitala Finance Corp. (CPTAL)

Industry: Asset Management

Sector: Financial Services

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | -30.79M | -22.61M | -13.25M | -43.00K | 11.28M | -47.13M | -48.91M | -5.60M | 24.60M | 25.92M |

| Cost of Revenue | 0.00 | 0.00 | 244.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -30.79M | -22.61M | -13.49M | -43.00K | 11.28M | -47.13M | -48.91M | -5.60M | 24.60M | 25.92M |

| Gross Profit Ratio | 100.00% | 100.00% | 101.84% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 4.82M | 4.70M | 4.70M | 6.61M | 3.80M | 4.05M | 4.30M | 1.31M | 119.00K | 585.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 4.82M | 4.70M | 4.70M | 6.61M | 3.80M | 4.05M | 4.30M | 1.31M | 119.00K | 585.00K |

| Other Expenses | -155.00K | -288.00K | 0.00 | -958.00K | -1.67M | -1.06M | -238.00K | -333.00K | -150.00K | 0.00 |

| Operating Expenses | 4.66M | 4.41M | 4.70M | 5.65M | 2.13M | 2.99M | 4.06M | 976.00K | -31.00K | 585.00K |

| Cost & Expenses | 4.66M | 4.41M | 13.99M | 14.97M | 21.23M | 20.69M | 16.43M | 7.57M | 4.31M | 585.00K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 15.14M | 17.12M | 17.28M | 18.83M | 19.71M | 19.02M | 13.38M | 8.38M | 7.85M | 5.48M |

| Depreciation & Amortization | 206.30K | 171.86K | -33.96M | -22.99M | -18.22M | -10.42M | -23.17M | 9.37M | 36.80M | 0.00 |

| EBITDA | -20.30M | -9.90M | -659.00K | 13.13M | 28.86M | 32.87M | 9.94M | 37.24M | 57.42M | 30.81M |

| EBITDA Ratio | 65.95% | 43.77% | 4.97% | -30,534.88% | 255.81% | -69.74% | -20.31% | -665.15% | 233.43% | 118.87% |

| Operating Income | -20.30M | -9.90M | 33.31M | 36.12M | 47.08M | 43.29M | 33.10M | 27.87M | 20.63M | 30.81M |

| Operating Income Ratio | 65.95% | 43.77% | -251.42% | -84,006.98% | 417.25% | -91.85% | -67.68% | -497.73% | 83.85% | 118.87% |

| Total Other Income/Expenses | -15.14M | -17.12M | -51.25M | -41.82M | -37.93M | -29.44M | -36.54M | 990.00K | 28.94M | -5.48M |

| Income Before Tax | -35.45M | -27.02M | -17.94M | -5.70M | 9.15M | 13.85M | -3.44M | 28.86M | 49.57M | 25.34M |

| Income Before Tax Ratio | 115.14% | 119.49% | 135.44% | 13,244.19% | 81.11% | -29.39% | 7.03% | -515.41% | 201.50% | 97.74% |

| Income Tax Expense | 0.00 | 628.00K | -1.92M | 1.29M | 18.22M | 10.42M | 23.17M | -9.37M | -36.80M | 0.00 |

| Net Income | -35.45M | -27.65M | -16.03M | -6.98M | -9.06M | 3.43M | -26.61M | 38.23M | 86.37M | 25.34M |

| Net Income Ratio | 115.14% | 122.27% | 120.98% | 16,241.86% | -80.32% | -7.28% | 54.40% | -682.84% | 351.08% | 97.74% |

| EPS | -13.08 | -10.29 | -6.01 | -2.63 | -3.44 | 1.35 | -12.30 | 17.68 | 39.94 | 11.72 |

| EPS Diluted | -13.08 | -10.29 | -6.01 | -2.63 | -3.44 | 1.35 | -12.30 | 17.68 | 39.94 | 11.72 |

| Weighted Avg Shares Out | 2.71M | 2.69M | 2.67M | 2.65M | 2.64M | 2.54M | 2.16M | 2.16M | 2.16M | 2.16M |

| Weighted Avg Shares Out (Dil) | 2.71M | 2.69M | 2.67M | 2.65M | 2.64M | 2.54M | 2.16M | 2.16M | 2.16M | 2.16M |

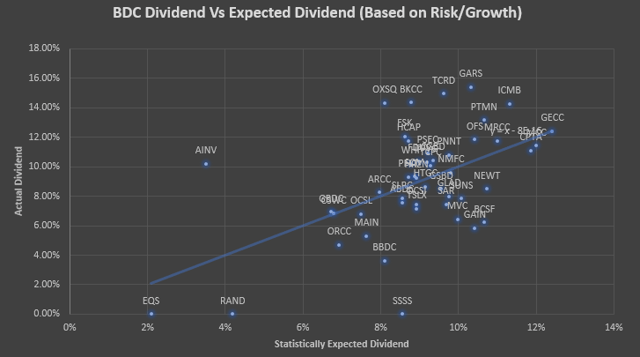

Ranking Business Development Companies From Most Undervalued To Overvalued

Source: https://incomestatements.info

Category: Stock Reports