See more : Arcee Industries Limited (ARCEEIN.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Cisco Systems, Inc. (CSCO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Cisco Systems, Inc., a leading company in the Communication Equipment industry within the Technology sector.

- BioVie Inc. (BIVI) Income Statement Analysis – Financial Results

- Nebius Group N.V. (NBIS) Income Statement Analysis – Financial Results

- Canadian Manganese Company Inc. (CDMNF) Income Statement Analysis – Financial Results

- One Media iP Group Plc (OMIP.L) Income Statement Analysis – Financial Results

- Exxaro Tiles Limited (EXXARO.NS) Income Statement Analysis – Financial Results

Cisco Systems, Inc. (CSCO)

About Cisco Systems, Inc.

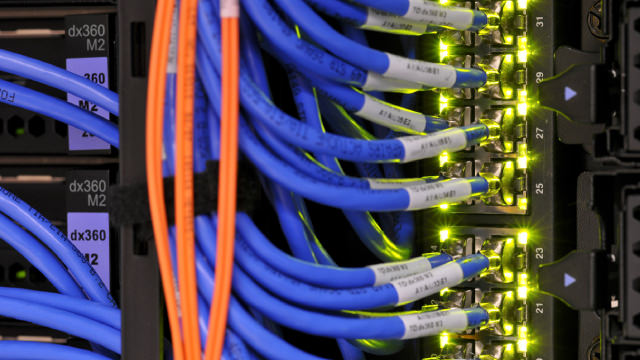

Cisco Systems, Inc. designs, manufactures, and sells Internet Protocol based networking and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. The company also offers switching portfolio encompasses campus switching as well as data center switching; enterprise routing portfolio interconnects public and private wireline and mobile networks, delivering highly secure, and reliable connectivity to campus, data center and branch networks; and wireless products include indoor and outdoor wireless coverage designed for seamless roaming use of voice, video, and data applications. In addition, it provides security, which comprising network security, identity and access management, secure access service edge, and threat intelligence, detection, and response offerings; collaboration products, such as Webex Suite, collaboration devices, contact center, and communication platform as a service; end-to-end collaboration solutions that can be delivered from the cloud, on-premise or within hybrid cloud environments allowing customers to transition their collaboration solutions from on-premise to the cloud; and observability offers network assurance, monitoring and analytics and observability suite. Further, the company offers a range of service and support options for its customers, including technical support and advanced services and advisory services. It serves businesses of various sizes, public institutions, governments, and service providers. The company sells its products and services directly, as well as through systems integrators, service providers, other resellers, and distributors. Cisco Systems, Inc. has strategic alliances with other companies. Cisco Systems, Inc. was incorporated in 1984 and is headquartered in San Jose, California.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 53.80B | 57.00B | 51.56B | 49.82B | 49.30B | 51.90B | 49.33B | 48.01B | 49.25B | 49.16B | 47.14B | 48.61B | 46.06B | 43.22B | 40.04B | 36.12B | 39.54B | 34.92B | 28.48B | 24.80B | 22.05B | 18.88B | 18.92B | 22.29B | 18.93B | 12.15B | 8.46B | 6.44B | 4.10B | 1.98B | 1.24B | 649.00M | 339.60M | 183.20M | 69.80M | 27.70M | 5.50M |

| Cost of Revenue | 18.98B | 21.25B | 19.31B | 17.92B | 17.62B | 19.24B | 18.72B | 17.78B | 18.29B | 19.48B | 19.37B | 19.17B | 17.85B | 16.68B | 14.40B | 13.02B | 14.06B | 12.59B | 9.74B | 8.13B | 6.92B | 5.65B | 6.90B | 11.22B | 6.75B | 4.24B | 2.92B | 2.24B | 1.41B | 644.15M | 382.00M | 196.90M | 104.50M | 59.50M | 22.90M | 11.50M | 2.40M |

| Gross Profit | 34.83B | 35.75B | 32.25B | 31.89B | 31.68B | 32.67B | 30.61B | 30.22B | 30.96B | 29.68B | 27.77B | 29.44B | 28.21B | 26.54B | 25.64B | 23.09B | 25.48B | 22.34B | 18.75B | 16.67B | 15.13B | 13.23B | 12.01B | 11.07B | 12.18B | 7.91B | 5.54B | 4.20B | 2.69B | 1.33B | 861.00M | 452.10M | 235.10M | 123.70M | 46.90M | 16.20M | 3.10M |

| Gross Profit Ratio | 64.73% | 62.73% | 62.55% | 64.02% | 64.26% | 62.94% | 62.04% | 62.96% | 62.87% | 60.38% | 58.91% | 60.57% | 61.24% | 61.40% | 64.04% | 63.94% | 64.45% | 63.96% | 65.82% | 67.22% | 68.61% | 70.10% | 63.51% | 49.67% | 64.36% | 65.11% | 65.51% | 65.20% | 65.58% | 67.45% | 69.27% | 69.66% | 69.23% | 67.52% | 67.19% | 58.48% | 56.36% |

| Research & Development | 7.98B | 7.55B | 6.77B | 6.55B | 6.35B | 6.58B | 6.33B | 6.06B | 6.30B | 6.21B | 6.29B | 5.94B | 5.49B | 5.82B | 5.27B | 5.27B | 5.16B | 4.58B | 4.16B | 3.35B | 3.20B | 3.14B | 3.51B | 4.78B | 4.08B | 2.07B | 1.61B | 1.21B | 399.29M | 260.58M | 88.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.81B | 2.48B | 2.10B | 2.15B | 1.93B | 1.83B | 2.14B | 1.99B | 1.81B | 2.04B | 1.93B | 2.26B | 2.32B | 1.91B | 2.00B | 1.57B | 2.01B | 1.51B | 1.17B | 959.00M | 867.00M | 702.00M | 618.00M | 778.00M | 633.00M | 418.00M | 258.25M | 204.66M | 159.77M | 76.52M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 10.36B | 9.88B | 9.09B | 9.26B | 9.17B | 9.57B | 9.24B | 9.18B | 9.62B | 9.82B | 9.50B | 9.54B | 9.65B | 9.81B | 8.72B | 8.40B | 8.38B | 7.22B | 6.03B | 4.72B | 4.53B | 4.12B | 4.26B | 5.30B | 3.95B | 2.45B | 1.56B | 1.16B | 726.28M | 354.72M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 13.18B | 12.36B | 11.19B | 11.41B | 11.09B | 11.40B | 11.39B | 11.18B | 11.43B | 11.86B | 11.44B | 11.80B | 11.97B | 11.72B | 10.72B | 9.97B | 10.39B | 8.73B | 7.20B | 5.68B | 5.40B | 4.82B | 4.88B | 6.07B | 4.58B | 2.87B | 1.82B | 1.36B | 886.05M | 431.25M | 253.30M | 174.90M | 99.00M | 54.50M | 24.40M | 9.20M | 2.50M |

| Other Expenses | 0.00 | -248.00M | 313.00M | 215.00M | 141.00M | 150.00M | 165.00M | -163.00M | -69.00M | 228.00M | 243.00M | -40.00M | 40.00M | 138.00M | 239.00M | -128.00M | -114.00M | -85.00M | -94.00M | -27.00M | 33.00M | -9.00M | -1.10B | 1.06B | 291.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 30.80M | 13.60M | 6.70M | 3.00M | 1.00M | 100.00K | 100.00K |

| Operating Expenses | 22.65B | 20.19B | 18.27B | 18.18B | 17.58B | 18.13B | 17.94B | 17.50B | 18.03B | 18.43B | 18.01B | 18.14B | 17.84B | 18.06B | 16.48B | 15.77B | 16.04B | 13.72B | 11.75B | 9.26B | 8.83B | 8.35B | 9.09B | 11.91B | 8.95B | 4.93B | 3.44B | 2.57B | 1.29B | 691.83M | 372.90M | 188.50M | 105.70M | 57.50M | 25.40M | 9.30M | 2.60M |

| Cost & Expenses | 41.62B | 41.44B | 37.58B | 36.10B | 35.20B | 37.36B | 36.66B | 35.28B | 36.32B | 37.91B | 37.38B | 37.31B | 35.69B | 34.75B | 30.88B | 28.80B | 30.10B | 26.30B | 21.49B | 17.39B | 15.75B | 14.00B | 16.00B | 23.13B | 15.69B | 9.17B | 6.35B | 4.81B | 2.70B | 1.34B | 754.90M | 385.40M | 210.20M | 117.00M | 48.30M | 20.80M | 5.00M |

| Interest Income | 1.37B | 962.00M | 476.00M | 618.00M | 920.00M | 1.31B | 1.51B | 1.34B | 1.01B | 769.00M | 691.00M | 654.00M | 650.00M | 641.00M | 635.00M | 845.00M | 1.14B | 1.09B | 755.00M | 552.00M | 512.00M | 660.00M | 895.00M | 967.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.01B | 427.00M | 360.00M | 434.00M | 585.00M | 859.00M | 943.00M | 861.00M | 676.00M | 566.00M | 564.00M | 583.00M | 596.00M | 628.00M | 623.00M | 346.00M | 319.00M | 377.00M | 148.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.51B | 1.73B | 1.96B | 1.86B | 1.81B | 1.90B | 2.19B | 2.24B | 2.08B | 2.44B | 2.43B | 2.35B | 2.60B | 2.49B | 2.03B | 1.77B | 1.74B | 1.41B | 1.29B | 1.01B | 1.44B | 1.59B | 1.96B | 2.24B | 863.00M | 486.00M | 327.33M | 212.20M | 132.59M | 58.51M | 30.80M | 13.60M | 6.70M | 3.00M | 1.00M | 100.00K | 100.00K |

| EBITDA | 15.75B | 17.47B | 16.79B | 15.56B | 16.36B | 17.33B | 16.17B | 15.38B | 15.68B | 14.21B | 12.71B | 14.16B | 12.96B | 10.94B | 12.07B | 9.71B | 12.29B | 11.25B | 9.01B | 9.05B | 7.49B | 4.88B | 4.88B | 1.40B | 4.10B | 3.47B | 2.40B | 1.84B | 1.53B | 701.45M | 518.90M | 277.15M | 136.10M | 69.20M | 22.50M | 7.00M | 600.00K |

| EBITDA Ratio | 29.27% | 31.58% | 32.59% | 33.01% | 34.17% | 34.00% | 33.51% | 33.73% | 32.52% | 29.89% | 27.85% | 29.35% | 29.66% | 27.16% | 30.14% | 25.17% | 30.89% | 31.62% | 31.42% | 33.59% | 34.38% | 37.04% | 25.78% | 11.54% | 21.65% | 28.55% | 28.68% | 26.19% | 37.44% | 35.45% | 40.02% | 40.92% | 38.10% | 35.26% | 29.23% | 24.55% | 9.09% |

| Operating Income | 12.18B | 15.03B | 13.97B | 12.83B | 13.62B | 14.22B | 12.31B | 11.97B | 12.66B | 10.77B | 9.35B | 11.20B | 10.07B | 7.67B | 9.16B | 7.32B | 9.44B | 8.62B | 7.00B | 7.42B | 6.29B | 4.88B | 2.92B | -2.00B | 3.24B | 2.98B | 2.10B | 1.63B | 1.40B | 642.94M | 488.10M | 263.60M | 129.40M | 66.20M | 21.50M | 6.90M | 500.00K |

| Operating Income Ratio | 22.64% | 26.37% | 27.09% | 25.76% | 27.63% | 27.39% | 24.95% | 24.94% | 25.71% | 21.91% | 19.82% | 23.03% | 21.85% | 17.76% | 22.89% | 20.27% | 23.88% | 24.69% | 24.56% | 29.90% | 28.54% | 25.86% | 15.43% | -8.99% | 17.09% | 24.55% | 24.88% | 25.27% | 34.20% | 32.49% | 39.27% | 40.62% | 38.10% | 36.14% | 30.80% | 24.91% | 9.09% |

| Total Other Income/Expenses | 53.00M | 287.00M | 508.00M | 429.00M | 350.00M | 352.00M | 730.00M | 314.00M | 260.00M | 431.00M | 370.00M | -115.00M | -303.00M | 151.00M | 251.00M | 371.00M | 813.00M | 840.00M | 637.00M | 594.00M | 700.00M | 131.00M | -209.00M | 1.13B | 1.11B | 219.00M | 166.65M | 263.71M | 64.02M | 95.04M | 21.40M | 11.60M | 6.70M | 4.60M | 2.00M | 100.00K | 200.00K |

| Income Before Tax | 12.23B | 15.32B | 14.48B | 13.26B | 13.97B | 14.57B | 13.04B | 12.29B | 12.92B | 11.20B | 9.72B | 11.23B | 10.16B | 7.83B | 9.42B | 7.69B | 10.26B | 9.46B | 7.63B | 8.04B | 6.99B | 5.01B | 2.71B | -874.00M | 4.34B | 3.32B | 2.30B | 1.89B | 1.46B | 679.05M | 509.50M | 275.20M | 136.10M | 70.80M | 23.50M | 7.00M | 700.00K |

| Income Before Tax Ratio | 22.74% | 26.87% | 28.08% | 26.62% | 28.34% | 28.07% | 26.43% | 25.60% | 26.24% | 22.78% | 20.61% | 23.10% | 22.06% | 18.11% | 23.51% | 21.30% | 25.94% | 27.09% | 26.80% | 32.40% | 31.72% | 26.55% | 14.33% | -3.92% | 22.94% | 27.28% | 27.22% | 29.33% | 35.76% | 34.31% | 40.99% | 42.40% | 40.08% | 38.65% | 33.67% | 25.27% | 12.73% |

| Income Tax Expense | 1.91B | 2.71B | 2.67B | 2.67B | 2.76B | 2.95B | 12.93B | 2.68B | 2.18B | 2.22B | 1.86B | 1.24B | 2.12B | 1.34B | 1.65B | 1.56B | 2.20B | 2.13B | 2.05B | 2.30B | 2.02B | 1.44B | 817.00M | 140.00M | 1.68B | 1.22B | 952.39M | 840.19M | 551.50M | 258.04M | 194.60M | 103.20M | 51.70M | 27.60M | 9.60M | 2.80M | 300.00K |

| Net Income | 10.32B | 12.61B | 11.81B | 10.59B | 11.21B | 11.62B | 110.00M | 9.61B | 10.74B | 8.98B | 7.85B | 9.98B | 8.04B | 6.49B | 7.77B | 6.13B | 8.05B | 7.33B | 5.58B | 5.74B | 4.40B | 3.58B | 1.89B | -1.01B | 2.67B | 2.10B | 1.35B | 1.05B | 913.32M | 421.01M | 314.90M | 172.00M | 84.40M | 43.20M | 13.90M | 4.20M | 400.00K |

| Net Income Ratio | 19.18% | 22.13% | 22.91% | 21.26% | 22.75% | 22.39% | 0.22% | 20.02% | 21.81% | 18.27% | 16.66% | 20.54% | 17.46% | 15.02% | 19.40% | 16.98% | 20.36% | 21.00% | 19.59% | 23.15% | 19.96% | 18.95% | 10.01% | -4.55% | 14.10% | 17.25% | 15.96% | 16.28% | 22.30% | 21.27% | 25.33% | 26.50% | 24.85% | 23.58% | 19.91% | 15.16% | 7.27% |

| EPS | 2.55 | 3.08 | 2.83 | 2.51 | 2.65 | 2.63 | 0.02 | 1.92 | 2.13 | 1.76 | 1.50 | 1.87 | 1.50 | 1.17 | 1.36 | 1.05 | 1.35 | 1.21 | 0.91 | 0.88 | 0.64 | 0.50 | 0.26 | -0.14 | 0.39 | 0.30 | 0.21 | 0.18 | 0.16 | 0.16 | 0.06 | 0.04 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 |

| EPS Diluted | 2.54 | 3.07 | 2.82 | 2.50 | 2.64 | 2.61 | 0.02 | 1.90 | 2.11 | 1.75 | 1.49 | 1.86 | 1.49 | 1.17 | 1.33 | 1.05 | 1.31 | 1.17 | 0.89 | 0.87 | 0.62 | 0.50 | 0.25 | -0.14 | 0.36 | 0.29 | 0.20 | 0.17 | 0.15 | 0.16 | 0.06 | 0.04 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 |

| Weighted Avg Shares Out | 4.04B | 4.09B | 4.17B | 4.22B | 4.24B | 4.42B | 4.84B | 5.01B | 5.05B | 5.10B | 5.23B | 5.33B | 5.37B | 5.53B | 5.73B | 5.83B | 5.99B | 6.06B | 6.16B | 6.49B | 6.84B | 7.12B | 7.30B | 7.20B | 6.92B | 6.65B | 6.31B | 5.98B | 5.75B | 2.84B | 5.37B | 4.65B | 4.22B | 4.32B | 3.85B | 3.85B | 40.00M |

| Weighted Avg Shares Out (Dil) | 4.06B | 4.11B | 4.19B | 4.24B | 4.25B | 4.45B | 4.88B | 5.05B | 5.09B | 5.15B | 5.28B | 5.38B | 5.40B | 5.56B | 5.85B | 5.86B | 6.16B | 6.27B | 6.27B | 6.61B | 7.06B | 7.22B | 7.45B | 7.20B | 7.44B | 7.06B | 6.66B | 6.26B | 5.96B | 2.84B | 5.37B | 4.65B | 4.22B | 4.32B | 3.85B | 3.85B | 40.00M |

Cisco to Participate in RBC Conference

Cisco Systems Long-Term AI Play Turns a Corner: New Highs Likely

Cisco's 'financial discipline' is 'paying off': CFO

Cisco's Q1 Results Didn't Impress The Market, But It Remains A Strong Value Play

AI Spending Remains a Focus. How Cisco Is Benefiting.

CSCO to Grow Amid "Fairly Bright" Networking Industry

Cisco CEO remains ‘as bullish as ever,' but stock continues to fall

CSCO Falls Despite Q1 Earnings Beat: Buy, Sell or Hold the Stock?

Cisco nets upgrade from Bank of American following solid first quarter

Why Wall Street Is Bullish on Cisco Stock After Earnings

Source: https://incomestatements.info

Category: Stock Reports