See more : BioMarin Pharmaceutical Inc. (BMRN) Income Statement Analysis – Financial Results

Complete financial analysis of Covanta Holding Corporation (CVA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Covanta Holding Corporation, a leading company in the Waste Management industry within the Industrials sector.

- Saratoga Investment Corp 6.00% (SAT) Income Statement Analysis – Financial Results

- CloudCoCo Group plc (CLCO.L) Income Statement Analysis – Financial Results

- Fittech Co.,Ltd (6706.TW) Income Statement Analysis – Financial Results

- Euronav NV (EURN.BR) Income Statement Analysis – Financial Results

- ClearPoint Neuro, Inc. (CLPT) Income Statement Analysis – Financial Results

Covanta Holding Corporation (CVA)

About Covanta Holding Corporation

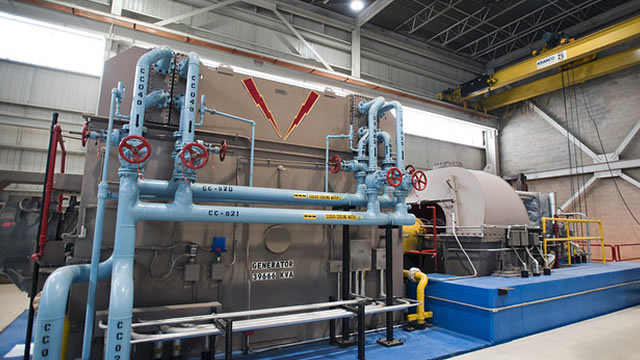

Covanta Holding Corporation, through its subsidiaries, provides waste and energy services to municipal entities primarily in the United States and Canada. It owns and operates infrastructure for the conversion of waste to energy, as well as engages in related waste transport and disposal, and other renewable energy production businesses. The company disposes waste and generates electricity and/or steam; sells metal recovered during the energy-from-waste (EfW) process; and offers waste management solutions, such as site clean-up, wastewater treatment, pharmaceutical and healthcare solutions, reverse distribution, transportation and logistics, recycling, and depackaging. As of December 31, 2019, it owned and operated 41 EfW operations, 14 transfer stations, 20 material processing facilities, four landfills, two wood waste energy projects, one regional metals recycling facility, and one ash processing facility. Covanta Holding Corporation has a strategic partnership with the Green Investment Group Limited to develop EfW projects in Ireland and the United Kingdom. The company was formerly known as Danielson Holding Corporation and changed its name to Covanta Holding Corporation in September 2005. Covanta Holding Corporation was incorporated in 1992 and is headquartered in Morristown, New Jersey.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.90B | 1.87B | 1.87B | 1.75B | 1.70B | 1.65B | 1.68B | 1.63B | 1.64B | 1.65B | 1.58B | 1.55B | 1.66B | 1.43B | 1.27B | 978.76M | 580.41M | 42.56M | 531.50M | 94.10M | 86.24M | 71.16M | 64.70M | 65.70M | 48.70M | 80.10M | 110.30M | 102.40M | 88.40M | 73.80M | 100.00K |

| Cost of Revenue | 1.42B | 1.37B | 1.32B | 1.27B | 1.18B | 1.13B | 1.06B | 993.00M | 963.00M | 1.11B | 1.06B | 946.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 484.00M | 499.00M | 547.00M | 481.00M | 522.00M | 516.00M | 627.00M | 637.00M | 681.00M | 545.00M | 518.86M | 604.30M | 1.66B | 1.43B | 1.27B | 978.76M | 580.41M | 42.56M | 531.50M | 94.10M | 86.24M | 71.16M | 64.70M | 65.70M | 48.70M | 80.10M | 110.30M | 102.40M | 88.40M | 73.80M | 100.00K |

| Gross Profit Ratio | 25.42% | 26.68% | 29.28% | 27.45% | 30.72% | 31.37% | 37.28% | 39.08% | 41.42% | 33.03% | 32.79% | 38.98% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 120.00M | 122.00M | 115.00M | 112.00M | 100.00M | 93.00M | 97.00M | 84.00M | 97.00M | 103.00M | 102.58M | 109.24M | 97.02M | 82.73M | 73.60M | 69.63M | 0.00 | 0.00 | 487.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 120.00M | 122.00M | 115.00M | 112.00M | 100.00M | 93.00M | 97.00M | 84.00M | 97.00M | 103.00M | 102.58M | 109.24M | 97.02M | 82.73M | 73.60M | 69.63M | 0.00 | 0.00 | 487.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 276.00M | 285.00M | 283.00M | 266.00M | 293.00M | 271.00M | 315.00M | 314.00M | 348.00M | 193.00M | 189.76M | 250.84M | 1.27B | 1.09B | 910.31M | 710.49M | 0.00 | 0.00 | 41.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 396.00M | 407.00M | 398.00M | 378.00M | 393.00M | 364.00M | 412.00M | 398.00M | 445.00M | 296.00M | 292.34M | 360.08M | 1.36B | 1.17B | 983.91M | 780.12M | 0.00 | 0.00 | 529.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost & Expenses | 1.82B | 1.78B | 1.72B | 1.65B | 1.57B | 1.49B | 1.47B | 1.39B | 1.41B | 1.40B | 1.36B | 1.31B | 1.36B | 1.17B | 983.91M | 780.12M | 0.00 | 0.00 | 529.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 133.00M | 143.00M | 145.00M | 147.00M | 139.00M | 134.00M | 135.00M | 131.00M | 121.00M | 98.00M | 82.84M | 86.51M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -30.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 224.00M | 221.00M | 218.00M | 215.00M | 207.00M | 198.00M | 211.00M | 210.00M | 195.00M | 193.00M | 189.76M | 202.87M | -69.87M | -97.57M | -140.37M | -104.67M | 52.80M | 400.00K | 42.40M | 1.60M | 400.00K | 700.00K | 900.00K | 900.00K | 900.00K | 2.50M | -106.40M | -99.20M | -80.40M | -73.60M | -800.00K |

| EBITDA | 311.00M | 367.00M | 486.00M | 228.00M | 364.00M | 316.00M | 359.00M | 374.00M | 456.00M | 538.00M | 357.60M | 441.07M | 231.50M | 161.55M | 144.25M | 93.98M | 86.89M | -68.83M | -20.60M | -12.73M | 1.43M | 1.96M | 3.20M | 5.50M | -7.10M | 4.80M | 3.90M | 3.20M | 8.00M | 200.00K | -700.00K |

| EBITDA Ratio | 16.33% | 19.63% | 26.02% | 13.01% | 21.42% | 19.21% | 21.34% | 22.94% | 27.74% | 32.61% | 22.60% | 28.45% | 13.91% | 11.27% | 11.37% | 9.60% | 14.97% | -161.72% | -3.88% | -13.53% | 1.66% | 2.75% | 4.95% | 8.37% | -14.58% | 5.99% | 3.54% | 3.13% | 9.05% | 0.27% | -700.00% |

| Operating Income | 88.00M | 92.00M | 149.00M | 103.00M | 129.00M | 152.00M | 215.00M | 239.00M | 236.00M | 249.00M | 226.52M | 244.23M | 301.37M | 259.12M | 284.63M | 198.65M | 580.41M | 42.56M | 2.30M | 94.10M | 86.24M | 71.16M | 64.70M | 65.70M | 48.70M | 80.10M | 110.30M | 102.40M | 88.40M | 73.80M | 100.00K |

| Operating Income Ratio | 4.62% | 4.92% | 7.98% | 5.88% | 7.59% | 9.24% | 12.78% | 14.66% | 14.36% | 15.09% | 14.32% | 15.75% | 18.11% | 18.08% | 22.44% | 20.30% | 100.00% | 100.00% | 0.43% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Total Other Income/Expenses | -138.00M | -95.00M | -32.00M | -238.00M | -115.00M | -180.00M | -211.00M | -161.00M | -102.00M | -142.00M | -170.02M | -106.79M | -69.87M | -97.57M | -140.37M | -104.67M | 0.00 | 0.00 | -34.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -50.00M | -3.00M | 117.00M | -135.00M | 14.00M | -28.00M | 4.00M | 78.00M | 134.00M | 107.00M | 56.50M | 137.44M | 231.50M | 161.55M | 144.25M | 93.98M | 0.00 | 0.00 | -32.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | -2.63% | -0.16% | 6.26% | -7.71% | 0.82% | -1.70% | 0.24% | 4.79% | 8.15% | 6.48% | 3.57% | 8.86% | 13.91% | 11.27% | 11.37% | 9.60% | 0.00% | 0.00% | -6.13% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -18.00M | -7.00M | -29.00M | -191.00M | 22.00M | -84.00M | 15.00M | 40.00M | 26.00M | 28.00M | 23.36M | 50.04M | 92.23M | 31.04M | 38.47M | 34.65M | 0.00 | 0.00 | 300.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 106.40M | 99.20M | 80.40M | 73.60M | 800.00K |

| Net Income | -28.00M | 10.00M | 152.00M | 57.00M | -4.00M | 68.00M | -2.00M | -7.00M | 114.00M | 219.00M | 61.65M | 101.65M | 139.27M | 130.51M | 105.79M | 59.33M | 34.09M | -69.23M | -33.00M | -14.33M | 1.03M | 1.26M | 2.30M | 4.60M | -8.00M | 2.30M | 3.90M | 3.20M | 8.00M | 200.00K | -700.00K |

| Net Income Ratio | -1.47% | 0.53% | 8.14% | 3.25% | -0.24% | 4.13% | -0.12% | -0.43% | 6.93% | 13.27% | 3.90% | 6.56% | 8.37% | 9.11% | 8.34% | 6.06% | 5.87% | -162.66% | -6.21% | -15.23% | 1.19% | 1.76% | 3.55% | 7.00% | -16.43% | 2.87% | 3.54% | 3.13% | 9.05% | 0.27% | -700.00% |

| EPS | -0.21 | 0.08 | 1.15 | 0.44 | -0.03 | 0.52 | -0.02 | -0.05 | 0.86 | 1.55 | 0.40 | 0.66 | 0.91 | 0.85 | 0.73 | 0.49 | 0.54 | -2.25 | -1.25 | -0.74 | 0.06 | 0.08 | 0.15 | 0.30 | -0.53 | 0.14 | 0.25 | 0.20 | 0.53 | 0.01 | -0.08 |

| EPS Diluted | -0.21 | 0.08 | 1.15 | 0.44 | -0.03 | 0.51 | -0.02 | -0.05 | 0.86 | 1.54 | 0.40 | 0.66 | 0.90 | 0.85 | 0.72 | 0.46 | 0.52 | -2.25 | -1.25 | -0.74 | 0.05 | 0.07 | 0.14 | 0.28 | -0.52 | 0.14 | 0.25 | 0.20 | 0.53 | 0.01 | -0.08 |

| Weighted Avg Shares Out | 132.00M | 133.00M | 132.00M | 130.00M | 129.00M | 132.00M | 129.00M | 129.00M | 132.00M | 141.00M | 153.00M | 153.69M | 153.35M | 152.65M | 144.92M | 121.07M | 63.14M | 30.77M | 26.30M | 19.37M | 17.17M | 15.69M | 15.33M | 15.33M | 15.09M | 16.43M | 15.60M | 16.00M | 15.09M | 14.00M | 8.75M |

| Weighted Avg Shares Out (Dil) | 132.00M | 133.00M | 132.00M | 131.00M | 129.00M | 133.00M | 130.00M | 130.00M | 133.00M | 142.00M | 154.00M | 154.99M | 154.73M | 154.00M | 146.93M | 128.97M | 65.57M | 30.77M | 26.30M | 19.37M | 20.60M | 17.93M | 16.43M | 16.43M | 15.26M | 16.43M | 15.60M | 16.00M | 15.09M | 14.00M | 8.75M |

Covanta Holding (CVA) Q4 Earnings & Revenues Beat Estimates

Covanta Holding's (CVA) CEO Mike Ranger on Q4 2020 Results - Earnings Call Transcript

Covanta (CVA) Surpasses Q4 Earnings and Revenue Estimates

Recap: Covanta Holding Q4 Earnings

Why Earnings Season Could Be Great for Covanta (CVA)

Billionaire Investor Says Buy Office And Urban REITs And Avoid Big Tech

Covanta Holding Corporation Fourth Quarter And Full Year 2020 Earnings Conference Call To Be Held On February 19, 2021

Covanta (CVA), North Hempstead Ink Deal for Waste Management

Protos Energy Recovery Facility achieves Financial Close and moves into construction

Covanta: Green Day Hopes Turn Into Boulevard Of Broken Dreams

Source: https://incomestatements.info

Category: Stock Reports