See more : Cash Converters International Limited (CCV.AX) Income Statement Analysis – Financial Results

Complete financial analysis of Covanta Holding Corporation (CVA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Covanta Holding Corporation, a leading company in the Waste Management industry within the Industrials sector.

- Sai MicroElectronics Inc. (300456.SZ) Income Statement Analysis – Financial Results

- Ediston Property Investment Company plc (EPIC.L) Income Statement Analysis – Financial Results

- EMS-CHEMIE HOLDING AG (EMSHF) Income Statement Analysis – Financial Results

- Copper Lake Resources Ltd. (WTCZF) Income Statement Analysis – Financial Results

- WUXIHYATECH Co.Ltd (688510.SS) Income Statement Analysis – Financial Results

Covanta Holding Corporation (CVA)

About Covanta Holding Corporation

Covanta Holding Corporation, through its subsidiaries, provides waste and energy services to municipal entities primarily in the United States and Canada. It owns and operates infrastructure for the conversion of waste to energy, as well as engages in related waste transport and disposal, and other renewable energy production businesses. The company disposes waste and generates electricity and/or steam; sells metal recovered during the energy-from-waste (EfW) process; and offers waste management solutions, such as site clean-up, wastewater treatment, pharmaceutical and healthcare solutions, reverse distribution, transportation and logistics, recycling, and depackaging. As of December 31, 2019, it owned and operated 41 EfW operations, 14 transfer stations, 20 material processing facilities, four landfills, two wood waste energy projects, one regional metals recycling facility, and one ash processing facility. Covanta Holding Corporation has a strategic partnership with the Green Investment Group Limited to develop EfW projects in Ireland and the United Kingdom. The company was formerly known as Danielson Holding Corporation and changed its name to Covanta Holding Corporation in September 2005. Covanta Holding Corporation was incorporated in 1992 and is headquartered in Morristown, New Jersey.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.90B | 1.87B | 1.87B | 1.75B | 1.70B | 1.65B | 1.68B | 1.63B | 1.64B | 1.65B | 1.58B | 1.55B | 1.66B | 1.43B | 1.27B | 978.76M | 580.41M | 42.56M | 531.50M | 94.10M | 86.24M | 71.16M | 64.70M | 65.70M | 48.70M | 80.10M | 110.30M | 102.40M | 88.40M | 73.80M | 100.00K |

| Cost of Revenue | 1.42B | 1.37B | 1.32B | 1.27B | 1.18B | 1.13B | 1.06B | 993.00M | 963.00M | 1.11B | 1.06B | 946.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 484.00M | 499.00M | 547.00M | 481.00M | 522.00M | 516.00M | 627.00M | 637.00M | 681.00M | 545.00M | 518.86M | 604.30M | 1.66B | 1.43B | 1.27B | 978.76M | 580.41M | 42.56M | 531.50M | 94.10M | 86.24M | 71.16M | 64.70M | 65.70M | 48.70M | 80.10M | 110.30M | 102.40M | 88.40M | 73.80M | 100.00K |

| Gross Profit Ratio | 25.42% | 26.68% | 29.28% | 27.45% | 30.72% | 31.37% | 37.28% | 39.08% | 41.42% | 33.03% | 32.79% | 38.98% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 120.00M | 122.00M | 115.00M | 112.00M | 100.00M | 93.00M | 97.00M | 84.00M | 97.00M | 103.00M | 102.58M | 109.24M | 97.02M | 82.73M | 73.60M | 69.63M | 0.00 | 0.00 | 487.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 120.00M | 122.00M | 115.00M | 112.00M | 100.00M | 93.00M | 97.00M | 84.00M | 97.00M | 103.00M | 102.58M | 109.24M | 97.02M | 82.73M | 73.60M | 69.63M | 0.00 | 0.00 | 487.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 276.00M | 285.00M | 283.00M | 266.00M | 293.00M | 271.00M | 315.00M | 314.00M | 348.00M | 193.00M | 189.76M | 250.84M | 1.27B | 1.09B | 910.31M | 710.49M | 0.00 | 0.00 | 41.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 396.00M | 407.00M | 398.00M | 378.00M | 393.00M | 364.00M | 412.00M | 398.00M | 445.00M | 296.00M | 292.34M | 360.08M | 1.36B | 1.17B | 983.91M | 780.12M | 0.00 | 0.00 | 529.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost & Expenses | 1.82B | 1.78B | 1.72B | 1.65B | 1.57B | 1.49B | 1.47B | 1.39B | 1.41B | 1.40B | 1.36B | 1.31B | 1.36B | 1.17B | 983.91M | 780.12M | 0.00 | 0.00 | 529.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 133.00M | 143.00M | 145.00M | 147.00M | 139.00M | 134.00M | 135.00M | 131.00M | 121.00M | 98.00M | 82.84M | 86.51M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -30.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 224.00M | 221.00M | 218.00M | 215.00M | 207.00M | 198.00M | 211.00M | 210.00M | 195.00M | 193.00M | 189.76M | 202.87M | -69.87M | -97.57M | -140.37M | -104.67M | 52.80M | 400.00K | 42.40M | 1.60M | 400.00K | 700.00K | 900.00K | 900.00K | 900.00K | 2.50M | -106.40M | -99.20M | -80.40M | -73.60M | -800.00K |

| EBITDA | 311.00M | 367.00M | 486.00M | 228.00M | 364.00M | 316.00M | 359.00M | 374.00M | 456.00M | 538.00M | 357.60M | 441.07M | 231.50M | 161.55M | 144.25M | 93.98M | 86.89M | -68.83M | -20.60M | -12.73M | 1.43M | 1.96M | 3.20M | 5.50M | -7.10M | 4.80M | 3.90M | 3.20M | 8.00M | 200.00K | -700.00K |

| EBITDA Ratio | 16.33% | 19.63% | 26.02% | 13.01% | 21.42% | 19.21% | 21.34% | 22.94% | 27.74% | 32.61% | 22.60% | 28.45% | 13.91% | 11.27% | 11.37% | 9.60% | 14.97% | -161.72% | -3.88% | -13.53% | 1.66% | 2.75% | 4.95% | 8.37% | -14.58% | 5.99% | 3.54% | 3.13% | 9.05% | 0.27% | -700.00% |

| Operating Income | 88.00M | 92.00M | 149.00M | 103.00M | 129.00M | 152.00M | 215.00M | 239.00M | 236.00M | 249.00M | 226.52M | 244.23M | 301.37M | 259.12M | 284.63M | 198.65M | 580.41M | 42.56M | 2.30M | 94.10M | 86.24M | 71.16M | 64.70M | 65.70M | 48.70M | 80.10M | 110.30M | 102.40M | 88.40M | 73.80M | 100.00K |

| Operating Income Ratio | 4.62% | 4.92% | 7.98% | 5.88% | 7.59% | 9.24% | 12.78% | 14.66% | 14.36% | 15.09% | 14.32% | 15.75% | 18.11% | 18.08% | 22.44% | 20.30% | 100.00% | 100.00% | 0.43% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Total Other Income/Expenses | -138.00M | -95.00M | -32.00M | -238.00M | -115.00M | -180.00M | -211.00M | -161.00M | -102.00M | -142.00M | -170.02M | -106.79M | -69.87M | -97.57M | -140.37M | -104.67M | 0.00 | 0.00 | -34.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -50.00M | -3.00M | 117.00M | -135.00M | 14.00M | -28.00M | 4.00M | 78.00M | 134.00M | 107.00M | 56.50M | 137.44M | 231.50M | 161.55M | 144.25M | 93.98M | 0.00 | 0.00 | -32.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | -2.63% | -0.16% | 6.26% | -7.71% | 0.82% | -1.70% | 0.24% | 4.79% | 8.15% | 6.48% | 3.57% | 8.86% | 13.91% | 11.27% | 11.37% | 9.60% | 0.00% | 0.00% | -6.13% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -18.00M | -7.00M | -29.00M | -191.00M | 22.00M | -84.00M | 15.00M | 40.00M | 26.00M | 28.00M | 23.36M | 50.04M | 92.23M | 31.04M | 38.47M | 34.65M | 0.00 | 0.00 | 300.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 106.40M | 99.20M | 80.40M | 73.60M | 800.00K |

| Net Income | -28.00M | 10.00M | 152.00M | 57.00M | -4.00M | 68.00M | -2.00M | -7.00M | 114.00M | 219.00M | 61.65M | 101.65M | 139.27M | 130.51M | 105.79M | 59.33M | 34.09M | -69.23M | -33.00M | -14.33M | 1.03M | 1.26M | 2.30M | 4.60M | -8.00M | 2.30M | 3.90M | 3.20M | 8.00M | 200.00K | -700.00K |

| Net Income Ratio | -1.47% | 0.53% | 8.14% | 3.25% | -0.24% | 4.13% | -0.12% | -0.43% | 6.93% | 13.27% | 3.90% | 6.56% | 8.37% | 9.11% | 8.34% | 6.06% | 5.87% | -162.66% | -6.21% | -15.23% | 1.19% | 1.76% | 3.55% | 7.00% | -16.43% | 2.87% | 3.54% | 3.13% | 9.05% | 0.27% | -700.00% |

| EPS | -0.21 | 0.08 | 1.15 | 0.44 | -0.03 | 0.52 | -0.02 | -0.05 | 0.86 | 1.55 | 0.40 | 0.66 | 0.91 | 0.85 | 0.73 | 0.49 | 0.54 | -2.25 | -1.25 | -0.74 | 0.06 | 0.08 | 0.15 | 0.30 | -0.53 | 0.14 | 0.25 | 0.20 | 0.53 | 0.01 | -0.08 |

| EPS Diluted | -0.21 | 0.08 | 1.15 | 0.44 | -0.03 | 0.51 | -0.02 | -0.05 | 0.86 | 1.54 | 0.40 | 0.66 | 0.90 | 0.85 | 0.72 | 0.46 | 0.52 | -2.25 | -1.25 | -0.74 | 0.05 | 0.07 | 0.14 | 0.28 | -0.52 | 0.14 | 0.25 | 0.20 | 0.53 | 0.01 | -0.08 |

| Weighted Avg Shares Out | 132.00M | 133.00M | 132.00M | 130.00M | 129.00M | 132.00M | 129.00M | 129.00M | 132.00M | 141.00M | 153.00M | 153.69M | 153.35M | 152.65M | 144.92M | 121.07M | 63.14M | 30.77M | 26.30M | 19.37M | 17.17M | 15.69M | 15.33M | 15.33M | 15.09M | 16.43M | 15.60M | 16.00M | 15.09M | 14.00M | 8.75M |

| Weighted Avg Shares Out (Dil) | 132.00M | 133.00M | 132.00M | 131.00M | 129.00M | 133.00M | 130.00M | 130.00M | 133.00M | 142.00M | 154.00M | 154.99M | 154.73M | 154.00M | 146.93M | 128.97M | 65.57M | 30.77M | 26.30M | 19.37M | 20.60M | 17.93M | 16.43M | 16.43M | 15.26M | 16.43M | 15.60M | 16.00M | 15.09M | 14.00M | 8.75M |

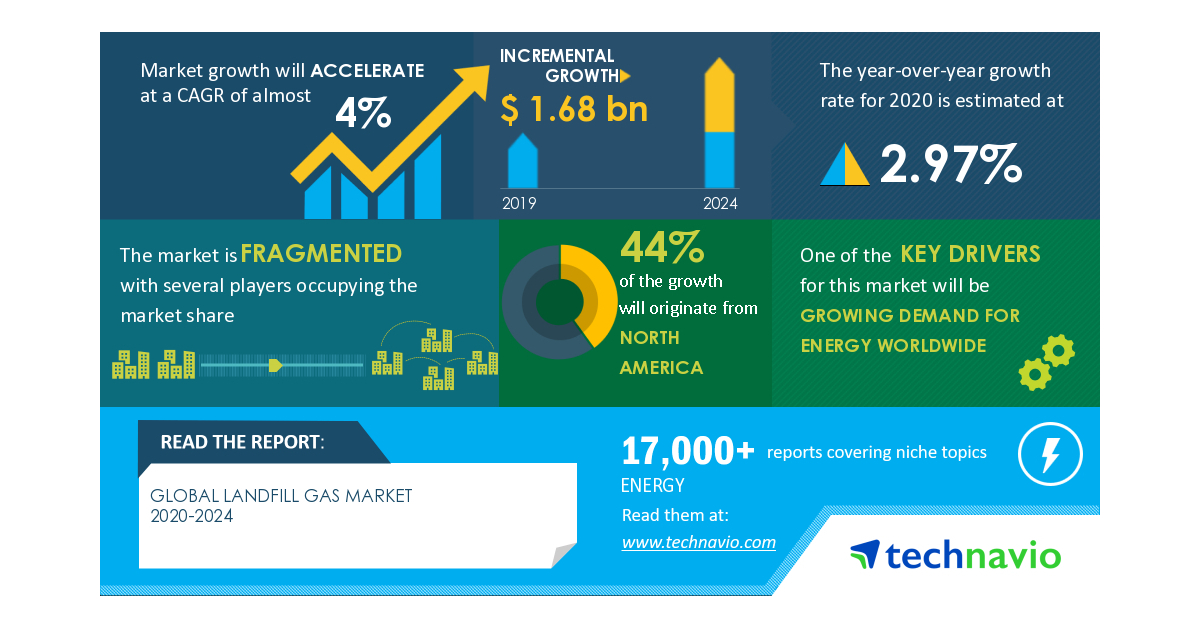

Global Landfill Gas Market 2020-2024 | Growing Demand for Energy Worldwide to Boost Growth | Technavio

Traders Purchase Large Volume of Put Options on Covanta (NYSE:CVA)

58,120 Shares in Covanta Holding Corp (NYSE:CVA) Bought by Voloridge Investment Management LLC

Microplastics Could Power Covanta's Earnings

Worker Injured After Falling Through Roof At Covanta Plant

Covanta Holding Corp (NYSE:CVA) Announces Quarterly Dividend of $0.08

Source: https://incomestatements.info

Category: Stock Reports