See more : Alcoa Corporation (0HCB.L) Income Statement Analysis – Financial Results

Complete financial analysis of Tritium DCFC Limited (DCFC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Tritium DCFC Limited, a leading company in the Electrical Equipment & Parts industry within the Industrials sector.

- GET Holdings Limited (8100.HK) Income Statement Analysis – Financial Results

- Ta Yih Industrial Co., Ltd. (1521.TW) Income Statement Analysis – Financial Results

- Okta, Inc. (0KB7.L) Income Statement Analysis – Financial Results

- International Research Corporation Public Company Limited (IRCP.BK) Income Statement Analysis – Financial Results

- Sanrhea Technical Textiles Ltd. (SANTETX.BO) Income Statement Analysis – Financial Results

Tritium DCFC Limited (DCFC)

About Tritium DCFC Limited

Tritium DCFC Limited designs, manufactures, and supplies direct current chargers for electric vehicles in the United States, North America, Europe, the Middle East, and the Asia Pacific. The company's charging station hardware portfolio includes various standalone chargers, such as 50, 75, 175, and 350-kilowatt chargers. Its service and maintenance portfolio includes warranties, service level agreements, and spare parts. The company provides approximately 3.6 million high-power charging sessions. It serves charge point operators, automakers, electric vehicle fleets, and fuel stations, as well as retail and utility sectors. The company is based in Murarrie, Australia.

| Metric | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|

| Revenue | 184.54M | 85.82M | 56.16M | 46.97M |

| Cost of Revenue | 188.63M | 89.10M | 60.37M | 49.25M |

| Gross Profit | -4.08M | -3.28M | -4.22M | -2.28M |

| Gross Profit Ratio | -2.21% | -3.82% | -7.51% | -4.86% |

| Research & Development | 15.47M | 14.03M | 10.52M | 9.55M |

| General & Administrative | 70.80M | 72.10M | 28.60M | 21.78M |

| Selling & Marketing | 1.13M | 449.00K | 188.00K | 304.00K |

| SG&A | 71.93M | 72.74M | 29.31M | 22.31M |

| Other Expenses | 0.00 | 36.00K | 171.00K | 3.00K |

| Operating Expenses | 93.82M | 86.77M | 39.83M | 31.85M |

| Cost & Expenses | 283.66M | 175.87M | 100.21M | 81.11M |

| Interest Income | 147.00K | 7.00K | 12.00K | 18.00K |

| Interest Expense | 35.05M | 17.14M | 8.59M | 1.51M |

| Depreciation & Amortization | 2.43M | 2.20M | 2.31M | 1.31M |

| EBITDA | -83.89M | -108.57M | -51.97M | -31.63M |

| EBITDA Ratio | -45.46% | -102.37% | -74.32% | -69.89% |

| Operating Income | -99.12M | -90.05M | -44.05M | -34.14M |

| Operating Income Ratio | -53.71% | -104.93% | -78.44% | -72.68% |

| Total Other Income/Expenses | -22.25M | -38.85M | -19.03M | -307.00K |

| Income Before Tax | -121.37M | -128.90M | -63.08M | -34.44M |

| Income Before Tax Ratio | -65.77% | -150.20% | -112.33% | -73.33% |

| Income Tax Expense | 0.00 | 20.00K | 11.00K | 0.00 |

| Net Income | -121.37M | -128.92M | -63.09M | -34.44M |

| Net Income Ratio | -65.77% | -150.22% | -112.35% | -73.33% |

| EPS | -156.20 | -203.32 | -116.87 | -63.80 |

| EPS Diluted | -156.20 | -203.32 | -116.87 | -63.80 |

| Weighted Avg Shares Out | 777.00K | 634.07K | 539.84K | 539.84K |

| Weighted Avg Shares Out (Dil) | 777.01K | 634.07K | 539.84K | 539.84K |

Why Tritium DCFC Limited Rocketed Higher Today

Why Is Tritium (DCFC) Stock Up 27% Today?

5 Penny Stocks To Watch After Big News This Week

California’s 1st Taco Bell® is Officially “Electrified”

What The Stock Market Did Today & Top Penny Stocks To Watch Now

Tritium DCFC Limited (DCFC) CEO Jane Hunter on Q4 2022 Results - Earnings Call Transcript

Tritium Announces Timing of Release of Fiscal Year 2021 Financial Results and Conference Call

Sycuan Casino Resort Adds Smart Electric Vehicle Charging and Battery Energy Storage to its Landmark Location in San Diego

Volta Inc. Reports Second Quarter Financial Results

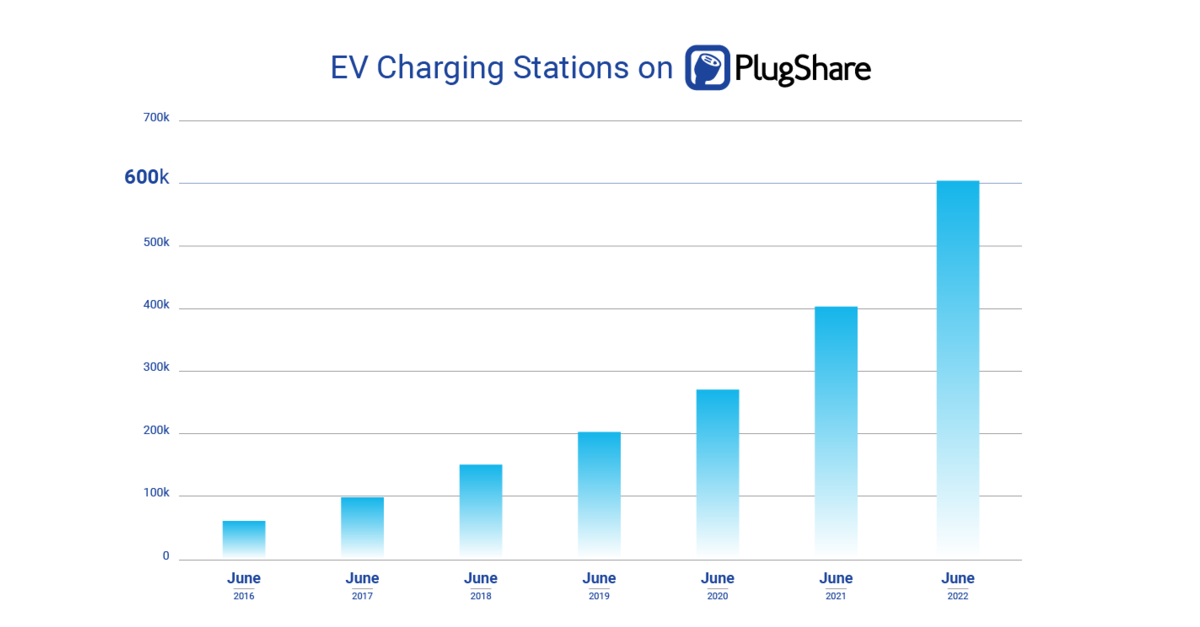

PlugShare Surpasses 5 Million Check-Ins as Number of EV Stations on App Increases 50%

Source: https://incomestatements.info

Category: Stock Reports