Complete financial analysis of Delaware Investments Dividend and Income Fund, Inc. (DDF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Delaware Investments Dividend and Income Fund, Inc., a leading company in the Asset Management – Income industry within the Financial Services sector.

- Finning International Inc. (FINGF) Income Statement Analysis – Financial Results

- PJSC LUKOIL (LKOH.ME) Income Statement Analysis – Financial Results

- Polar Capital Holdings plc (POLR.L) Income Statement Analysis – Financial Results

- Liberty Media Acquisition Corporation (LMACA) Income Statement Analysis – Financial Results

- FSA Group Limited (FSA.AX) Income Statement Analysis – Financial Results

Delaware Investments Dividend and Income Fund, Inc. (DDF)

Industry: Asset Management - Income

Sector: Financial Services

About Delaware Investments Dividend and Income Fund, Inc.

Delaware Investments Dividend and Income Fund, Inc. is a closed-ended equity mutual fund launched by Delaware Management Holdings, Inc. It is managed by Delaware Management Company. The fund invests in public equity markets of the United States. It seeks to invest in stocks of companies operating across diversified sectors. The fund primarily invests in dividend paying value stocks of large cap companies. It benchmarks the performance of its portfolio against the S&P 500 Index and the Lipper Closed-End Income and Preferred Stock Funds Average. Delaware Investments Dividend and Income Fund, Inc. was formed on March 26, 1993 and is domiciled in the United States.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2010 |

|---|---|---|---|---|---|---|---|

| Revenue | 225.61K | 13.80M | -3.97M | 8.48M | 2.66M | 13.04M | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 225.61K | 13.80M | -3.97M | 8.48M | 2.66M | 13.04M | 0.00 |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 382.05K | 408.44K | 424.40K | 761.23K | 333.18K | 319.28K | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 382.05K | 408.44K | 424.40K | 761.23K | 333.18K | 319.28K | 0.00 |

| Other Expenses | 104.54K | 107.49K | 102.90K | 89.72K | 78.10K | 0.00 | 0.00 |

| Operating Expenses | 486.59K | 515.94K | 527.30K | 850.95K | 411.28K | 432.12K | 0.00 |

| Cost & Expenses | 486.59K | 515.94K | 527.30K | 850.95K | 411.28K | 432.12K | 0.00 |

| Interest Income | 1.39M | 1.57M | 1.65M | 2.74M | 2.32M | 2.51M | 0.00 |

| Interest Expense | 607.83K | 291.16K | 432.85K | 1.13M | 1.10M | 766.62K | 0.00 |

| Depreciation & Amortization | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 52.52K | 0.00 |

| EBITDA | 346.85K | 13.28M | -4.50M | 7.63M | 3.34M | 12.60M | 0.00 |

| EBITDA Ratio | 153.74% | 96.26% | 113.27% | 89.97% | 125.82% | 96.69% | 0.00% |

| Operating Income | 346.85K | 13.28M | -4.50M | 7.63M | 3.34M | 12.60M | 0.00 |

| Operating Income Ratio | 153.74% | 96.26% | 113.27% | 89.97% | 125.82% | 96.69% | 0.00% |

| Total Other Income/Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -260.98K | 13.28M | -4.50M | 7.63M | 2.24M | 12.60M | 0.00 |

| Income Before Tax Ratio | -115.68% | 96.26% | 113.27% | 89.97% | 84.51% | 96.69% | 0.00% |

| Income Tax Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | -260.98K | 13.28M | -4.50M | 7.63M | 2.24M | 12.60M | 0.00 |

| Net Income Ratio | -115.68% | 96.26% | 113.27% | 89.97% | 84.51% | 96.69% | 0.00% |

| EPS | -0.03 | 1.74 | -0.57 | 0.99 | 0.29 | 1.61 | 0.00 |

| EPS Diluted | -0.03 | 1.74 | -0.57 | 0.99 | 0.29 | 1.61 | 0.00 |

| Weighted Avg Shares Out | 7.63M | 7.63M | 7.89M | 7.71M | 7.74M | 7.83M | 9.44M |

| Weighted Avg Shares Out (Dil) | 7.63M | 7.63M | 7.89M | 7.71M | 7.74M | 7.83M | 9.44M |

The Fed's Corporate Credit Facility

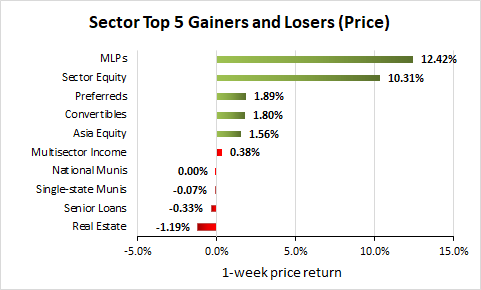

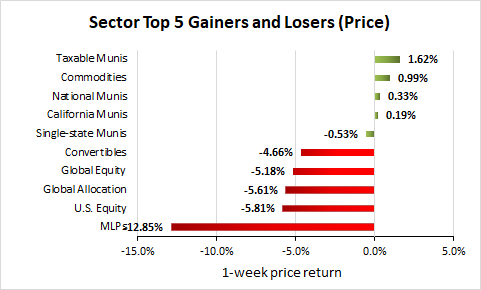

Weekly Closed-End Fund Roundup: June 21, 2020

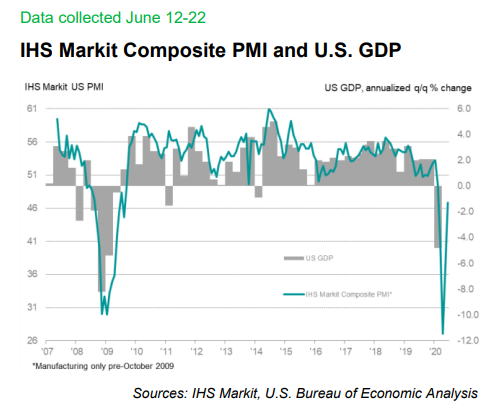

The Reopening Killed The V-Shaped Recovery

Statement Pursuant to Section 19(a) of the Investment Company Act of 1940: DEX

Weekly Closed-End Fund Roundup: June 14, 2020

Statement Pursuant to Section 19(a) of the Investment Company Act of 1940: DDF

Buy-And-Hold Vs. Rotational Strategy April 2020 Update

Looking At The Debt Markets

Bear Market Thoughts: Closed-End Fund Bankruptcy Discussion

Source: https://incomestatements.info

Category: Stock Reports