See more : Primorus Investments plc (PRIM.L) Income Statement Analysis – Financial Results

Complete financial analysis of BNY Mellon Municipal Income, Inc. (DMF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BNY Mellon Municipal Income, Inc., a leading company in the Asset Management – Income industry within the Financial Services sector.

- Mega Union Technology Inc. (6944.TWO) Income Statement Analysis – Financial Results

- Chengtun Mining Group Co., Ltd. (600711.SS) Income Statement Analysis – Financial Results

- China Overseas Grand Oceans Group Limited (0081.HK) Income Statement Analysis – Financial Results

- Gosun Holding Co., Ltd. (000971.SZ) Income Statement Analysis – Financial Results

- JanOne Inc. (JAN) Income Statement Analysis – Financial Results

BNY Mellon Municipal Income, Inc. (DMF)

Industry: Asset Management - Income

Sector: Financial Services

Website: http://im.bnymellon.com/us/en/

About BNY Mellon Municipal Income, Inc.

BNY Mellon Municipal Income, Inc. is a closed ended fixed income mutual fund launched and managed by BNY Mellon Investment Adviser, Inc. It invests in the fixed income markets of the United States. The fund primarily invests in municipal obligations that are rated investment grade and have maturities of less than one year. It employs fundamental analysis to create its portfolio. The fund was formerly known as Dreyfus Municipal Income, Inc. BNY Mellon Municipal Income, Inc. was formed on October 24, 1988 and is domiciled in the United States.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 26.28M | 3.77M | -41.01M | 14.16M | 3.08M | 19.38M | 87.13K | 1.29M | 18.07M | 10.59M | 27.64M | -15.99M | 34.06M | 8.83M | 18.42M | 31.25M | 17.24M | 17.56M | 16.62M | 16.55M | 16.69M | 17.34M | 17.97M | 17.70M | 17.66M | 12.63M | 12.86M | 13.90M | 14.45M | 14.59M | 15.07M | 15.65M | 15.39M | 15.35M | 15.20M | 13.23M |

| Cost of Revenue | 0.00 | 1.40M | 1.66M | 1.78M | 1.75M | 1.73M | 1.86M | 1.98M | 2.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 670.00K | 1.00M | 870.00K | 310.00K | 300.00K | 310.00K | 300.00K | 320.00K | 320.00K | 30.00K | 30.00K | 30.00K | 30.00K | 20.00K | 20.00K | 20.00K | 20.00K | 20.00K | 30.00K | 40.00K |

| Gross Profit | 26.28M | 2.37M | -42.66M | 12.38M | 1.33M | 17.65M | -1.77M | -688.10K | 15.97M | 10.59M | 27.64M | -15.99M | 34.06M | 8.83M | 18.42M | 31.25M | 16.57M | 16.56M | 15.75M | 16.24M | 16.39M | 17.03M | 17.67M | 17.38M | 17.34M | 12.60M | 12.83M | 13.87M | 14.42M | 14.57M | 15.05M | 15.63M | 15.37M | 15.33M | 15.17M | 13.19M |

| Gross Profit Ratio | 100.00% | 62.96% | 104.04% | 87.44% | 43.16% | 91.09% | -2,030.82% | -53.40% | 88.39% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 96.11% | 94.31% | 94.77% | 98.13% | 98.20% | 98.21% | 98.33% | 98.19% | 98.19% | 99.76% | 99.77% | 99.78% | 99.79% | 99.86% | 99.87% | 99.87% | 99.87% | 99.87% | 99.80% | 99.70% |

| Research & Development | 0.00 | 0.00 | -8.08 | 1.21 | 0.36 | 1.43 | -0.03 | 0.06 | 1.10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 693.79K | 374.00K | 331.57K | 302.30K | 250.43K | 238.81K | 513.04K | 331.33K | 401.11K | 307.41K | 316.62K | 298.64K | 440.93K | 415.03K | 470.21K | 518.78K | 2.20M | 2.24M | 2.27M | 2.28M | 2.22M | 2.24M | 2.25M | 2.28M | 2.25M | 1.60M | 1.56M | 1.55M | 1.57M | 1.59M | 1.64M | 1.63M | 1.62M | 1.57M | 1.48M | 1.37M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 693.79K | 374.00K | 331.57K | 302.30K | 250.43K | 238.81K | 513.04K | 331.33K | 401.11K | 307.41K | 316.62K | 298.64K | 440.93K | 415.03K | 470.21K | 518.78K | 2.20M | 2.24M | 2.27M | 2.28M | 2.22M | 2.24M | 2.25M | 2.28M | 2.25M | 1.60M | 1.56M | 1.55M | 1.57M | 1.59M | 1.64M | 1.63M | 1.62M | 1.57M | 1.48M | 1.37M |

| Other Expenses | 25.59M | 3.40M | 76.33K | 61.26K | 106.65K | 96.80K | 60.25K | 122.85K | 128.73K | 116.57K | 117.77K | 160.58K | 0.00 | 0.00 | 0.00 | 0.00 | 40.00K | 40.00K | 30.00K | 30.00K | 30.00K | 30.00K | 20.00K | 30.00K | 20.00K | 10.00K | 10.00K | 10.00K | 20.00K | 0.00 | 10.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 26.28M | 3.77M | 407.91K | 363.56K | 357.08K | 335.61K | 573.30K | 454.18K | 529.83K | 423.99K | 434.39K | 459.22K | 440.93K | 415.03K | 470.21K | 518.78K | 2.24M | 2.28M | 2.30M | 2.31M | 2.25M | 2.27M | 2.27M | 2.31M | 2.27M | 1.61M | 1.57M | 1.56M | 1.59M | 1.59M | 1.65M | 1.63M | 1.62M | 1.57M | 1.48M | 1.37M |

| Cost & Expenses | 26.28M | -1.40M | 407.91K | 363.56K | 357.08K | 335.61K | 573.30K | 454.18K | 529.83K | 423.99K | 434.39K | 459.22K | 440.93K | 415.03K | 470.21K | 518.78K | 2.91M | 3.28M | 3.17M | 2.62M | 2.55M | 2.58M | 2.57M | 2.63M | 2.59M | 1.64M | 1.60M | 1.59M | 1.62M | 1.61M | 1.67M | 1.65M | 1.64M | 1.59M | 1.51M | 1.41M |

| Interest Income | 10.16M | 9.57M | 10.03M | 10.90M | 12.17M | 13.03M | 13.60M | 13.67M | 13.52M | 13.87M | 14.69M | 14.72M | 15.43M | 15.93M | 15.97M | 16.06M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 3.14M | 2.12M | 736.56K | 491.43K | 1.27M | 1.70M | 1.13M | 708.64K | 400.86K | 316.77K | 314.51K | 200.00K | 190.33K | 159.50K | 144.05K | 0.00 | -19.38M | -6.99M | -250.00K | 4.35M | 1.83M | -4.98M | 150.00K | 16.18M | -1.72M | -15.17M | 4.15M | -460.00K | -2.96M | 6.98M | -18.65M | 8.65M | 5.63M | 9.31M | -3.60M | 2.44M |

| Depreciation & Amortization | 0.00 | 0.00 | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 52.52K | 400.86K | 316.77K | 0.00 | 200.00K | 190.33K | 159.50K | 144.05K | 0.00 | -38.76M | -13.98M | -500.00K | 8.70M | 3.67M | -9.96M | 300.00K | 32.36M | -3.43M | -30.34M | 8.30M | -920.00K | -5.93M | 13.95M | -37.30M | 17.29M | 11.26M | 18.62M | -7.19M | 4.87M |

| EBITDA | 0.00 | 5.53M | -40.68M | 13.80M | 4.00M | 19.04M | -1.53M | 834.40K | 17.94M | 0.00 | 27.52M | 0.00 | 0.00 | 0.00 | 0.00 | 30.74M | -24.43M | 300.00K | 12.95M | 22.63M | 17.81M | 4.81M | 15.70M | 47.43M | 11.64M | -19.35M | 19.56M | 11.39M | 6.91M | 26.93M | -23.90M | 31.29M | 25.02M | 32.38M | 6.50M | 16.70M |

| EBITDA Ratio | 0.00% | 146.79% | 99.20% | 97.43% | 88.42% | 98.27% | 742.24% | 119.75% | 99.29% | 98.99% | 99.57% | 101.62% | 99.26% | 97.11% | 98.23% | 98.34% | -141.71% | 1.71% | 77.92% | 136.74% | 106.71% | 27.74% | 87.37% | 267.97% | 65.91% | -153.21% | 152.10% | 81.94% | 47.82% | 184.58% | -158.59% | 199.94% | 162.57% | 210.94% | 42.76% | 126.23% |

| Operating Income | -57.48M | 5.53M | -40.68M | 13.80M | 2.73M | 19.04M | 646.71K | 1.54M | 17.54M | 10.16M | 27.52M | -16.45M | 33.62M | 8.41M | 17.95M | 30.74M | 14.33M | 14.28M | 13.45M | 13.93M | 14.14M | 14.77M | 15.40M | 15.07M | 15.07M | 10.99M | 11.26M | 12.31M | 12.84M | 12.98M | 13.40M | 14.00M | 13.76M | 13.76M | 13.69M | 11.83M |

| Operating Income Ratio | -218.69% | 146.79% | 99.20% | 97.43% | 88.42% | 98.27% | 742.24% | 119.75% | 97.07% | 95.99% | 99.57% | 102.87% | 98.71% | 95.30% | 97.45% | 98.34% | 83.12% | 81.32% | 80.93% | 84.17% | 84.72% | 85.18% | 85.70% | 85.14% | 85.33% | 87.02% | 87.56% | 88.56% | 88.86% | 88.97% | 88.92% | 89.46% | 89.41% | 89.64% | 90.07% | 89.42% |

| Total Other Income/Expenses | 83.08M | -2.14M | -736.56K | 0.00 | 1.75M | 0.00 | 1.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -19.38M | -6.99M | -250.00K | 4.35M | 1.84M | -4.98M | 150.00K | 16.18M | -1.71M | -15.17M | 4.15M | -460.00K | -2.97M | 6.97M | -18.65M | 8.64M | 5.63M | 9.31M | -3.59M | 2.43M |

| Income Before Tax | 25.60M | 3.40M | -41.41M | 13.80M | 2.73M | 19.04M | -486.17K | 834.40K | 17.54M | 10.16M | 27.20M | -16.45M | 33.62M | 8.41M | 17.95M | 30.74M | -5.05M | 7.29M | 13.20M | 18.28M | 15.98M | 9.79M | 15.55M | 31.25M | 13.36M | -4.18M | 15.41M | 11.85M | 9.87M | 19.95M | -5.25M | 22.64M | 19.39M | 23.07M | 10.10M | 14.26M |

| Income Before Tax Ratio | 97.38% | 90.15% | 100.99% | 97.43% | 88.42% | 98.27% | -557.99% | 64.75% | 97.07% | 95.99% | 98.43% | 102.87% | 98.71% | 95.30% | 97.45% | 98.34% | -29.29% | 41.51% | 79.42% | 110.45% | 95.75% | 56.46% | 86.53% | 176.55% | 75.65% | -33.10% | 119.83% | 85.25% | 68.30% | 136.74% | -34.84% | 144.66% | 125.99% | 150.29% | 66.45% | 107.79% |

| Income Tax Expense | 0.00 | 0.00 | -40.68M | 36.37K | 464.85K | 20.74M | -161.14K | -52.52K | -400.86K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 25.60M | 3.40M | -41.41M | 13.80M | 2.73M | 19.04M | -486.17K | 834.40K | 17.54M | 10.16M | 27.20M | -16.45M | 33.62M | 8.41M | 17.95M | 30.74M | -5.05M | 7.29M | 13.20M | 18.28M | 15.98M | 9.79M | 15.55M | 31.25M | 13.36M | -4.18M | 15.41M | 11.85M | 9.87M | 19.95M | -5.25M | 22.64M | 19.39M | 23.07M | 10.10M | 14.26M |

| Net Income Ratio | 97.38% | 90.15% | 100.99% | 97.43% | 88.42% | 98.27% | -557.99% | 64.75% | 97.07% | 95.99% | 98.43% | 102.87% | 98.71% | 95.30% | 97.45% | 98.34% | -29.29% | 41.51% | 79.42% | 110.45% | 95.75% | 56.46% | 86.53% | 176.55% | 75.65% | -33.10% | 119.83% | 85.25% | 68.30% | 136.74% | -34.84% | 144.66% | 125.99% | 150.29% | 66.45% | 107.79% |

| EPS | 1.23 | 0.10 | -2.00 | 0.66 | 0.11 | 0.88 | -0.02 | 0.03 | 0.84 | 0.49 | 1.31 | -0.79 | 1.62 | 0.40 | 0.85 | 1.43 | -0.25 | 0.35 | 0.64 | 0.89 | 0.78 | 0.48 | 0.76 | 1.53 | 0.66 | -0.21 | 0.76 | 0.58 | 0.48 | 0.99 | -0.26 | 1.14 | 0.99 | 1.20 | 0.53 | 0.77 |

| EPS Diluted | 1.23 | 0.10 | -2.00 | 0.66 | 0.11 | 0.88 | -0.02 | 0.03 | 0.84 | 0.49 | 1.31 | -0.79 | 1.62 | 0.40 | 0.85 | 1.43 | -0.25 | 0.35 | 0.64 | 0.89 | 0.78 | 0.48 | 0.76 | 1.53 | 0.66 | -0.21 | 0.76 | 0.58 | 0.48 | 0.99 | -0.26 | 1.14 | 0.99 | 1.20 | 0.53 | 0.77 |

| Weighted Avg Shares Out | 20.76M | 20.76M | 20.76M | 20.76M | 20.75M | 20.75M | 20.75M | 20.75M | 20.59M | 20.61M | 20.72M | 20.75M | 20.68M | 20.62M | 20.60M | 20.59M | 20.59M | 20.59M | 20.59M | 20.59M | 20.55M | 20.44M | 20.38M | 20.38M | 20.38M | 20.38M | 20.34M | 20.27M | 20.36M | 20.08M | 20.06M | 19.81M | 19.49M | 19.16M | 18.88M | 18.57M |

| Weighted Avg Shares Out (Dil) | 20.76M | 20.76M | 20.76M | 20.76M | 20.75M | 20.75M | 20.90M | 20.75M | 20.59M | 20.61M | 20.72M | 20.75M | 20.68M | 20.62M | 20.60M | 20.59M | 20.59M | 20.59M | 20.59M | 20.59M | 20.55M | 20.44M | 20.38M | 20.38M | 20.38M | 20.38M | 20.34M | 20.27M | 20.36M | 20.08M | 20.06M | 19.81M | 19.49M | 19.16M | 18.88M | 18.57M |

BNY, Wilshire roll out small-plan custom TDF option for advisers - InvestmentNews

Top 20 Upcoming Live Fintech Webinars for Those Located in APAC: June/July - Fintech Singapore

BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund, Inc. Declares Monthly Distribution

Wells Fargo Becomes iCapital Network Investor

CoinShares, Ledger and Nomura Launch Crypto Custody Service

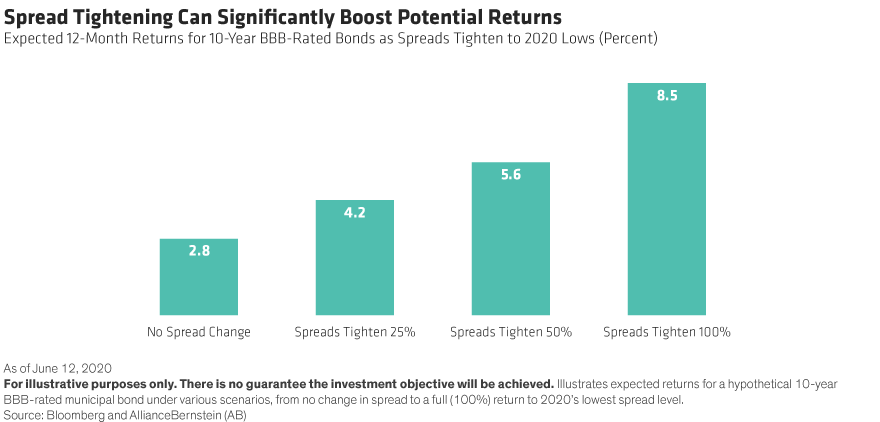

Mid-Grade Munis Have Room To Rebound

Investors at the gates: MMF reforms fail the Covid test - Risk.net

Source: https://incomestatements.info

Category: Stock Reports