See more : Life Intelligent Enterprise Holdings Co.,Ltd. (5856.T) Income Statement Analysis – Financial Results

Complete financial analysis of BNY Mellon Municipal Income, Inc. (DMF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BNY Mellon Municipal Income, Inc., a leading company in the Asset Management – Income industry within the Financial Services sector.

- Eden Innovations Ltd (EDE.AX) Income Statement Analysis – Financial Results

- Star Health and Allied Insurance Company Limited (STARHEALTH.BO) Income Statement Analysis – Financial Results

- IWG plc (IWGFF) Income Statement Analysis – Financial Results

- Safran SA (SAF.PA) Income Statement Analysis – Financial Results

- The Crypto Company (CRCW) Income Statement Analysis – Financial Results

BNY Mellon Municipal Income, Inc. (DMF)

Industry: Asset Management - Income

Sector: Financial Services

Website: http://im.bnymellon.com/us/en/

About BNY Mellon Municipal Income, Inc.

BNY Mellon Municipal Income, Inc. is a closed ended fixed income mutual fund launched and managed by BNY Mellon Investment Adviser, Inc. It invests in the fixed income markets of the United States. The fund primarily invests in municipal obligations that are rated investment grade and have maturities of less than one year. It employs fundamental analysis to create its portfolio. The fund was formerly known as Dreyfus Municipal Income, Inc. BNY Mellon Municipal Income, Inc. was formed on October 24, 1988 and is domiciled in the United States.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 26.28M | 3.77M | -41.01M | 14.16M | 3.08M | 19.38M | 87.13K | 1.29M | 18.07M | 10.59M | 27.64M | -15.99M | 34.06M | 8.83M | 18.42M | 31.25M | 17.24M | 17.56M | 16.62M | 16.55M | 16.69M | 17.34M | 17.97M | 17.70M | 17.66M | 12.63M | 12.86M | 13.90M | 14.45M | 14.59M | 15.07M | 15.65M | 15.39M | 15.35M | 15.20M | 13.23M |

| Cost of Revenue | 0.00 | 1.40M | 1.66M | 1.78M | 1.75M | 1.73M | 1.86M | 1.98M | 2.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 670.00K | 1.00M | 870.00K | 310.00K | 300.00K | 310.00K | 300.00K | 320.00K | 320.00K | 30.00K | 30.00K | 30.00K | 30.00K | 20.00K | 20.00K | 20.00K | 20.00K | 20.00K | 30.00K | 40.00K |

| Gross Profit | 26.28M | 2.37M | -42.66M | 12.38M | 1.33M | 17.65M | -1.77M | -688.10K | 15.97M | 10.59M | 27.64M | -15.99M | 34.06M | 8.83M | 18.42M | 31.25M | 16.57M | 16.56M | 15.75M | 16.24M | 16.39M | 17.03M | 17.67M | 17.38M | 17.34M | 12.60M | 12.83M | 13.87M | 14.42M | 14.57M | 15.05M | 15.63M | 15.37M | 15.33M | 15.17M | 13.19M |

| Gross Profit Ratio | 100.00% | 62.96% | 104.04% | 87.44% | 43.16% | 91.09% | -2,030.82% | -53.40% | 88.39% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 96.11% | 94.31% | 94.77% | 98.13% | 98.20% | 98.21% | 98.33% | 98.19% | 98.19% | 99.76% | 99.77% | 99.78% | 99.79% | 99.86% | 99.87% | 99.87% | 99.87% | 99.87% | 99.80% | 99.70% |

| Research & Development | 0.00 | 0.00 | -8.08 | 1.21 | 0.36 | 1.43 | -0.03 | 0.06 | 1.10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 693.79K | 374.00K | 331.57K | 302.30K | 250.43K | 238.81K | 513.04K | 331.33K | 401.11K | 307.41K | 316.62K | 298.64K | 440.93K | 415.03K | 470.21K | 518.78K | 2.20M | 2.24M | 2.27M | 2.28M | 2.22M | 2.24M | 2.25M | 2.28M | 2.25M | 1.60M | 1.56M | 1.55M | 1.57M | 1.59M | 1.64M | 1.63M | 1.62M | 1.57M | 1.48M | 1.37M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 693.79K | 374.00K | 331.57K | 302.30K | 250.43K | 238.81K | 513.04K | 331.33K | 401.11K | 307.41K | 316.62K | 298.64K | 440.93K | 415.03K | 470.21K | 518.78K | 2.20M | 2.24M | 2.27M | 2.28M | 2.22M | 2.24M | 2.25M | 2.28M | 2.25M | 1.60M | 1.56M | 1.55M | 1.57M | 1.59M | 1.64M | 1.63M | 1.62M | 1.57M | 1.48M | 1.37M |

| Other Expenses | 25.59M | 3.40M | 76.33K | 61.26K | 106.65K | 96.80K | 60.25K | 122.85K | 128.73K | 116.57K | 117.77K | 160.58K | 0.00 | 0.00 | 0.00 | 0.00 | 40.00K | 40.00K | 30.00K | 30.00K | 30.00K | 30.00K | 20.00K | 30.00K | 20.00K | 10.00K | 10.00K | 10.00K | 20.00K | 0.00 | 10.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 26.28M | 3.77M | 407.91K | 363.56K | 357.08K | 335.61K | 573.30K | 454.18K | 529.83K | 423.99K | 434.39K | 459.22K | 440.93K | 415.03K | 470.21K | 518.78K | 2.24M | 2.28M | 2.30M | 2.31M | 2.25M | 2.27M | 2.27M | 2.31M | 2.27M | 1.61M | 1.57M | 1.56M | 1.59M | 1.59M | 1.65M | 1.63M | 1.62M | 1.57M | 1.48M | 1.37M |

| Cost & Expenses | 26.28M | -1.40M | 407.91K | 363.56K | 357.08K | 335.61K | 573.30K | 454.18K | 529.83K | 423.99K | 434.39K | 459.22K | 440.93K | 415.03K | 470.21K | 518.78K | 2.91M | 3.28M | 3.17M | 2.62M | 2.55M | 2.58M | 2.57M | 2.63M | 2.59M | 1.64M | 1.60M | 1.59M | 1.62M | 1.61M | 1.67M | 1.65M | 1.64M | 1.59M | 1.51M | 1.41M |

| Interest Income | 10.16M | 9.57M | 10.03M | 10.90M | 12.17M | 13.03M | 13.60M | 13.67M | 13.52M | 13.87M | 14.69M | 14.72M | 15.43M | 15.93M | 15.97M | 16.06M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 3.14M | 2.12M | 736.56K | 491.43K | 1.27M | 1.70M | 1.13M | 708.64K | 400.86K | 316.77K | 314.51K | 200.00K | 190.33K | 159.50K | 144.05K | 0.00 | -19.38M | -6.99M | -250.00K | 4.35M | 1.83M | -4.98M | 150.00K | 16.18M | -1.72M | -15.17M | 4.15M | -460.00K | -2.96M | 6.98M | -18.65M | 8.65M | 5.63M | 9.31M | -3.60M | 2.44M |

| Depreciation & Amortization | 0.00 | 0.00 | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 52.52K | 400.86K | 316.77K | 0.00 | 200.00K | 190.33K | 159.50K | 144.05K | 0.00 | -38.76M | -13.98M | -500.00K | 8.70M | 3.67M | -9.96M | 300.00K | 32.36M | -3.43M | -30.34M | 8.30M | -920.00K | -5.93M | 13.95M | -37.30M | 17.29M | 11.26M | 18.62M | -7.19M | 4.87M |

| EBITDA | 0.00 | 5.53M | -40.68M | 13.80M | 4.00M | 19.04M | -1.53M | 834.40K | 17.94M | 0.00 | 27.52M | 0.00 | 0.00 | 0.00 | 0.00 | 30.74M | -24.43M | 300.00K | 12.95M | 22.63M | 17.81M | 4.81M | 15.70M | 47.43M | 11.64M | -19.35M | 19.56M | 11.39M | 6.91M | 26.93M | -23.90M | 31.29M | 25.02M | 32.38M | 6.50M | 16.70M |

| EBITDA Ratio | 0.00% | 146.79% | 99.20% | 97.43% | 88.42% | 98.27% | 742.24% | 119.75% | 99.29% | 98.99% | 99.57% | 101.62% | 99.26% | 97.11% | 98.23% | 98.34% | -141.71% | 1.71% | 77.92% | 136.74% | 106.71% | 27.74% | 87.37% | 267.97% | 65.91% | -153.21% | 152.10% | 81.94% | 47.82% | 184.58% | -158.59% | 199.94% | 162.57% | 210.94% | 42.76% | 126.23% |

| Operating Income | -57.48M | 5.53M | -40.68M | 13.80M | 2.73M | 19.04M | 646.71K | 1.54M | 17.54M | 10.16M | 27.52M | -16.45M | 33.62M | 8.41M | 17.95M | 30.74M | 14.33M | 14.28M | 13.45M | 13.93M | 14.14M | 14.77M | 15.40M | 15.07M | 15.07M | 10.99M | 11.26M | 12.31M | 12.84M | 12.98M | 13.40M | 14.00M | 13.76M | 13.76M | 13.69M | 11.83M |

| Operating Income Ratio | -218.69% | 146.79% | 99.20% | 97.43% | 88.42% | 98.27% | 742.24% | 119.75% | 97.07% | 95.99% | 99.57% | 102.87% | 98.71% | 95.30% | 97.45% | 98.34% | 83.12% | 81.32% | 80.93% | 84.17% | 84.72% | 85.18% | 85.70% | 85.14% | 85.33% | 87.02% | 87.56% | 88.56% | 88.86% | 88.97% | 88.92% | 89.46% | 89.41% | 89.64% | 90.07% | 89.42% |

| Total Other Income/Expenses | 83.08M | -2.14M | -736.56K | 0.00 | 1.75M | 0.00 | 1.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -19.38M | -6.99M | -250.00K | 4.35M | 1.84M | -4.98M | 150.00K | 16.18M | -1.71M | -15.17M | 4.15M | -460.00K | -2.97M | 6.97M | -18.65M | 8.64M | 5.63M | 9.31M | -3.59M | 2.43M |

| Income Before Tax | 25.60M | 3.40M | -41.41M | 13.80M | 2.73M | 19.04M | -486.17K | 834.40K | 17.54M | 10.16M | 27.20M | -16.45M | 33.62M | 8.41M | 17.95M | 30.74M | -5.05M | 7.29M | 13.20M | 18.28M | 15.98M | 9.79M | 15.55M | 31.25M | 13.36M | -4.18M | 15.41M | 11.85M | 9.87M | 19.95M | -5.25M | 22.64M | 19.39M | 23.07M | 10.10M | 14.26M |

| Income Before Tax Ratio | 97.38% | 90.15% | 100.99% | 97.43% | 88.42% | 98.27% | -557.99% | 64.75% | 97.07% | 95.99% | 98.43% | 102.87% | 98.71% | 95.30% | 97.45% | 98.34% | -29.29% | 41.51% | 79.42% | 110.45% | 95.75% | 56.46% | 86.53% | 176.55% | 75.65% | -33.10% | 119.83% | 85.25% | 68.30% | 136.74% | -34.84% | 144.66% | 125.99% | 150.29% | 66.45% | 107.79% |

| Income Tax Expense | 0.00 | 0.00 | -40.68M | 36.37K | 464.85K | 20.74M | -161.14K | -52.52K | -400.86K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 25.60M | 3.40M | -41.41M | 13.80M | 2.73M | 19.04M | -486.17K | 834.40K | 17.54M | 10.16M | 27.20M | -16.45M | 33.62M | 8.41M | 17.95M | 30.74M | -5.05M | 7.29M | 13.20M | 18.28M | 15.98M | 9.79M | 15.55M | 31.25M | 13.36M | -4.18M | 15.41M | 11.85M | 9.87M | 19.95M | -5.25M | 22.64M | 19.39M | 23.07M | 10.10M | 14.26M |

| Net Income Ratio | 97.38% | 90.15% | 100.99% | 97.43% | 88.42% | 98.27% | -557.99% | 64.75% | 97.07% | 95.99% | 98.43% | 102.87% | 98.71% | 95.30% | 97.45% | 98.34% | -29.29% | 41.51% | 79.42% | 110.45% | 95.75% | 56.46% | 86.53% | 176.55% | 75.65% | -33.10% | 119.83% | 85.25% | 68.30% | 136.74% | -34.84% | 144.66% | 125.99% | 150.29% | 66.45% | 107.79% |

| EPS | 1.23 | 0.10 | -2.00 | 0.66 | 0.11 | 0.88 | -0.02 | 0.03 | 0.84 | 0.49 | 1.31 | -0.79 | 1.62 | 0.40 | 0.85 | 1.43 | -0.25 | 0.35 | 0.64 | 0.89 | 0.78 | 0.48 | 0.76 | 1.53 | 0.66 | -0.21 | 0.76 | 0.58 | 0.48 | 0.99 | -0.26 | 1.14 | 0.99 | 1.20 | 0.53 | 0.77 |

| EPS Diluted | 1.23 | 0.10 | -2.00 | 0.66 | 0.11 | 0.88 | -0.02 | 0.03 | 0.84 | 0.49 | 1.31 | -0.79 | 1.62 | 0.40 | 0.85 | 1.43 | -0.25 | 0.35 | 0.64 | 0.89 | 0.78 | 0.48 | 0.76 | 1.53 | 0.66 | -0.21 | 0.76 | 0.58 | 0.48 | 0.99 | -0.26 | 1.14 | 0.99 | 1.20 | 0.53 | 0.77 |

| Weighted Avg Shares Out | 20.76M | 20.76M | 20.76M | 20.76M | 20.75M | 20.75M | 20.75M | 20.75M | 20.59M | 20.61M | 20.72M | 20.75M | 20.68M | 20.62M | 20.60M | 20.59M | 20.59M | 20.59M | 20.59M | 20.59M | 20.55M | 20.44M | 20.38M | 20.38M | 20.38M | 20.38M | 20.34M | 20.27M | 20.36M | 20.08M | 20.06M | 19.81M | 19.49M | 19.16M | 18.88M | 18.57M |

| Weighted Avg Shares Out (Dil) | 20.76M | 20.76M | 20.76M | 20.76M | 20.75M | 20.75M | 20.90M | 20.75M | 20.59M | 20.61M | 20.72M | 20.75M | 20.68M | 20.62M | 20.60M | 20.59M | 20.59M | 20.59M | 20.59M | 20.59M | 20.55M | 20.44M | 20.38M | 20.38M | 20.38M | 20.38M | 20.34M | 20.27M | 20.36M | 20.08M | 20.06M | 19.81M | 19.49M | 19.16M | 18.88M | 18.57M |

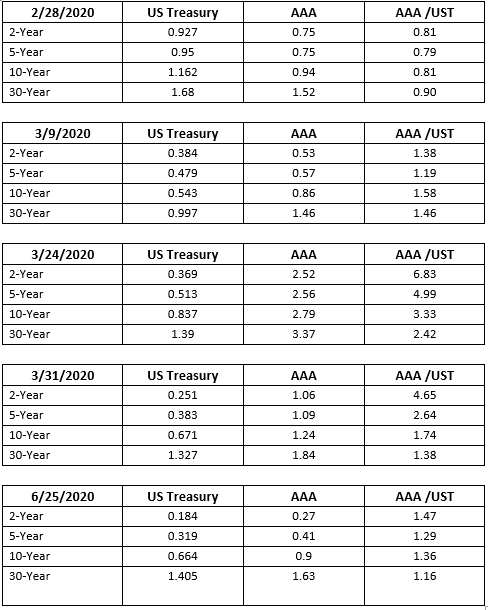

The Muni Selloff That Was

PAN AFRICAN RESOURCES PLC – Pan African Resources establishes Sponsored American Depository Receipt (ADR) Programme - SENS

BNY Mellon Municipal Bond Infrastructure Fund, Inc. (NYSE: DMB) Announces Dividend

Et si la relance économique était également écologique ?

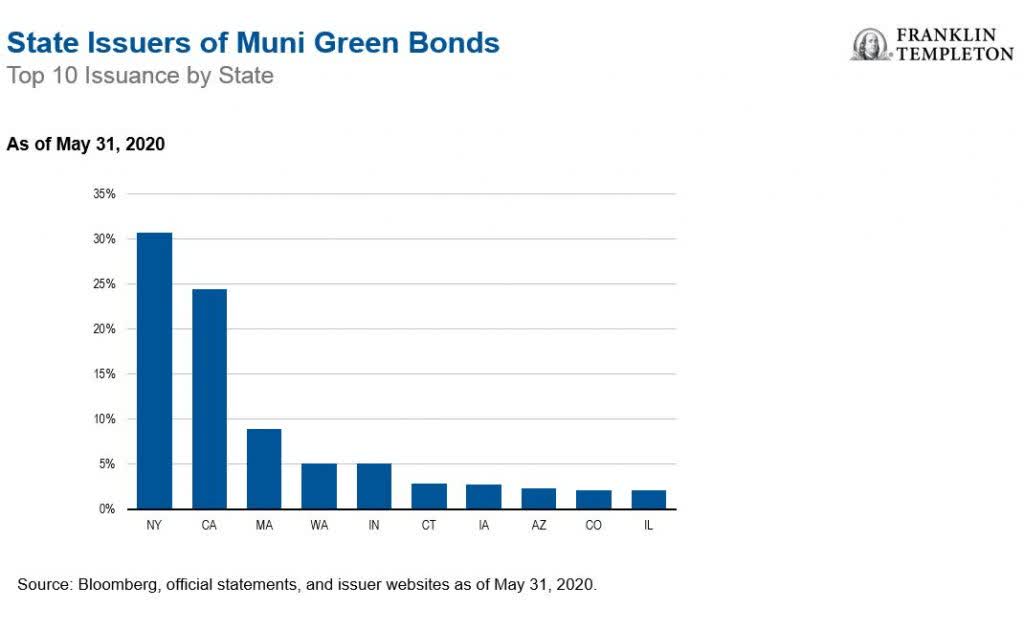

Responsible Investing In A Traditional Asset Class

Wolters Kluwer Triumphs in Operational Risk Awards

The Reopening Killed The V-Shaped Recovery

Postalis passa bem pela crise, enquanto busca ressarcimento por perdas do passado

Source: https://incomestatements.info

Category: Stock Reports