See more : Odyssey Corporation Limited (ODYCORP.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Directa Plus Plc (DTPKF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Directa Plus Plc, a leading company in the Chemicals – Specialty industry within the Basic Materials sector.

- THN Corporation (019180.KS) Income Statement Analysis – Financial Results

- Ecobuilt Holdings Berhad (0059.KL) Income Statement Analysis – Financial Results

- Sumitomo Corporation (SSUMY) Income Statement Analysis – Financial Results

- Eicher Motors Limited (EICHERMOT.BO) Income Statement Analysis – Financial Results

- Sankyo Kasei Corporation (8138.T) Income Statement Analysis – Financial Results

Directa Plus Plc (DTPKF)

About Directa Plus Plc

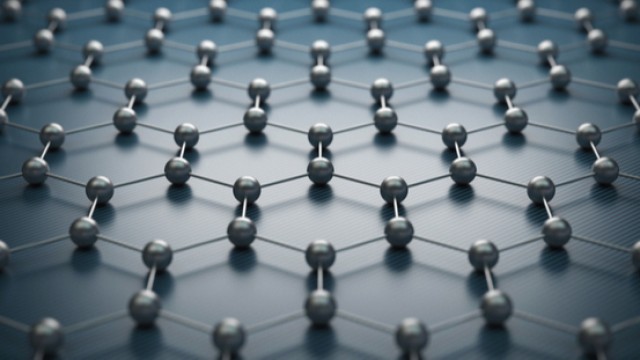

Directa Plus Plc manufactures and sells graphene-based products for industrial and commercial applications in Italy and internationally. It operates through Textile, Environmental, and Others segments. The company offers its products under the G+ brand name. Its products are used in environment, elastomers, textiles, composite materials, golf balls, footwear, and tyre applications. The company was incorporated in 2003 and is based in Lomazzo, Italy.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 10.53M | 10.86M | 8.62M | 6.43M | 2.63M | 2.25M | 952.20K | 738.03K | 1.39M | 101.57K | 65.15K |

| Cost of Revenue | 5.88M | 6.05M | 3.62M | 2.35M | 1.10M | 1.43M | 217.05K | 281.20K | 2.17M | 59.19K | 75.52K |

| Gross Profit | 4.65M | 4.81M | 4.99M | 4.08M | 1.53M | 820.83K | 735.15K | 456.83K | -782.22K | 42.38K | -10.38K |

| Gross Profit Ratio | 44.17% | 44.29% | 57.97% | 63.46% | 58.29% | 36.43% | 77.21% | 61.90% | -56.18% | 41.72% | -15.93% |

| Research & Development | 0.00 | 635.71K | 778.14K | 480.16K | 813.22K | 726.97K | 712.76K | 242.60K | 232.63K | 185.67K | 147.88K |

| General & Administrative | 1.86M | 1.94M | 1.82M | 3.23M | 545.39K | 0.00 | 0.00 | 0.00 | 972.67K | 650.19K | 506.01K |

| Selling & Marketing | 25.11K | 15.72K | 32.99K | 27.87K | 248.20K | 0.00 | 0.00 | 0.00 | 185.14K | 199.28K | 112.73K |

| SG&A | 1.88M | 1.96M | 3.59M | 3.26M | 793.59K | 2.17M | 1.95M | 1.52M | 1.16M | 849.47K | 618.74K |

| Other Expenses | 6.95M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | -4.62K | -3.86K | -2.88K |

| Operating Expenses | 8.84M | 9.82M | 8.53M | 8.39M | 5.09M | 4.74M | 4.53M | 5.26M | 2.45M | 1.11M | 1.00M |

| Cost & Expenses | 14.72M | 15.87M | 12.15M | 10.75M | 6.19M | 6.17M | 4.75M | 4.98M | 4.63M | 1.17M | 1.08M |

| Interest Income | 46.11K | 5.90K | 1.62K | 1.18K | 3.99K | 4.44K | 5.50K | 4.23K | 7.03K | 4.47K | 8.11K |

| Interest Expense | 194.66K | 115.77K | 74.68K | 77.44K | 35.97K | 23.47K | 26.40K | 216.36K | 432.11K | 70.16K | 12.43K |

| Depreciation & Amortization | 1.27M | 1.35M | 1.58M | 1.68M | 866.70K | 665.29K | 625.34K | 549.76K | 492.14K | 353.77K | 242.47K |

| EBITDA | -2.84M | -3.81M | -1.77M | -2.89M | -2.55M | -3.26M | -3.29M | -4.58M | -3.44M | -715.88K | -762.55K |

| EBITDA Ratio | -26.99% | -35.08% | -20.51% | -44.90% | -97.02% | -144.59% | -345.10% | -621.22% | -196.57% | -704.82% | -1,170.50% |

| Operating Income | -4.18M | -5.02M | -3.53M | -4.31M | -3.56M | -3.92M | -3.79M | -4.24M | -3.23M | -1.07M | -1.01M |

| Operating Income Ratio | -39.74% | -46.21% | -41.00% | -67.00% | -135.08% | -173.78% | -398.49% | -574.31% | -232.24% | -1,055.90% | -1,554.48% |

| Total Other Income/Expenses | -122.39K | -311.90K | 146.94K | -346.53K | 128.56K | -40.70K | -151.81K | -2.19M | -1.13M | -67.35K | -4.75K |

| Income Before Tax | -4.31M | -5.33M | -3.38M | -4.66M | -3.43M | -3.96M | -3.95M | -6.42M | -4.37M | -1.14M | -1.02M |

| Income Before Tax Ratio | -40.90% | -49.08% | -39.29% | -72.38% | -130.19% | -175.58% | -414.43% | -870.56% | -313.70% | -1,122.20% | -1,561.77% |

| Income Tax Expense | -31.72K | -53.20K | 44.62K | -124.41K | -25.23K | 414.00 | 1.24K | -933.47K | 4.43K | -236.55K | -205.98K |

| Net Income | -3.86M | -4.82M | -3.65M | -4.20M | -3.59M | -3.96M | -3.95M | -6.42M | -4.37M | -900.45K | -803.78K |

| Net Income Ratio | -36.62% | -44.42% | -42.39% | -65.20% | -136.23% | -175.80% | -414.63% | -870.16% | -313.70% | -886.54% | -1,233.80% |

| EPS | -0.06 | -0.07 | -0.06 | -0.07 | -0.07 | -0.09 | -0.09 | -0.19 | -0.10 | -0.02 | -0.02 |

| EPS Diluted | -0.06 | -0.07 | -0.06 | -0.07 | -0.07 | -0.09 | -0.09 | -0.19 | -0.10 | -0.02 | -0.02 |

| Weighted Avg Shares Out | 64.27M | 66.05M | 61.38M | 61.06M | 52.97M | 44.38M | 43.87M | 33.80M | 44.21M | 44.21M | 44.21M |

| Weighted Avg Shares Out (Dil) | 67.05M | 66.05M | 61.38M | 61.06M | 52.97M | 44.38M | 44.21M | 34.47M | 44.21M | 44.21M | 44.21M |

Directa Plus says two designers to show its G+ graphene coatings products at Milan Design Week

Directa Plus says two designers to show its G+ graphene coatings products at Milan Fashion Week

Directa Plus part of Milan Design Week as two designers select G+ graphene coatings

Directa Plus says Setcar unit awarded €1.15mln EU grant

Directa Plus arranges loan through Italian Covid support scheme

Dutch Cyclist wins Olympic silver medal in shirt printed by Directa Plus

Directa Plus says peer-reviewed research supports the use of its graphene nano-materials in Covid face masks

Directa Plus highlights continued strong revenue growth

Directa Plus highlights progress in partnership with NexTech Batteries

Directa Plus highlights progress in partnership with NextTech Batteries

Source: https://incomestatements.info

Category: Stock Reports