See more : WuXi Xinje Electric Co.,Ltd. (603416.SS) Income Statement Analysis – Financial Results

Complete financial analysis of Enable Midstream Partners, LP (ENBL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Enable Midstream Partners, LP, a leading company in the Oil & Gas Midstream industry within the Energy sector.

- Essential Utilities, Inc. (WTRG) Income Statement Analysis – Financial Results

- Bread Financial Holdings, Inc. (ADS) Income Statement Analysis – Financial Results

- Invictus Energy Limited (IVZ.AX) Income Statement Analysis – Financial Results

- ScreenPro Security Inc. (SCRN.CN) Income Statement Analysis – Financial Results

- engcon AB (publ) (ENGCON-B.ST) Income Statement Analysis – Financial Results

Enable Midstream Partners, LP (ENBL)

About Enable Midstream Partners, LP

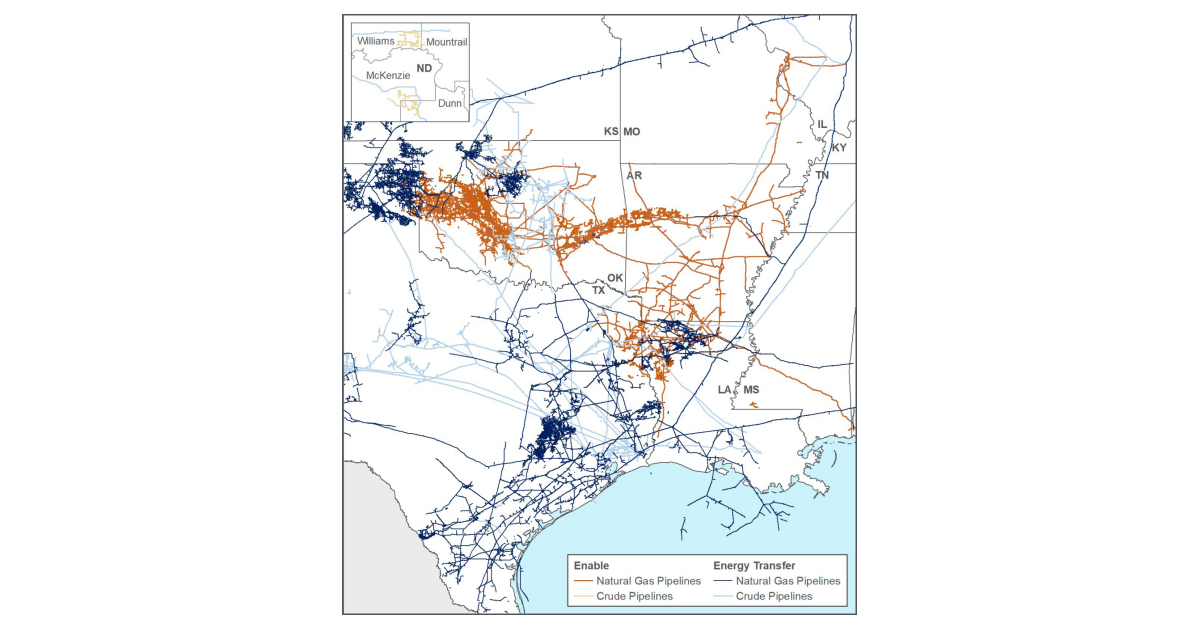

Enable Midstream Partners, LP owns, operates, and develops midstream energy infrastructure assets in the United States. The company operates in two segments, Gathering and Processing; and Transportation and Storage. The Gathering and Processing segment provides natural gas gathering, processing, and fractionation services in the Anadarko, Arkoma, and Ark-La-Tex basins, as well as crude oil gathering services in the Bakken Shale formation of the Williston Basin for its producer customers. The Transportation and Storage segment offers interstate and intrastate natural gas pipeline transportation and storage services to natural gas producers, utilities, and industrial customers. The company's natural gas gathering and processing assets are located in Oklahoma, Texas, Arkansas, and Louisiana; crude oil gathering assets are located in North Dakota; and natural gas transportation and storage assets extend from western Oklahoma and the Texas Panhandle to Louisiana, from Louisiana to Illinois, in Oklahoma, and from Louisiana to Alabama. As of December 31, 2018, its portfolio of midstream energy infrastructure assets included approximately 13,900 miles of gathering pipelines; 15 processing plants with 2.6 billion cubic feet per day of processing capacity; approximately 7,800 miles of interstate pipelines; approximately 2,300 miles of intrastate pipelines; and 8 natural gas storage facilities with 84.5 billion cubic feet of storage capacity. The company was founded in 2013 and is based in Oklahoma City, Oklahoma. Enable Midstream Partners, LP operates as a subsidiary of Centerpoint Energy Resources Corp.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.46B | 2.96B | 3.43B | 2.80B | 2.27B | 2.42B | 3.37B | 2.49B | 952.00M | 932.00M | 871.00M |

| Cost of Revenue | 1.39B | 1.28B | 1.82B | 1.38B | 1.02B | 1.10B | 1.91B | 1.31B | 235.00M | 192.00M | 175.00M |

| Gross Profit | 1.08B | 1.68B | 1.61B | 1.42B | 1.26B | 1.32B | 1.45B | 1.18B | 717.00M | 740.00M | 696.00M |

| Gross Profit Ratio | 43.77% | 56.79% | 46.98% | 50.73% | 55.24% | 54.63% | 43.15% | 47.25% | 75.32% | 79.40% | 79.91% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 98.00M | 593.00M | 566.00M | 528.00M | 523.00M | 581.00M | 583.00M | 483.00M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 98.00M | 593.00M | 566.00M | 528.00M | 523.00M | 581.00M | 583.00M | 483.00M | 0.00 | 0.00 | 0.00 |

| Other Expenses | 487.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 301.00M | 300.00M | 270.00M |

| Operating Expenses | 585.00M | 593.00M | 566.00M | 528.00M | 523.00M | 581.00M | 583.00M | 483.00M | 301.00M | 300.00M | 270.00M |

| Cost & Expenses | 1.97B | 2.39B | 2.78B | 2.28B | 1.89B | 3.13B | 2.78B | 2.02B | 536.00M | 492.00M | 445.00M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 9.00M | 21.00M | 14.00M | 9.00M |

| Interest Expense | 178.00M | 190.00M | 152.00M | 120.00M | 99.00M | 90.00M | 70.00M | -43.00M | 85.00M | 90.00M | 83.00M |

| Depreciation & Amortization | 420.00M | 433.00M | 398.00M | 366.00M | 338.00M | 318.00M | 276.00M | 212.00M | 106.00M | 91.00M | 77.00M |

| EBITDA | 686.00M | 1.02B | 1.07B | 921.00M | 750.00M | -344.00M | 878.00M | 592.00M | 710.00M | 576.00M | 539.00M |

| EBITDA Ratio | 27.85% | 34.39% | 31.19% | 32.86% | 33.01% | -14.23% | 26.08% | 23.78% | 74.58% | 61.80% | 61.88% |

| Operating Income | 493.00M | 569.00M | 648.00M | 528.00M | 385.00M | -712.00M | 586.00M | 469.00M | 416.00M | 440.00M | 426.00M |

| Operating Income Ratio | 20.02% | 19.22% | 18.89% | 18.84% | 16.95% | -29.45% | 17.40% | 18.84% | 43.70% | 47.21% | 48.91% |

| Total Other Income/Expenses | -410.00M | -170.00M | -126.00M | -92.00M | -71.00M | -59.00M | -51.00M | -43.00M | 103.00M | -45.00M | -47.00M |

| Income Before Tax | 83.00M | 399.00M | 522.00M | 436.00M | 314.00M | -771.00M | 535.00M | 426.00M | 519.00M | 395.00M | 379.00M |

| Income Before Tax Ratio | 3.37% | 13.48% | 15.21% | 15.55% | 13.82% | -31.89% | 15.89% | 17.12% | 54.52% | 42.38% | 43.51% |

| Income Tax Expense | -232.00M | -1.00M | -1.00M | -1.00M | 1.00M | 31.00M | 2.00M | -1.19B | 203.00M | 163.00M | 155.00M |

| Net Income | 88.00M | 396.00M | 521.00M | 436.00M | 312.00M | -752.00M | 530.00M | 1.62B | 316.00M | 232.00M | 224.00M |

| Net Income Ratio | 3.57% | 13.38% | 15.19% | 15.55% | 13.73% | -31.10% | 15.74% | 64.89% | 33.19% | 24.89% | 25.72% |

| EPS | 0.20 | 0.91 | 1.19 | 1.01 | 0.74 | -1.78 | 1.29 | 3.89 | 0.76 | 0.56 | 0.54 |

| EPS Diluted | 0.20 | 0.91 | 1.19 | 1.01 | 0.74 | -1.78 | 1.29 | 3.89 | 0.76 | 0.56 | 0.54 |

| Weighted Avg Shares Out | 433.33M | 437.00M | 436.00M | 433.00M | 424.00M | 422.00M | 412.00M | 415.70M | 415.71M | 415.71M | 415.71M |

| Weighted Avg Shares Out (Dil) | 433.33M | 437.00M | 436.00M | 433.00M | 424.00M | 422.00M | 412.00M | 415.70M | 415.71M | 415.71M | 415.71M |

ENABLE MIDSTREAM ALERT: Bragar Eagel & Squire, P.C. Investigates Sale of ENBL and Encourages Investors to Contact the Firm

Energy Transfer: Enable Midstream Acquisition, 2020 Results, Green Energy Is Increasing And I Am Still Bullish

The Merger Wave in the Oil Patch Starts Heading Midstream

SHAREHOLDER ALERT: Monteverde & Associates PC Announces an Investigation of Enable Midstream Partners LP - ENBL

SHAREHOLDER ALERT: WeissLaw LLP Investigates Enable Midstream Partners LP

Energy Transfer Buys Enable Midstream: Old Habits Hard To Break

Energy Transfer to buy Enable Midstream in an all-stock deal valued at $7.2 billion

CenterPoint Energy Announces Its Support of the Proposed Merger Between Enable Midstream Partners, LP and Energy Transfer LP

OGE Energy Corp. sets path to becoming a pure-play electric utility with the proposed merger between Energy Transfer LP and Enable Midstream Partners LP

Energy Transfer to Acquire Enable Midstream in $7 Billion All-Equity Transaction

Source: https://incomestatements.info

Category: Stock Reports