Complete financial analysis of Enable Midstream Partners, LP (ENBL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Enable Midstream Partners, LP, a leading company in the Oil & Gas Midstream industry within the Energy sector.

- Rainforest Resources Inc. (RRIF) Income Statement Analysis – Financial Results

- SHINKO Inc. (7120.T) Income Statement Analysis – Financial Results

- ZEN Corporation Group Public Company Limited (ZEN.BK) Income Statement Analysis – Financial Results

- LXP Industrial Trust (LXP-PC) Income Statement Analysis – Financial Results

- Edvance International Holdings Limited (1410.HK) Income Statement Analysis – Financial Results

Enable Midstream Partners, LP (ENBL)

About Enable Midstream Partners, LP

Enable Midstream Partners, LP owns, operates, and develops midstream energy infrastructure assets in the United States. The company operates in two segments, Gathering and Processing; and Transportation and Storage. The Gathering and Processing segment provides natural gas gathering, processing, and fractionation services in the Anadarko, Arkoma, and Ark-La-Tex basins, as well as crude oil gathering services in the Bakken Shale formation of the Williston Basin for its producer customers. The Transportation and Storage segment offers interstate and intrastate natural gas pipeline transportation and storage services to natural gas producers, utilities, and industrial customers. The company's natural gas gathering and processing assets are located in Oklahoma, Texas, Arkansas, and Louisiana; crude oil gathering assets are located in North Dakota; and natural gas transportation and storage assets extend from western Oklahoma and the Texas Panhandle to Louisiana, from Louisiana to Illinois, in Oklahoma, and from Louisiana to Alabama. As of December 31, 2018, its portfolio of midstream energy infrastructure assets included approximately 13,900 miles of gathering pipelines; 15 processing plants with 2.6 billion cubic feet per day of processing capacity; approximately 7,800 miles of interstate pipelines; approximately 2,300 miles of intrastate pipelines; and 8 natural gas storage facilities with 84.5 billion cubic feet of storage capacity. The company was founded in 2013 and is based in Oklahoma City, Oklahoma. Enable Midstream Partners, LP operates as a subsidiary of Centerpoint Energy Resources Corp.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.46B | 2.96B | 3.43B | 2.80B | 2.27B | 2.42B | 3.37B | 2.49B | 952.00M | 932.00M | 871.00M |

| Cost of Revenue | 1.39B | 1.28B | 1.82B | 1.38B | 1.02B | 1.10B | 1.91B | 1.31B | 235.00M | 192.00M | 175.00M |

| Gross Profit | 1.08B | 1.68B | 1.61B | 1.42B | 1.26B | 1.32B | 1.45B | 1.18B | 717.00M | 740.00M | 696.00M |

| Gross Profit Ratio | 43.77% | 56.79% | 46.98% | 50.73% | 55.24% | 54.63% | 43.15% | 47.25% | 75.32% | 79.40% | 79.91% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 98.00M | 593.00M | 566.00M | 528.00M | 523.00M | 581.00M | 583.00M | 483.00M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 98.00M | 593.00M | 566.00M | 528.00M | 523.00M | 581.00M | 583.00M | 483.00M | 0.00 | 0.00 | 0.00 |

| Other Expenses | 487.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 301.00M | 300.00M | 270.00M |

| Operating Expenses | 585.00M | 593.00M | 566.00M | 528.00M | 523.00M | 581.00M | 583.00M | 483.00M | 301.00M | 300.00M | 270.00M |

| Cost & Expenses | 1.97B | 2.39B | 2.78B | 2.28B | 1.89B | 3.13B | 2.78B | 2.02B | 536.00M | 492.00M | 445.00M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 9.00M | 21.00M | 14.00M | 9.00M |

| Interest Expense | 178.00M | 190.00M | 152.00M | 120.00M | 99.00M | 90.00M | 70.00M | -43.00M | 85.00M | 90.00M | 83.00M |

| Depreciation & Amortization | 420.00M | 433.00M | 398.00M | 366.00M | 338.00M | 318.00M | 276.00M | 212.00M | 106.00M | 91.00M | 77.00M |

| EBITDA | 686.00M | 1.02B | 1.07B | 921.00M | 750.00M | -344.00M | 878.00M | 592.00M | 710.00M | 576.00M | 539.00M |

| EBITDA Ratio | 27.85% | 34.39% | 31.19% | 32.86% | 33.01% | -14.23% | 26.08% | 23.78% | 74.58% | 61.80% | 61.88% |

| Operating Income | 493.00M | 569.00M | 648.00M | 528.00M | 385.00M | -712.00M | 586.00M | 469.00M | 416.00M | 440.00M | 426.00M |

| Operating Income Ratio | 20.02% | 19.22% | 18.89% | 18.84% | 16.95% | -29.45% | 17.40% | 18.84% | 43.70% | 47.21% | 48.91% |

| Total Other Income/Expenses | -410.00M | -170.00M | -126.00M | -92.00M | -71.00M | -59.00M | -51.00M | -43.00M | 103.00M | -45.00M | -47.00M |

| Income Before Tax | 83.00M | 399.00M | 522.00M | 436.00M | 314.00M | -771.00M | 535.00M | 426.00M | 519.00M | 395.00M | 379.00M |

| Income Before Tax Ratio | 3.37% | 13.48% | 15.21% | 15.55% | 13.82% | -31.89% | 15.89% | 17.12% | 54.52% | 42.38% | 43.51% |

| Income Tax Expense | -232.00M | -1.00M | -1.00M | -1.00M | 1.00M | 31.00M | 2.00M | -1.19B | 203.00M | 163.00M | 155.00M |

| Net Income | 88.00M | 396.00M | 521.00M | 436.00M | 312.00M | -752.00M | 530.00M | 1.62B | 316.00M | 232.00M | 224.00M |

| Net Income Ratio | 3.57% | 13.38% | 15.19% | 15.55% | 13.73% | -31.10% | 15.74% | 64.89% | 33.19% | 24.89% | 25.72% |

| EPS | 0.20 | 0.91 | 1.19 | 1.01 | 0.74 | -1.78 | 1.29 | 3.89 | 0.76 | 0.56 | 0.54 |

| EPS Diluted | 0.20 | 0.91 | 1.19 | 1.01 | 0.74 | -1.78 | 1.29 | 3.89 | 0.76 | 0.56 | 0.54 |

| Weighted Avg Shares Out | 433.33M | 437.00M | 436.00M | 433.00M | 424.00M | 422.00M | 412.00M | 415.70M | 415.71M | 415.71M | 415.71M |

| Weighted Avg Shares Out (Dil) | 433.33M | 437.00M | 436.00M | 433.00M | 424.00M | 422.00M | 412.00M | 415.70M | 415.71M | 415.71M | 415.71M |

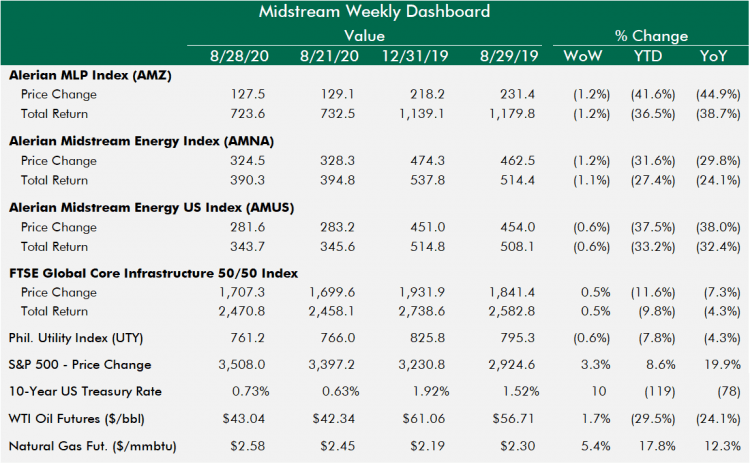

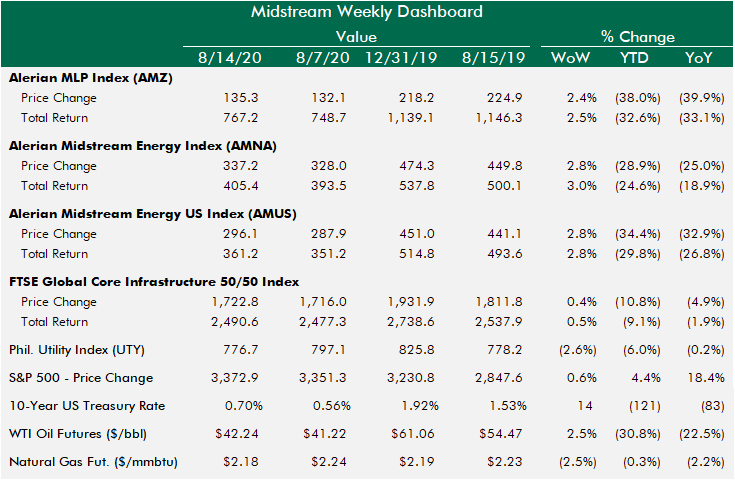

Stocks Up, Midstream Down

Tracking David Tepper's Appaloosa Management Portfolio - Q2 2020 Update

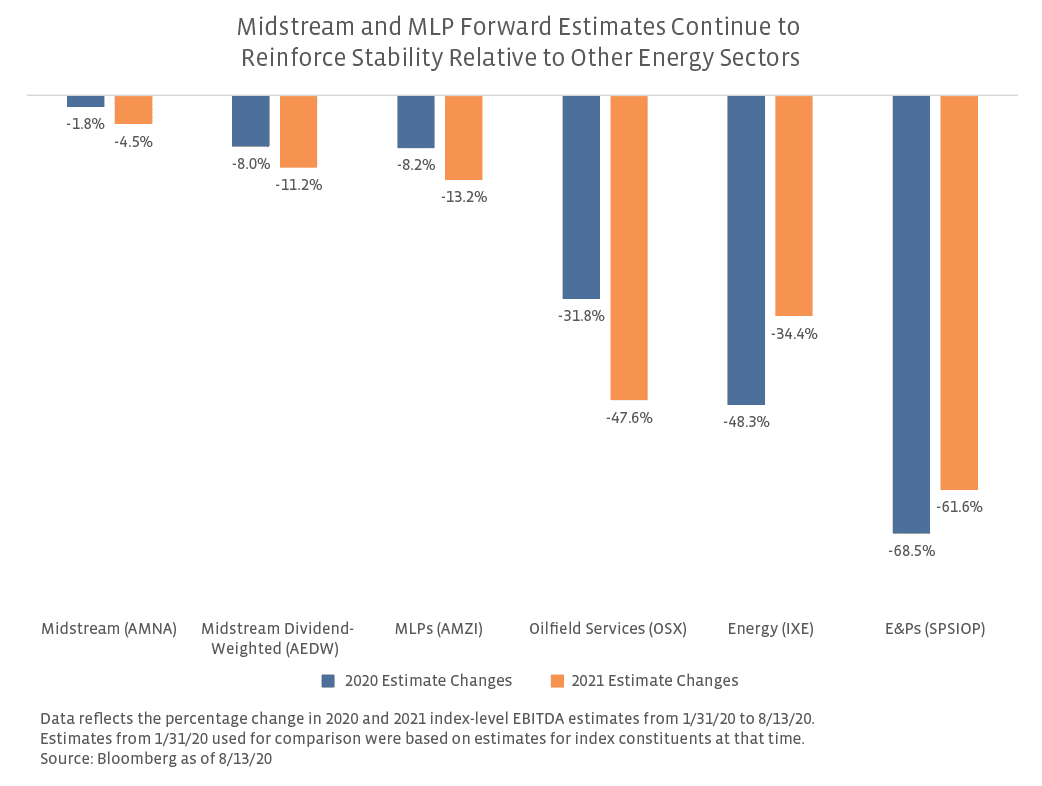

Steady Midstream EBITDA Outlooks Contrast With Performance

Blue Flame Special For Midstream

Enable Midstream Partners (ENBL) Presents At Citi Midstream Energy Infrastructure Conference - Slideshow

Midstream Restraint Rewarded

Summit Midstream Partners (SMLP) Scheduled to Post Earnings on Friday

ClearBridge MLP and Midstream Total Return Fund Inc. Announces Unaudited Balance Sheet Information as of July 31, 2020

Enable Midstream to Participate in Upcoming Conferences

Summit Midstream Partners (NYSE:SMLP) Stock Rating Lowered by ValuEngine

Source: https://incomestatements.info

Category: Stock Reports