See more : Ann Joo Resources Berhad (6556.KL) Income Statement Analysis – Financial Results

Complete financial analysis of Empire State Realty OP, L.P. (ESBA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Empire State Realty OP, L.P., a leading company in the REIT – Office industry within the Real Estate sector.

- Guangxi Fenglin Wood Industry Group Co.,Ltd (601996.SS) Income Statement Analysis – Financial Results

- Frontier Services Group Limited (0500.HK) Income Statement Analysis – Financial Results

- Wonik Pne Co., Ltd. (217820.KQ) Income Statement Analysis – Financial Results

- Mostostal Warszawa S.A. (MSW.WA) Income Statement Analysis – Financial Results

- Xiamen Overseas Chinese Electronic Co.,Ltd. (600870.SS) Income Statement Analysis – Financial Results

Empire State Realty OP, L.P. (ESBA)

About Empire State Realty OP, L.P.

Empire State Realty OP, L.P. operates as a subsidiary of Empire State Realty Trust, Inc.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 739.57M | 727.04M | 624.09M | 609.23M | 731.34M | 731.51M | 712.47M | 678.00M | 657.63M | 635.33M | 311.85M | 260.29M | 294.79M | 246.55M | 232.32M | 268.80M |

| Cost of Revenue | 339.02M | 321.35M | 279.49M | 291.11M | 333.99M | 319.47M | 305.60M | 289.07M | 296.53M | 306.16M | 145.44M | 105.71M | 86.26M | 87.94M | 87.79M | 80.15M |

| Gross Profit | 400.56M | 405.69M | 344.61M | 318.12M | 397.36M | 412.04M | 406.87M | 388.93M | 361.11M | 329.17M | 166.41M | 154.59M | 208.53M | 158.60M | 144.53M | 188.64M |

| Gross Profit Ratio | 54.16% | 55.80% | 55.22% | 52.22% | 54.33% | 56.33% | 57.11% | 57.36% | 54.91% | 51.81% | 53.36% | 59.39% | 70.74% | 64.33% | 62.21% | 70.18% |

| Research & Development | 0.00 | 0.09 | -0.02 | -0.05 | 0.12 | 0.17 | 0.18 | 0.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 63.94M | 61.77M | 55.95M | 62.24M | 61.06M | 52.67M | 50.32M | 49.08M | 38.07M | 39.04M | 42.57M | 23.21M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.30M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 63.94M | 61.77M | 55.95M | 62.24M | 61.06M | 52.67M | 50.32M | 49.08M | 38.07M | 39.04M | 42.57M | 23.21M | 61.92M | 41.51M | 33.43M | 73.84M |

| Other Expenses | 0.00 | 216.89M | 201.81M | 191.01M | 181.59M | 168.51M | 160.71M | 155.21M | 171.47M | 145.43M | 65.41M | 42.69M | 97.43M | 75.55M | 62.75M | 100.68M |

| Operating Expenses | 253.85M | 278.66M | 257.75M | 253.25M | 242.65M | 221.18M | 211.03M | 204.29M | 209.55M | 184.47M | 107.97M | 65.90M | 97.43M | 75.55M | 62.75M | 100.68M |

| Cost & Expenses | 592.87M | 600.01M | 537.24M | 544.36M | 576.64M | 540.65M | 516.62M | 493.36M | 506.07M | 490.62M | 253.41M | 171.61M | 183.69M | 163.49M | 150.54M | 180.84M |

| Interest Income | 15.14M | 4.95M | 704.00K | 2.64M | 11.26M | 10.66M | 2.94M | 647.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 101.48M | 101.21M | 94.39M | 89.91M | 79.25M | 79.62M | 68.47M | 71.15M | 67.49M | 66.46M | 56.96M | 54.39M | 54.75M | 52.26M | 50.74M | 48.66M |

| Depreciation & Amortization | 189.91M | 600.01M | 537.24M | 551.96M | 587.54M | 552.75M | 533.72M | 518.06M | 171.47M | 145.43M | 70.96M | 47.57M | 38.76M | 36.03M | 30.86M | 28.16M |

| EBITDA | 336.62M | 343.92M | 288.66M | 251.05M | 355.38M | 359.37M | 331.62M | 313.94M | 323.04M | 286.75M | 142.05M | 131.38M | 149.86M | 116.29M | 112.64M | 116.12M |

| EBITDA Ratio | 45.52% | 47.98% | 46.37% | 42.43% | 47.52% | 50.58% | 50.05% | 50.13% | 49.12% | 45.67% | 105.38% | 57.86% | 50.83% | 48.30% | 48.48% | 43.20% |

| Operating Income | 146.71M | 127.03M | 79.13M | 58.66M | 154.71M | 190.86M | 195.85M | 184.54M | 151.37M | 141.32M | 58.44M | 88.69M | 111.10M | 83.06M | 81.78M | 87.96M |

| Operating Income Ratio | 19.84% | 17.47% | 12.68% | 9.63% | 21.15% | 26.09% | 27.49% | 27.22% | 23.02% | 22.24% | 18.74% | 34.07% | 37.69% | 33.69% | 35.20% | 32.72% |

| Total Other Income/Expenses | -59.58M | -62.27M | -93.90M | -88.52M | -67.99M | -68.96M | -70.92M | -70.50M | -67.49M | -66.46M | 218.63M | -40.05M | -51.90M | -36.94M | -50.74M | -48.66M |

| Income Before Tax | 87.12M | 64.76M | -14.77M | -29.86M | 86.72M | 121.90M | 124.93M | 113.40M | 83.88M | 74.87M | 200.71M | 48.64M | 56.35M | 30.79M | 31.04M | 39.30M |

| Income Before Tax Ratio | 11.78% | 8.91% | -2.37% | -4.90% | 11.86% | 16.66% | 17.53% | 16.73% | 12.75% | 11.78% | 64.36% | 18.69% | 19.12% | 12.49% | 13.36% | 14.62% |

| Income Tax Expense | 2.72M | 1.55M | -1.73M | -6.97M | 2.43M | 4.64M | 6.67M | 6.15M | 3.95M | 4.66M | 374.39M | 68.74M | -3.89M | -15.32M | -10.80M | -13.42M |

| Net Income | 53.25M | 63.21M | -13.04M | -22.89M | 84.29M | 66.54M | 63.58M | 52.39M | 34.67M | 27.14M | 82.53M | 48.64M | 60.24M | 46.12M | 41.84M | 52.72M |

| Net Income Ratio | 7.20% | 8.69% | -2.09% | -3.76% | 11.53% | 9.10% | 8.92% | 7.73% | 5.27% | 4.27% | 26.46% | 18.69% | 20.44% | 18.71% | 18.01% | 19.61% |

| EPS | 0.50 | 0.38 | -0.08 | -0.13 | 0.47 | 0.38 | 0.40 | 0.38 | 0.30 | 0.27 | 0.79 | 0.53 | 0.66 | 0.49 | 0.46 | 0.58 |

| EPS Diluted | 0.30 | 0.23 | -0.05 | -0.08 | 0.29 | 0.22 | 0.39 | 0.38 | 0.29 | 0.27 | 0.79 | 0.53 | 0.66 | 0.49 | 0.46 | 0.58 |

| Weighted Avg Shares Out | 161.12M | 165.04M | 172.45M | 175.17M | 178.34M | 173.84M | 158.38M | 133.88M | 114.25M | 97.94M | 95.46M | 91.66M | 91.66M | 91.66M | 91.66M | 91.66M |

| Weighted Avg Shares Out (Dil) | 265.63M | 269.95M | 274.98M | 278.18M | 294.75M | 297.26M | 298.05M | 277.57M | 266.62M | 254.51M | 95.61M | 91.66M | 91.66M | 91.66M | 91.66M | 91.66M |

Empire State Realty OP LP Unit Series ES (NYSEARCA:ESBA) Shares Acquired by Acadian Asset Management LLC

Steve Levy: Gov. Cuomo’s liberal policies are putting illegal immigrants ahead of New Yorkers

<![CDATA[Market crash eases]]>

7 Small Cap Stocks That Pack a Wallop

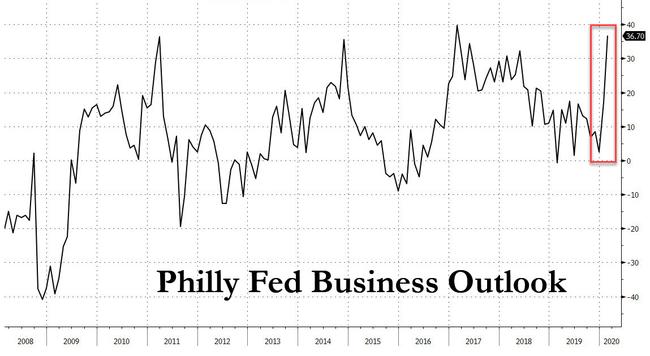

Philly Fed Unexpectedly Soars To Second Highest Since Financial Crisis

Covid-19 Hits Yen and Korean Won

Euro US Dollar (EUR/USD) Exchange Rate Flat Ahead of Federal Reserve Meeting Minutes

New York’s taxes are driving out thousands, but Millennials keep moving in

Euro Hangs Above Three-Year Lows on Eurozone Growth Concerns

Economic Report: Empire State manufacturing index hits highest level in nine months

Source: https://incomestatements.info

Category: Stock Reports