See more : eGuarantee, Inc. (8771.T) Income Statement Analysis – Financial Results

Complete financial analysis of Evelo Biosciences, Inc. (EVLO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Evelo Biosciences, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Union Quality Plastics Limited (UNQTYMI.BO) Income Statement Analysis – Financial Results

- Megaport Limited (MP1.AX) Income Statement Analysis – Financial Results

- J.D Development Co., LTD (4402.TWO) Income Statement Analysis – Financial Results

- DRC Systems India Limited (DRCSYSTEMS.BO) Income Statement Analysis – Financial Results

- Genesis Growth Tech Acquisition Corp. (GGAA) Income Statement Analysis – Financial Results

Evelo Biosciences, Inc. (EVLO)

About Evelo Biosciences, Inc.

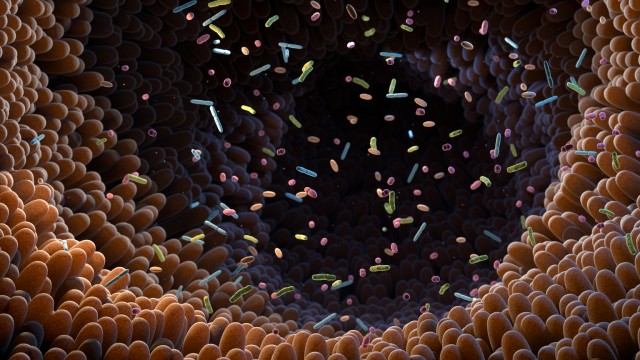

Evelo Biosciences, Inc., a biotechnology company, discovers and develops oral biologics for the treatment of inflammatory diseases and cancer. It is developing EDP1815, a whole-microbe candidate for the treatment of inflammatory diseases; and is in Phase 2 clinical trial for the treatment of psoriasis and atopic dermatitis, as well as for the hyperinflammatory response associated with COVID-19. The company also develops EDP1867, an inactivated investigational oral biologic, which is in Phase 1b for the treatment of inflammatory diseases; EDP2939, an extracellular vesicle investigational oral biologic for the treatment of inflammatory diseases; and EDP1908, a product candidate for oncology. Evelo Biosciences, Inc. was incorporated in 2014 and is headquartered in Cambridge, Massachusetts.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 78.55M | 83.64M | 69.62M | 63.13M | 39.89M | 19.96M | 9.13M |

| General & Administrative | 29.91M | 31.75M | 22.27M | 23.23M | 18.22M | 7.57M | 3.89M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 29.91M | 31.75M | 22.27M | 23.23M | 18.22M | 7.57M | 3.89M |

| Other Expenses | 0.00 | 486.00K | -1.37M | 1.08M | 1.16M | -301.00K | -20.00K |

| Operating Expenses | 108.47M | 115.40M | 91.89M | 86.36M | 58.10M | 27.53M | 13.03M |

| Cost & Expenses | 108.47M | 115.40M | 91.89M | 86.36M | 58.10M | 27.53M | 13.03M |

| Interest Income | 4.67K | 3.61K | 0.00 | 1.05K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 4.67M | 3.61M | 2.11M | 1.05M | 1.56M | 0.00 | 0.00 |

| Depreciation & Amortization | 2.06M | 2.22M | 2.03M | 1.76K | 1.94K | 834.00 | 495.00 |

| EBITDA | -106.35M | -115.40M | -91.89M | -86.36M | -58.10M | -26.70M | -12.53M |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -108.47M | -115.40M | -91.89M | -86.36M | -58.10M | -27.53M | -13.03M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -5.13M | -6.35M | -1.37M | 885.00K | 1.16M | -516.00K | -307.00K |

| Income Before Tax | -113.60M | -121.75M | -93.26M | -85.47M | -56.95M | -28.05M | -13.33M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 930.00K | 428.00K | 409.00K | 190.00K | -3.09M | 215.00K | 287.00K |

| Net Income | -114.53M | -122.18M | -93.67M | -85.66M | -53.85M | -28.05M | -13.33M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -26.28 | -46.18 | -47.45 | -53.49 | -49.25 | -149.98 | -94.55 |

| EPS Diluted | -26.28 | -46.18 | -47.45 | -53.49 | -49.25 | -149.55 | -94.06 |

| Weighted Avg Shares Out | 4.36M | 2.65M | 1.97M | 1.60M | 1.09M | 187.00K | 141.00K |

| Weighted Avg Shares Out (Dil) | 4.36M | 2.65M | 1.97M | 1.60M | 1.09M | 187.54K | 141.74K |

EVLO to Provide Dominion Energy With Safety Enhanced Energy Storage Systems

Top 4 Health Care Stocks That May Rocket Higher This Month - Generation Bio (NASDAQ:GBIO), Evelo Biosciences (NASDAQ:EVLO)

Evelo (EVLO) Drops 59% on Flunking Psoriasis Drug Study

Evelo Biosciences shares tank 46% after trial failure

Evelo Biosciences to review options after Phase 2 trial of psoriasis treatment fails to meet main goal

Evelo Biosciences Announces Top-Line Results From its Phase 2 Clinical Study with EDP2939 in Moderate Psoriasis

Evelo Biosciences: May Be Worth A Small, Highly Speculative Long Position Considering Upcoming Psoriasis Phase 2 Results

Evelo Biosciences Announces Second Quarter Financial Results and Recent Business Highlights

Evelo Biosciences Closes $25.5 Million Private Placement

Evelo Biosciences Announces $25.5 Million Private Placement

Source: https://incomestatements.info

Category: Stock Reports