See more : Science to Consumers, Inc. (BEUT) Income Statement Analysis – Financial Results

Complete financial analysis of Ford Motor Company (F) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ford Motor Company, a leading company in the Auto – Manufacturers industry within the Consumer Cyclical sector.

- PureTech Health plc (PTCHF) Income Statement Analysis – Financial Results

- Arhaus, Inc. (ARHS) Income Statement Analysis – Financial Results

- Mynaric AG (MYNA) Income Statement Analysis – Financial Results

- BANDAI NAMCO Holdings Inc. (7832.T) Income Statement Analysis – Financial Results

- Ajanta Soya Limited (AJANTSOY.BO) Income Statement Analysis – Financial Results

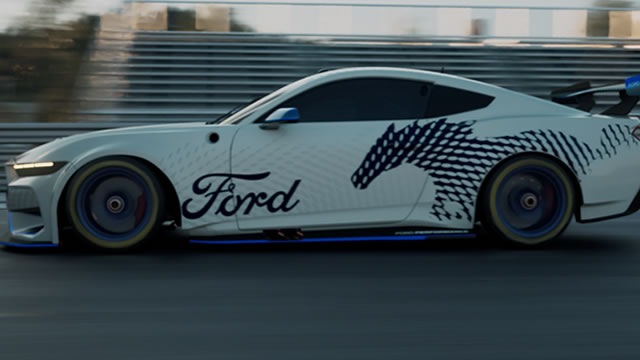

Ford Motor Company (F)

About Ford Motor Company

Ford Motor Company develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles worldwide. It operates through Ford Blue, Ford Model e, and Ford Pro; Ford Next; and Ford Credit segments. The company sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments. It also engages in vehicle-related financing and leasing activities to and through automotive dealers. In addition, the company provides retail installment sale contracts for new and used vehicles; and direct financing leases for new vehicles to retail and commercial customers, such as leasing companies, government entities, daily rental companies, and fleet customers. Further, it offers wholesale loans to dealers to finance the purchase of vehicle inventory; and loans to dealers to finance working capital and enhance dealership facilities, purchase dealership real estate, and other dealer vehicle programs. The company was incorporated in 1903 and is based in Dearborn, Michigan.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 176.19B | 158.06B | 136.34B | 127.14B | 155.90B | 160.34B | 156.78B | 151.80B | 149.56B | 144.08B | 146.92B | 134.25B | 136.26B | 128.95B | 118.31B | 146.28B | 172.46B | 160.12B | 177.09B | 171.65B | 164.20B | 163.42B | 162.41B | 170.06B | 162.56B | 144.42B | 153.63B | 146.99B | 137.14B | 128.44B | 108.52B | 100.13B | 88.29B | 97.65B | 96.15B | 92.45B | 71.64B | 62.72B | 52.77B |

| Cost of Revenue | 160.03B | 134.40B | 114.65B | 112.75B | 134.69B | 136.27B | 131.33B | 126.58B | 126.50B | 126.22B | 128.09B | 115.69B | 113.35B | 104.45B | 100.02B | 127.10B | 142.59B | 148.87B | 144.94B | 135.86B | 129.82B | 125.14B | 134.89B | 135.64B | 126.73B | 112.82B | 118.62B | 118.59B | 110.60B | 103.20B | 88.36B | 80.03B | 70.37B | 78.00B | 72.62B | 68.23B | 58.50B | 51.87B | 44.44B |

| Gross Profit | 16.16B | 23.66B | 21.69B | 14.39B | 21.21B | 24.07B | 25.44B | 25.22B | 23.06B | 17.86B | 18.82B | 18.56B | 22.92B | 24.50B | 18.29B | 19.17B | 29.87B | 11.25B | 32.15B | 35.80B | 34.38B | 38.28B | 27.52B | 34.43B | 35.83B | 31.60B | 35.01B | 28.41B | 26.54B | 25.24B | 20.16B | 20.11B | 17.92B | 19.65B | 23.53B | 24.21B | 13.15B | 10.85B | 8.34B |

| Gross Profit Ratio | 9.17% | 14.97% | 15.91% | 11.32% | 13.60% | 15.01% | 16.23% | 16.61% | 15.42% | 12.40% | 12.81% | 13.82% | 16.82% | 19.00% | 15.46% | 13.11% | 17.32% | 7.03% | 18.15% | 20.85% | 20.94% | 23.43% | 16.94% | 20.24% | 22.04% | 21.88% | 22.79% | 19.32% | 19.35% | 19.65% | 18.57% | 20.08% | 20.29% | 20.12% | 24.47% | 26.19% | 18.35% | 17.30% | 15.80% |

| Research & Development | 8.20B | 7.80B | 7.60B | 7.10B | 7.40B | 8.20B | 8.00B | 7.30B | 6.70B | 6.70B | 6.20B | 5.50B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 8.20B | 8.69B | 8.82B | 7.39B | 7.56B | 7.40B | 11.53B | 7.90B | 10.70B | 9.82B | 8.78B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 2.50B | 2.20B | 3.10B | 2.80B | 3.60B | 4.00B | 4.10B | 4.30B | 4.30B | 4.30B | 4.40B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 10.70B | 10.89B | 11.92B | 10.19B | 11.16B | 11.40B | 11.53B | 12.20B | 15.00B | 14.12B | 13.18B | 12.18B | 11.58B | 11.91B | 13.26B | 21.43B | 21.17B | 19.18B | 24.65B | 25.12B | 17.48B | 28.43B | 13.60B | 9.88B | 9.55B | 7.62B | 7.08B | 6.63B | 6.04B | 5.13B | 6.49B | 6.23B | 6.15B | 5.92B | 5.32B | 8.31B | 3.78B | 3.83B | 3.22B |

| Other Expenses | 0.00 | 2.02B | 6.65B | 679.00M | -1.12B | 2.25B | 3.27B | 1.21B | 1.03B | 898.00M | 927.00M | 434.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.64B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 10.70B | 10.89B | 11.92B | 10.19B | 11.16B | 11.40B | 11.53B | 12.20B | 15.42B | 14.42B | 13.38B | 12.27B | 11.58B | 11.91B | 13.26B | 21.43B | 21.17B | 19.18B | 24.65B | 25.12B | 26.26B | 28.43B | 35.09B | 19.29B | 18.80B | 16.21B | 14.73B | 13.50B | 12.54B | 10.04B | 9.56B | 12.99B | 11.93B | 9.11B | 9.55B | 10.76B | 6.95B | 6.79B | 5.61B |

| Cost & Expenses | 170.73B | 145.29B | 126.57B | 122.95B | 145.85B | 147.67B | 142.86B | 138.78B | 141.91B | 140.64B | 141.48B | 127.96B | 124.92B | 116.36B | 113.27B | 148.53B | 163.76B | 168.05B | 169.60B | 160.97B | 156.08B | 153.56B | 169.98B | 154.93B | 145.53B | 129.02B | 133.35B | 132.09B | 123.14B | 113.24B | 97.92B | 93.01B | 82.30B | 87.11B | 82.17B | 79.00B | 65.44B | 58.66B | 50.04B |

| Interest Income | 1.57B | 639.00M | 261.00M | 452.00M | 809.00M | 700.00M | 464.00M | 299.00M | 312.00M | 340.00M | 213.00M | 342.00M | 471.00M | 348.00M | 5.84B | 1.06B | 1.16B | 1.48B | 473.00M | 0.00 | 0.00 | 0.00 | 0.00 | 1.49B | 1.43B | 1.33B | 1.12B | 841.00M | 800.00M | 665.00M | 563.00M | 653.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.32B | 1.28B | 1.80B | 1.65B | 1.05B | 1.23B | 1.19B | 951.00M | 773.00M | 810.00M | 829.00M | 713.00M | 4.43B | 6.15B | 6.83B | 10.44B | 10.93B | 8.78B | 7.64B | 0.00 | 0.00 | 0.00 | 0.00 | 1.38B | 1.40B | 829.00M | 788.00M | 695.00M | 622.00M | 721.00M | 807.00M | 860.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 6.52B | 6.49B | 5.96B | 7.46B | 8.49B | 8.31B | 8.45B | 8.72B | 7.97B | 7.42B | 6.46B | 5.20B | 4.26B | 5.58B | 6.93B | 12.93B | 1.55B | 16.52B | 6.72B | 13.05B | 14.30B | 15.18B | 19.75B | 14.85B | 15.19B | 14.33B | 13.58B | 12.79B | 11.72B | 9.34B | 3.06B | 6.76B | 5.78B | 3.18B | 4.23B | 2.46B | 3.17B | 2.96B | 2.39B |

| EBITDA | 11.82B | 4.74B | 25.54B | 7.99B | 8.87B | 13.89B | 18.02B | 16.77B | 19.36B | 9.76B | 14.00B | 12.86B | 13.75B | 14.95B | 15.97B | 10.83B | 11.66B | 8.83B | 16.37B | 23.73B | 22.41B | 25.03B | 12.18B | 33.67B | 33.73B | 38.98B | 34.89B | 28.53B | 26.36B | 25.47B | 12.28B | 13.21B | 11.76B | 13.73B | 18.21B | 15.91B | 9.37B | 7.02B | 5.12B |

| EBITDA Ratio | 6.71% | 11.95% | 17.12% | 12.80% | 11.73% | 14.56% | 17.12% | 16.58% | 12.58% | 8.73% | 9.53% | 9.58% | 12.16% | 14.78% | 15.06% | 7.41% | 5.94% | 5.52% | 7.68% | 13.83% | 13.65% | 15.32% | 7.50% | 18.46% | 20.75% | 32.52% | 22.71% | 19.41% | 19.22% | 19.83% | 11.96% | 13.19% | 12.59% | 13.51% | 18.26% | 16.09% | 10.82% | 8.80% | 7.15% |

| Operating Income | 5.46B | 12.40B | 17.38B | 8.82B | 9.79B | 2.68B | 4.14B | 3.52B | 7.65B | 3.44B | 5.44B | 6.29B | 11.34B | 12.59B | 5.03B | -2.26B | 8.70B | -7.93B | 7.49B | 10.68B | 8.12B | 9.86B | -7.57B | 15.13B | 17.03B | 15.39B | 20.28B | 14.91B | 14.00B | 15.20B | 10.60B | 7.12B | 5.98B | 10.54B | 13.98B | 13.45B | 6.20B | 4.06B | 2.73B |

| Operating Income Ratio | 3.10% | 7.85% | 12.75% | 6.94% | 6.28% | 1.67% | 2.64% | 2.32% | 5.11% | 2.39% | 3.70% | 4.69% | 8.32% | 9.77% | 4.25% | -1.54% | 5.04% | -4.95% | 4.23% | 6.22% | 4.94% | 6.03% | -4.66% | 8.90% | 10.48% | 10.66% | 13.20% | 10.14% | 10.21% | 11.83% | 9.77% | 7.11% | 6.78% | 10.79% | 14.54% | 14.55% | 8.66% | 6.47% | 5.17% |

| Total Other Income/Expenses | -1.49B | -9.29B | 402.00M | 3.29B | -1.21B | 1.14B | 3.28B | 3.28B | 2.61B | -2.21B | -5.81B | 1.92B | -2.66B | -5.45B | -1.79B | -11.08B | -12.45B | -7.13B | -1.17B | -6.57B | -6.67B | -8.03B | -10.91B | -9.60B | -6.01B | 10.01B | -9.34B | -8.11B | -7.29B | -6.41B | -4.84B | -4.93B | -8.64B | -9.15B | -8.03B | -5.15B | 1.15B | 1.00B | 888.80M |

| Income Before Tax | 3.97B | -3.02B | 17.78B | -1.12B | -640.00M | 4.35B | 8.15B | 6.80B | 10.25B | 4.34B | 7.00B | 7.72B | 8.68B | 7.15B | 3.03B | -14.40B | -3.75B | -15.05B | 2.00B | 4.85B | 1.37B | 953.00M | -7.58B | 8.23B | 11.03B | 25.40B | 10.94B | 6.79B | 6.71B | 8.79B | 3.88B | -207.10M | -2.65B | 1.39B | 5.95B | 8.30B | 7.35B | 5.06B | 3.62B |

| Income Before Tax Ratio | 2.25% | -1.91% | 13.04% | -0.88% | -0.41% | 2.71% | 5.20% | 4.48% | 6.85% | 3.01% | 4.77% | 5.75% | 6.37% | 5.54% | 2.56% | -9.85% | -2.17% | -9.40% | 1.13% | 2.83% | 0.83% | 0.58% | -4.67% | 4.84% | 6.78% | 17.59% | 7.12% | 4.62% | 4.89% | 6.84% | 3.57% | -0.21% | -3.01% | 1.42% | 6.19% | 8.98% | 10.26% | 8.07% | 6.86% |

| Income Tax Expense | -362.00M | -864.00M | -130.00M | 160.00M | -724.00M | 650.00M | 520.00M | 2.19B | 2.88B | 1.16B | -147.00M | 2.06B | -11.54B | 592.00M | 69.00M | 63.00M | -1.29B | -2.65B | -512.00M | 937.00M | 135.00M | 302.00M | -2.15B | 2.71B | 3.67B | 3.18B | 3.74B | 2.17B | 2.38B | 3.33B | 1.35B | 294.70M | -395.40M | 530.40M | 2.11B | 3.00B | 2.73B | 1.77B | 1.10B |

| Net Income | 4.35B | -2.15B | 17.94B | -1.28B | 84.00M | 3.68B | 7.60B | 4.60B | 7.37B | 3.19B | 7.16B | 5.67B | 20.21B | 6.56B | 2.72B | -14.67B | -2.72B | -12.61B | 2.02B | 3.49B | 495.00M | -980.00M | -5.45B | 3.47B | 7.24B | 22.07B | 6.92B | 4.45B | 4.14B | 5.31B | 2.53B | -7.39B | -2.26B | 860.10M | 3.84B | 5.30B | 4.63B | 3.29B | 2.52B |

| Net Income Ratio | 2.47% | -1.36% | 13.16% | -1.00% | 0.05% | 2.29% | 4.85% | 3.03% | 4.93% | 2.21% | 4.87% | 4.22% | 14.83% | 5.09% | 2.30% | -10.03% | -1.58% | -7.88% | 1.14% | 2.03% | 0.30% | -0.60% | -3.36% | 2.04% | 4.45% | 15.28% | 4.50% | 3.02% | 3.02% | 4.13% | 2.33% | -7.38% | -2.56% | 0.88% | 3.99% | 5.73% | 6.46% | 5.24% | 4.77% |

| EPS | 1.09 | -0.54 | 4.49 | -0.32 | 0.02 | 0.93 | 1.91 | 1.16 | 1.86 | 0.31 | 3.04 | 1.47 | 5.33 | 1.90 | 0.91 | -6.45 | -1.38 | -6.71 | 0.78 | 1.66 | 0.13 | -0.54 | -3.00 | 2.34 | 5.99 | 18.17 | 3.66 | 2.37 | 2.28 | 3.16 | 1.44 | -4.84 | -2.37 | 0.94 | 4.11 | 5.48 | 4.52 | 3.03 | 2.29 |

| EPS Diluted | 1.08 | -0.54 | 4.45 | -0.32 | 0.02 | 0.92 | 1.90 | 1.15 | 1.84 | 0.31 | 2.94 | 1.41 | 4.94 | 1.66 | 0.86 | -6.45 | -1.38 | -6.71 | 0.77 | 1.52 | 0.13 | -0.54 | -3.00 | 2.30 | 5.86 | 17.76 | 3.58 | 2.32 | 2.12 | 2.83 | 1.34 | -4.84 | -2.37 | 0.92 | 4.06 | 5.41 | 4.45 | 3.03 | 2.22 |

| Weighted Avg Shares Out | 4.00B | 4.01B | 3.99B | 3.97B | 3.97B | 3.95B | 3.98B | 3.97B | 3.97B | 3.91B | 3.94B | 3.82B | 3.79B | 3.45B | 2.99B | 2.27B | 1.98B | 1.88B | 1.85B | 1.74B | 1.83B | 1.82B | 1.82B | 1.48B | 1.21B | 1.21B | 1.88B | 1.85B | 1.68B | 1.59B | 1.55B | 1.53B | 953.97M | 915.00M | 933.09M | 967.19M | 1.02B | 1.08B | 1.10B |

| Weighted Avg Shares Out (Dil) | 4.04B | 4.01B | 4.03B | 3.97B | 4.00B | 4.00B | 4.00B | 4.00B | 4.00B | 3.96B | 4.09B | 4.02B | 4.11B | 4.18B | 3.31B | 2.27B | 1.98B | 1.88B | 1.87B | 1.90B | 1.89B | 1.82B | 1.82B | 1.50B | 1.24B | 1.24B | 1.93B | 1.89B | 1.81B | 1.59B | 1.55B | 1.53B | 953.97M | 934.89M | 944.58M | 979.70M | 1.04B | 1.08B | 1.13B |

Is Ford a Millionaire-Maker Stock?

These 5 ‘Special' Dividends Are More Than One-Hit Wonders

Is Ford Stock a Buy?

Could Buying Ford Stock Today Set You Up for Life?

Ford's Rich Dividend Yield, Diversification Remain Tempting

Ford's Stock 20% In Two Years

GM, Stellantis, and Ford could bear the brunt of Trump's planned 25% tariff hike

Why Is Ford Motor (F) Up 6.6% Since Last Earnings Report?

Union says layoffs at Ford spell 'incremental death' for German site

3 Auto Stocks Sliding on Trump Tariff Concerns

Source: https://incomestatements.info

Category: Stock Reports