See more : China Qinfa Group Limited (0866.HK) Income Statement Analysis – Financial Results

Complete financial analysis of Ford Motor Company (F) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ford Motor Company, a leading company in the Auto – Manufacturers industry within the Consumer Cyclical sector.

- CME Group Inc. (CME) Income Statement Analysis – Financial Results

- PT PP Presisi Tbk (PPRE.JK) Income Statement Analysis – Financial Results

- CM Life Sciences II Inc. (CMIIU) Income Statement Analysis – Financial Results

- Journeo plc (JNEO.L) Income Statement Analysis – Financial Results

- River Valley Community Bancorp (RVCB) Income Statement Analysis – Financial Results

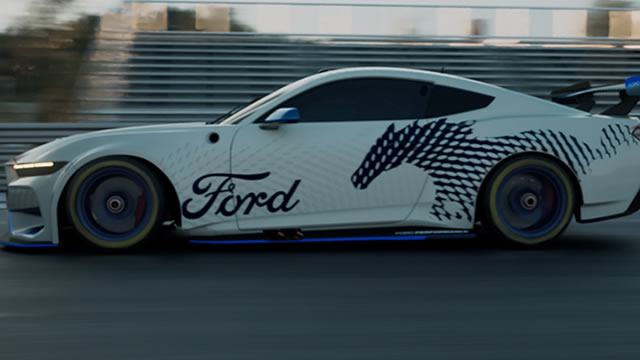

Ford Motor Company (F)

About Ford Motor Company

Ford Motor Company develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles worldwide. It operates through Ford Blue, Ford Model e, and Ford Pro; Ford Next; and Ford Credit segments. The company sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments. It also engages in vehicle-related financing and leasing activities to and through automotive dealers. In addition, the company provides retail installment sale contracts for new and used vehicles; and direct financing leases for new vehicles to retail and commercial customers, such as leasing companies, government entities, daily rental companies, and fleet customers. Further, it offers wholesale loans to dealers to finance the purchase of vehicle inventory; and loans to dealers to finance working capital and enhance dealership facilities, purchase dealership real estate, and other dealer vehicle programs. The company was incorporated in 1903 and is based in Dearborn, Michigan.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 176.19B | 158.06B | 136.34B | 127.14B | 155.90B | 160.34B | 156.78B | 151.80B | 149.56B | 144.08B | 146.92B | 134.25B | 136.26B | 128.95B | 118.31B | 146.28B | 172.46B | 160.12B | 177.09B | 171.65B | 164.20B | 163.42B | 162.41B | 170.06B | 162.56B | 144.42B | 153.63B | 146.99B | 137.14B | 128.44B | 108.52B | 100.13B | 88.29B | 97.65B | 96.15B | 92.45B | 71.64B | 62.72B | 52.77B |

| Cost of Revenue | 160.03B | 134.40B | 114.65B | 112.75B | 134.69B | 136.27B | 131.33B | 126.58B | 126.50B | 126.22B | 128.09B | 115.69B | 113.35B | 104.45B | 100.02B | 127.10B | 142.59B | 148.87B | 144.94B | 135.86B | 129.82B | 125.14B | 134.89B | 135.64B | 126.73B | 112.82B | 118.62B | 118.59B | 110.60B | 103.20B | 88.36B | 80.03B | 70.37B | 78.00B | 72.62B | 68.23B | 58.50B | 51.87B | 44.44B |

| Gross Profit | 16.16B | 23.66B | 21.69B | 14.39B | 21.21B | 24.07B | 25.44B | 25.22B | 23.06B | 17.86B | 18.82B | 18.56B | 22.92B | 24.50B | 18.29B | 19.17B | 29.87B | 11.25B | 32.15B | 35.80B | 34.38B | 38.28B | 27.52B | 34.43B | 35.83B | 31.60B | 35.01B | 28.41B | 26.54B | 25.24B | 20.16B | 20.11B | 17.92B | 19.65B | 23.53B | 24.21B | 13.15B | 10.85B | 8.34B |

| Gross Profit Ratio | 9.17% | 14.97% | 15.91% | 11.32% | 13.60% | 15.01% | 16.23% | 16.61% | 15.42% | 12.40% | 12.81% | 13.82% | 16.82% | 19.00% | 15.46% | 13.11% | 17.32% | 7.03% | 18.15% | 20.85% | 20.94% | 23.43% | 16.94% | 20.24% | 22.04% | 21.88% | 22.79% | 19.32% | 19.35% | 19.65% | 18.57% | 20.08% | 20.29% | 20.12% | 24.47% | 26.19% | 18.35% | 17.30% | 15.80% |

| Research & Development | 8.20B | 7.80B | 7.60B | 7.10B | 7.40B | 8.20B | 8.00B | 7.30B | 6.70B | 6.70B | 6.20B | 5.50B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 8.20B | 8.69B | 8.82B | 7.39B | 7.56B | 7.40B | 11.53B | 7.90B | 10.70B | 9.82B | 8.78B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 2.50B | 2.20B | 3.10B | 2.80B | 3.60B | 4.00B | 4.10B | 4.30B | 4.30B | 4.30B | 4.40B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 10.70B | 10.89B | 11.92B | 10.19B | 11.16B | 11.40B | 11.53B | 12.20B | 15.00B | 14.12B | 13.18B | 12.18B | 11.58B | 11.91B | 13.26B | 21.43B | 21.17B | 19.18B | 24.65B | 25.12B | 17.48B | 28.43B | 13.60B | 9.88B | 9.55B | 7.62B | 7.08B | 6.63B | 6.04B | 5.13B | 6.49B | 6.23B | 6.15B | 5.92B | 5.32B | 8.31B | 3.78B | 3.83B | 3.22B |

| Other Expenses | 0.00 | 2.02B | 6.65B | 679.00M | -1.12B | 2.25B | 3.27B | 1.21B | 1.03B | 898.00M | 927.00M | 434.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.64B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 10.70B | 10.89B | 11.92B | 10.19B | 11.16B | 11.40B | 11.53B | 12.20B | 15.42B | 14.42B | 13.38B | 12.27B | 11.58B | 11.91B | 13.26B | 21.43B | 21.17B | 19.18B | 24.65B | 25.12B | 26.26B | 28.43B | 35.09B | 19.29B | 18.80B | 16.21B | 14.73B | 13.50B | 12.54B | 10.04B | 9.56B | 12.99B | 11.93B | 9.11B | 9.55B | 10.76B | 6.95B | 6.79B | 5.61B |

| Cost & Expenses | 170.73B | 145.29B | 126.57B | 122.95B | 145.85B | 147.67B | 142.86B | 138.78B | 141.91B | 140.64B | 141.48B | 127.96B | 124.92B | 116.36B | 113.27B | 148.53B | 163.76B | 168.05B | 169.60B | 160.97B | 156.08B | 153.56B | 169.98B | 154.93B | 145.53B | 129.02B | 133.35B | 132.09B | 123.14B | 113.24B | 97.92B | 93.01B | 82.30B | 87.11B | 82.17B | 79.00B | 65.44B | 58.66B | 50.04B |

| Interest Income | 1.57B | 639.00M | 261.00M | 452.00M | 809.00M | 700.00M | 464.00M | 299.00M | 312.00M | 340.00M | 213.00M | 342.00M | 471.00M | 348.00M | 5.84B | 1.06B | 1.16B | 1.48B | 473.00M | 0.00 | 0.00 | 0.00 | 0.00 | 1.49B | 1.43B | 1.33B | 1.12B | 841.00M | 800.00M | 665.00M | 563.00M | 653.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.32B | 1.28B | 1.80B | 1.65B | 1.05B | 1.23B | 1.19B | 951.00M | 773.00M | 810.00M | 829.00M | 713.00M | 4.43B | 6.15B | 6.83B | 10.44B | 10.93B | 8.78B | 7.64B | 0.00 | 0.00 | 0.00 | 0.00 | 1.38B | 1.40B | 829.00M | 788.00M | 695.00M | 622.00M | 721.00M | 807.00M | 860.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 6.52B | 6.49B | 5.96B | 7.46B | 8.49B | 8.31B | 8.45B | 8.72B | 7.97B | 7.42B | 6.46B | 5.20B | 4.26B | 5.58B | 6.93B | 12.93B | 1.55B | 16.52B | 6.72B | 13.05B | 14.30B | 15.18B | 19.75B | 14.85B | 15.19B | 14.33B | 13.58B | 12.79B | 11.72B | 9.34B | 3.06B | 6.76B | 5.78B | 3.18B | 4.23B | 2.46B | 3.17B | 2.96B | 2.39B |

| EBITDA | 11.82B | 4.74B | 25.54B | 7.99B | 8.87B | 13.89B | 18.02B | 16.77B | 19.36B | 9.76B | 14.00B | 12.86B | 13.75B | 14.95B | 15.97B | 10.83B | 11.66B | 8.83B | 16.37B | 23.73B | 22.41B | 25.03B | 12.18B | 33.67B | 33.73B | 38.98B | 34.89B | 28.53B | 26.36B | 25.47B | 12.28B | 13.21B | 11.76B | 13.73B | 18.21B | 15.91B | 9.37B | 7.02B | 5.12B |

| EBITDA Ratio | 6.71% | 11.95% | 17.12% | 12.80% | 11.73% | 14.56% | 17.12% | 16.58% | 12.58% | 8.73% | 9.53% | 9.58% | 12.16% | 14.78% | 15.06% | 7.41% | 5.94% | 5.52% | 7.68% | 13.83% | 13.65% | 15.32% | 7.50% | 18.46% | 20.75% | 32.52% | 22.71% | 19.41% | 19.22% | 19.83% | 11.96% | 13.19% | 12.59% | 13.51% | 18.26% | 16.09% | 10.82% | 8.80% | 7.15% |

| Operating Income | 5.46B | 12.40B | 17.38B | 8.82B | 9.79B | 2.68B | 4.14B | 3.52B | 7.65B | 3.44B | 5.44B | 6.29B | 11.34B | 12.59B | 5.03B | -2.26B | 8.70B | -7.93B | 7.49B | 10.68B | 8.12B | 9.86B | -7.57B | 15.13B | 17.03B | 15.39B | 20.28B | 14.91B | 14.00B | 15.20B | 10.60B | 7.12B | 5.98B | 10.54B | 13.98B | 13.45B | 6.20B | 4.06B | 2.73B |

| Operating Income Ratio | 3.10% | 7.85% | 12.75% | 6.94% | 6.28% | 1.67% | 2.64% | 2.32% | 5.11% | 2.39% | 3.70% | 4.69% | 8.32% | 9.77% | 4.25% | -1.54% | 5.04% | -4.95% | 4.23% | 6.22% | 4.94% | 6.03% | -4.66% | 8.90% | 10.48% | 10.66% | 13.20% | 10.14% | 10.21% | 11.83% | 9.77% | 7.11% | 6.78% | 10.79% | 14.54% | 14.55% | 8.66% | 6.47% | 5.17% |

| Total Other Income/Expenses | -1.49B | -9.29B | 402.00M | 3.29B | -1.21B | 1.14B | 3.28B | 3.28B | 2.61B | -2.21B | -5.81B | 1.92B | -2.66B | -5.45B | -1.79B | -11.08B | -12.45B | -7.13B | -1.17B | -6.57B | -6.67B | -8.03B | -10.91B | -9.60B | -6.01B | 10.01B | -9.34B | -8.11B | -7.29B | -6.41B | -4.84B | -4.93B | -8.64B | -9.15B | -8.03B | -5.15B | 1.15B | 1.00B | 888.80M |

| Income Before Tax | 3.97B | -3.02B | 17.78B | -1.12B | -640.00M | 4.35B | 8.15B | 6.80B | 10.25B | 4.34B | 7.00B | 7.72B | 8.68B | 7.15B | 3.03B | -14.40B | -3.75B | -15.05B | 2.00B | 4.85B | 1.37B | 953.00M | -7.58B | 8.23B | 11.03B | 25.40B | 10.94B | 6.79B | 6.71B | 8.79B | 3.88B | -207.10M | -2.65B | 1.39B | 5.95B | 8.30B | 7.35B | 5.06B | 3.62B |

| Income Before Tax Ratio | 2.25% | -1.91% | 13.04% | -0.88% | -0.41% | 2.71% | 5.20% | 4.48% | 6.85% | 3.01% | 4.77% | 5.75% | 6.37% | 5.54% | 2.56% | -9.85% | -2.17% | -9.40% | 1.13% | 2.83% | 0.83% | 0.58% | -4.67% | 4.84% | 6.78% | 17.59% | 7.12% | 4.62% | 4.89% | 6.84% | 3.57% | -0.21% | -3.01% | 1.42% | 6.19% | 8.98% | 10.26% | 8.07% | 6.86% |

| Income Tax Expense | -362.00M | -864.00M | -130.00M | 160.00M | -724.00M | 650.00M | 520.00M | 2.19B | 2.88B | 1.16B | -147.00M | 2.06B | -11.54B | 592.00M | 69.00M | 63.00M | -1.29B | -2.65B | -512.00M | 937.00M | 135.00M | 302.00M | -2.15B | 2.71B | 3.67B | 3.18B | 3.74B | 2.17B | 2.38B | 3.33B | 1.35B | 294.70M | -395.40M | 530.40M | 2.11B | 3.00B | 2.73B | 1.77B | 1.10B |

| Net Income | 4.35B | -2.15B | 17.94B | -1.28B | 84.00M | 3.68B | 7.60B | 4.60B | 7.37B | 3.19B | 7.16B | 5.67B | 20.21B | 6.56B | 2.72B | -14.67B | -2.72B | -12.61B | 2.02B | 3.49B | 495.00M | -980.00M | -5.45B | 3.47B | 7.24B | 22.07B | 6.92B | 4.45B | 4.14B | 5.31B | 2.53B | -7.39B | -2.26B | 860.10M | 3.84B | 5.30B | 4.63B | 3.29B | 2.52B |

| Net Income Ratio | 2.47% | -1.36% | 13.16% | -1.00% | 0.05% | 2.29% | 4.85% | 3.03% | 4.93% | 2.21% | 4.87% | 4.22% | 14.83% | 5.09% | 2.30% | -10.03% | -1.58% | -7.88% | 1.14% | 2.03% | 0.30% | -0.60% | -3.36% | 2.04% | 4.45% | 15.28% | 4.50% | 3.02% | 3.02% | 4.13% | 2.33% | -7.38% | -2.56% | 0.88% | 3.99% | 5.73% | 6.46% | 5.24% | 4.77% |

| EPS | 1.09 | -0.54 | 4.49 | -0.32 | 0.02 | 0.93 | 1.91 | 1.16 | 1.86 | 0.31 | 3.04 | 1.47 | 5.33 | 1.90 | 0.91 | -6.45 | -1.38 | -6.71 | 0.78 | 1.66 | 0.13 | -0.54 | -3.00 | 2.34 | 5.99 | 18.17 | 3.66 | 2.37 | 2.28 | 3.16 | 1.44 | -4.84 | -2.37 | 0.94 | 4.11 | 5.48 | 4.52 | 3.03 | 2.29 |

| EPS Diluted | 1.08 | -0.54 | 4.45 | -0.32 | 0.02 | 0.92 | 1.90 | 1.15 | 1.84 | 0.31 | 2.94 | 1.41 | 4.94 | 1.66 | 0.86 | -6.45 | -1.38 | -6.71 | 0.77 | 1.52 | 0.13 | -0.54 | -3.00 | 2.30 | 5.86 | 17.76 | 3.58 | 2.32 | 2.12 | 2.83 | 1.34 | -4.84 | -2.37 | 0.92 | 4.06 | 5.41 | 4.45 | 3.03 | 2.22 |

| Weighted Avg Shares Out | 4.00B | 4.01B | 3.99B | 3.97B | 3.97B | 3.95B | 3.98B | 3.97B | 3.97B | 3.91B | 3.94B | 3.82B | 3.79B | 3.45B | 2.99B | 2.27B | 1.98B | 1.88B | 1.85B | 1.74B | 1.83B | 1.82B | 1.82B | 1.48B | 1.21B | 1.21B | 1.88B | 1.85B | 1.68B | 1.59B | 1.55B | 1.53B | 953.97M | 915.00M | 933.09M | 967.19M | 1.02B | 1.08B | 1.10B |

| Weighted Avg Shares Out (Dil) | 4.04B | 4.01B | 4.03B | 3.97B | 4.00B | 4.00B | 4.00B | 4.00B | 4.00B | 3.96B | 4.09B | 4.02B | 4.11B | 4.18B | 3.31B | 2.27B | 1.98B | 1.88B | 1.87B | 1.90B | 1.89B | 1.82B | 1.82B | 1.50B | 1.24B | 1.24B | 1.93B | 1.89B | 1.81B | 1.59B | 1.55B | 1.53B | 953.97M | 934.89M | 944.58M | 979.70M | 1.04B | 1.08B | 1.13B |

1 Wall Street Analyst Thinks Ford Stock Is Going to $15. Is It a Buy Around $10.50?

Ford Motor Company (F) Is a Trending Stock: Facts to Know Before Betting on It

Ford Stock Is Solid Value At $10 Despite Guidance Cut

Friday's big stock stories: What's likely to move the market in the next trading session

Ford Halting Production of Its Electric F-150 Lightning Truck, Report Says

Ford is stalling F-150 Lightning production and slashing manager bonuses as it races to cut costs

Ford to pause production of F-150 Lightning pickup

Ford stops manufacturing electric F-150 pickups for six weeks as demand sags

Ford pauses F-150 Lightning production as Tesla Cybertruck heats up

Ford Halts F-150 Production. Blame Slower EV Demand.

Source: https://incomestatements.info

Category: Stock Reports