See more : CRISPR Therapeutics AG (CRSP) Income Statement Analysis – Financial Results

Complete financial analysis of Falcon Gold Corp. (FGLDF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Falcon Gold Corp., a leading company in the Gold industry within the Basic Materials sector.

- Toyo Kanetsu K.K. (6369.T) Income Statement Analysis – Financial Results

- Mirion Technologies, Inc. (MIR) Income Statement Analysis – Financial Results

- FibraHotel (DBMXF) Income Statement Analysis – Financial Results

- JAIC Co.,Ltd. (7073.T) Income Statement Analysis – Financial Results

- TransAKT Ltd. (TAKD) Income Statement Analysis – Financial Results

Falcon Gold Corp. (FGLDF)

About Falcon Gold Corp.

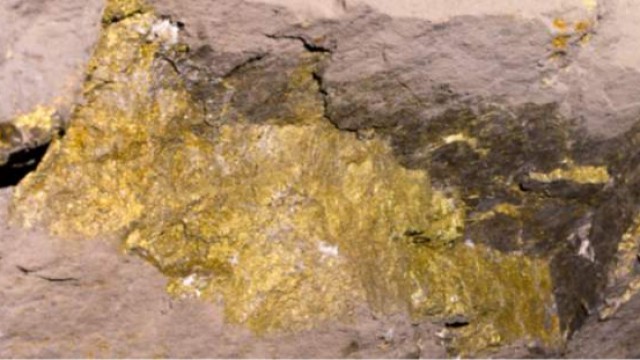

Falcon Gold Corp. engages in the acquisition and exploration of mineral properties in the Americas. It explores for gold, silver, and base metal deposits. Its flagship project is the Central Canada Gold Mine that consists of 117 claims located in North Ontario. The company was formerly known as Chesstown Capital Inc. and changed its name to Falcon Gold Corp. in July 2011. Falcon Gold Corp. was incorporated in 2006 and is headquartered in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 25.35 | 0.00 | 24.74K | 26.78K | 0.00 | 0.00 | 2.07K | 0.00 |

| Gross Profit | 0.00 | 0.00 | 0.00 | -25.35 | 0.00 | -24.74K | -26.78K | 0.00 | 0.00 | -2.07K | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 591.23K | 1.09M | 920.39K | 521.64K | 318.57K | 384.92K | 494.21K | 222.15K | 565.39K | 175.19K | 402.39K |

| Selling & Marketing | 0.00 | 178.76K | 149.05K | 113.50K | 339.94K | 95.80K | 141.14K | 14.68K | 215.07K | 0.00 | 186.13K |

| SG&A | 591.23K | 1.27M | 1.07M | 635.14K | 340.26K | 480.71K | 635.34K | 236.83K | 780.46K | 175.19K | 588.52K |

| Other Expenses | 151.34K | 46.35K | 87.05K | -25.35K | 0.00 | 0.00 | 27.54K | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 781.22K | 1.27M | 1.07M | 660.49K | 340.26K | 480.71K | 607.80K | 236.83K | 1.06M | 338.49K | 642.94K |

| Cost & Expenses | 781.22K | 1.27M | 1.07M | 660.49K | 340.26K | 480.71K | 607.81K | 236.83K | 1.06M | 340.57K | 642.94K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 17.07K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 358.68K | 30.00K | 42.56K | 148.34K | 1.31M | 456.87K | 1.14M | 1.14M | 261.18K | 186.19K | 2.47K |

| EBITDA | -419.90K | -1.27M | -1.07M | -660.49K | -340.26K | -23.85K | 529.06K | -236.83K | -780.46K | -177.27K | -588.52K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -778.58K | -1.27M | -1.07M | -660.49K | -340.26K | -480.71K | -607.80K | -236.83K | -1.04M | -363.46K | -590.99K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -212.62K | -290.87K | -14.86K | -86.11K | -1.32M | -23.85K | -6.00 | -1.14M | -13.49K | 22.89K | -51.95K |

| Income Before Tax | -991.20K | -1.33M | -887.00K | -671.50K | -1.66M | -480.71K | -607.81K | -1.38M | -1.06M | -340.57K | -642.94K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -30.00 | -42.56 | -148.34 | -1.31K | -23.85K | -2.93K | -1.14M | 0.00 | 0.00 | 0.00 |

| Net Income | -991.20K | -1.33M | -887.00K | -671.50K | -1.66M | -480.71K | -607.81K | -1.38M | -1.06M | -340.57K | -642.94K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.01 | -0.01 | -0.01 | -0.01 | -0.05 | -0.02 | -0.03 | -0.16 | -0.14 | -0.07 | -0.12 |

| EPS Diluted | -0.01 | -0.01 | -0.01 | -0.01 | -0.05 | -0.02 | -0.03 | -0.16 | -0.14 | -0.07 | -0.12 |

| Weighted Avg Shares Out | 124.45M | 110.91M | 91.81M | 59.63M | 36.27M | 25.45M | 18.24M | 8.41M | 7.56M | 5.15M | 5.15M |

| Weighted Avg Shares Out (Dil) | 124.45M | 110.91M | 91.81M | 59.63M | 36.27M | 25.45M | 18.24M | 8.41M | 7.56M | 5.15M | 5.15M |

Falcon Gold and Marvel Discovery alliance finds kilometer-scale shear zone corridors at combined Newfoundland Hope Brook projects

Falcon Gold reveals positive initial sample results from its Gander North property in Newfoundland

Falcon Gold says it is positioned for success as potential discoveries are made across its portfolio of projects

Franklin Templeton Launches Franklin Responsibly Sourced Gold ETF

Falcon Gold bolsters portfolio with two 'green metal' projects in Canada

Falcon Gold gets started on new exploration program at Gander North gold project to locate promising drill targets on the Newfoundland property

Falcon Gold completes option and work requirements to earn 100% of Central Canada project in Ontario; says near-term focus is on Central Newfoundland project portfolio

Falcon Gold announces intention to spin-out its Argentina operations into a wholly-owned subsidiary Latamark Resources

Falcon Gold appoints Glayton Dias as exploration manager for British Columbia and South America

Falcon Gold acquires additional ground west of Valentine Lake in Newfoundland

Source: https://incomestatements.info

Category: Stock Reports