See more : Capital One Financial Corporation (COF-PJ) Income Statement Analysis – Financial Results

Complete financial analysis of Falcon Gold Corp. (FGLDF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Falcon Gold Corp., a leading company in the Gold industry within the Basic Materials sector.

- The Michinoku Bank, Ltd. (8350.T) Income Statement Analysis – Financial Results

- Surteco Group SE (SUR.DE) Income Statement Analysis – Financial Results

- Red Light Holland Corp. (TRUFF) Income Statement Analysis – Financial Results

- Sri Trang Agro-Industry Public Company Limited (STA-R.BK) Income Statement Analysis – Financial Results

- DLF Limited (DLF.BO) Income Statement Analysis – Financial Results

Falcon Gold Corp. (FGLDF)

About Falcon Gold Corp.

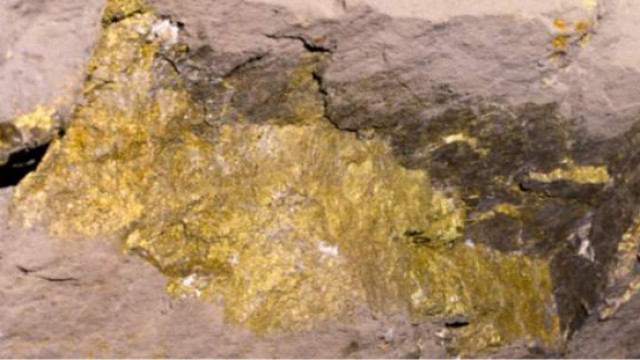

Falcon Gold Corp. engages in the acquisition and exploration of mineral properties in the Americas. It explores for gold, silver, and base metal deposits. Its flagship project is the Central Canada Gold Mine that consists of 117 claims located in North Ontario. The company was formerly known as Chesstown Capital Inc. and changed its name to Falcon Gold Corp. in July 2011. Falcon Gold Corp. was incorporated in 2006 and is headquartered in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 25.35 | 0.00 | 24.74K | 26.78K | 0.00 | 0.00 | 2.07K | 0.00 |

| Gross Profit | 0.00 | 0.00 | 0.00 | -25.35 | 0.00 | -24.74K | -26.78K | 0.00 | 0.00 | -2.07K | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 591.23K | 1.09M | 920.39K | 521.64K | 318.57K | 384.92K | 494.21K | 222.15K | 565.39K | 175.19K | 402.39K |

| Selling & Marketing | 0.00 | 178.76K | 149.05K | 113.50K | 339.94K | 95.80K | 141.14K | 14.68K | 215.07K | 0.00 | 186.13K |

| SG&A | 591.23K | 1.27M | 1.07M | 635.14K | 340.26K | 480.71K | 635.34K | 236.83K | 780.46K | 175.19K | 588.52K |

| Other Expenses | 151.34K | 46.35K | 87.05K | -25.35K | 0.00 | 0.00 | 27.54K | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 781.22K | 1.27M | 1.07M | 660.49K | 340.26K | 480.71K | 607.80K | 236.83K | 1.06M | 338.49K | 642.94K |

| Cost & Expenses | 781.22K | 1.27M | 1.07M | 660.49K | 340.26K | 480.71K | 607.81K | 236.83K | 1.06M | 340.57K | 642.94K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 17.07K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 358.68K | 30.00K | 42.56K | 148.34K | 1.31M | 456.87K | 1.14M | 1.14M | 261.18K | 186.19K | 2.47K |

| EBITDA | -419.90K | -1.27M | -1.07M | -660.49K | -340.26K | -23.85K | 529.06K | -236.83K | -780.46K | -177.27K | -588.52K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -778.58K | -1.27M | -1.07M | -660.49K | -340.26K | -480.71K | -607.80K | -236.83K | -1.04M | -363.46K | -590.99K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -212.62K | -290.87K | -14.86K | -86.11K | -1.32M | -23.85K | -6.00 | -1.14M | -13.49K | 22.89K | -51.95K |

| Income Before Tax | -991.20K | -1.33M | -887.00K | -671.50K | -1.66M | -480.71K | -607.81K | -1.38M | -1.06M | -340.57K | -642.94K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -30.00 | -42.56 | -148.34 | -1.31K | -23.85K | -2.93K | -1.14M | 0.00 | 0.00 | 0.00 |

| Net Income | -991.20K | -1.33M | -887.00K | -671.50K | -1.66M | -480.71K | -607.81K | -1.38M | -1.06M | -340.57K | -642.94K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.01 | -0.01 | -0.01 | -0.01 | -0.05 | -0.02 | -0.03 | -0.16 | -0.14 | -0.07 | -0.12 |

| EPS Diluted | -0.01 | -0.01 | -0.01 | -0.01 | -0.05 | -0.02 | -0.03 | -0.16 | -0.14 | -0.07 | -0.12 |

| Weighted Avg Shares Out | 124.45M | 110.91M | 91.81M | 59.63M | 36.27M | 25.45M | 18.24M | 8.41M | 7.56M | 5.15M | 5.15M |

| Weighted Avg Shares Out (Dil) | 124.45M | 110.91M | 91.81M | 59.63M | 36.27M | 25.45M | 18.24M | 8.41M | 7.56M | 5.15M | 5.15M |

Falcon Applies for Work Permits at Hope Brook

Falcon Receives TSX.V Approval, Warrant Incentive

Falcon Awaits Final Approval - Warrant Exercise Incentive

Falcon Gold stakes more prospective ground in central Newfoundland

Falcon Acquires Ground Along the Baie Verte Brompton Line, Contiguous with Marvel Discovery, Central Newfoundland

Falcon Gold gets to work on its prospective Gaspard gold project in British Columbia

Falcon Commences Work at Gaspard Gold Project - Spences Bridge BC

Falcon Gold plans to launch warrant exercise incentive program

Falcon Offers Warrant Exercise Incentive Program

Falcon Gold acquires strategic land position in Hope Brook as exploration activity in Newfoundland shows no sign of slowing

Source: https://incomestatements.info

Category: Stock Reports