See more : DevPort AB (publ) (DEVP-B.ST) Income Statement Analysis – Financial Results

Complete financial analysis of Full House Resorts, Inc. (FLL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Full House Resorts, Inc., a leading company in the Gambling, Resorts & Casinos industry within the Consumer Cyclical sector.

- SolarBank Corporation (SUUN) Income Statement Analysis – Financial Results

- P.B. Group Limited (8331.HK) Income Statement Analysis – Financial Results

- Lode Metals Corp. (LODE.CN) Income Statement Analysis – Financial Results

- Absolute Clean Energy Public Company Limited (ACE-R.BK) Income Statement Analysis – Financial Results

- Japan Airport Terminal Co., Ltd. (JTTRY) Income Statement Analysis – Financial Results

Full House Resorts, Inc. (FLL)

Industry: Gambling, Resorts & Casinos

Sector: Consumer Cyclical

Website: https://www.fullhouseresorts.com

About Full House Resorts, Inc.

Full House Resorts, Inc. owns, develops, invests in, operates, manages, and leases casinos, and related hospitality and entertainment facilities in the United States. The company owns and operates the Silver Slipper Casino and Hotel in Hancock County, Mississippi, which has 757 slot machines and 24 table games, a surface parking lot, and a 129 hotel rooms; an on-site sportsbook, a fine-dining restaurant, a buffet, and a quick-service restaurant, as well as an oyster bar, a casino bar, and a beachfront bar; and 37-space beachfront RV park. It also owns and operates the Bronco Billy's Casino and Hotel in Cripple Creek, Colorado that has gaming space and 14 hotel rooms, as well as a steakhouse and a casual dining outlet. In addition, the company owns and operates the Rising Star Casino Resort in Rising Sun, Indiana, which has 642 slot machines and 16 table games; a land-based pavilion with approximately 31,500 square feet of meeting and convention space; a contiguous 190-guest-room hotel and an adjacent leased 104-guest-room hotel; a 56-space RV park; surface parking; an 18-hole golf course on approximately 230 acres; and four dining outlets. Further, it owns and operates the Stockman's Casino that is located in Fallon, Nevada, which has 186 slot machines, a bar, a fine-dining restaurant, and a coffee shop; and the Grand Lodge Casino that has 269 slot machines and 9 table games, which is integrated into the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada. Full House Resorts, Inc. was incorporated in 1987 and is headquartered in Las Vegas, Nevada.

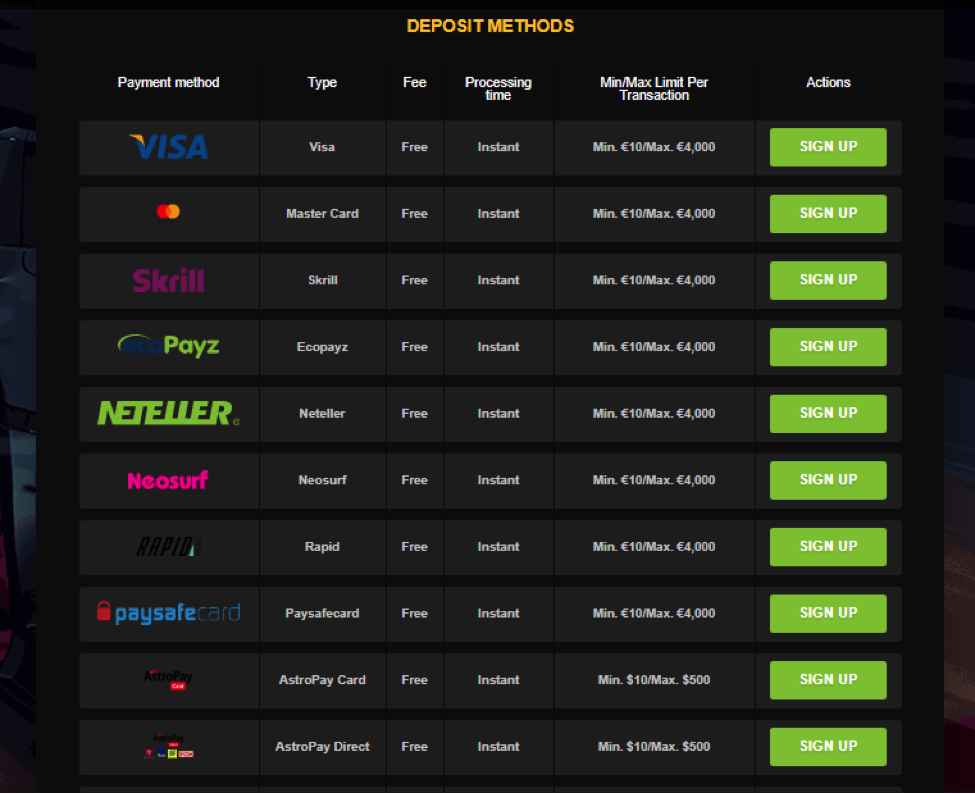

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 241.06M | 163.28M | 180.16M | 125.59M | 165.43M | 163.88M | 161.27M | 145.99M | 124.59M | 121.42M | 144.73M | 128.76M | 105.46M | 32.90M | 19.01M | 9.67M | 9.56M | 3.86M | 3.70M | 3.59M | 3.34M | 4.82M | 5.00M | 3.92M | 3.60M | 4.60M | 8.30M | 7.70M | 5.60M | 5.60M | 4.40M |

| Cost of Revenue | 109.69M | 73.13M | 73.95M | 58.76M | 93.79M | 98.16M | 91.84M | 80.46M | 68.72M | 67.18M | 81.34M | 74.56M | 51.44M | 4.18M | 4.24M | 4.72M | 4.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 122.44K | 528.90K | 300.00K | 700.00K | 3.40M | 3.90M | 4.00M | 3.40M | 2.80M |

| Gross Profit | 131.37M | 90.15M | 106.21M | 66.83M | 71.64M | 65.71M | 69.43M | 65.53M | 55.87M | 54.24M | 63.39M | 54.20M | 54.02M | 28.72M | 14.77M | 4.95M | 5.38M | 3.86M | 3.70M | 3.59M | 3.34M | 4.82M | 4.87M | 3.39M | 3.30M | 3.90M | 4.90M | 3.80M | 1.60M | 2.20M | 1.60M |

| Gross Profit Ratio | 54.50% | 55.21% | 58.96% | 53.22% | 43.31% | 40.10% | 43.05% | 44.89% | 44.84% | 44.67% | 43.80% | 42.09% | 51.22% | 87.31% | 77.69% | 51.19% | 56.20% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 97.55% | 86.52% | 91.67% | 84.78% | 59.04% | 49.35% | 28.57% | 39.29% | 36.36% |

| Research & Development | 0.00 | 228.00K | 782.00K | 423.00K | 1.04M | 843.00K | 284.00K | 1.31M | 891.00K | 296.00K | 67.00K | 1.86M | 792.75K | 423.16K | 218.35K | 151.12K | 431.44K | 513.18K | 1.23M | 1.07M | 692.40K | 954.06K | 1.08M | 0.00 | 1.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 92.93M | 57.01M | 57.17M | 45.39M | 51.85M | 44.89M | 49.77M | 46.36M | 42.04M | 46.68M | 44.27M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | -7.19M | 2.70M | 2.80M | 2.20M | 4.20M | 3.80M | 3.70M | 3.40M | 2.00M | 1.80M | 2.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 85.75M | 59.71M | 59.97M | 47.59M | 56.05M | 48.69M | 53.47M | 49.76M | 42.04M | 46.68M | 46.97M | 37.00M | 25.43M | 6.43M | 6.47M | 6.26M | 6.81M | 3.80M | 2.34M | 1.65M | 1.86M | 1.78M | 1.64M | 1.85M | 2.20M | 2.10M | 2.50M | 2.40M | 2.70M | 2.40M | 900.00K |

| Other Expenses | 46.78M | 17.49M | 7.24M | 7.67M | 8.33M | -13.00K | 8.60M | 7.93M | 12.00K | -23.00K | -15.00K | -6.00K | 3.70M | -1.67M | 2.09M | -5.66M | 1.02M | -1.60M | -964.93K | 102.26K | 176.56K | 216.55K | 5.17M | 586.48K | 700.00K | 800.00K | 600.00K | 500.00K | 1.20M | 500.00K | 400.00K |

| Operating Expenses | 85.75M | 77.42M | 67.98M | 55.67M | 65.42M | 58.21M | 62.36M | 59.00M | 50.82M | 56.16M | 56.43M | 45.75M | 29.93M | 5.18M | 8.78M | 750.96K | 8.26M | 2.71M | 2.61M | 2.82M | 2.73M | 2.95M | 7.89M | 2.43M | 4.50M | 2.90M | 3.10M | 2.90M | 3.90M | 2.90M | 1.30M |

| Cost & Expenses | 242.22M | 150.56M | 141.93M | 114.43M | 159.21M | 156.37M | 154.20M | 139.46M | 119.54M | 123.34M | 137.77M | 120.31M | 81.37M | 9.36M | 13.02M | 5.47M | 12.45M | 2.71M | 2.61M | 2.82M | 2.73M | 2.95M | 8.01M | 2.96M | 4.80M | 3.60M | 6.50M | 6.80M | 7.90M | 6.30M | 4.10M |

| Interest Income | 3.74M | 1.36M | 23.66M | 9.82M | 10.73M | 146.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 8.06K | 120.75K | 389.01K | 171.96K | 745.66K | 88.33K | 60.63K | 0.00 | 30.28K | 0.00 | 0.00 | 11.62K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 26.72M | 22.99M | 23.66M | 9.82M | 10.73M | 10.31M | 10.86M | 9.49M | 6.72M | 6.27M | 7.27M | 2.73M | 2.84M | 58.37K | 173.82K | 532.50K | 1.27M | 189.54K | 147.41K | 0.00 | 99.17K | 0.00 | 0.00 | 328.38K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 31.09M | 11.33M | 7.22M | 7.67M | 8.33M | 8.40M | 8.60M | 7.93M | 7.89M | 9.18M | 9.39M | 6.88M | 4.20M | 1.05M | 1.07M | 1.21M | 1.27M | 75.08K | 76.96K | 102.26K | 176.56K | 216.55K | 572.37K | 586.48K | 700.00K | 800.00K | 600.00K | 500.00K | 1.20M | 500.00K | 400.00K |

| EBITDA | 29.94M | 20.66M | 45.45M | 18.83M | 14.56M | 15.90M | 15.66M | 15.06M | 13.34M | -6.38M | 16.35M | 54.81M | 25.67M | 27.08M | 11.07M | 5.00M | -2.05M | 1.23M | 1.17M | 866.93K | 788.80K | 2.09M | -2.45M | 1.55M | -495.53K | 1.80M | 2.40M | 1.40M | -1.10M | -200.00K | 700.00K |

| EBITDA Ratio | 12.42% | 12.65% | 25.23% | 14.99% | 8.80% | 9.70% | 9.72% | 9.91% | 10.40% | 5.96% | 11.29% | 11.90% | 29.49% | 82.32% | 58.20% | 53.95% | -21.39% | -11.62% | 3.35% | 24.17% | 23.62% | 43.33% | 42.98% | 39.47% | -13.89% | 26.09% | 27.71% | 28.57% | 55.36% | -5.36% | 11.36% |

| Operating Income | -1.16M | 12.68M | 37.55M | 10.48M | 6.22M | 7.43M | 7.06M | 6.19M | 5.04M | -13.84M | 2.96M | 49.64M | 19.17M | 23.54M | 8.59M | 3.62M | -2.88M | 1.15M | 1.09M | 764.67K | 612.24K | 1.87M | -3.02M | 962.25K | -1.20M | 1.00M | 1.80M | 900.00K | -2.30M | -700.00K | 300.00K |

| Operating Income Ratio | -0.48% | 7.77% | 20.84% | 8.34% | 3.76% | 4.53% | 4.38% | 4.24% | 4.05% | -11.40% | 2.05% | 38.55% | 18.18% | 71.55% | 45.16% | 37.38% | -30.15% | 29.91% | 29.43% | 21.32% | 18.34% | 38.84% | -60.43% | 24.53% | -33.33% | 21.74% | 21.69% | 11.69% | -41.07% | -12.50% | 6.82% |

| Total Other Income/Expenses | -22.59M | -27.52M | -25.41M | -10.42M | -11.96M | -11.32M | -12.24M | -10.65M | -6.70M | -8.00M | -7.26M | -6.18M | -3.34M | 62.38K | 215.19K | -360.54K | -722.93K | 22.38K | -86.78K | -904.74K | -68.89K | -41.72K | -277.68K | -316.76K | -104.47K | 0.00 | -500.00K | -800.00K | -5.20M | 100.00K | 200.00K |

| Income Before Tax | -23.76M | -14.84M | 12.14M | 55.00K | -5.74M | -3.90M | -5.18M | -4.46M | -1.66M | -21.83M | -4.32M | 45.19M | 15.83M | 23.60M | 8.80M | 2.89M | 1.10M | 1.18M | 1.63M | 667.25K | 543.35K | 1.83M | -3.30M | 645.48K | -1.30M | 1.00M | 1.30M | 100.00K | -7.50M | -600.00K | 500.00K |

| Income Before Tax Ratio | -9.85% | -9.09% | 6.74% | 0.04% | -3.47% | -2.38% | -3.21% | -3.06% | -1.33% | -17.98% | -2.99% | 35.10% | 15.01% | 71.74% | 46.29% | 29.85% | 11.45% | 30.49% | 44.12% | 18.61% | 16.27% | 37.97% | -65.99% | 16.45% | -36.11% | 21.74% | 15.66% | 1.30% | -133.93% | -10.71% | 11.36% |

| Income Tax Expense | 1.15M | -31.00K | 435.00K | -92.00K | 80.00K | 476.00K | -150.00K | 630.00K | -342.00K | -988.00K | -361.00K | 15.18M | 3.24M | 5.74M | 3.18M | 1.31M | 441.02K | 537.22K | 793.68K | 347.46K | 350.15K | 873.53K | -846.05K | 490.39K | -300.00K | 300.00K | 300.00K | 1.70M | -1.90M | 700.00K | 200.00K |

| Net Income | -24.90M | -14.80M | 11.71M | 147.00K | -5.82M | -4.37M | -5.03M | -5.09M | -1.32M | -20.85M | -3.96M | 27.83M | 2.34M | 7.67M | 4.77M | 1.62M | 940.59K | 639.68K | 839.34K | 319.79K | 193.20K | 955.76K | -2.45M | 155.09K | -1.50M | 700.00K | 1.00M | -800.00K | -5.60M | -1.40M | 100.00K |

| Net Income Ratio | -10.33% | -9.07% | 6.50% | 0.12% | -3.52% | -2.67% | -3.12% | -3.49% | -1.06% | -17.17% | -2.74% | 21.62% | 2.22% | 23.31% | 25.08% | 16.73% | 9.83% | 16.57% | 22.68% | 8.92% | 5.79% | 19.84% | -49.05% | 3.95% | -41.67% | 15.22% | 12.05% | -10.39% | -100.00% | -25.00% | 2.27% |

| EPS | -0.72 | -0.43 | 0.36 | 0.01 | -0.22 | -0.17 | -0.22 | -0.26 | -0.07 | -1.10 | -0.20 | 1.42 | 0.12 | 0.41 | 0.25 | 0.08 | 0.05 | 0.04 | 0.06 | 0.05 | 0.02 | 0.07 | -0.23 | -0.01 | -0.14 | 0.05 | 0.08 | -0.07 | -0.54 | -0.16 | -0.03 |

| EPS Diluted | -0.72 | -0.43 | 0.34 | 0.01 | -0.22 | -0.17 | -0.22 | -0.26 | -0.07 | -1.05 | -0.20 | 1.42 | 0.12 | 0.41 | 0.25 | 0.08 | 0.05 | 0.04 | 0.05 | 0.05 | 0.02 | 0.07 | -0.23 | -0.01 | -0.14 | 0.05 | 0.08 | -0.07 | -0.54 | -0.16 | -0.03 |

| Weighted Avg Shares Out | 34.52M | 34.35M | 32.52M | 27.09M | 26.98M | 26.01M | 22.88M | 19.60M | 19.61M | 18.87M | 19.73M | 19.66M | 19.37M | 18.95M | 18.97M | 20.12M | 20.32M | 11.49M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.53M | 10.88M | 10.35M | 8.86M | 3.51M |

| Weighted Avg Shares Out (Dil) | 34.52M | 34.35M | 34.95M | 27.78M | 26.98M | 26.46M | 22.88M | 19.60M | 19.61M | 19.87M | 19.73M | 19.66M | 19.37M | 18.95M | 18.98M | 20.12M | 20.32M | 12.26M | 11.62M | 11.62M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.53M | 10.88M | 10.35M | 8.86M | 3.51M |

Ford's results not as grim as expected for virus-marred 2Q

Amazon sale: Watches from Titan, Fastrack, Casio & more at up to 60% off - Times of India

FastPay Casino: For Lightning Fast Payouts And Withdrawals!

Casio bringt "G-SHOCK × Rui Hachimura"-Kooperationsmodell auf den Markt

Stocks To Watch: Big Focus On Big Tech

10 Full House Writers Who Also Worked On Disney Channel Shows

Refinancing of all Derivatives Transactions of Rallye

State Lawmaker Says Union Leaders Used Strong-Arm Tactics To Thwart Police Reform Legislation

The troubling story of displacing the poor for the Olympic Games

Source: https://incomestatements.info

Category: Stock Reports